Insight

February 27, 2018

Real Bank Regulatory Reform is Finally on the Horizon

It’s been 10 years since the height of the financial crisis and nearly eight years since the Dodd-Frank Reform and Consumer Protection Act (Dodd-Frank) was signed into law. In those eight years, Dodd-Frank has spawned 147 new regulations resulting in $38.9 billion of regulatory costs and 82.9 million paperwork burden hours. Not surprisingly, this administration and Congress have prioritized reforming many of the Dodd-Frank rules and rolling back some of its regulations in an effort to curtail those costs. As early as next week, a bill will be on the Senate floor that would do just that.

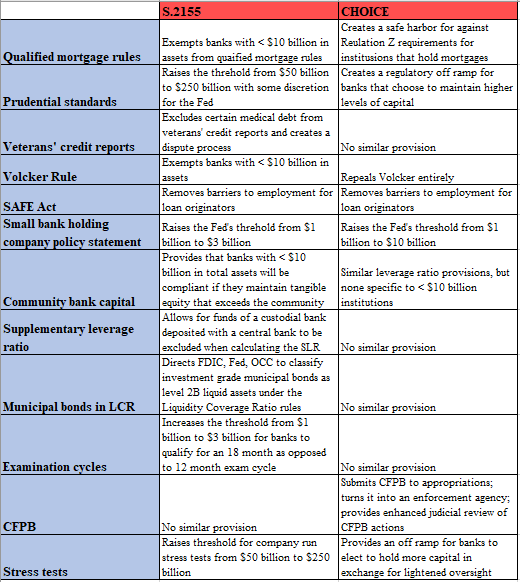

The Economic Growth, Regulatory Relief and Recovery Act (the Senate bill, S.2155) is made up of five titles covering issues ranging from mortgage origination rules to prudential standards to bank holding companies to veterans’ credit reports. Recall that in the last Congress the House passed the CHOICE Act, which was a similarly wide-ranging bill aimed at rolling back some of Dodd-Frank’s burdens. As the Senate bill nears its time on the floor, comparing the two bills helps to clarify the regulatory relief potential of each. Below is a chart showing the most discussed sections of the Senate bill along with their counterparts in the CHOICE Act (if any).

The Senate bill is expected to be on the floor next week and will have up to a week of floor time. While Dodd-Frank’s staunchest supporters will almost certainly oppose rolling back any part of Dodd-Frank, the Senate bill is expected to get up to 70 votes, thanks in large part to a number of Democratic co-sponsors. The still-unanswered question is what the manager’s amendment will look like, and what, if any, concessions will be made to ensure the Senate bill can get through the House.

As the chart above illustrates, there are a number of discrepancies between the House and Senate versions of bank regulatory relief bills. It would not be surprising if there are portions of the manager’s amendment that track closely to provisions in the CHOICE Act, as a nod to the House Financial Services Committee’s work to get the CHOICE Act through the House. Things like operational risk capital and slight movements in asset thresholds are on the table, but changes to CFPB are probably off as it has the potential to throw off the vote in the Senate.

Just this week House Chief Deputy Majority Whip and vice chair of the Financial Services Committee Patrick McHenry said that the House would likely pass the Senate bill before the August recess. That message is welcome for many observers who are concerned that such a big, controversial bill would have a tough time moving through Congress, especially in an election year.

Whatever the timeline is for passing the bill, Congress should ensure that it gets passed and signed by the president. Overreaching, burdensome, and often redundant regulations from Dodd-Frank have had widespread and adverse side effects, from bank closures to constricted small business lending.