Insight

November 3, 2022

Affordable Care Act Marketplace Premiums for Plan Year 2023

Executive Summary:

- Premiums for households with Affordable Care Act (ACA) Marketplace plans before receiving the Advanced Premium Tax Credit (APTC) are rising slightly for the first time since 2019, and some households will see premiums rise even after receiving the enhanced APTC.

- Despite rising costs for policyholders, premiums across ACA metal tiers are still lower than in 2019.

- Most of these households should expect to pay significantly less than the pre-APTC premiums as a result of changes made to APTC eligibility in the American Rescue Plan Act and Inflation Reduction Act.

Introduction

On October 25, 2022, the Centers for Medicare and Medicaid Services (CMS) released the Affordable Care Act’s (ACA) Marketplace premiums for plan year (PY) 2023. This year marks a decade of available Marketplace plans, and despite a slight increase for 2023, premiums have remained stable for several years. This insight provides a brief explanation of the updated premiums for PY23, how selected premiums have changed over time, and the impacts the American Rescue Plan Act (ARPA) and Inflation Reduction Act (IRA) have had on the enhanced Advanced Premium Tax Credit (APTC) and the ACA Marketplace.

Plan Year 2023 Premiums

Figure 1 displays the latest prices, before the application of the APTCs, for the ACA’s four main metal tiers (Bronze, Silver, Gold, and Platinum), as well as the second-lowest cost Silver (SLCS) plan. The SLCS plan is considered the “benchmark” plan upon which APTCs are based, and thus greatly affects Marketplace participation and actual premiums paid. As Figure 1 shows, premiums have increased across metal tiers and plan types, including for individuals and families. Of note, Gold plan premiums increased significantly less than other tiers, possibly due to enhanced APTCs in PY22 allowing more households to purchase Gold plans – increasing plan participants and thus decreasing the overall cost of the plan – while Platinum plans remained too expensive for many.

Figure 1: Plan Year 2023 Premiums by Metal Tier[1]

| Metal Tier Premiums (Pre-APTC) | PY2022 | PY2023 | Percent Change* |

| 27 Year-Old | |||

| Bronze | $329 | $346 | 5.1% |

| SLCS | $368 | $382 | 3.8% |

| Silver | $431 | $452 | 4.8% |

| Gold | $483 | $487 | 0.9% |

| Platinum | $573 | $649 | 13.3% |

| 40 Year-Old | |||

| Bronze | $401 | $421 | 5.1% |

| SLCS | $438 | $456 | 4.1% |

| Silver | $525 | $550 | 4.9% |

| Gold | $588 | $593 | 0.9% |

| Platinum | $699 | $783 | 12.0% |

| Family of Four (40 Year-Old Couple) | |||

| Bronze | $1,278 | $1,342 | 5.1% |

| SLCS | $1,439 | $1,503 | 4.4% |

| Silver | $1,671 | $1,752 | 4.9% |

| Gold | $1,872 | $1,889 | 0.9% |

| Platinum | $2,234 | $2,496 | 11.7% |

*Percentages were calculated using unrounded numbers.

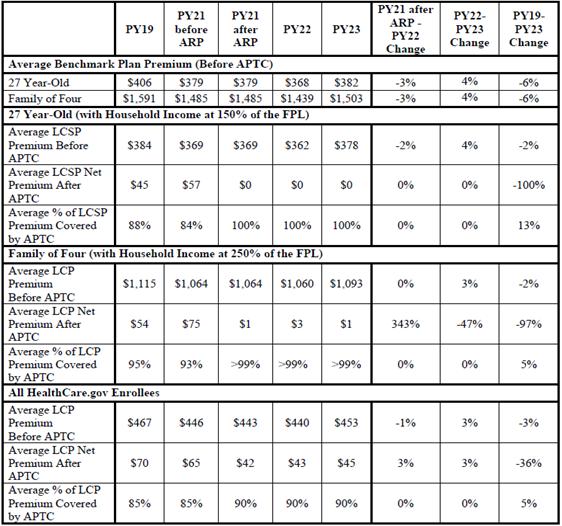

As Figure 2 demonstrates, however, these premiums are unlikely to be what most people pay. Provisions created in the ARPA, and extended by the IRA, decreased the maximum amount that households could be required to contribute toward premiums as a percentage of total household income down to 8.5 percent of household income, while also expanding eligibility for enhanced APTCs to households making more than 400 percent of the federal poverty level (FPL). These provisions mean that many households will pay significantly lower premiums than advertised after receiving the enhanced APTCs. CMS estimates that, before the APTCs, benchmark premiums for both an average 27-year-old and an average family of four will increase by around 4 percent. After the enhanced APTC, and depending on income level, many enrollees can expect to see significant discounts. In one example, CMS states that for an average 27-year-old in a HealthCare.gov state with a household income at 150 percent of the FPL, premiums for both the average Bronze and Silver lowest-cost plan (LCP) will cost $0, and premiums for average Gold LCPs will be just $18.[2] As shown in Figure 2, CMS estimates that, on average, the enhanced APTCs will cover around 90 percent of the average LCP premium. However, enhanced APTCs did not uniformly reduce costs. As demonstrated in Figure 2, the average LCP net premium post-APTC increased 3 percent for HealthCare.gov enrollees overall.

Figure 2: Premiums and Maximum APTC Amounts[3]

Of note, the IRA only extended the enhanced APTC subsidies for three years (2023–2025). During those years, the Congressional Budget Office (CBO) estimates that the enhanced APTCs will cost around $61.68 billion. In 2023 alone, CBO estimates the enhanced APTCs will cost $19.60 billion.[4]

Conclusion

Despite general high inflation across the economy, and the increasing rise in inflation in the health sector (which is generally a lagging indicator), ACA Marketplace premiums have remained relatively stable and have not seen the increases originally expected (and sought) by insurers. The ACA Marketplace premiums have been kept artificially low through the enhanced APTC subsidies provided by the ARPA and the IRA. These premiums are likely to be considerably lower than other types of private insurance and could cause more individuals to leave these plans in favor of ACA Marketplace plans. As health care inflation increases due to rising labor costs and increased utilization, and if subsidies are extended past 2025, the shift from private insurance to the ACA Marketplace could continue at increasing rates.

[1] QHP Landscape PY2023 Individual Medical Market File. Centers for Medicare and Medicaid Services. https://data.healthcare.gov/dataset/cfbbddd9-b405-4c4a-b679-fd2986945b88

[2] Plan Year 2023 Qualified Health Plan Choice and Premiums in HealthCare.gov Marketplaces. Centers for Medicare and Medicaid Services. https://www.cms.gov/CCIIO/Resources/Data-Resources/Downloads/2023QHPPremiumsChoiceReport.pdf

[3] Ibid.

[4] Estimated Budgetary Effects of Public Law 117-169, to Provide for Reconciliation Pursuant to Title II of S. Con. Res. 14. Congressional Budget Office. https://www.cbo.gov/system/files/2022-09/PL117-169_9-7-22.pdf