Insight

April 21, 2020

Addressing Oil Supply

Executive Summary

- Due to an oversupply of oil and historically low prices caused by the COVID-19 pandemic, some in the oil industry have appealed to the Trump Administration for aid.

- Both federal and state authorities have considered adopting measures to reduce supply and raise prices, with the administration exploring ways to use the Strategic Petroleum Reserve to remove oil from the market.

- Firms are already responding to market signals, however, and government intervention, such as plans to pay oil producers to keep stores of oil in the ground, will at best prove to be ineffective and costly and should be avoided.

Oil Oversupply

Demand for oil is estimated to decrease nearly 30 percent due to the shelter-in-place orders throughout the world resulting from the COVID-19 pandemic. Simultaneously, Saudi Arabia and Russia increased the quantities of oil they were bringing to market. This additional supply came on top of the growing quantities no longer consumed by the transportation sector as commuting and air traffic steeply declined. As a result, the market is oversupplied, and there is concern that this glut will exhaust storage capacity and that the resulting historically low oil prices will trigger mass bankruptcies of domestic exploration and production companies.

The threshold question is whether these challenges pose a policy issue. Despite the market’s response to decreased demand, the president, Congress, and federal and state agencies have all proposed solutions. While some are unprecedented, such as plans to justify paying oil producers not to produce under the auspices of the Strategic Petroleum Reserve (SPR), others are more conventional, such as tariff proposals. To date, however, all are ineffective attempts to shift a global market with domestic policy. This paper describes how each policy could raise costs for industry while failing to raise oil prices in the short term, potentially harming domestic industry in the long term and imposing additional costs on Americans.

State Authority

The federal government lacks clear authority to control the quantities of oil produced by private industry. An outgrowth of trust busting, the laws defining the current domestic oil industry create an opaque market to prevent producers from organizing. State agencies, on the other hand, have retained the ability to control production in specific scenarios.

Oil production in the state of Texas, the top U.S. producer of crude oil responsible for 41 percent of the nation’s crude oil production in 2019, may be regulated by the Texas Railroad Commission (TRRC). The Texas Natural Resource Code allows TRRC to limit production in the case of waste, which includes “production of oil in excess of transportation or market facilities or reasonable market demand.” Two Texas producers, Pioneer Natural Resources and Parsley Energy Inc., filed a complaint with TRRC asking that it consider whether waste is occurring. In response, the TRRC held an open meeting to hear various viewpoints. Pioneer suggested that TRRC proration 1 million barrels per day (bpd), or about 20 percent of production from May through September.[1]

A state-mandated production cut would have cascading consequences throughout the industry. The operation of the energy sector relies heavily on contractual agreements among its participants. Producers engage with field service companies, pipelines, rail and marine transport, and industrial end users, among others, to ensure that their product can leave the field and be conveyed in a timely fashion to its final destination for processing. These contracts include terms surrounding expected quantities and times of delivery. Faced with a mandated cut in production, each producer would no longer have the flexibility to determine how to meet contractual obligations based on their company performance. Instead, they would be forced to renegotiate contract terms or absorb the loss of failing to meet those terms with controls in place. Responding to decreased demand with their own circumstances in mind, some companies may choose to curtail more than 20 percent of production, while others may see fit to reduce less or modulate the production, cutting more or less as conditions warrant.

Tariffs

Both the president and members of Congress have proposed imposing tariffs on the import of foreign oil. Some specifically called for tariffs on Russian and Saudi Arabian oil as the two countries chose to flood the market in the face of declining demand. The intent of such tariffs is to insulate domestic producers from foreign competition.

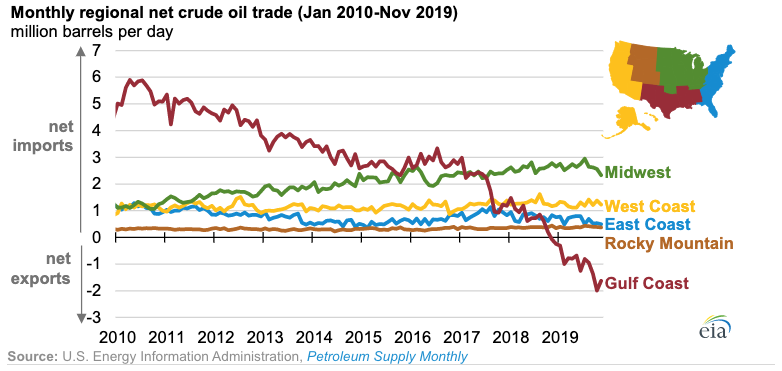

The United States became a net exporter of oil in September 2019, meaning that the quantities of domestically produced oil exported abroad are greater than those imported from foreign countries. While this has been touted as a sign of America’s energy independence, the United States still relies heavily on imports. In 2019 the United States imported over 6 million bpd of oil.[2]

Production in the Gulf Coast area has driven export volumes, while the remainder of the United States continues to rely on imports, as the chart above shows.[3] This oil is refined to produce diesel, jet fuel, heating oil, and other products critical to everyday life. For example, gasoline components are produced at domestic refineries by refining imported oil. The tariffs imposed on foreign producers would be passed on to these refineries, which in turn pass them on to consumers at the pump.

Strategic Petroleum Reserve

The SPR has served as a national stockpile of oil for decades. Following the 1973-74 oil embargo, the federal government sought to shield the economy from future supply shortages by developing facilities that can store 713.5 million barrels. As detailed below, however, the administration has proposed using the SPR not for security purposes but to increase confidence and raise prices by removing supply from the market. This strategy misuses a national resource to drive revenue for a few rather than provide domestic security.

Then…

The current administration’s plans to sell and later purchase oil from the SPR have not yet come to fruition. Initially, oil was to be sold to raise funds for facility modernization, but low oil prices led the Department of Energy (DOE) to shelve the plan. Shortly after, the president requested that the DOE purchase oil to reduce the amount of domestic supply on the market and raise prices. Congress, however, was unwilling to appropriate the funds when preparing the CARES Act.

Now…

Since then, the DOE has taken yet another position on the use of the SPR – leasing the available capacity. On April 2, 2020, the DOE issued a Request for Proposals (RFP) to provide temporary storage by making storage capacity at the SPR available. The DOE announced this week that it is negotiating with nine companies who have responded to the RFP and could store approximately 23 million barrels of crude oil with deliveries as soon as this month.[4] The DOE will collect on the storage term by retaining a percentage of the stored oil as the fee.

The quantities that will be stored are negligible. In March, domestic production peaked at 13.1 million bpd. And while this value has declined, the storage of less than two days’ worth of production has not proven to be market-moving. The DOE, however, intends to provide another round of leasing opportunities to companies.

In the Future…

Although leasing capacity has yet to be completed, the DOE is preparing another plan, characterized as a purchase for the SPR, in response to President Trump’s negotiations with the Organization of Petroleum Exporting Countries (OPEC), among others. The negotiations resulted in producer countries, including Saudi Arabia, an OPEC member, and Russia, agreeing to reduce supplies introduced into the market, with reductions spanning from May 1, 2020, through April 30, 2022. Initial cuts of 9.7 million bpd would be effective through June 30, 2020.[5] The president agreed to reduce U.S. production to cover quantities that Mexico was unwilling to curtail. Asked to reduce production by 400,000 bpd, Mexico was only willing to cut 100,000 bpd.

While this agreement was touted as a success, the market didn’t seem to think so. Prices remained low, with crude oil futures hovering around $20 and then dropping precipitously on Monday, April 20. But perhaps more troubling was the president’s assertion that he would direct the United States to curtail production although the administration made no guarantees in the agreement. Unlike the members of OPEC, the United States has no clear federal authority to control production, as noted above. As a result, the president is yet again relying on the authority of the Secretary of Energy, who can enter into a variety of agreements with producers in administering the SPR.

The DOE is assembling a plan, which has not been officially released, to pay domestic producers to not produce as much as 365 million barrels. Rather than produce the oil and provide it to the SPR, companies would ostensibly store the oil on behalf of the SPR by leaving it within their reservoir (i.e. in the ground) and produce it at a later date. [6] There is no indication of when companies would tap these acquired oil reserves, but upon receipt of the oil, the Treasury Department would collect the proceeds, according to the proposed plan. The presence of such proceeds suggests that, upon being produced, these reserves would be sold rather than transported to SPR facilities.

The Energy Policy and Conservation Act of 1975 (EPCA), which created the SPR, provides that up to 1 billion barrels of oil can be held in reserve.[7] With nearly 635 million barrels currently in the SPR, the administration is left with 365 million barrels before hitting the statutory cap.[8] The president’s initial request to purchase oil for the SPR, which Congress rejected, called for $3 billion in appropriations. While prices are at historic lows currently, it is difficult to estimate the cost to purchase 365 million barrels in the weeks ahead. Although congressional debate about an additional round of coronavirus response continues, to date it appears unlikely to appropriate funds for this purpose soon.

Assessing the Latest Plan

In principle, the administration’s plan strays from the purpose of the SPR in three ways. First, it misidentifies what constitutes a storage facility. Second, it mischaracterizes a purchase. Third, it intends to aid particular producers. But more broadly, it fails to heed the lessons from past responses to economic downturns.

The EPCA provides that the Secretary of Energy may “store petroleum products in storage facilities owned and controlled by the United States or in storage facilities owned by others if those facilities are subject to audit by the United States,” where a storage facility is “any facility or geological formation which is capable of storing significant quantities of petroleum products.” A storage facility in practice must be capable of two functions: injection, i.e. the ability to add product, and withdrawal, i.e. the ability to remove that product. In drilling oil fields, producers withdraw from natural stores but do not inject the very same product that they are extracting.

By entering into an agreement that establishes a price for a traded commodity to be paid upon future delivery, the secretary would be entering into a futures contract. This has inherent risks. First, the reservoir in which the oil quantities are contained must be operable from an engineering perspective at the undetermined future date the government would hope to tap it. Second, the producer must be operating or, at least, have sold their rights to contract to another producer in the case of insolvency. And finally, the market price of oil would have to increase at an opportune time. The EPCA provides that the secretary shall “avoid adversely affecting current and futures prices, supplies and inventories of oil” in acquiring oil for the SPR. But by making investment decisions regarding potentially large quantities of oil, it is hard to imagine prices wouldn’t be affected especially if any of these risks actualized.

This plan aims to aid small- and medium-sized producers who operate in areas with higher production and operating costs and may require an injection of funds to stay afloat.[9] Per the EPCA, those producers attempting to sell oil to the DOE would be subject to competitive bidding, which prevents the DOE from choosing winners and losers. Producers able to provide oil at the lowest price would be most likely to win. While the EPCA states that the price paid by the DOE should take the cost of production into account, the price cannot exceed that on the open market “without regard to the source of the petroleum products.” As a result, those producers who are most affected by low market prices are less likely to make the cut when time comes to bid. In other words, the plan would not help the firms that are already most struggling while helping those most likely to survive the downturn.

The administration’s attempts to raise prices while paying for surplus are reminiscent of the federal response to farmers’ concerns in the wake of the Great Depression, a textbook example of bad economic policy. By attempting to avoid floor prices for goods that industry deemed too low, the government response in turn led to prices that were inaccessible to consumers with lower incomes due to the Depression. The surplus of goods grew, and the government purchased those goods with tax dollars that could have been better spent in responding to the economic downturn. In this case, those goods subject to escalating prices would not only be oil but also products such as gasoline, diesel, or jet fuel that consumers and industry rely on to keep the wheels of commerce turning.

Conclusion

While some policymakers want to address the dramatic drop in oil demand and prices, such measures are unlikely to remedy the problem and may yield long-term harm. Moreover, producers are already responding to reduced demand globally. While the OPEC agreement has resulted in about 10 million bpd cuts, production cuts are estimated to be about 20 million bpd and the estimated decrease in demand is about 25-35 million bpd. Since its peak in mid-March, oil production in the United States has declined from 13.1 million bpd to 12.3 million bpd. Industry is closing the gap.

Similarly, in the United States distillation of oil has decreased, with production of gasoline down by over 30 percent and jet fuel down nearly 40 percent compared with the same four-week period last year.[10] And companies have announced reduced capital expenditures on new oil wells in the next year, a common response in a historically boom and bust industry. Nine major global producers announced cuts that amount to a 22 percent decrease in expected expenditures in 2020.[11] These cuts indicate that bringing new wells online is not currently in producers’ best interest. The point of intervention is to cut production, but companies are already cutting in response to the market, making intervention unnecessary. Overall, intervention by both federal and state authorities would fail to aid producers while harming consumers and, in the long term, potentially affect the market‘s ability to operate efficiently.

[1] https://www.rrc.state.tx.us/media/57361/apr14-docs-shown-at-mtg-all.pdf

[2] https://www.eia.gov/todayinenergy/detail.php?id=43196

[3] https://www.eia.gov/todayinenergy/detail.php?id=42735

[4] https://www.energy.gov/articles/doe-announces-crude-oil-storage-contracts-help-alleviate-us-oil-industry-storage-crunch

[5] https://www.opec.org/opec_web/en/press_room/5891.htm

[6] https://www.bloomberg.com/news/articles/2020-04-15/u-s-weighs-paying-drillers-to-leave-oil-in-the-ground-amid-glut

[7] https://legcounsel.house.gov/Comps/Energy%20Policy%20And%20Conservation%20Act.pdf

[8] https://www.eia.gov/dnav/pet/pet_stoc_typ_d_nus_SAS_mbbl_m.htm

[9] https://www.washingtonexaminer.com/policy/energy/trump-administration-considers-paying-us-oil-producers-to-keep-it-in-the-ground

[10] https://www.eia.gov/petroleum/supply/weekly/pdf/highlights.pdf

[11] https://www.reuters.com/article/us-global-oil-majors-capex-graphic/oil-majors-slash-2020-spending-by-20-after-prices-slump-idUSKBN21J516