The Daily Dish

October 24, 2023

Whither Home Prices?

Economists are often asked to predict the future, and I am no exception. Doing so is not hard, but being right is nearly impossible. So, let’s take another shot at the unachievable today. What will happen to house-price inflation in the years to come?

A lot of ink has been spilled on U.S. housing markets in the past several years. And rightly so. The pandemic produced a desire for geographic relocation by many, and the pandemic-related monetary and fiscal responses fueled a rapid rise in the prices of many assets, housing included. Between 2020 and 2021, there was a $5 trillion run-up in the Fed’s balance sheet and $5 trillion in fiscal stimulus.

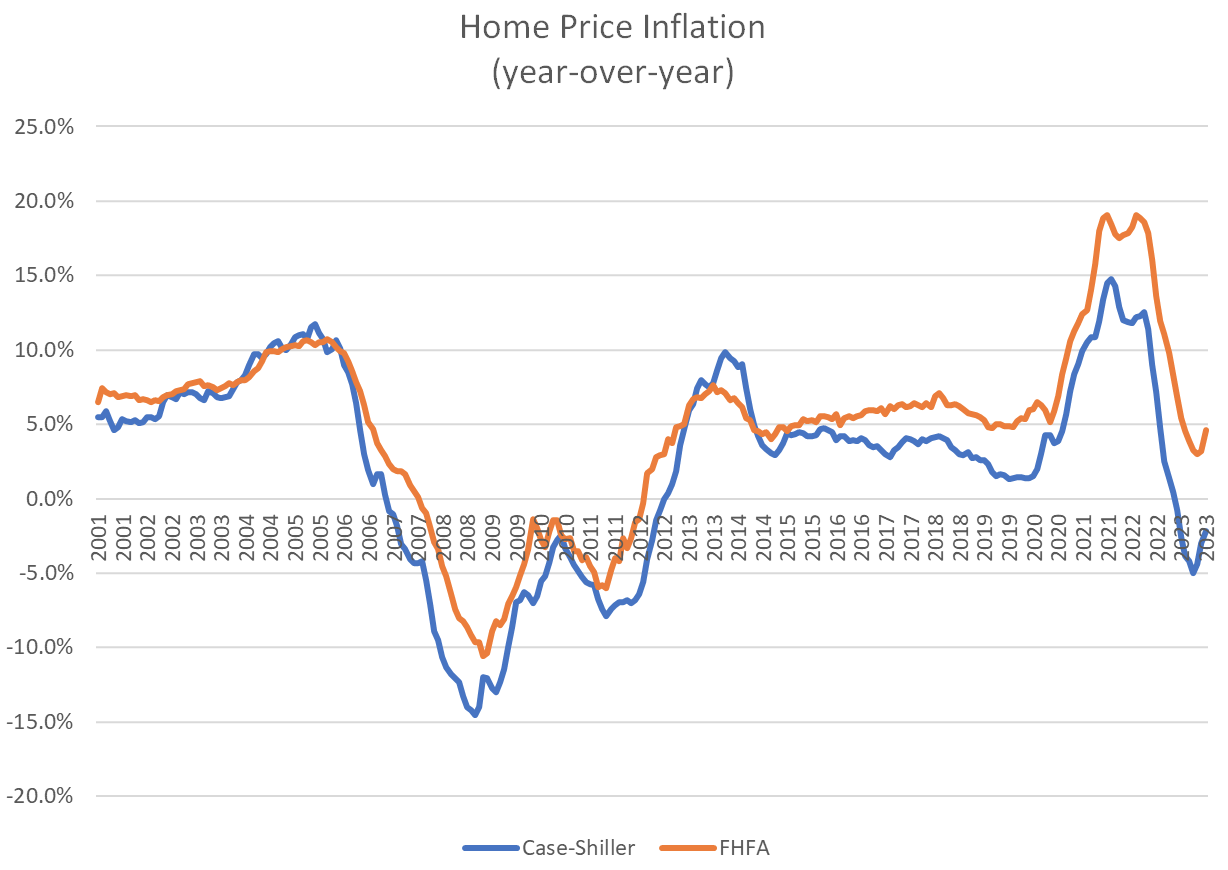

The response of housing prices (shown in the graph below) was dramatic. Measured using either the Case-Shiller national price index or the Federal Housing Finance Administration (FHFA) monthly national purchase price index, house price inflation jumped from about 5 percent to the region of 15–20 percent (measured year over year).

Of course, as is well known, the Federal Reserve did a sharp about-face in 2022 and the tightening resulted in 30-year, fixed-rate mortgage interest rates reaching 8 percent, mortgage applications plummeting, and recession-like levels for new and existing home sales. This is clear in the graph as well, with home price inflation ultimately falling to near-zero or below.

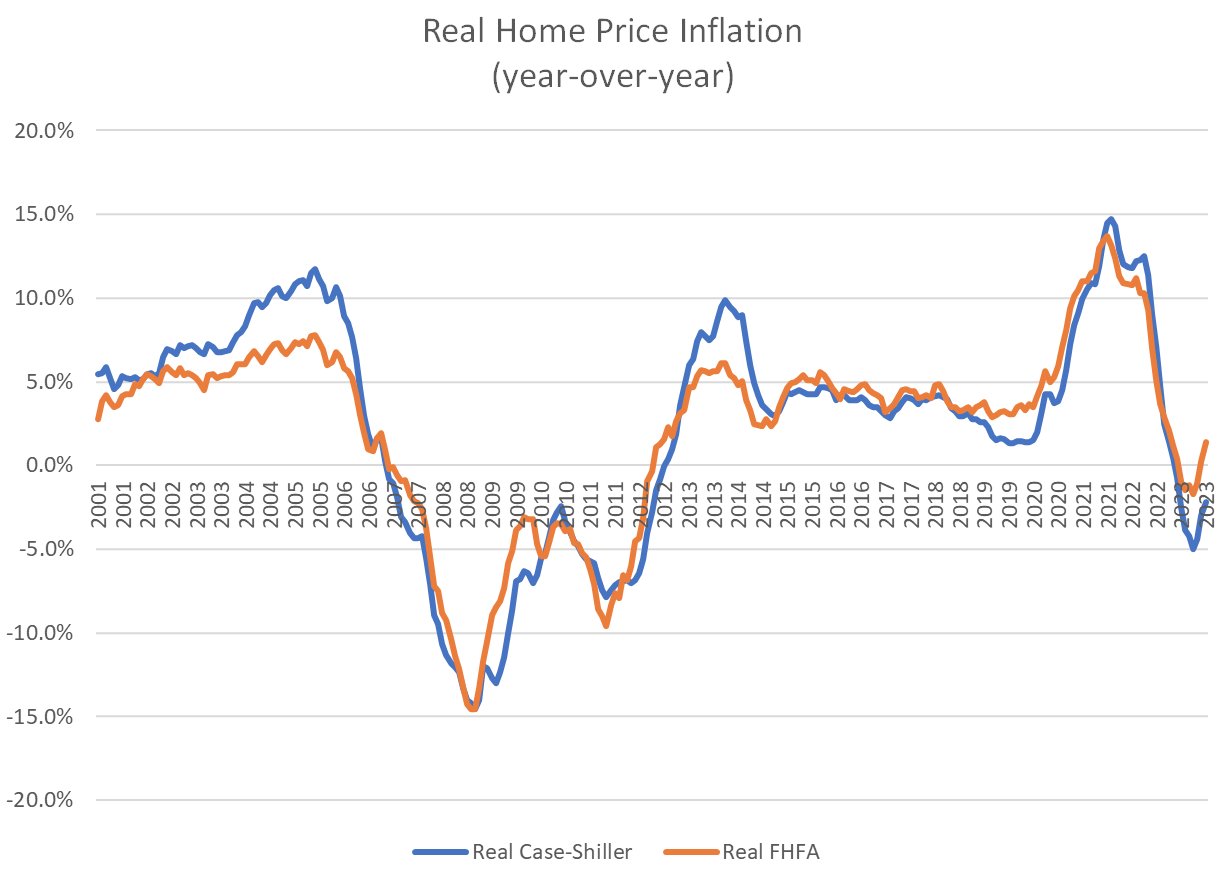

As is also well known, the monetary and fiscal stimulus also engendered a 40-year high in consumer price index (CPI) inflation and, thus, the Federal Reserve response. Accordingly, it is interesting to examine the real (inflation-adjusted) change in house prices. This is shown below.

Notice that in the years leading up to the pandemic, the two charts are nearly identical. Inflation-adjustment does not mean much when inflation is near zero. At the risk of over simplifying, however, it does look like in the “normal” times prior to the financial crisis and recession, and again from 2012 or so to the pandemic onset, the real house price inflation stabilizes in the neighborhood of roughly 5 percent.

If the period after 2023 marks a return to normalcy, then one might expect roughly 5 percent real increase again (on average). Given that the Fed is presumably going to successfully anchor CPI inflation at its 2 percent target, this implies that year-over-year changes in housing prices will level off in the 7 percent range.

See, that wasn’t hard.

Fact of the Day

As of October 19, the Fed’s assets stood at $7.9 trillion.