The Daily Dish

May 20, 2022

Hold On, It’s Going to be Bumpy

Margo Channing could have been talking about the future of the U.S. housing sector. Cooling the housing market is central to taming the inflation problem. Slowing housing construction is an important conduit for Federal Reserve policies to cool the economy. But the entire process is beginning at a time of record-low inventory and vacancy rates. How will this end?

Fortunately, Thomas Wade has released the latest edition of his housing chart book to help navigate the data. Let’s take a look.

Both owner-occupied and rental housing have been red hot over the past year, with housing prices and rents up roughly 20 percent. Shelter (owned plus rental) inflation is central to the inflation challenge, with year-over-year shelter inflation still rising, reaching 5.1 percent in April.

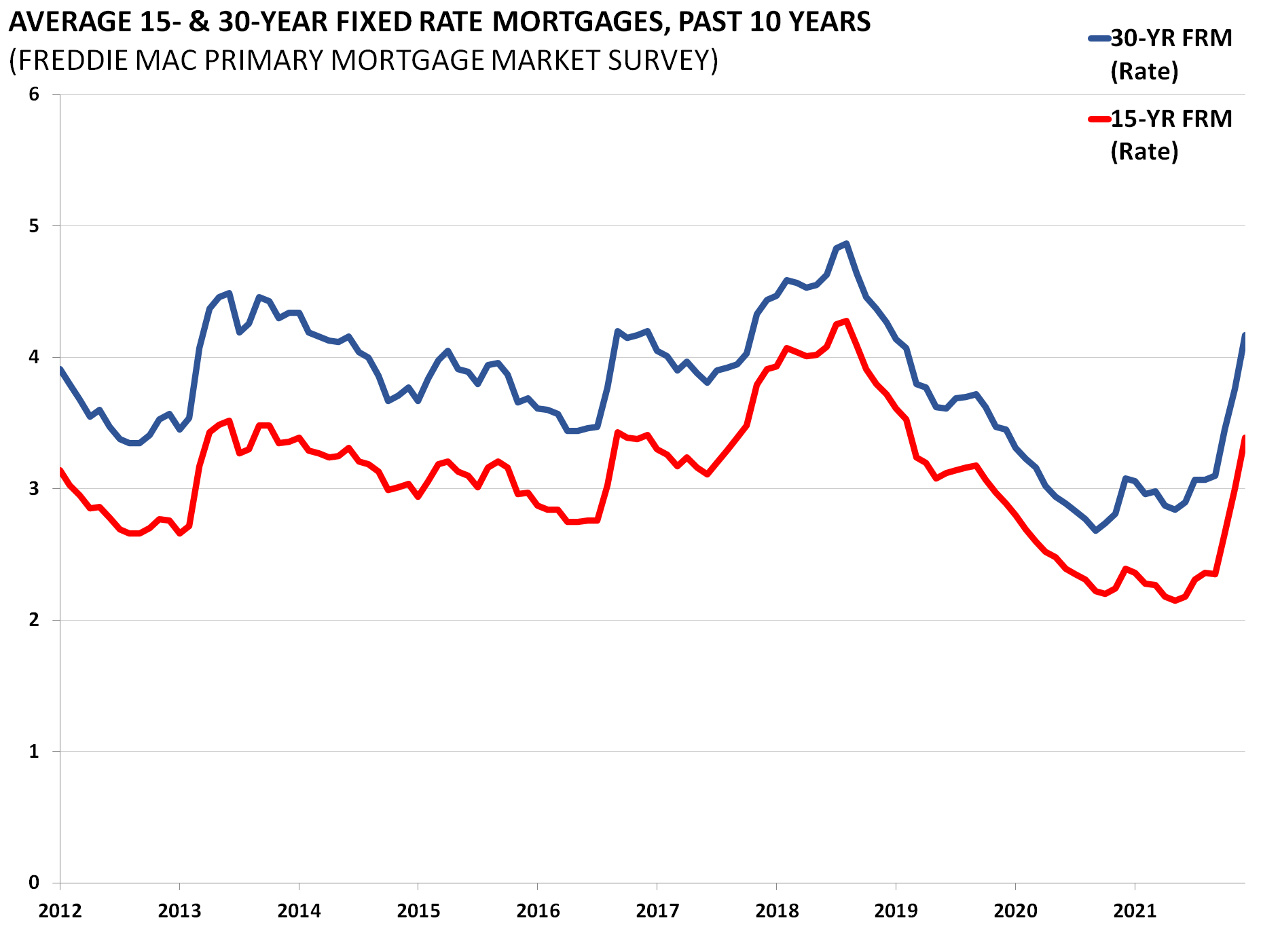

For perspective, the Fed could only hit its 2 percent target with shelter inflation at 5 percent if all other inflation were zero. So, the housing market will have to cool for the Fed to be successful in taming inflation. That process has begun, with tighter Fed policy having driven mortgage rates up sharply in recent weeks (below).

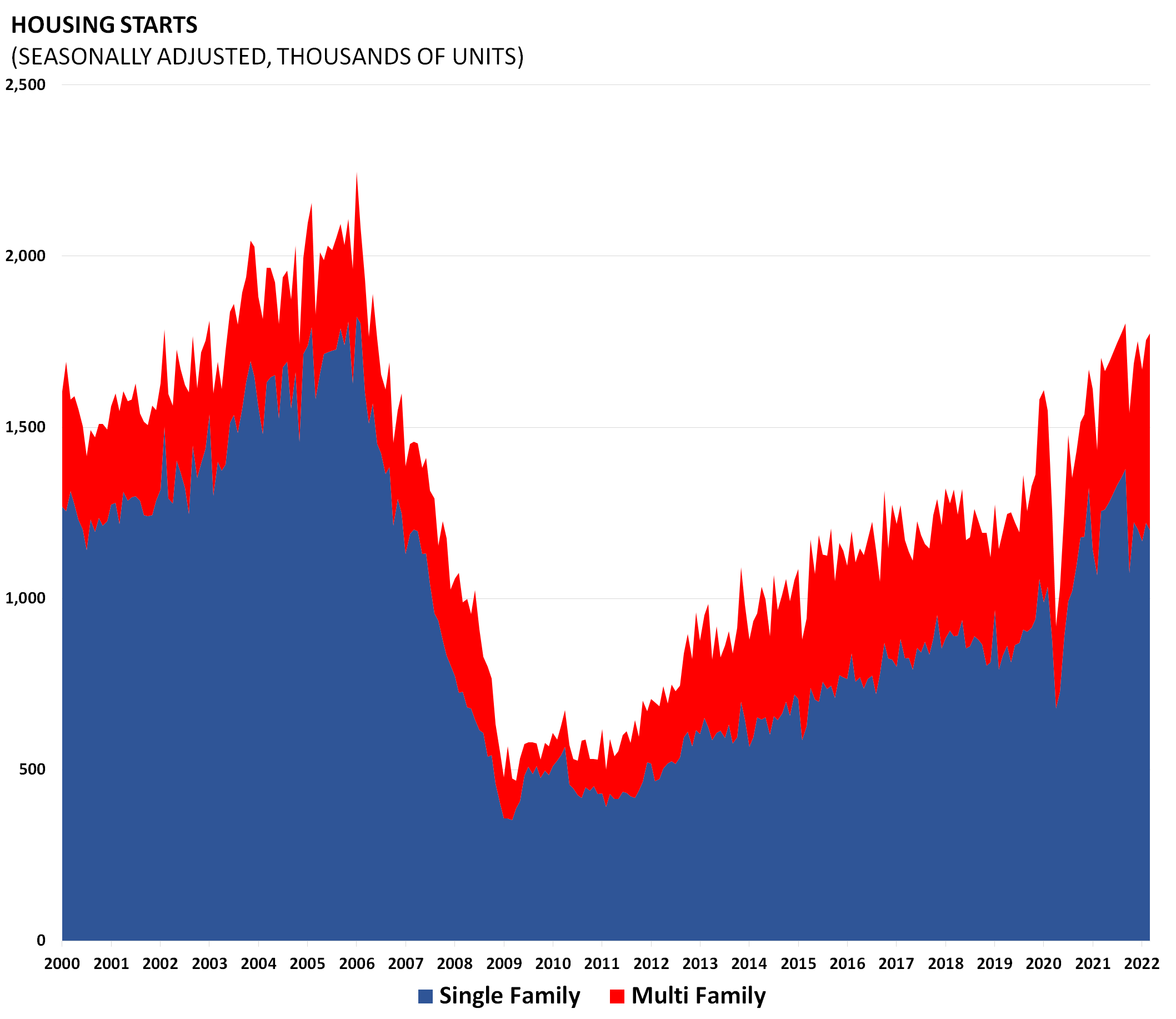

The basic idea is pretty simple: Make mortgages less attractive so that buying homes is less attractive. If buying homes becomes less attractive, then building homes will become less attractive, as well. Housing starts have recently been at levels exceeded only during the housing bubble early in this century. Expect them to head south.

When housing construction pulls back, so does the demand for dishwashers, furnaces, ovens, refrigerators, paved driveways, landscaping, and … you get the picture. Cooling the housing sector is a way for the Fed to cool large swaths of the economy.

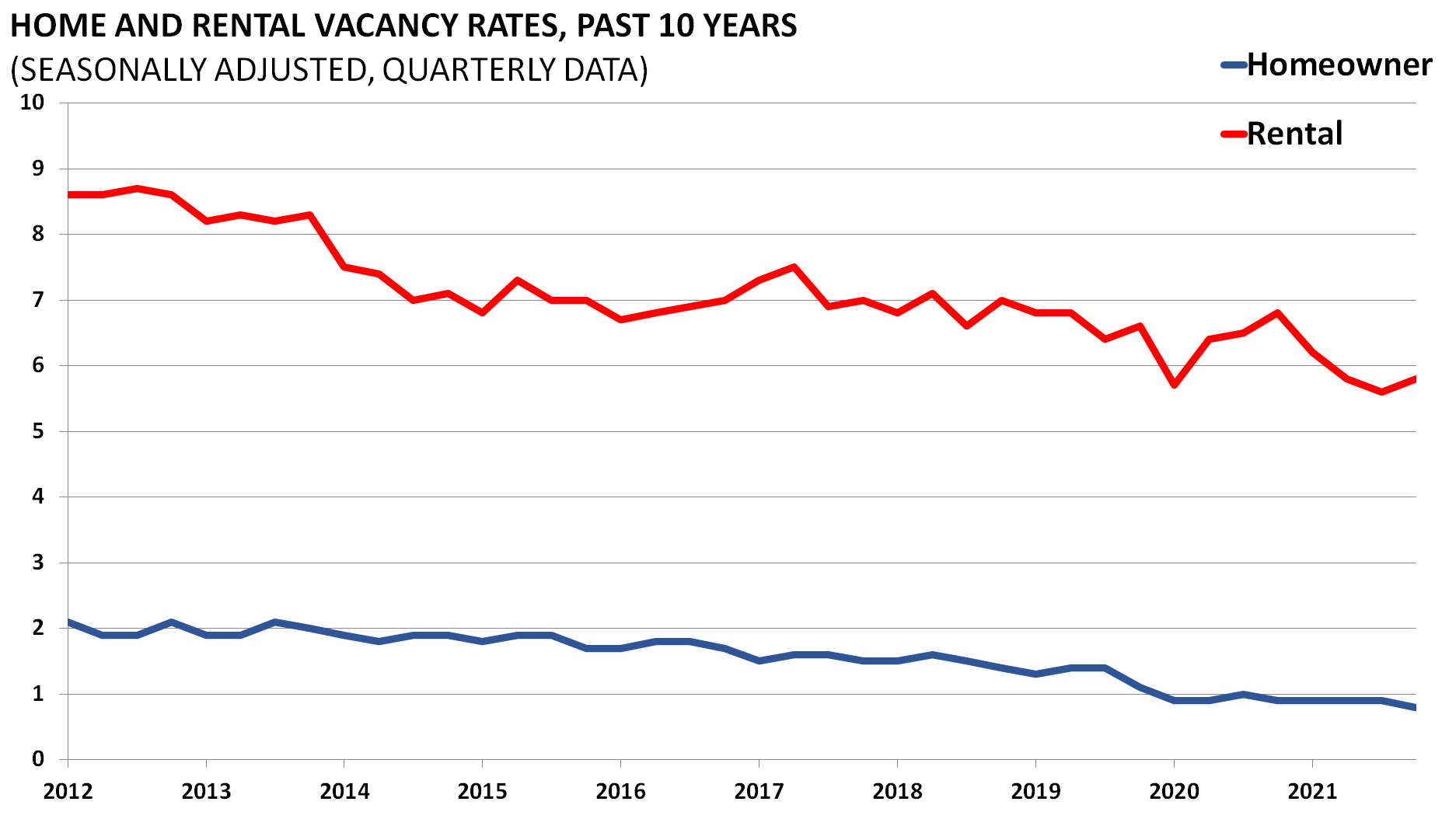

So far, so good. But here’s the catch. People have to live somewhere, even when the Fed is fighting inflation. Recently, vacancies in both the owner-occupied and rental sectors have been extremely low.

If people are going to pull back from buying homes, they will have to rent. This suggests that there will remain pressure on rents and that shelter inflation is not going to diminish quickly or easily.

The Biden Administration did announce a housing plan earlier this week. Despite the breathless advertisement (“This is the most comprehensive all of government effort[s] to close the housing supply shortfall in history”), it was an uninspiring mishmash of recycled programs, budget proposals with no legislative future, stalled pieces of the Build Back Better Act and the absolutely ludicrous (“Today, the Administration is announcing that DOT will continue to include language encouraging locally driven land use reform” – emphasis added).

Housing is going to be a bumpy ride and real solutions will be a focus for policymakers over the next several years.

Fact of the Day

Since January 1, the federal government has published $85.9 billion in total net costs and 48.4 million hours of net annual paperwork burden increases.