The Daily Dish

September 19, 2023

The Fed Is Continuing to Tighten

Today marks the start of a two-day Federal Open Market Committee (FOMC) meeting, at which the FOMC is widely expected to leave the target federal funds rate (the policy interest rate) unchanged. So, let us instead talk about the part of the Fed strategy that nobody is talking about: the shrinking Fed balance sheet, a.k.a. quantitative tightening (QT).

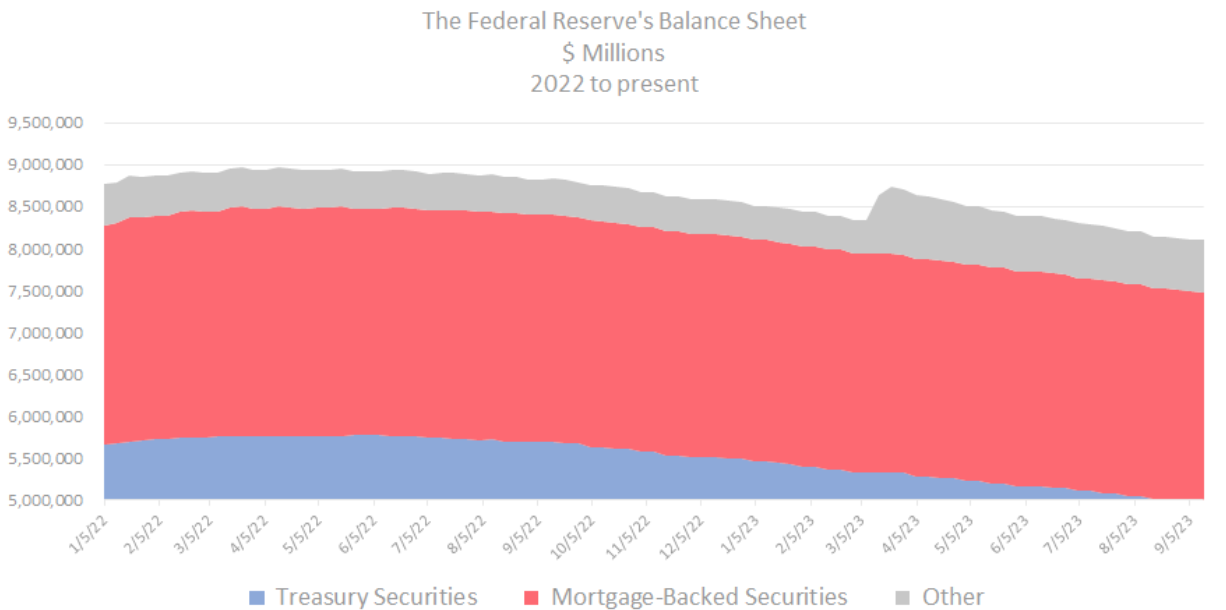

The chart below is reproduced from the latest version of Thomas Kingsley’s tracker of the Fed’s balance sheet. As one can see, the balance sheet ballooned to $9 trillion in early 2022 as the Fed bought $60 billion per month in Treasury Securities and $30 billion per month of mortgage-backed securities. In the process, the Fed pumped nearly $5 trillion in cash into financial markets.

Since then, the goal has been to steadily pull that money out. The balance sheet assets are now down to $8.1 trillion. This nearly $1 trillion reduction occurred despite a brief U-turn in the immediate aftermath of the Silicon Valley Bank collapse. Notice that as the balance sheet runs down, the liquidity that had been pumped into financial markets gets pulled out.

And that, indeed, is the point. With less money available, the competition for it will drive market interest rates even higher.

Thus, the Fed has been tightening in three ways. Obviously, it has raised the federal funds target rate. But as inflation subsides, at each target rate the real rate of interest is higher. This is the second form of tightening. And, finally, it continues with QT, the third form of tightening.

Tomorrow the FOMC will announce that it is leaving the target funds rate unchanged. But remember, this does not mean it has stopped tightening.

Fact of the Day

Across all rulemakings this past week, agencies published $25.9 billion in total costs and added 4 million annual paperwork burden hours.