The Daily Dish

July 9, 2021

Railroads in the Bullseye

Eakinomics: Railroads in the Bullseye

The Wall Street Journal reported yesterday that “The administration, in a sweeping executive order expected this week, will ask the Federal Maritime Commission and the Surface Transportation Board to combat what it calls a pattern of consolidation and aggressive pricing that has made it onerously expensive for American companies to transport goods to market.” The nostalgia wing of the economics team must have gotten jealous of the relentless focus on Big Tech and rolled the clock back to 1921.

In particular, “The executive order will encourage the STB to take up a longstanding proposed rule on so-called reciprocal or competitive switching, the practice whereby shippers served by a single railroad can request bids from a nearby competing railroad if service is available.”

The STB has been through the reciprocal switching territory before, as reviewed by Dan Bosch in his piece “Reciprocal Switching: Re-regulation at the STB?” A given shipper’s facility could be served by only one railroad, but another railroad can more efficiently move its goods. Under reciprocal switching, the shipper can use the first railroad to ship the goods until it reaches the second, at which point the cars are transferred to the more efficient railroad. For this to happen, the second railroad pays the nearer railroad to ship the goods the initial distance and, thus, reciprocal switching occurs naturally in the market to allow shippers to lower their costs.

In 2016, the STB proposed a rule that would lead to increased “forced switching” or STB-mandated reciprocal switching, adjudicated on a case-by-case basis. But there was no formal benefit-cost analysis of the rule. Certainly, if the administration contemplates an even more restrictive forced-switching regime, there should be a careful quantitative analysis of the impacts before moving forward.

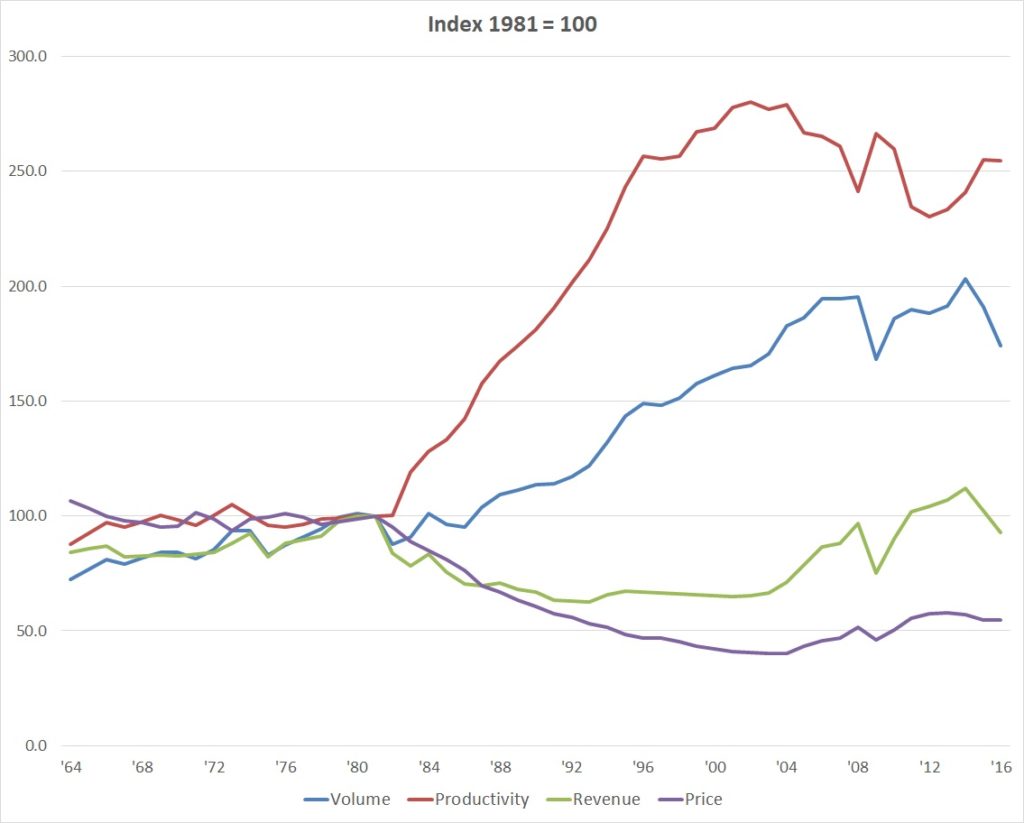

The more general question is, what problem is the administration trying to fix? Since the deregulation in 1980’s Staggers Rail Act, the freight railroads have displayed solid performance, as shown in the chart below (reproduced from Bosch). In particular, real prices of freight services remain dramatically below the regulated era, and have drifted up only lightly in recent years.

All of this suggests the need for an abundance of caution in the regulatory efforts. In particular, Bosch’s conclusion continues to ring true: “The deregulation of rate setting in the freight rail industry has been beneficial to the industry, shippers, and consumers as rates have dropped and volumes have increased. Justification for the STB’s 2016 reciprocal switching proposal seems to stem from the fact that the agency has not forced reciprocal switching on railroads since 1985. This fact alone does not necessarily warrant regulatory action. Accordingly, the STB should conduct a thorough analysis of its 2016 proposal before it acts to restrict the market by making it easier for the Board to impose switching requirements on freight railroads.”

Fact of the Day

The construction of new electricity transmission facilities would cost an estimated $314 to $504 billion in capital costs.