Insight

February 8, 2018

Bipartisan Budget Act Changes Who Pays for Drug Costs in Part D Coverage Gap

The Bipartisan Budget Act (BBA) of 2018, currently being considered by Congress, would make changes to the Affordable Care Act’s (ACA) coverage-gap provisions for Medicare Part D that could reduce costs for patients and insurers. These changes might also reduce incentives for insurers to manage costs—which have helped to make Part D a successful market-oriented program.

The Medicare Part D prescription drug program provides Medicare beneficiaries with robust insurance coverage for prescription drugs. All Part D plans are offered by private insurance companies that negotiate with drug manufacturers to provide patients with access to discounted prices. Beneficiaries are free to choose among the multiple plans available to them. This competitive structure has kept prices low, choices broad, and patients satisfied with the program.

Beneficiaries were not happy, however, with one piece of the program—the “coverage gap”—and the Affordable Care Act (ACA) included a provision to eliminate this gap, largely at the expense of drug manufacturers. Now, additional changes have been included in the most recent budget deal, the BBA of 2018.

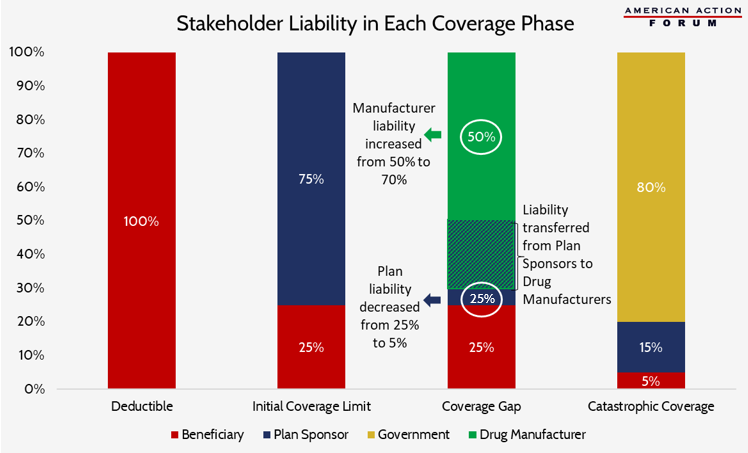

Part D prescription drug plans have four phases of insurance coverage: 1) the deductible, where the beneficiary must cover all costs until the deductible is reached; 2) the initial coverage limit, where beneficiaries pay 25 percent of the cost of their drugs and insurers pay the other 75 percent; 3) the “coverage gap,” so named for the structure of this phase prior to the ACA when the beneficiary resumed full responsibility for the cost of their drugs until reaching the catastrophic coverage limit; and 4) the catastrophic or reinsurance phase, where beneficiaries pay 5 percent, insurers pay 15 percent, and the government paid the remaining 80 percent of the costs.

Included in the ACA was a provision to begin “closing the coverage gap.” Beginning in 2013, drug manufacturers would be required to discount the negotiated price of their drugs by 50 percent for all beneficiaries in the coverage-gap phase of their insurance. The remaining 50 percent of the cost would be shared by insurers and beneficiaries, with the insurers’ liability gradually increasing each year from 0 percent in 2013 until reaching 25 percent of the negotiated price in 2020. As the insurer liability increased, the patient liability would decrease by the same amount. Further, the 50 percent manufacturer discount counts toward a patient’s calculated out-of-pocket costs. This has the effect of allowing the beneficiary to reach the catastrophic coverage limit more quickly (where their cost-sharing is reduced to 5 percent).

The changes included in the BBA of 2018 would bring the beneficiary’s cost-sharing liability down to 25 percent by 2019, rather than 2020, allowing patients to see greater savings one year earlier. However, rather than accelerating the planned increase in insurers’ liability, the legislation instead increases the required manufacturer discount from 50 percent to 70 percent indefinitely, as shown in the chart below. As a result, insurer liability in the coverage gap will be reduced 80 percent from where it otherwise would have been under current law in 2020, from 25 percent to 5 percent of the drug’s cost.

This reduction in plan liability should allow for reduced premiums that, in turn, should save money for both patients and the government (which heavily subsidizes the cost of the program). However, reducing plan liability to such a small percentage could decrease plans’ incentives to effectively manage their enrollees’ drug costs, incentives that have been at the root of the program’s success.