The Daily Dish

August 3, 2016

Ignoring the Lessons of History

Despite a previously optimistic view toward Obamacare exchanges, Aetna Inc. announced it expects to lose more than $300 million this year on its exchange plans. As a result of expected losses, Aetna has announced its decision to cancel the company’s planned Obamacare expansion. Earlier this year Aetna said it was aiming to break even on its exchange plans in 2016 and expected to profit from the exchanges in 2017, however, the company posted a $200 million loss on its individual exchange plans in the second quarter.

On Monday, U.S. banking regulators announced small banks will be exempted from the “swap rule” included in the Dodd-Frank Act. Regulators stated banks with less than $10 billion in assets will not be required to comply with the same rules and standards regarding swaps that larger banks will be required to meet. The rule announced this week finalizes an interim final rule approved last November.

Eakinomics: Ignoring the Lessons of History

Remember Social Security? It’s the entitlement program that (after working enough to be eligible) provides retirement and disability benefits (up to a limit) that are based on wage earnings, is financed by a tax on wages (up to a maximum) that is split 50-50 between employers and employees, and is backed by a trust fund to ensure benefits. How’s that working out?

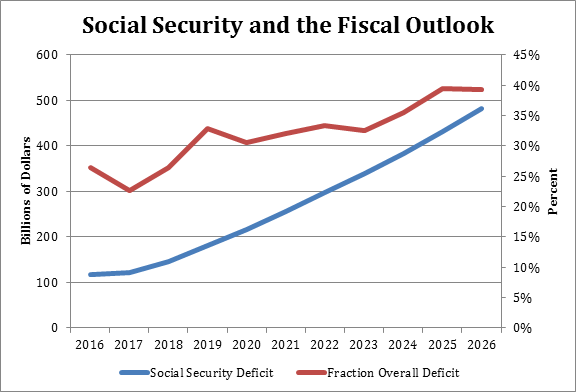

See for yourself (below). Social Security is running deficits (blue line, left scale) in the hundreds of billions of dollars and projected to get much worse. These are a quarter (right scale) of the overall deficit and projected to rise above 40 percent. Of course – Fear Not! – there is the “trust fund” so that when Social Security runs a $1 deficit it hands a piece of paper (a “special” Treasury security) to the Treasury in exchange for the needed $1, and the Treasury promptly turns around and issues a different piece of paper to borrow the $1. When the trust fund runs out of special Treasury bonds (about 20 years), the gig is up and Social Security simply cannot pay full benefits.

That’s the Social Security game plan: borrow unsustainably, cut retiree benefits, or both.

In light of this, consider the latest proposal in the paid-family-leave effort sweeping America. The Massachusetts proposal (hat tip to AAF’s Ben Gitis) would:

- Provide up to 16 weeks of paid family leave (caring for a newborn or ill family member) and 26 weeks of paid disability leave (recovering from your own medical condition),

- Provide a benefit that by 2020 will equal 90 percent of weekly pay, with a maximum weekly benefit of $1,000 (eligible workers include those who have worked at least 1,250 hours for an employer),

- Create a family and medical leave department, who will administer the benefits and manage the trust fund and determine the amount that employers will be required to contribute to the trust fund,

- Permit the employer to require an employee to pay 50 percent of the required contribution, and

- Tax up to the maximum earnings taxed under Social Security.

That is, it is an entitlement program that (after working enough to be eligible) provides leave and disability benefits (up to a limit) that are based on wage earnings, is financed by a tax on wages (up to a maximum) that is split 50-50 between employers and employees, and is backed by a trust fund to ensure benefits.

What could go wrong?

On the federal level, the left’s proposed FAMILY Act mirrors the Massachusetts initiative, which simply raises the fundamental question: if the federal government cannot honor the existing entitlements, why does anyone believe it can honor a host of new ones built in their exact image?

Fact of the Day

Does regulation affect employment? According to federal regulators, recent rules could eliminate more than 85,000 jobs.