The Daily Dish

June 5, 2025

Misunderstanding CBO – Again

The Congressional Budget Office (CBO) has come under seemingly orchestrated assault over its analyses of the One Big Beautiful Bill Act (OBBBA), aka the reconciliation legislation necessitated by the sunset of the 2017 tax law. The criticism reached a new low with the assertion by the White House that CBO was an intensely partisan organization staffed by donors to the Democratic party.

Glenn Kessler nicely disposes of this claim. Let me simply say that I remain the only CBO director appointed directly from the White House and was received with extreme skepticism by Democrats in Congress. Nevertheless, CBO met its statutory mandate to be non-partisan during the Holtz-Eakin reign of terror simply because CBO was (and remains) non-partisan in its DNA.

There are also complaints that CBO’s analysis is incomplete because it does not factor in the tariff and deregulatory policies of the administration This is just a misunderstanding of the job Congress has given CBO: to “score” (i.e., estimate the change in revenues and spending) legislation being considered by the House and Senate. If something is not in the legislation, it cannot be in the score.

Of course, it is always possible that there is a sincere difference in opinion on the science between the Joint Committee on Taxation (JCT), which scores all the tax proposals, and the administration. The way to flesh this out is for the Treasury to provide its estimates of the same proposals. There have been no Treasury estimates.

There is also a way to find out how CBO thinks about the overall economic plan. All the administration needs to do is actually submit a complete budget. CBO always provides an analysis of the president’s budgetary proposals, including a dynamic analysis of the comprehensive strategy. But no such budget has been forthcoming, perhaps because it would require the president to write down and stick to tariff proposals (no TACOs) so that they could be analyzed. And it would have to actually do something on deregulation.

But the overarching criticism is that CBO somehow doesn’t understand economic growth and pro-growth policies because it has not wrapped a bow around the administration’s claim that growth will average 3.0 percent over the 10-year budget window under its policies. Let’s look at that.

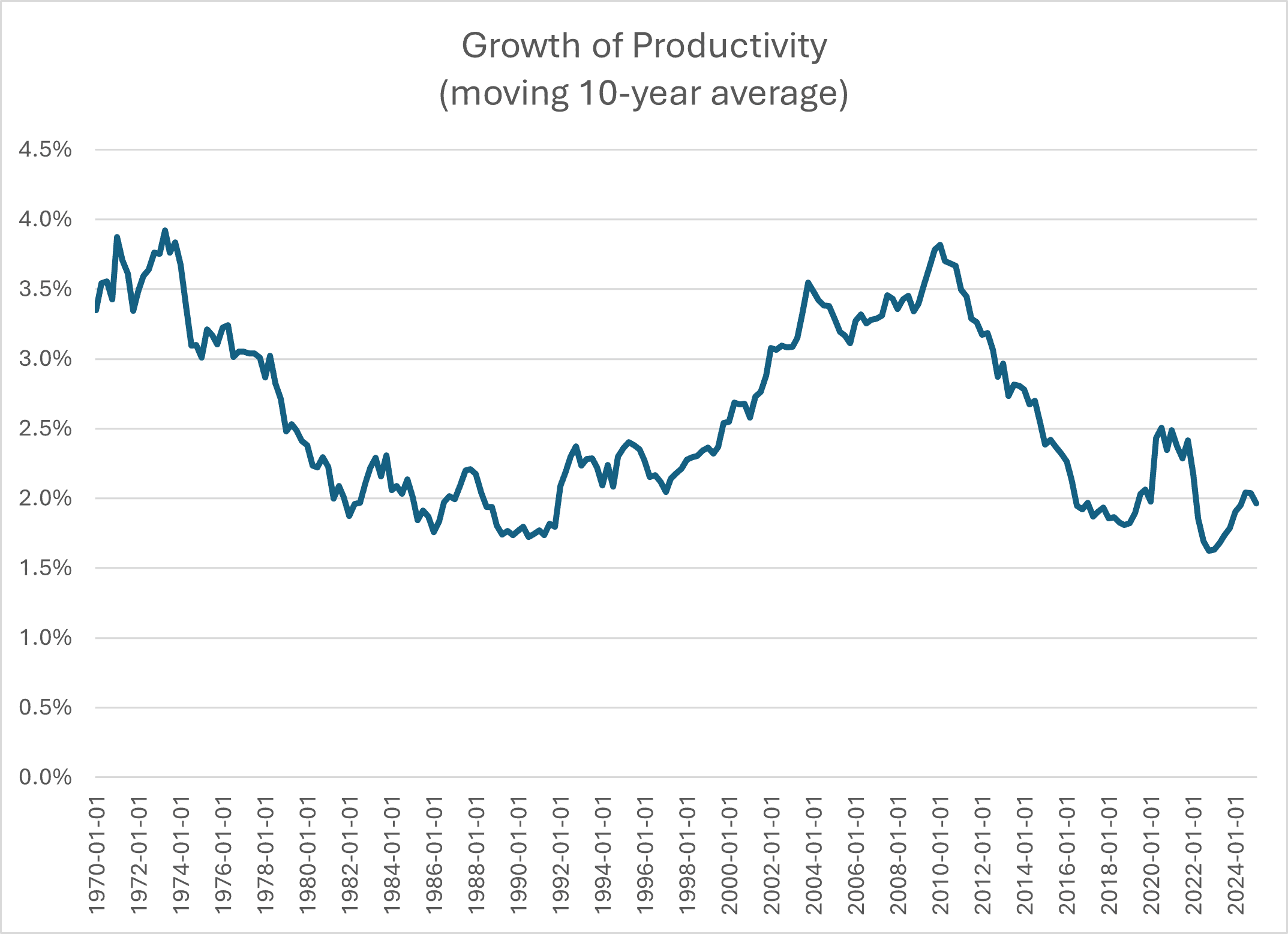

The trend growth rate is currently 1.8 percent, and the administration has no plans for immigration or other reforms that will raise the growth rate of the labor force. So, to get from 1.8 to 3.0 percent growth requires that annual labor productivity growth (graphed below) be 1.2 percentage points higher, on average, over the next 10 years.

If one compares every possible change in the 10-year average in productivity growth (graphed below), one will find that on only six occasions (2.7 percent of the time) would it have been correct to project productivity growth that was 1.2 percentage points (or more) higher over the next 10 years. And none of them occurred in the 21st century. Of course CBO should adopt a strategy that is wrong 97.3 percent of the time to make the administration happy!

The bottom line is simple. CBO is simply doing its job and doing so at its usual high level of professionalism. If the administration wants better numbers, it should try better policies.

Fact of the Day

The United States serves as the global hub for biopharmaceutical investment, accounting for 55 percent of worldwide R&D investments and 65 percent of all development-stage funding.