The Daily Dish

November 1, 2023

How Tight Is Monetary Policy?

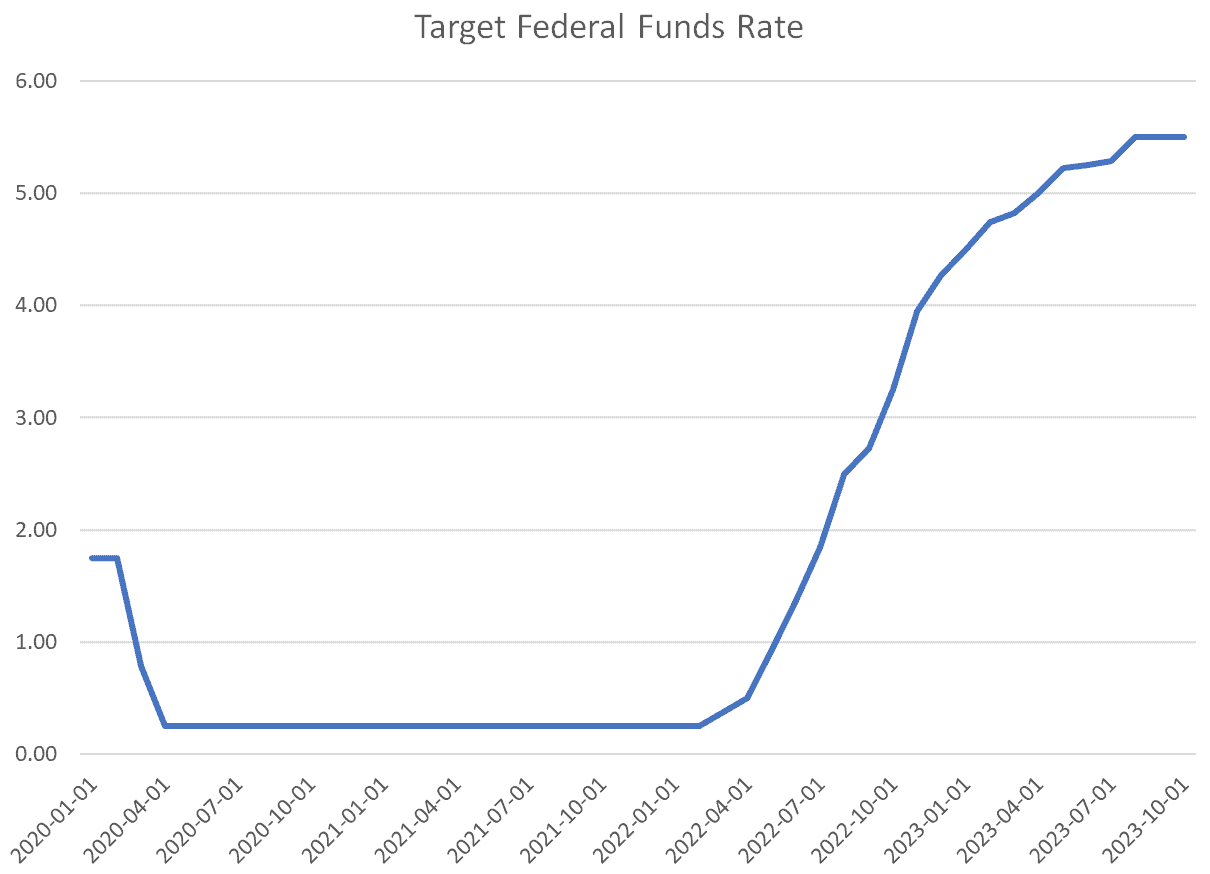

The Federal Open Market Committee (FOMC) – the policy-making council at the Fed – concludes its November meeting today. Most observers expect the FOMC to leave the target federal funds rate (its policy rate) unchanged. The recent path of the federal funds rate is shown below. As is widely known, the Fed has pushed the rate up by 500 basis points over the past 18 months and has recently characterized its expected policy as “higher for longer.”

Some conclude that this means the Fed is overdoing it. After all, the federal funds rate has risen at a record pace, other interest rates are higher as well, and inflation has moderated. They argue it is time, or it will shortly be time, for the Fed to ease monetary policy.

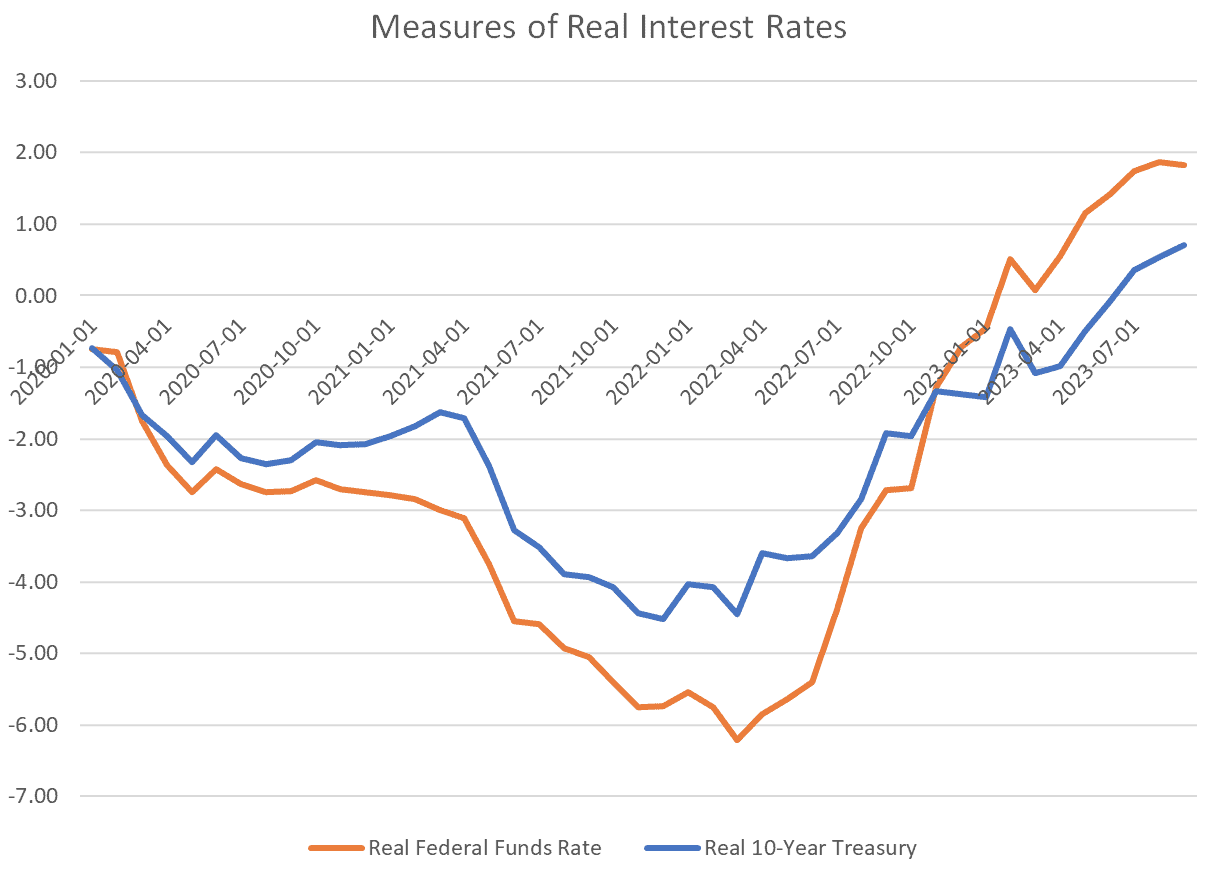

To put this in perspective, consider the chart below. It shows the real federal funds rate and the real interest rate on 10-year Treasury securities. Each is computed by taking the nominal interest rate and subtracting the (median) one-year inflation expectations as reported by the New York Federal Reserve Bank. Looking at real interest rates measures the cost of borrowing, accounting for the fact that the dollars being paid back are worth less because of the inflation.

Real interest rates paint a very different picture. At the beginning of 2022, real interest rates were dramatically negative. Measured by the policy rate, the real rate did not break into positive territory until the beginning of 2023, while using the 10-year Treasury this did not happen until mid-year.

As has been noted previously, keeping the policy rate unchanged still permits the Fed to tighten financial conditions by continuing to reduce its balance sheet. And, if inflation expectations continue to decline, real rates will rise correspondingly. Nevertheless, the Fed has not been all that tight for very long. Keeping rates where they are for a sustained period is likely the minimum that will be required to get inflation back to the 2 percent target.

Fact of the Day

Revoking China’s permanent normal trade relations would decrease total exports by an estimated 17.4 percent.