Insight

August 3, 2017

CFPB’s Pro-Class Action Rule Hurts Consumers

After years of waiting, the Consumer Financial Protection Bureau (CFPB) finalized its arbitration rule. Like many of the other rules coming from the past administration’s holdover employees, this one will have widespread and damaging effects on consumers. In effect, the arbitration rule will prevent financial services providers from settling customer disputes in arbitration, and, instead, encourages tort lawyers to steer disgruntled customers to court in the form of a class action lawsuit. The CFPB estimates that this rule will increase annual costs to the over 50,000 covered firms by over $17,000 each.

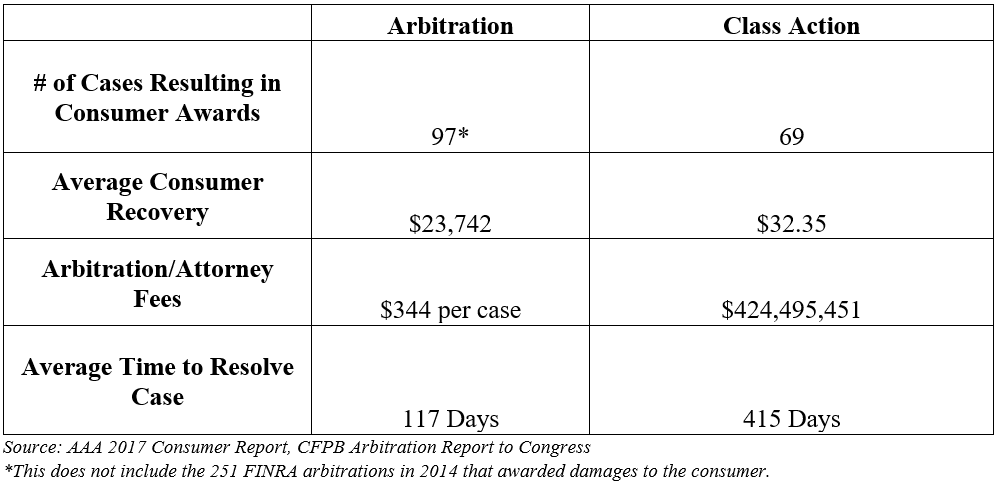

In relying only on its own internal study for data to support the rule, CFPB paints an incomplete picture of how arbitration compares to class action suits for consumers. The chart below, based on 2014 data from the Arbitration Association of America and the 2014 numbers from the CFPB report, shows that consumers fare far better in arbitration hearings than in class action lawsuits:

It is clear that consumers recover significantly more often, significantly more dollars, and significantly faster in arbitration than in class action lawsuits. The only winners in class action litigation are the attorneys who took $424 million from class action settlements over the course of the CFPB arbitration study.

Proponents of the arbitration rule claim that without it, consumers will not be able to have their day in court and that class action lawsuits are the best way for genuinely-harmed consumers to be compensated. First, even in strict arbitration clauses, consumers are not barred from bringing their claims in small claims court due to small claims court exemptions, so consumers can, in fact, have their day in court. On the other hand, most financial services providers with contractual agreements containing arbitration clauses also contain opt-out provisions, wherein consumers can choose to directly opt out of the arbitration clause while still signing whatever the contract may be. And, last but not least, CFPB’s own database of consumer complaints, shows that 90 percent of claims consumers may bring would not even be able to certify as a class because of their highly-individualized nature.

The data seem clear: pushing consumers into class action lawsuits helps nobody but the trial lawyers. The only claim to the contrary – a recent article from EPI – is based on numbers that cannot be replicated. The House realized this and has already passed a repeal of the arbitration rule using the Congressional Review Act (CRA). Now it’s up to the Senate to do the same.