Insight

August 6, 2025

CBO Estimates the Fiscal Impact of the One Big Beautiful Bill

Executive Summary

- In a new letter, the Congressional Budget Office (CBO) estimates the One Big Beautiful Bill will increase budget deficits by $4.1 trillion over the fiscal year (FY) 2025–2034 budget window and push federal debt held by the public up to 127 percent of gross domestic product (GDP) by the end FY 2034.

- While some of the law’s provisions are temporary and will expire in several years, CBO estimates that if 10 of the temporary provisions were made permanent, the One Big Beautiful Bill would increase budget deficits by an additional $858 billion, bringing its total cost to $5 trillion, and the national debt would rise to 129 percent of GDP by the end of FY 2034.

- Of note, CBO’s projections are based on its January 2025 baseline and do not account for administrative actions related to tariffs and immigration and changes in economic conditions since then, and thus they are subject to a degree of uncertainty.

Introduction

In a new letter, the Congressional Budget Office (CBO) estimates the fiscal impact of the One Big Beautiful Bill. Relative to its January 2025 baseline, CBO projects that the law as enacted will increase budget deficits by $4.1 trillion over the fiscal year (FY) 2025–2034 budget window and boost federal debt held by the public to 127 percent of gross domestic product (GDP) by the end of FY 2034.

Certain tax provisions in the One Big Beautiful Bill are temporary and will expire in several years. CBO estimates that if 10 of the temporary provisions were made permanent, budget deficits would increase by another $858 billion. As a result, a permanent version of the law would increase budget deficits by $5 trillion over the FY 2025–2034 budget window and boost federal debt held by the public to 129 percent of GDP by the end of FY 2034.

Of note, CBO’s projections are based on its January baseline and do not account for administrative actions related to tariffs and immigration and changes in economic conditions since then. As a result, the projections are subject to a degree of uncertainty and the fiscal impact of the One Big Beautiful Bill would likely differ if measured against a baseline that more accurately reflects reality.

The Fiscal Impact of the One Big Beautiful Bill

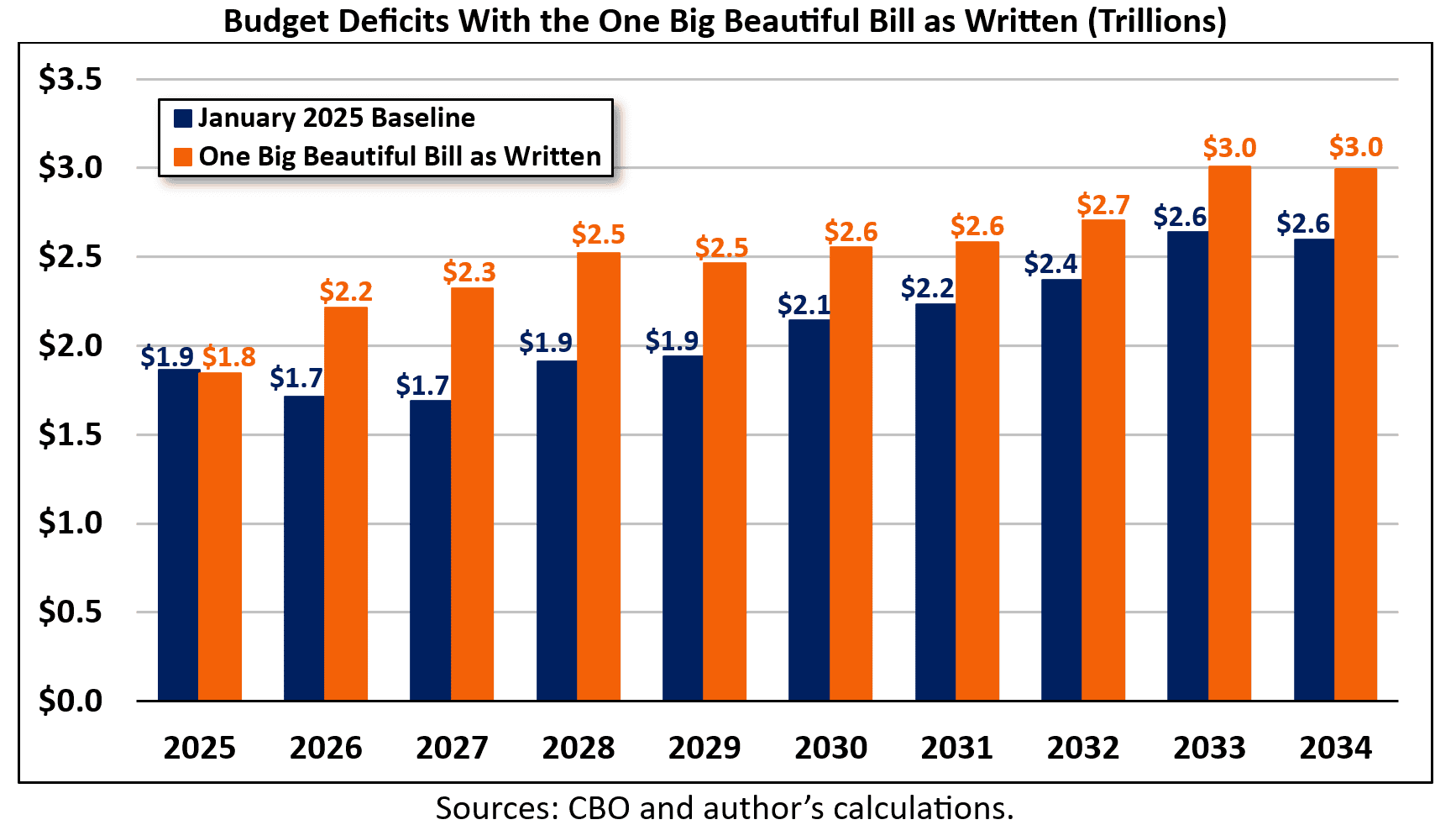

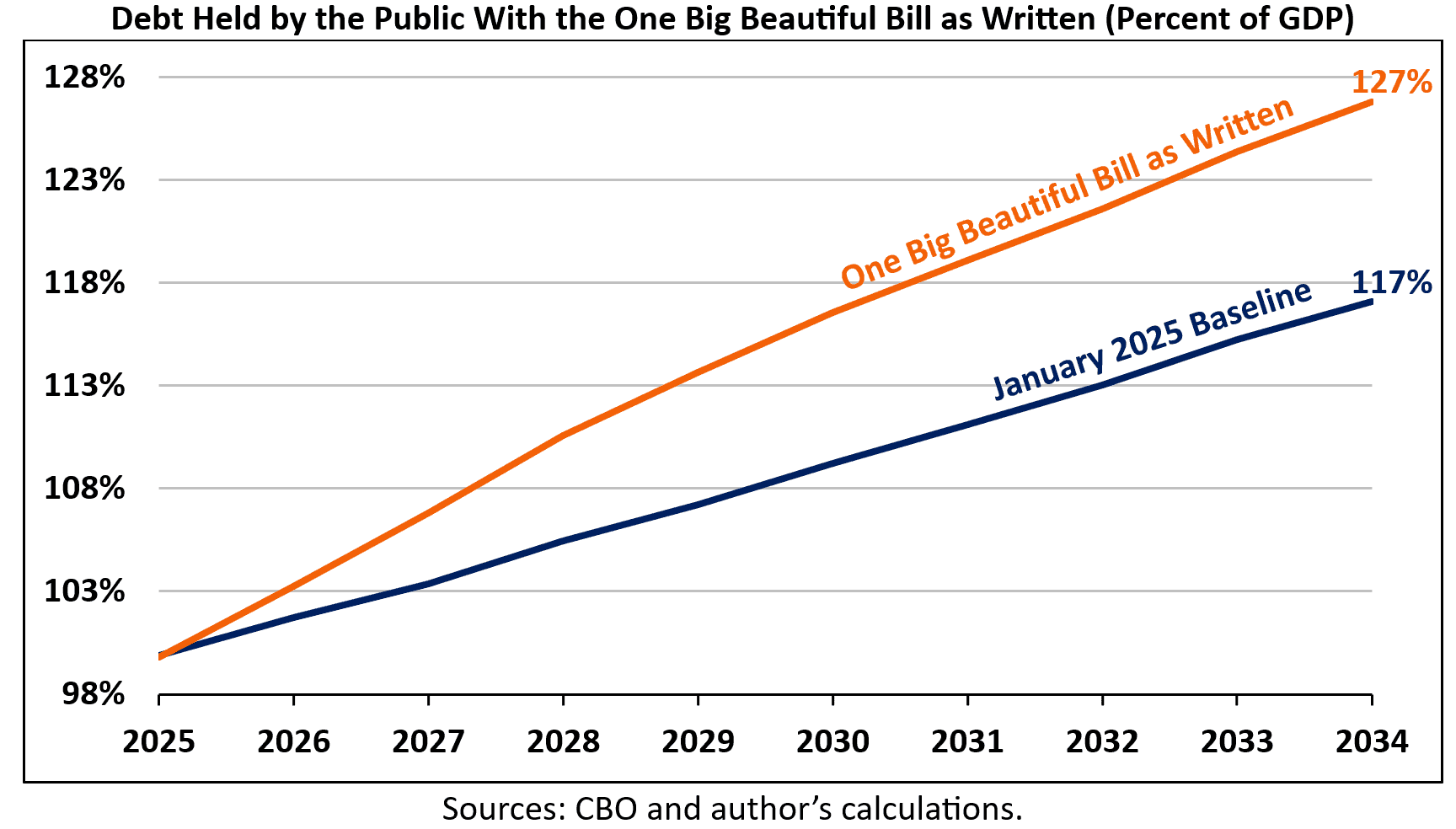

CBO’s January baseline projects that the budget deficit will climb from $1.9 trillion (6.2 percent of GDP) in FY 2025 to $2.6 trillion (6.1 percent of GDP) in FY 2034. Meanwhile, federal debt held by the public will rise from 100 percent of GDP ($30.1 trillion) at the end of FY 2025 to 117 percent of GDP ($49.6 trillion) by the end of FY 2034.

According to CBO, the One Big Beautiful Bill will increase budget deficits by $4.1 trillion over the FY 2025–2034 budget window. This includes $3.4 trillion of primary (non-interest) budget deficit increases and $718.0 billion of higher net interest costs. Relative to CBO’s January baseline, the budget deficit will fall slightly to $1.8 trillion (6.1 percent of GDP) in FY 2025 but rise steadily to $3.0 trillion (7.1 percent of GDP) in FY 2034. In FY 2034, the deficit will be $397 billion (0.9 percentage points of GDP) higher than CBO projected in January.

Higher budget deficits will cause the national debt to rise. CBO estimates the One Big Beautiful Bill will cause federal debt held by the public to grow from 100 percent of GDP ($30.1 trillion) at the end of FY 2025 to 127 percent of GDP ($53.7 trillion) by the end of FY 2034. In FY 2034, debt-to-GDP will be 10 percentage points higher than the 117-percent projection CBO made in January.

The Fiscal Impact of a Permanent One Big Beautiful Bill

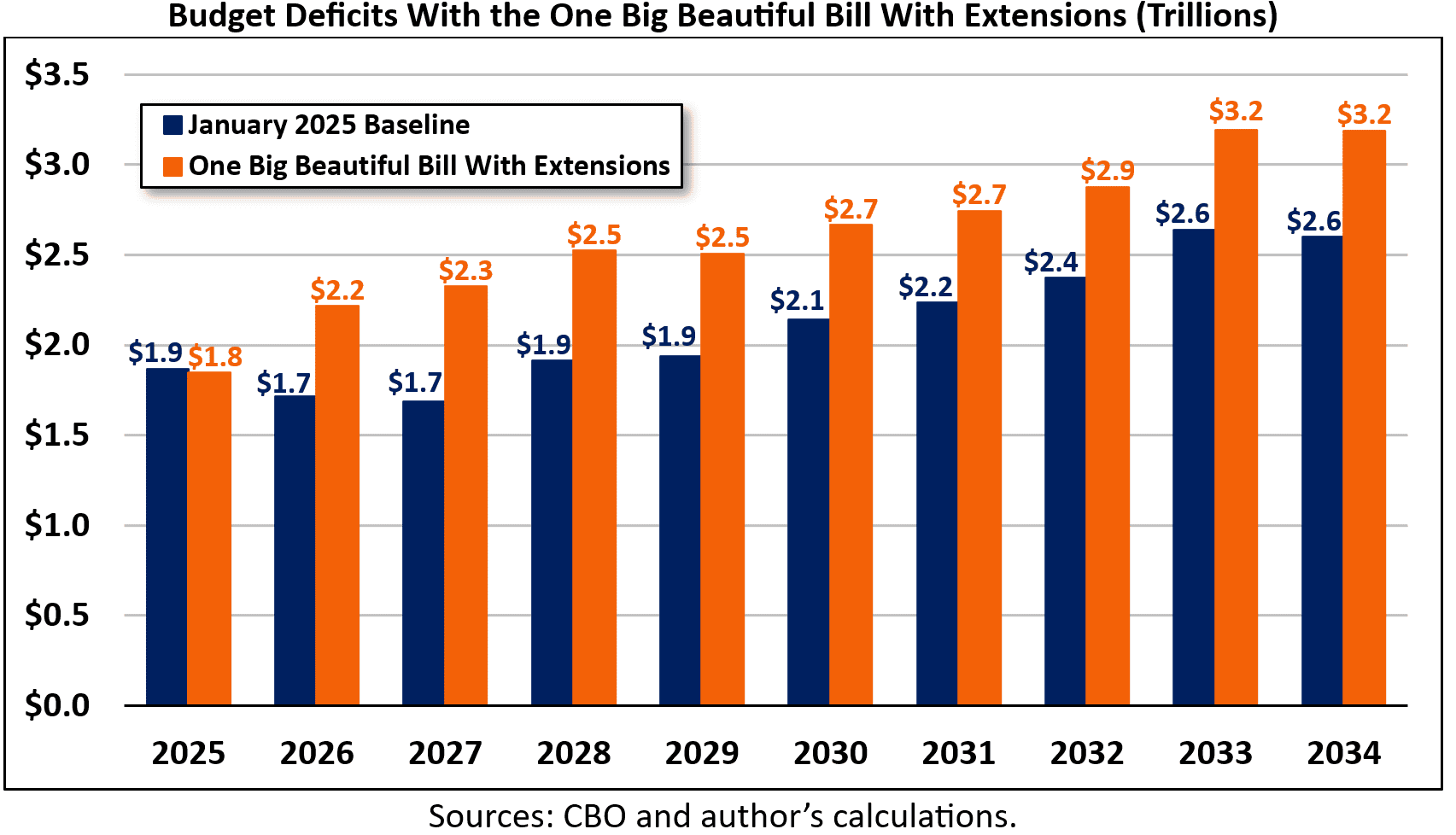

While most provisions of the One Big Beautiful Bill are permanent, there are a handful that will expire in several years. CBO estimates that if 10 of the temporary provisions were made permanent, the law would increase budget deficits by another $858 billion over the FY 2025–2034 budget window, bringing its total cost to $5 trillion.

The One Big Beautiful Bill provides no tax on tips, overtime pay, or car loan interest, and a $6,000 deduction for seniors for tax years 2025–2028. It increases the cap on the state and local tax (SALT) deduction through tax year 2029, allows 100-percent first-year depreciation for qualified production property constructed before January 1, 2029, and placed in service before January 1, 2031, extends the clean fuel production tax credit through tax year 2029, restricts the cardon oxide sequestration tax credit, and expands special expensing rules for qualified film, television, and live theatrical productions. The law also creates a pilot program for a new long-term savings account for children born between January 1, 2025, and January 1, 2029. CBO estimates that making these provisions permanent would increase budget deficits by another $858 billion over the FY 2025–2034 budget window, including $787.1 billion of primary budget deficit increases and $68.9 billion of higher net interest costs.

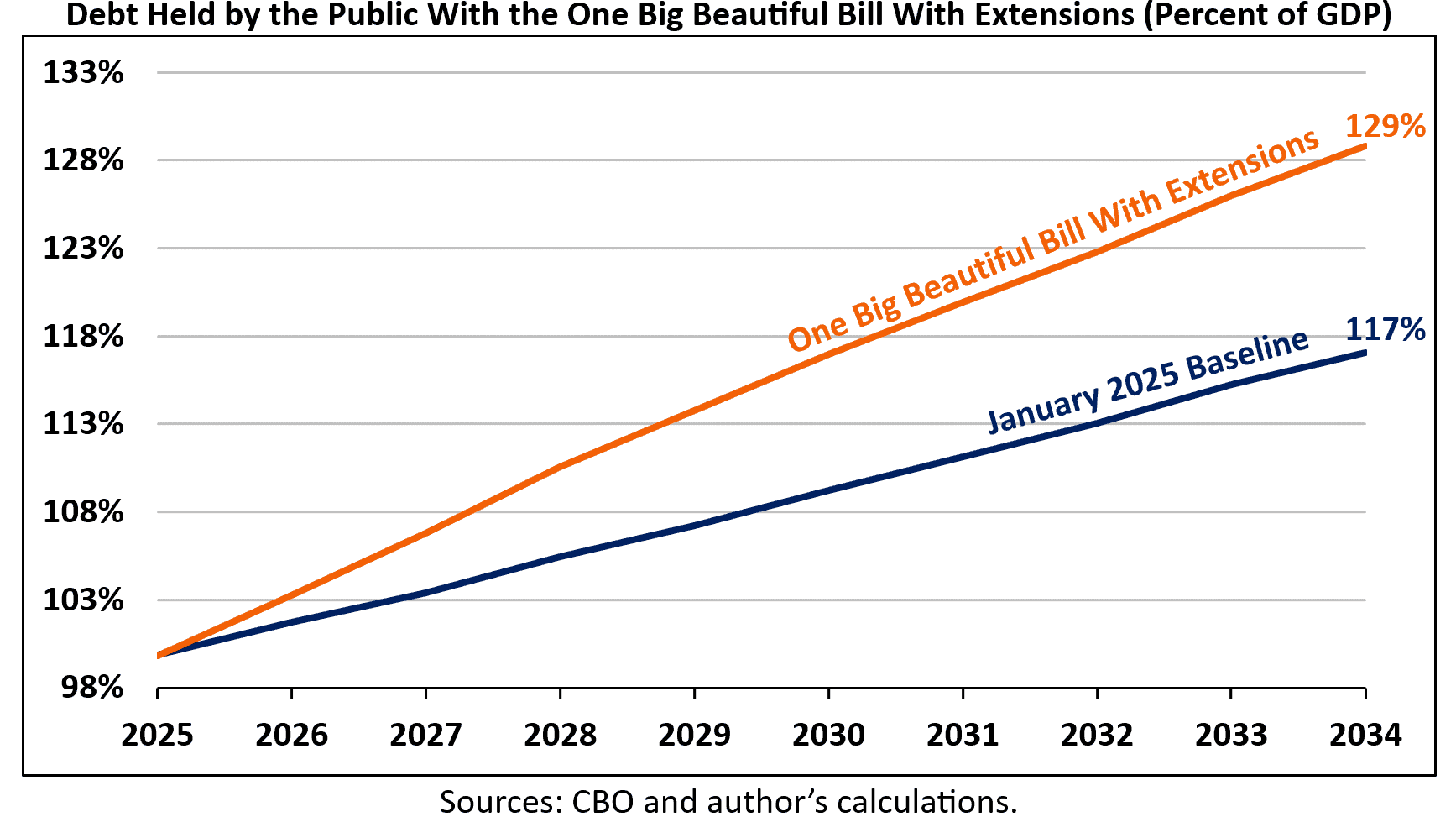

Adding the aforementioned costs to the price tag of the One Big Beautiful Bill as written would bring the law’s total deficit impact to $5 trillion. This would include $4.2 trillion of primary deficit increases and $789.1 billion of higher net interest costs. Relative to CBO’s January baseline, the budget deficit would fall slightly to $1.8 trillion (6.1 percent of GDP) in FY 2025 but rise steadily to $3.2 trillion (7.5 percent of GDP) in FY 2034. In FY 2034, the deficit would be $589 billion (1.4 percentage points of GDP) higher than CBO projected in January.

The higher budget deficits would cause the national debt to rise. CBO estimates the One Big Beautiful Bill with extensions would cause federal debt held by the public to grow from 100 percent of GDP ($30.1 trillion) at the end of FY 2025 to 129 percent of GDP ($54.5 trillion) by the end of FY 2034. In FY 2034, debt-to-GDP would be 12 percentage points higher than the 117-percent projection CBO made in January and 2 percentage points higher than the 127-percent projection with the One Big Beautiful Bill as written.