Insight

January 13, 2026

CBO Offers More Pessimistic View of Economy Than Other Forecasters

Executive Summary

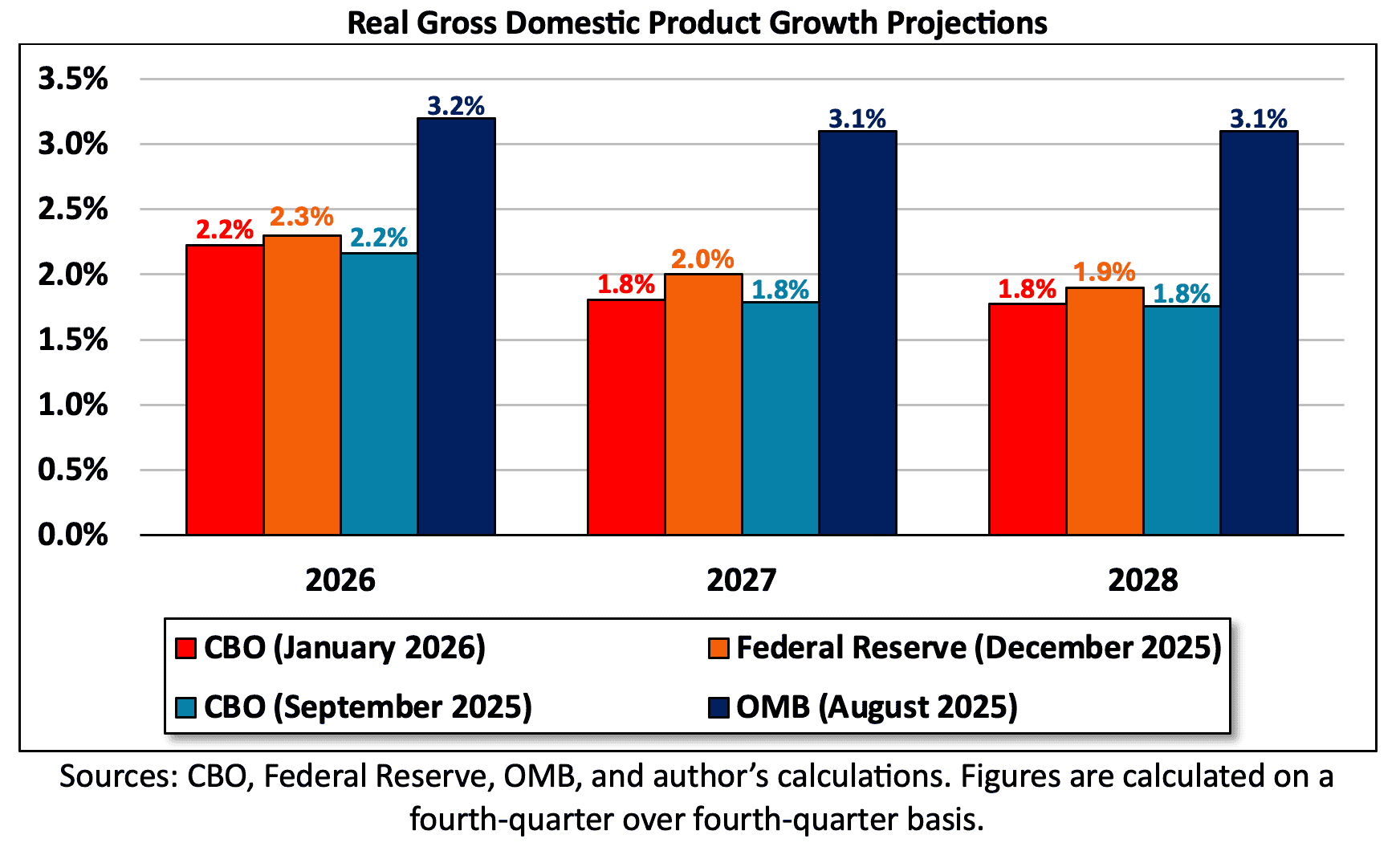

- The Congressional Budget Office (CBO) has released a new set of economic projections for 2026 to 2028, showing a more pessimistic forecast than its own September projections as well as recent projections from the Federal Reserve and the administration’s Office of Management and Budget.

- CBO expects real gross domestic product (real GDP) growth to total 2.2 percent in 2026 as the positive impacts of the One Big Beautiful Bill materialize; real GDP growth will stabilize around 1.8 percent per year thereafter.

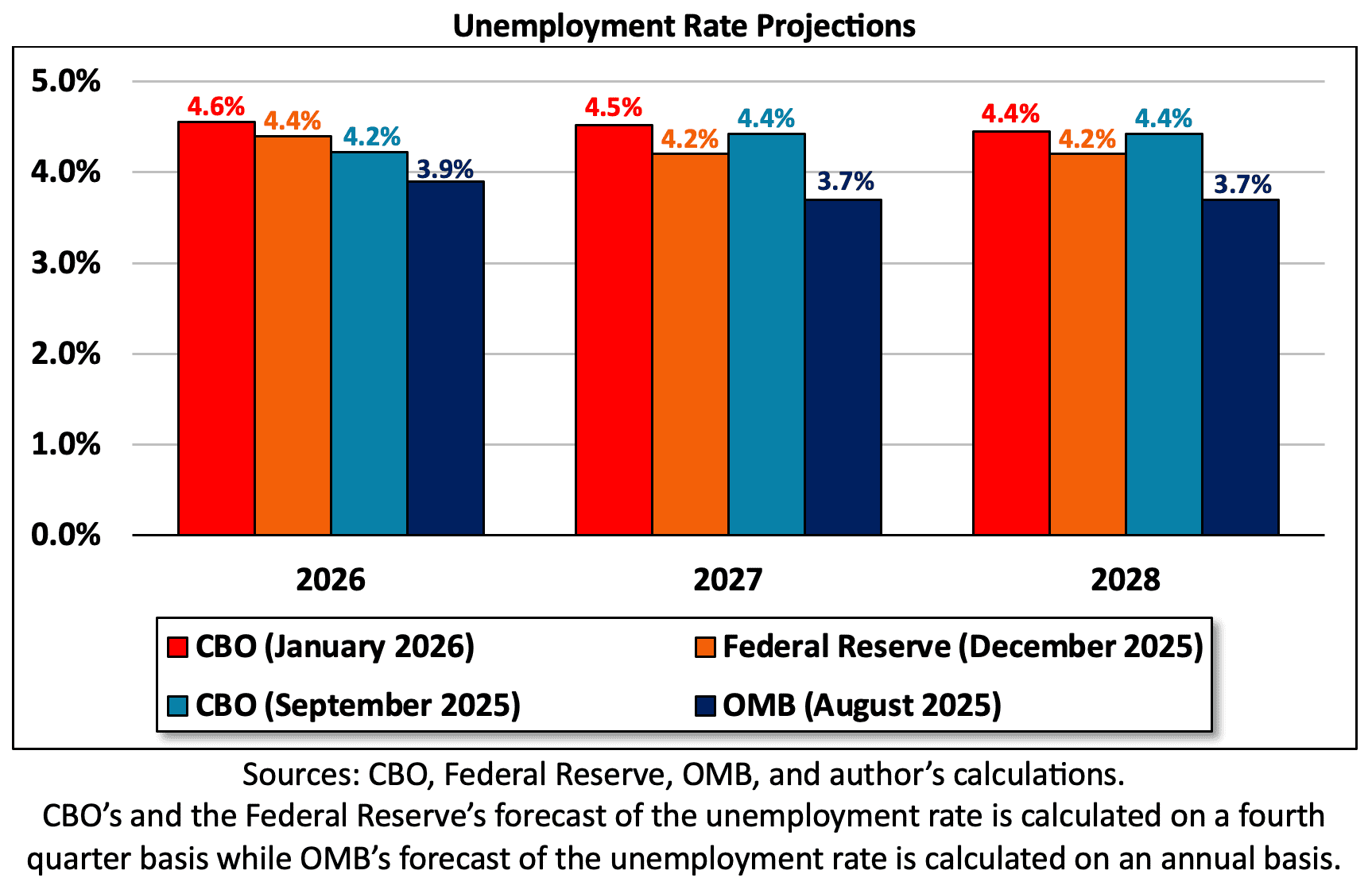

- CBO expects the unemployment rate to rise from 4.4 percent today to 4.6 percent by the end of 2026 and then fall to 4.5 percent by the end of 2027 and to 4.4 percent by the end of 2028.

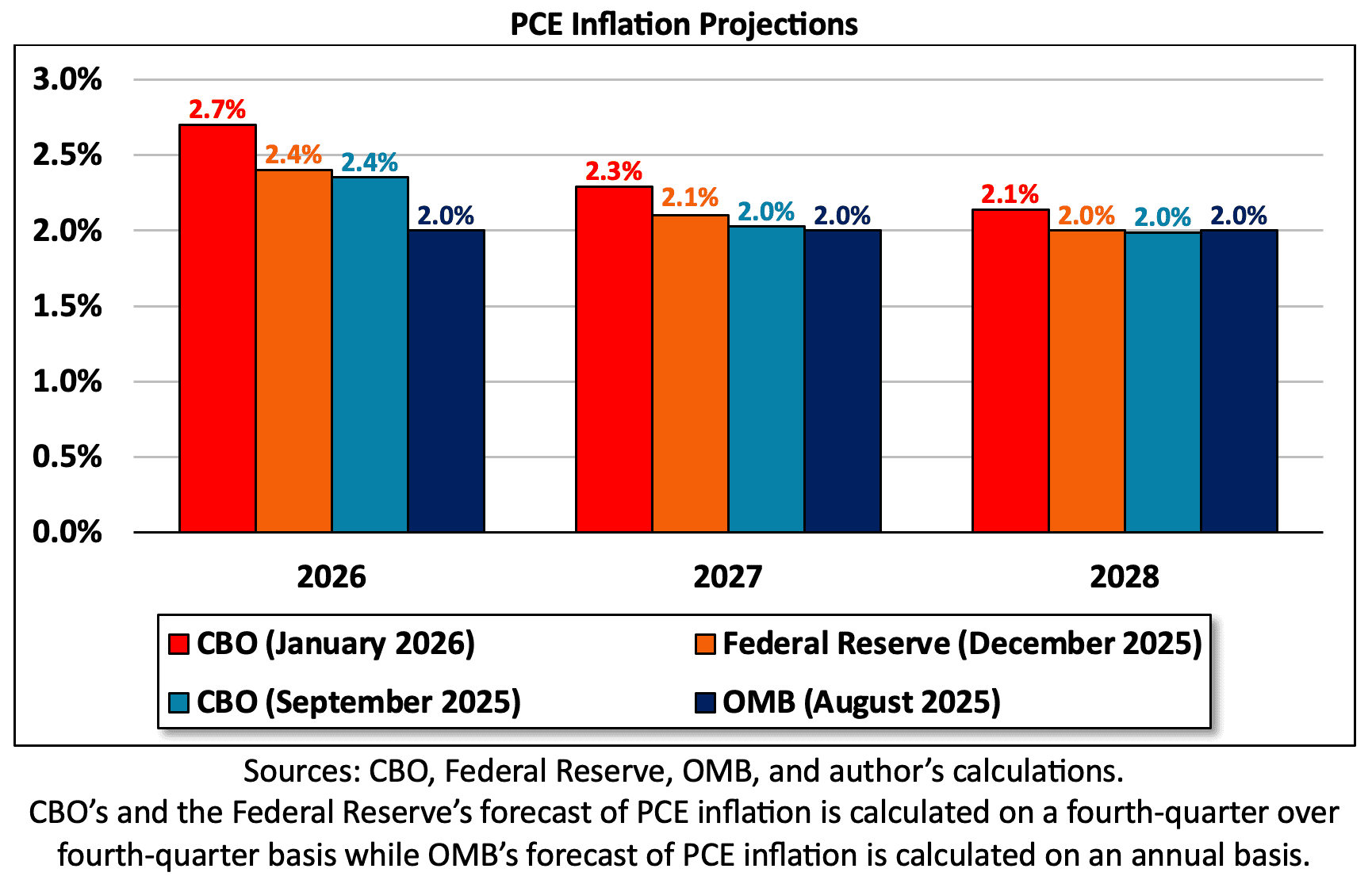

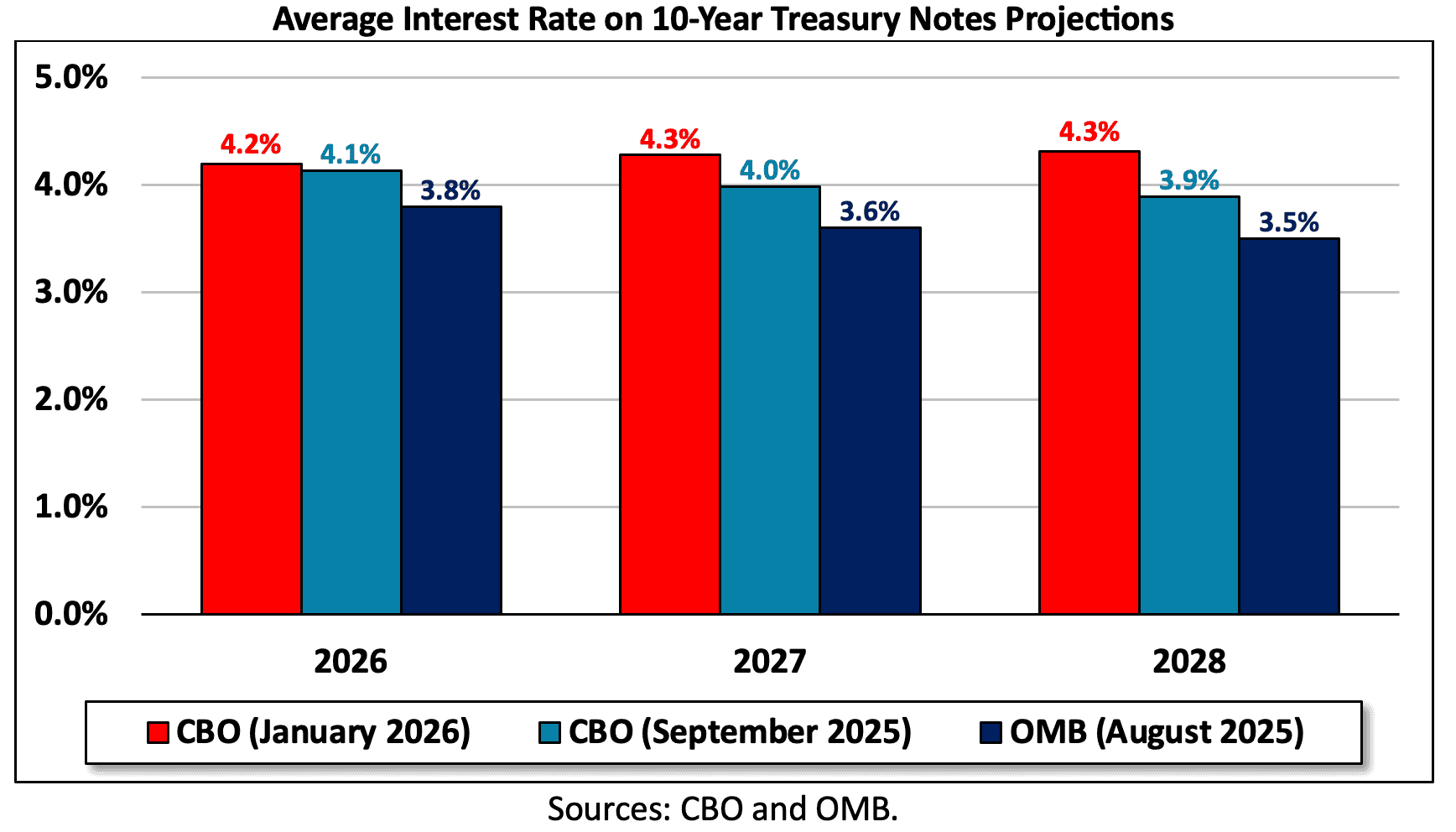

- CBO expects inflation to cool over the next few years while the average interest rate on 10-year Treasury notes will rise from 4.2 percent in 2026 to 4.3 percent in 2027 and 2028 as term premiums rise from the low levels seen in recent years.

Introduction

The Congressional Budget Office (CBO) has released a new set of economic projections for 2026 to 2028. The forecast updates CBO’s September 2025 economic forecast to incorporate tariff policy changes since August and the economic impact of the record 43-day government shutdown, among other policy changes. Overall, CBO’s projections are more pessimistic than its September forecast, as well as the Federal Reserve’s December 2025 projections and the administration’s Office of Management and Budget’s (OMB) August 2025 forecast.

Comparing CBO’s Latest Economic Projections to Other Forecasts

Since CBO’s September 2025 economic forecast, its outlook for fourth-quarter –over fourth quarter real gross domestic product (real GDP) growth is unchanged. In 2026, CBO projects 2.2-percent real GDP growth as the One Big Beautiful Bill’s (OBBB) boost to consumption, private investment, and federal purchases materializes. In addition, the resumption of federal government activities following the 43-day government shutdown has shifted some government spending from late 2025 to early 2026, boosting projected real GDP growth. CBO notes that higher tariffs and changes in immigration partially offset real GDP growth in 2026. The Federal Reserve expects real GDP growth of 2.3 percent and OMB forecasts 3.2-percent growth in 2026.

In 2027 and 2028, CBO expects real GDP growth to slow to 1.8 percent per year as the OBBB’s impact on aggregate demand wanes and net immigration falls. The Federal Reserve projects 2.0-percent real GDP growth in 2027 and 1.9 percent in 2028, while OMB forecasts 3.1-percent growth in both years.

CBO expects the unemployment rate to rise from 4.4 percent today to 4.6 percent by the end of 2026. It expects the OBBB’s provisions that reduce the effective marginal tax rate on labor income – including no tax on tips and overtime pay – to increase the incentive to work and thus boost employment this year. Lower projected net immigration and other factors will negatively offset the OBBB’s positive impact on employment, however, leading to an increase in the near-term unemployment rate. CBO expects the unemployment rate to fall to 4.5 percent by the end of 2027 and to 4.4 percent by the end of 2028, in line with its previous forecast.

The Federal Reserve expects the unemployment rate to total 4.4 percent in 2026 and then fall to 4.2 percent in 2027 and 2028. On an annual basis, OMB expects the unemployment rate to total 3.9 percent in 2027 and 3.7 percent in 2027 and 2028.

CBO expects inflation to cool over the next few years. It expects Personal Consumption Expenditure(PCE) price index inflation, on a fourth-quarter over fourth-quarter basis, to fall from 2.8 percent in 2025 to 2.7 percent in 2026. From there, PCE inflation will fall to 2.3 percent in 2027 and to 2.1 percent in 2028. In September, CBO projected PCE inflation would fall from 3.1 percent in 2025 to 2.4 in 2026 and then stabilize at the Federal Reserve’s 2-percent target by 2027. In both forecasts, CBO expected a softening of PCE inflation, though its latest PCE inflation projections are slightly more pessimistic than its September forecast.

The Federal Reserve projects 2.4-percent PCE inflation in 2026, 2.1 percent in 2027, and then expects inflation to stabilize at its 2-percent target by 2028 and over the long term. On an annual basis, OMB expects PCE inflation to stabilize at the 2-percent target in 2026 and beyond.

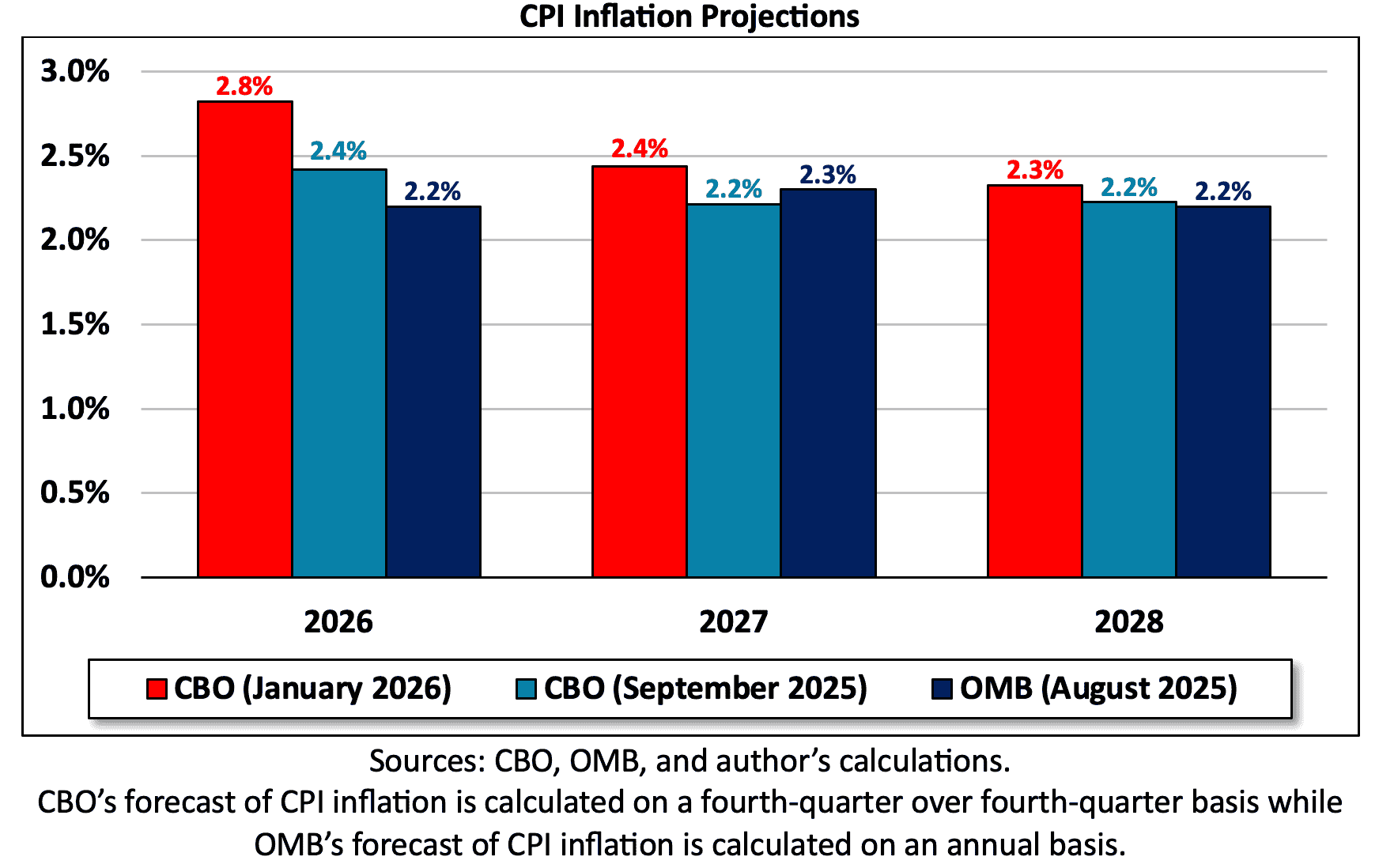

CBO expects Consumer Price Index (CPI) inflation, on a fourth-quarter over fourth-quarter basis, to fall from 3.0 percent in 2025 to 2.8 percent in 2026. CPI inflation will continue to soften to 2.4 percent in 2027 and to 2.3 percent in 2028. In September, CBO projected CPI inflation would fall from 3.1 percent in 2025 to 2.4 percent in 2026 and then stabilize at 2 percent by 2027. In both forecasts, CBO expected a softening of CPI inflation, though its latest CPI inflation projections are slightly more pessimistic than its September forecast. On an annual basis, OMB projects 2.2-percent CPI inflation in 2026, 2.3 percent in 2027, and 2.2 percent in 2028.

In response to modest inflation and a slowing labor market, the Federal Reserve’s Federal Open Market Committee (FOMC) cut interest rates three times in 2025, by 25 basis points each time. The FOMC’s 75-basis point cut lowered the federal funds rate from a range of 4.25–4.50 percent to 3.50–3.75 percent. The Federal Reserve’s latest economic projections suggest more interest rate cuts are likely over the next few years, with the federal funds rate projected to fall to a median of 3.4 percent in 2026 and 3.1 percent in 2027 and 2028.

The average interest rate on 10-year Treasury notes remained above 4 percent for most of 2025 and has averaged 4.2 percent in the early days of 2026. CBO expects the interest rate on 10-year Treasuries to average 4.2 percent in 2026 before ticking up slightly to 4.3 percent in 2027 and 2028 as term premiums rise from the low levels seen in recent years. In September, CBO forecasted a 4.1-percent average 10-year rate in 2026, 4.0 percent in 2027, and 3.9 percent in 2028, so its latest, higher interest rate forecast is slightly more pessimistic. OMB expects the average interest rate on 10-year Treasury notes to total 3.8 percent in 2026, 3.6 percent in 2027, and 3.5 percent in 2028.