Insight

April 7, 2016

Is China Still a Currency Manipulator?

Currency manipulation in trade is a top issue for this year’s presidential election. Republican frontrunner Donald Trump has repeatedly criticized China for devaluing its currency, claiming it “suck(s) the blood out of the United States.” In response, he vowed to significantly reduce U.S.-China trade by increasing taxes on all Chinese imports.

Currency manipulation is a major issue for the United States. From 1995 to 2005, China’s currency was fixed at around 8.3 Chinese yuan to one U.S. dollar. This artificially depressed the value of the yuan, making Chinese goods relatively cheaper than U.S. goods and boosting Chinese exports to the United States. It also made American goods relatively more expensive compared to Chinese goods, hurting American businesses that export to China. However, China abandoned this fixed interest rate in 2005 in favor of a more market-oriented system in which the value of the yuan is allowed to fluctuate relative to a basket of currencies. This change was a major move for China toward an open market economy. And although China’s dollar peg was reinstated for a short time after the 2008 financial crisis, the yuan’s ties to the dollar have since been loosened further so that its value relies even more on market forces.

Last August, China jolted global markets by devaluing the yuan 3.5 percent against the U.S. dollar. This sparked widespread fear that China was starting a currency war. However, the devaluation was chiefly driven by China’s weakening economy. In 2015, China experienced 6.9 percent growth, its lowest growth rate in 25 years, and a rate that may have actually been inflated by Chinese officials. Furthermore, Chinese exports fell over 8 percent last July.

Critics condemned China for its devaluation last August and the yuan’s continued depreciation. However, it is important to consider the forces driving down the value of China’s currency relative to that of the United States. The end of quantitative easing, a Federal Reserve program to boost demand by expanding the money supply, has strengthened the U.S. dollar while China’s slowing economy has put downward pressure on the yuan. This, combined with China’ recent decision to measure the yuan against a wider basket of currencies, has allowed the yuan to depreciate against the dollar.

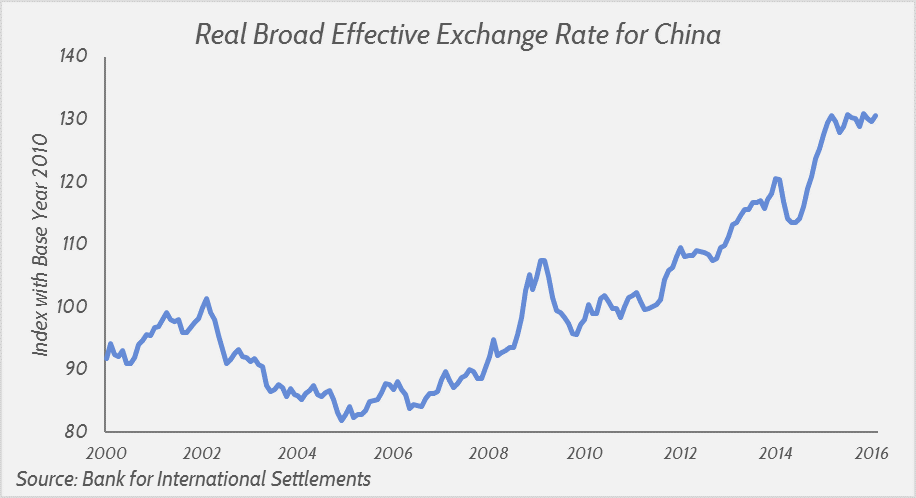

The following chart shows China’s real broad effective exchange rate, a trade-weighted index that measures the strength of China’s currency compared to 61 other economies. This index has steadily trended upward since China abandoned its dollar peg in 2005. Moreover, in real terms, it has completely regained its value since the devaluation last August.

The Peterson Institute recently published a blog assessing the current value of China’s currency. It asserts that, based on China’s current account balance and real effective exchange rate, the yuan has not been undervalued since late 2014. Currency manipulation should nevertheless be discouraged and Congress should take full advantage of its enforcement tools to punish currency manipulators. However, rhetoric on the campaign trail blasting China for its continuous currency manipulation should be taken with a grain of salt.