The Daily Dish

November 17, 2023

Pssst! The Fed Is Shrinking Its Balance Sheet

Readers of Eakinomics are doubtless aware that the Federal Reserve is tightening financial conditions in order to tame the worst inflation in 40 years. Those who read after coffee probably also know that the Fed is using two tools in this effort. As is customary, it is raising its policy interest rate (the federal funds rate), which has the straightforward consequence of raising the interest rate on all types – mortgages, auto loans, credit cards, etc. – and all maturities of loans. Thus far, it has raised the target federal funds rate by over 500 basis points and has promised further increases if the economic data indicate that they are needed.

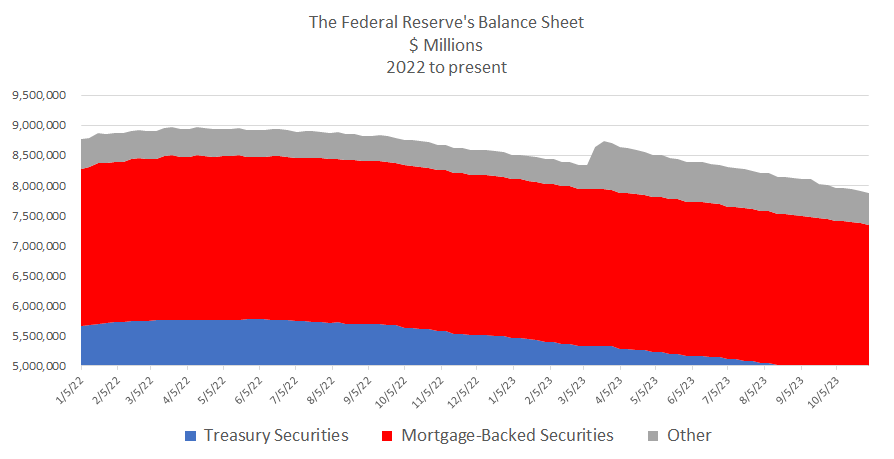

But readers may not have focused on the fact that the Fed is also shrinking its balance sheet, also known as quantitative tightening. Recall that in 2020 and 2021, the Fed figuratively printed $5 trillion in new cash and bought Treasury securities and mortgage-backed securities at a rate of $90 billion per month. The Fed is now engaged in the reverse and shedding up to $95 billion a month from its balance sheet (and figuratively draining the cash from financial markets). This is shown in the figure below, which is stolen from Thomas Kingsley’s balance sheet tracker.

So, the very astute follower of the Fed will know about quantitative tightening, and that the maximum pace of tightening is $95 billion a month. And those who bother to do the arithmetic can figure out that the balance sheet has shrunk by just over $1 trillion since the peak in April 2022. But what one cannot possibly know is how much the Fed plans to shrink the balance sheet or how the Fed thinks about the interaction between its two tools.

That’s right. This transparent Fed with its release of the minutes of FOMC meetings, press conferences by Chairman Powell, and economic and interest rate projections by member of the FOMC is absolutely mum on the balance sheet policy. Do they intend to take back all $5 trillion? Stop at $2 trillion? Bet the inflation house on pi and shrink by $3.14159 trillion? We have no clue, and it must not be an accident.

How much is $1 trillion of balance sheet shrinkage worth in terms of additional interest rate hikes? Using a simple statistical model, Eakinomics estimates that $1 trillion in shrinkage has half the impact of 500 basis points of rate hikes. The 10-year Treasury is up by a ballpark 1.8 percentage points since April 2022, so the estimate implies that 1.2 percentage points follow from rate hikes and 60 basis points from quantitative tightening. If taken at face value, each month’s $95 billion of shrinkage is the equivalent of roughly 6 basis points in higher rates.

Shrinking the balance sheet is the Manhattan Project of the tightening cycle: doubtless important, perhaps crucial, unprecedented, and shrouded in secrecy.

Fact of the Day

Since January 1, the federal government has published rules that imposed $638.8 billion in total net costs and 191.2 million hours of net annual paperwork burden increases.