Insight

June 30, 2021

Assessing the Impact of Blanket Student Loan Forgiveness

Executive Summary

- The Biden Administration is examining whether it has the authority to provide $10,000 in blanket student loan forgiveness on every federal student loan.

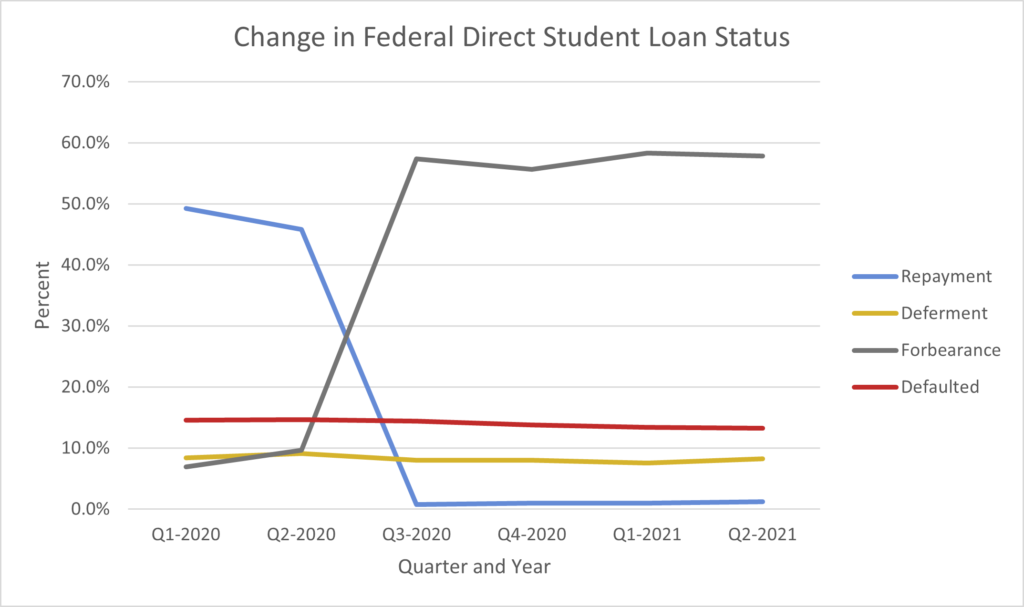

- More than 60 percent of federal student loan holders have entered and remained in forbearance on their loans since the third quarter of 2020, a 47.8 percentage point increase from the previous quarter, while just 1 percent of all borrowers are regularly making payments right now.

- A $10,000 blanket forgiveness would reduce outstanding federal student loan debt by $380 billion, but more than half of this relief would go toward families in the top 40 percent of income, while the bottom 40 percent would receive just a quarter of the relief.

- Blanket loan forgiveness also would introduce a moral hazard into the federal student loan system and likely inundate the system with poorly written and possibly fraudulent loans.

Introduction

In the second quarter of 2021, more than 60 percent of federal student loan holders are in forbearance. Most of these students entered forbearance during the third quarter of 2020, when the Trump Administration allowed borrowers of federal student loans to pause principal and interest payments in light of the pandemic. President Biden has extended that policy and even initially indicated his support for a $10,000 blanket student loan forgiveness proposal as part of his administration’s response to the COVID-19 recession. The administration has since walked back this commitment due to uncertainty about the president’s authority to provide blanket loan forgiveness, but the administration is currently performing a legal review to determine if the president has the authority to do this.

In the meantime, the Biden Administration has cancelled about $2.8 billion in outstanding federal student loan debt for about 90,000 borrowers through more targeted and less controversial mechanisms. While this debt forgiveness is so far a relatively miniscule part of the total outstanding student debt, it has raised speculation on what further forgiveness the Biden Administration will ultimately provide and when. This analysis examines the impact of a blanket $10,000 student loan forgiveness for every federal borrower. While forgiving $10,000 in outstanding student debt for all holders would reduce total outstanding debt by $380 billion—almost 25 percent—it would be highly regressive. More than half of this relief would be realized by the top 40 percent of families by income, while the bottom 40 percent would realize just a quarter of the relief. Further, any form of blanket loan forgiveness would also inundate the already-troubled student loan system with a new set of disincentives to pay.

Pauses on Student Loan Payments during the COVID-19 Pandemic

Repayment on federal student loans was initially paused as part of the Coronavirus Aid, Relief, and Economic Security Act (CARES), a $2.2 trillion economic stimulus bill in response to the COVID-19 induced economic recession, passed on March 27, 2020. CARES specifically suspended the requirement for principal and interest payments on outstanding federal student loans, and set zero percent interest rates for outstanding federal student loans. CARES also stopped collections on defaulted federal student loans. These suspensions were not mandatory; borrowers were free to make payments during this time. The Trump Administration extended these suspensions for federal student loans twice more until January 31, 2021. One of the first moves by the Biden Administration was to extend these suspensions again until September 31, 2021, which as of now, is the current date of resumption for federal student loan principal and interest payments.

Many borrowers availed themselves of the opportunity to suspend their repayment of federal student loans over the past year. The percent of federal direct student loan holders in forbearance increased from 9.6 percent in the second quarter of 2020 to 57.4 percent in the third quarter of 2020. The portion of holders in repayment decreased from 45.8 percent to just 0.8 percent in the third quarter of 2020.

Chart 1: Distribution of Federal Direct Loans by Status[1]

It is advantageous for these borrowers to enter forbearance, as they can temporarily forgo repayment in the hopes of receiving forgiveness under the Biden Administration without facing any penalties. As of the second quarter of 2021, over 57 percent of federal student loan holders are still in forbearance. Just over one percent are making regular payments.

Forgiveness Under the Biden Administration So Far

The Biden Administration initially signaled its support for $10,000 in blanket forgiveness for all federal student loan holders. The administration has since walked back this commitment due to uncertainty over whether it has the legal authority to do so. In the meantime, amid increasing calls to provide blanket forgiveness, the administration has used more targeted mechanisms that are less controversial or contentious. The main one is “borrower defense,” which allows the Department of Education to discharge loans for students that were defrauded or misled by their higher education institution. This mechanism also allows for discharging loans for students who attended a school that violated state or federal law.

The administration has so far cancelled $2.8 billion in student debt for about 131,000 borrowers in three tranches:

- $1 billion for 72,000 borrowers through borrower defense;

- $1.3 billion for 41,000 borrowers with total and/or permanent disabilities; and

- $500 million for 18,000 students that were defrauded by ITT Technical Institute, also through borrower defense.

Overall, this forgiveness amounts to less than 0.002 percent of outstanding federal student loans ($1.6 trillion total in the second quarter of 2021) and just over 0.003 percent of borrowers (51.6 million holders of student debt in the second quarter of 2021).

What $10,000 Blanket Forgiveness Looks Like

Below is a table of the current federal student loan portfolio by the outstanding balances of borrowers. A $10,000 blanket forgiveness would fully eliminate the balances for 14.8 million holders in the first two categories (in bold and underlined) while reducing for each holder in the subsequent categories up to the amount. Overall, a $10,000 blanket forgiveness would reduce total federal outstanding student debt by $380 billion, 24 percent of the $1.6 trillion in total outstanding federal student loan debt.

Table 1: Federal Student Loan Portfolio by Borrower Debt Size as of the Second Quarter of 2021[2]

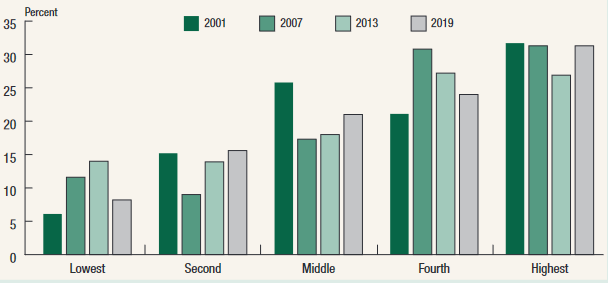

Upper-income families hold a disproportionate amount of outstanding student debt. According to the chart below produced by the Federal Reserve, more than half of outstanding student debt is held by families in the top 40 percent of the income distribution, while the bottom 40 percent of the income distribution hold just about a quarter of the total federal student loan debt. Of the approximate $380 billion in cancelled debt under the $10,000 blanket forgiveness proposal, more than half would be realized by families in the upper 40 percent of income. The bottom 40 percent would realize just a quarter of the $380 billion forgiven.

Chart 2: Distribution of Student Debt by Income Quintiles[3]

Moral Hazard

Blanket loan forgiveness would also create a moral hazard in the student loan system. Students would enter college with the notion that past forgiveness programs will be repeated. This assumption would reduce their incentive to repay loans in a timely fashion. If enough students were to hold this perspective, the entire federal loan system would be inundated with poorly written and possibly fraudulent loans. And since taxpayers back federal student loans, forgiveness amounts to providing taxpayer-financed checks to each loan holder.

Conclusion

The current pause on repayment of federal student loans is slated to end on September 30, 2021. The Department of Education is contemplating extending the pause again into next year. If it were to do so, it is likely most federal student loan holders would remain in forbearance into next year. The Department of Education is also likely to continue to provide more targeted debt relief through options such as borrower defense. These combined actions will increase the expectation that the Biden Administration eventually will provide blanket student debt relief.

Blanket student loan forgiveness would be a highly regressive policy. It would reward the wealthiest of students and families. Further, it would do so in a backward-looking fashion, doing nothing to increase access to higher education, as current and prospective students would still have to pay the same amount of tuition as before.

A better approach is to build upon income-based repayment options. These options cap monthly payments for loan holders and do not accrue interest. They also have built-in forgiveness options that do not encourage a moral hazard. Such efforts would increase students’ ability to repay their loans, while avoiding the problems associated with blanket forgiveness.

[1] Note the percentages will not add up to 100 percent because other payment categories were not included for simplicity. These categories are “in-school”, “grace”, and “other”.

[2] https://studentaid.gov/data-center/student/portfolio

[3] https://www.federalreserve.gov/publications/files/scf20.pdf