The Daily Dish

February 21, 2019

Student Loan Debt in Perspective

Eakinomics: Student Loan Debt in Perspective

Readers of the economic press have become numb to “the sky is falling” articles about student debt. It is commonplace for articles to bewail the negative impact of student debt on the housing and auto markets, for example. And Fortune recently lamented the lack of broader attention given to this issue, noting, “Trump’s 82-minute [State of the Union] speech failed to mention the truly record-breaking $1.465 trillion that Americans face in outstanding student loan debt.”

Perhaps, but what are the facts about this “crisis”?

In 2017, the average student loan debt of a graduating senior was just under $30,000. But averages of graduating seniors hardly capture the whole picture.

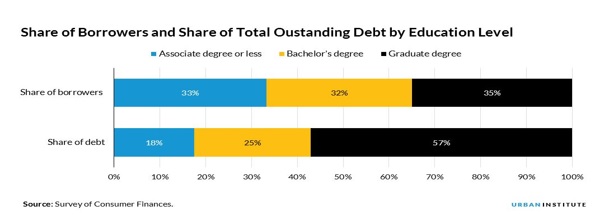

The first thing to note is that the really big student loans – and the vast portion of total borrowing – are for those who achieve a degree or even go to graduate school (see below).

These borrowers can typically handle their debt. According to The Institute for College Access & Success, “Nationally, only 5 percent of bachelor’s degree recipients who entered college in 2003-04 had defaulted on their federal student loans within 12 years of entering college, compared to 12 percent of associate’s degree recipients, 29 percent of certificate completers, and 23 percent of non-completers.”

So, if there is a problem, it is among those who do not finish their bachelor’s degree, and one would suspect that they are relatively young.

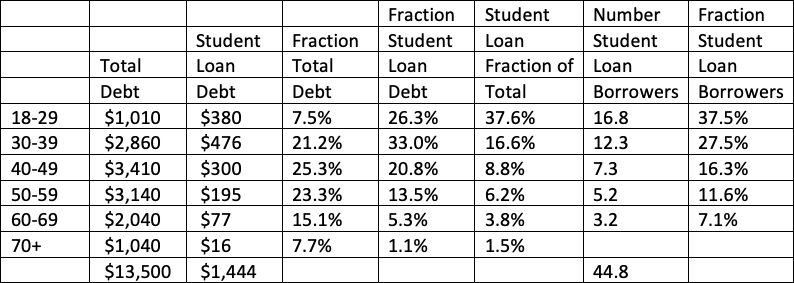

The table below shows loan balances by age. For example, among those 18-29 years of age (in 2018), total debt was a bit over $1 trillion, of which roughly $380 billion was student loan debt. That $380 billion is 26 percent of overall student loan debt, while only 7.5 percent of overall debt of any kind. The 16.8 million borrowers in this age bracket were 38 percent of all student loan borrowers compared to the 7 percent who are 60 or older.

What do we learn? Total debt has the familiar humped shape, rising to a peak in mid-life and declining thereafter. This shape is mirrored by student loan debt as a fraction of all student loan debt (column 4) and by student loan debt as a fraction of overall debt (column 5).

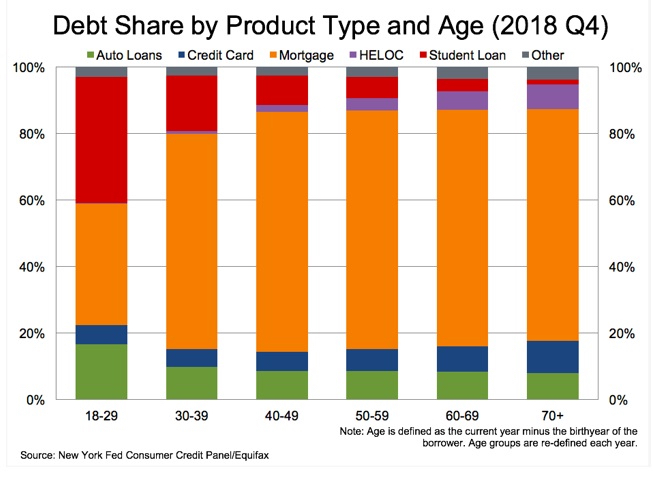

But most important is the very high fraction of borrowing (38 percent) that is student loans – more than twice the next highest figure (16.6 percent among the 30-39 year age group). This proportion is shown in a slightly different form below, which emphasizes that a higher fraction of student loan debt is the mirror image of lower mortgage debt but not auto loans.

This sheds new light on claims that student debt is causing direct harm to the housing or auto loan markets. The latter does not appear diminished in these data. And it seems unlikely that inability to access a mortgage because of student loan debt is the primary obstacle to homeownership for someone under 30 and without a completed degree.

Student loans are undoubtedly a real burden for some. But it seems hard to make the case that they are the macroeconomic apocalypse that many suggest.

Fact of the Day

Between both proposed and final rules last week, agencies published $52.8 million in total net costs, but also put forward 4.8 million hours of paperwork reductions.