Insight

April 22, 2024

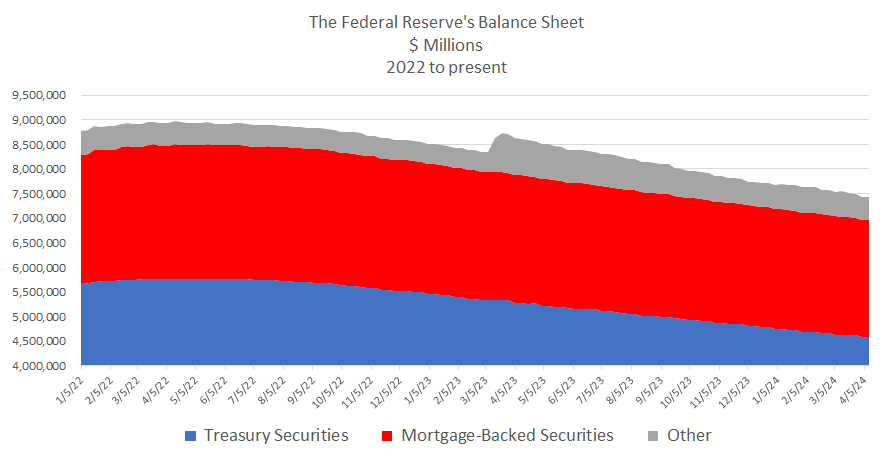

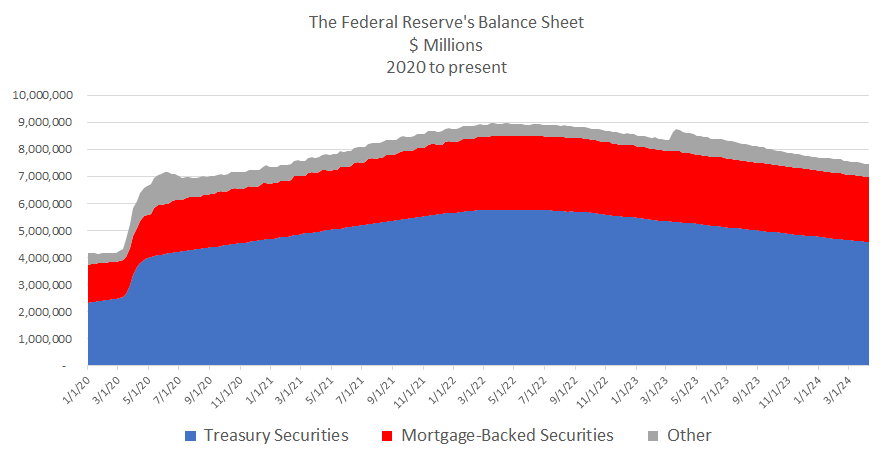

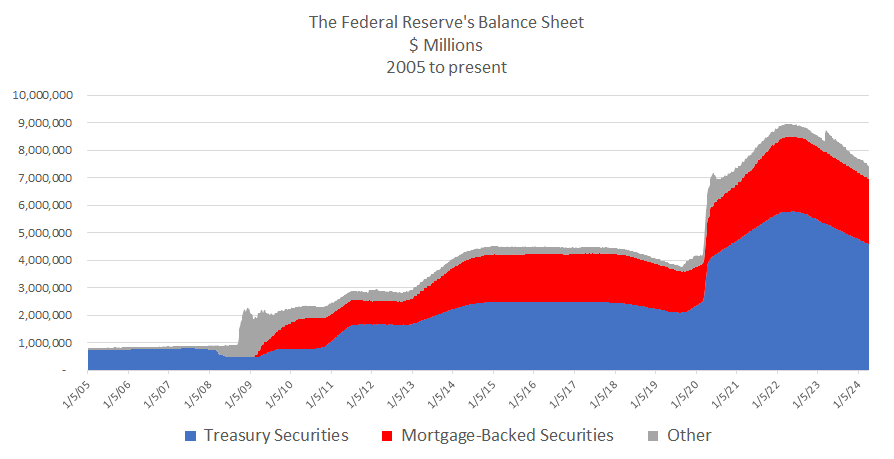

Tracker: The Federal Reserve’s Balance Sheet Assets

Introduction

This tracker follows the Federal Reserve’s (Fed) total consolidated assets, held on its balance sheet, as the best indicator of the Fed’s direct intervention in the economy.

Context

The Fed’s dual mandate requires it to ensure both stable prices and maximum employment. The traditional tool the Fed uses to accomplish these goals is the adjustment of the federal funds rate, the short-term interest rate that determines how much it costs for banks to lend to each other overnight. The 2007-2008 financial crisis, however, demonstrated that even lowering the interest rate to zero was considered insufficient to shore up economies in freefall, and the Fed turned to more unusual tactics. One of these measures was what the Fed refers to as “large-scale asset purchases,” which is more commonly known as “quantitative easing.” Under this process, the Fed enters the market to buy securities, typically mortgage-backed securities (MBS) and Treasuries, injecting both capital and liquidity into the market. This approach is not without risks – for the first time in its history, the Fed is regulator, supervisor, and now participant in the economy.

The development of quantitative easing as a go-to tool for the Fed in times of crisis has led to an unprecedented focus on one of its traditionally unremarkable aspects – the Fed total assets. Just as with any other firm, securities that the Fed purchases are considered assets and therefore are represented on the Fed’s balance sheet. This therefore is the most reflective guide of the state of quantitative easing and, by extension, the degree to which the Fed has deemed it necessary to intervene in the economy.

Each week, the Federal Reserve publishes its balance sheet, typically on Wednesday afternoon around 4:30 p.m.

As of April 17, the Fed’s assets stand at $7.4 trillion.

Sources:

https://fred.stlouisfed.org/series/WALCL

https://fred.stlouisfed.org/series/TREAST

https://fred.stlouisfed.org/series/WSHOMCB