Insight

January 25, 2021

Estimated Cost of President Biden’s COVID-19 Paid Leave Proposal

Executive Summary

- President Biden’s proposal to extend and expand paid sick, family, and medical leave would provide greater benefits for a longer period of time and to more people.

- The cost to the federal government to cover these benefits could be between $132.0 billion and $154.6 billion.

- Large employers, who would be required to provide benefits at their own expense, could face additional costs of between $72.3 billion and $124.6 billion.

Background

The Families First Act provided American workers with up to 2 weeks of fully paid sick leave for those ill, quarantining, or taking preventive care measures in relation to COVID-19, and 12 weeks (10 paid at two-thirds wage replacement and 2 unpaid) of emergency child care leave to care for children whose school or day care closed as a result of the pandemic or family leave to care for a family member suffering from COVID-19. These benefits are available in the form of tax credits paid to businesses whose employees take such leave, with some exceptions. Businesses with more than 500 employees were exempt from the mandate and not eligible for the tax credits; businesses with less than 50 employees were exempt from the mandate but could receive the tax credits if they chose to offer such leave.

These tax credits were set to expire at the end of 2020, but the Consolidated Appropriations Act of 2020 passed at the end of December extended the availability of the employer tax credits through the end of March 2021; the requirement to provide such leave was not extended, however.

President Biden’s Proposal to Extend Benefits

Biden’s plan would reinstate the mandate to provide such leave through September 30, 2021, including eliminating the exemptions in place for employers with more than 500 or less than 50 employees and for federal workers. This expansion of the requirement is estimated by the Biden Administration to cover between 68 and 106 million additional private-sector workers plus 2 million federal workers, yet many of these workers already receive at least some paid leave benefits. Employers with less than 500 employees and state and local governments will be fully reimbursed for the cost of providing this benefit.

According to documents released thus far, the benefit will provide 14 weeks of paid sick, family, and medical leave. As with the Families First Act, these benefits will be available to those needing to care for a child when their school or care center is closed; for those who are caring for someone with COVID-19 or if they themselves have it or are quarantining as a result of exposure; and for individuals taking time off to get the vaccine.

Emergency paid leave benefits will also be expanded to include federal workers, approximately 2 million people.

The maximum benefit will be $1,400 per week, or full wage replacement for the roughly three-fourths of workers who earn up to $73,000.

In short, this proposal would provide greater benefits, for a longer period of time, and to more people than was provided under the Families First Act.

Estimating the Impact

There are 111.4 million private-sector workers in the United States.[1] Of the 59.7 million workers at private-sector firms employing more than 500 employees, 88 percent already enjoy paid sick leave benefits. In contrast, only 66 percent of the 33.8 million employees at firms with less than 50 workers had paid sick leave benefits, as of March 2020.[2] Thus, between these two groups, roughly 18.7 million workers could gain access to paid sick leave (assuming all of these workers are still employed, which is almost certainly not the case). Among the 16 million state and local government workers, 99 percent of full-time workers have paid sick leave benefits.[3], [4] All federal government employees also have access to paid leave benefits.[5]

Some share of the other 74.8 million private-sector workers may become eligible for additional paid leave benefits, as well as the two million federal workers who do have some paid leave benefits but are not currently eligible for the new leave benefits provided by the Families First Act. Among private-sector firms with fewer than 50 employees, only 13 percent of employees have paid family leave benefits. For firms with more than 500 employees, this rate rises to an estimated 31 percent, but still leaves two-thirds of workers without paid family leave.[6] Among state and local employees, roughly a quarter receive paid family leave benefits.[7] Across the board, the likelihood of having paid leave benefits increases with wages.

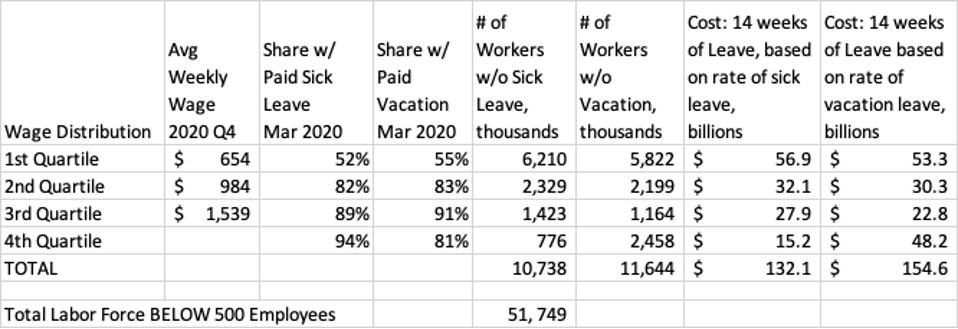

With a $1,400 weekly benefit available for 14 weeks, the maximum benefit per person would be $19,600. The charts below show the estimated cost to the federal government and large employers, respectively, based on the best available data regarding rates of paid leave relative to wages, in order to account for the cost of the benefit available to workers. Because of the near-unanimous availability of paid leave benefits for government employees, this estimate is based solely on the cost for the 111 million private-sector employees. While some government employees may need more leave than currently available, any additional costs are not likely to affect the magnitude of this estimate.

Estimated Cost to Federal Government:

The federal cost of providing this benefit for a full 14 weeks to all workers without paid leave benefits at firms with fewer than 500 employees is estimated between $132.0 billion (based on access to paid sick leave) and $154.6 billion (based on access to paid vacation). Although, this estimate assumes the same access to leave at smaller firms as the average across all firms when it is known that employees of smaller firms are less likely to have paid leave than those at larger firms; thus, in this regard, the estimate is likely low. Conversely, it is not expected that every single employee would need a full 14 weeks of leave, let alone any leave at all, which could cause an overstatement in the estimate. Taken together, the estimate is more likely an overstatement of the costs.

Estimated Cost to Large Employers:

The cost to employers with 500 or more employees is estimated to be between $72.3 billion and $124.6 billion, assuming all employees currently without leave benefits took a full 14 weeks of leave and assuming no cost for those with some leave benefits already available. While larger employers once paid significantly higher wages to workers at the bottom and in the middle of the wage distribution than smaller employers, the firm-size wage premium has declined considerably over the past several decades.[8] Thus, this estimate assumes a similar wage distribution for employees of larger firms as is reported to be the average for all firms. On the other hand, because larger firms have higher than average rates of paid leave, it is assumed that lower rates of employees of such firms would be newly eligible for paid leave under this proposal. Finally, it is important to recognize that not all employees with no leave benefits are likely to need a full 14 weeks of leave just as some employees with some leave available are likely to need more than they are currently entitled to absent this legislation; these effects will cancel each other out, to a degree.

Conclusion

The paid leave proposal included in President Biden’s $1.9 trillion COVID-19 relief package would provide much more generous benefits than are currently available and would make those benefits available to tens of millions more workers. It is estimated that the cost to the federal government to cover these benefits could be between $132.0 billion and $154.6 billion. Large employers, who would be required to provide benefits at their own expense, could face additional costs of between $72.3 billion and $124.6 billion.

[1] https://www.bls.gov/web/cewbd/table_f.txt

[2] https://www.bls.gov/news.release/ebs2.t06.htm#ncs_nb_table6.f.2

[3] https://www.kff.org/coronavirus-covid-19/issue-brief/coronavirus-puts-a-spotlight-on-paid-leave-policies/

[4] https://www.brookings.edu/policy2020/votervital/public-service-and-the-federal-government/

[5] https://www.opm.gov/policy-data-oversight/pay-leave/leave-administration/fact-sheets/annual-leave/

[6] https://www.kff.org/coronavirus-covid-19/issue-brief/coronavirus-puts-a-spotlight-on-paid-leave-policies/

[7] https://www.kff.org/coronavirus-covid-19/issue-brief/coronavirus-puts-a-spotlight-on-paid-leave-policies/

[8] https://repository.upenn.edu/cgi/viewcontent.cgi?article=1296&context=mgmt_papers