Insight

June 3, 2019

Even with New Reforms, the RFS is a Costly Policy

Summary

- The EPA has reformed the Renewable Fuel Standard to allow for year-round sales of 15 percent ethanol-blend fuel (E15), while pairing this change with restrictions on speculative investments in markets.

- The reduced speculative activity will help reduce costs for gasoline consumers, but increasing E15 consumption will increase smog pollution.

- The RFS fundamentally fails in its environmental and national security mandates, while imposing higher than expected costs on Americans.

Introduction

After the September 11th terrorist attacks, many policymakers had an epiphany about U.S. energy consumption: America’s unrivaled demand for petroleum fuels supported actors that are ideologically opposed to U.S. interests, such as Iran, Russia, and oil-funded terrorist groups. As a result, the federal government created the Renewable Fuel Standard (RFS), a policy designed to offset oil imports with domestically produced biofuels (mostly ethanol distilled from American-grown corn). The idea appeared sound, and it was expected that the policy would have only marginal costs, as ethanol demand would be high anyway. A couple years after creating the policy, Congress expanded it further, thinking that the RFS had environmental and climate benefits on top of its strategic goals.

Unfortunately, the policy did not work as expected. The RFS now costs Americans billions of dollars every year, hurts domestic oil production, and increases pollution. Yet the Trump Administration has recently chosen to expand its burdens, with many speculating that it is seeking to buoy farmers hurt by another bad Washington policy: rising tariffs.

To buoy the RFS, it will now be possible to sell year-round gasoline blends that are 15 percent ethanol (E15)—a move that will increase biofuel demand and aid farmers. Yet regulators placed these restrictions on when E15 could be sold to combat air pollution. This expansion is part of a political deal, but the economic, national security, and environmental rationale for preserving the RFS in any capacity weaken every day.

The RFS Hurts the Economy by Making Americans Pay More at the Pump, and More Frequently

Rosy assumptions of ethanol demand have obscured the RFS’s true economic costs. The economic cost of a policy can be thought of as the difference in cost between a favored product and its otherwise-cheaper competitor, and then that cost multiplied by the forced increase in demand from the baseline. Unfortunately, when Congress first crafted the RFS in 2005 (and then expanded it in 2007), policymakers made an assumption that turned out not to be true: that oil prices would keep rising. Higher oil prices would increase demand for ethanol regardless of Washington’s policies, because the market would seek it as a substitute for gasoline where possible. Breakthroughs in drilling technology, however, created a booming domestic oil industry that caused prices to collapse (roughly 70 percent from peak to valley) and inverted the market preferences between ethanol and gasoline. A market no longer drove the expected baseline demand for ethanol, among other renewable fuels mandated by the RFS. Rather, federal mandates drove demand.

One way to measure the cost of this increased demand is through what are called “Renewable Identification Numbers” (RINs), which are purchased to prove compliance with the RFS. When government policy pushes demand for ethanol higher, RIN prices rise, and thus reflect an increased cost that is passed on to consumers. (RINs would not exist without the RFS, so any cost for a RIN equals a cost created by the policy.) Previous American Action Forum (AAF) research noted that RIN prices typically range between $0.30 and $1.00 per gallon, and with the federal government mandating over 19 billion gallons of renewable fuel purchases, the increased costs range from $5.8 to $19.3 billion annually.

Another way the RFS increases costs is by requiring the purchase of less efficient fuel. Ethanol is less energy-dense than gasoline, but purchases are made by liquid volume rather than energy content. As a result, cars running on ethanol have a reduced fuel efficiency. An AAF report last year noted that this efficiency loss resulted in $76.7 billion in costs over the prior decade and imposes an annual cost ranging from $4 billion to $16 billion.

The RFS Hurts National Security

The possibility that the RFS could impose costs was not lost upon policymakers. If market preferences alone could drive the consumption of renewable fuels, the policy would not be needed. The rationale, though, was that the RFS would have a national security benefit by reducing demand for imported oil and thus curb the flow of American dollars to Middle Eastern oil powers and Russia. Unfortunately, this idea was also premised on an assumption that turned out to not be true: that the U.S. would continue to import more oil than it produced.

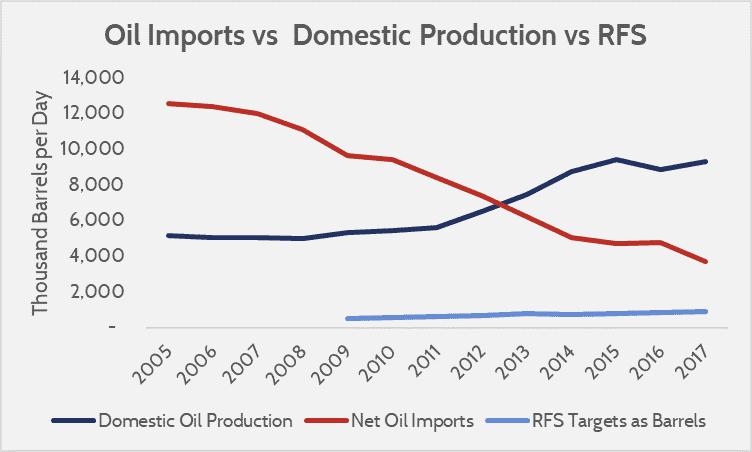

As the policy was originally conceived, the relative strategic gains of the policy that came from harming foreign producers would outweigh the absolute costs borne domestically. The RFS indiscriminately substitutes gasoline with biofuels, meaning that the policy reduces demand for oil from both domestic and foreign oil producers, so when the United States was importing most of its oil, foreign suppliers felt most of the burden. This effect no longer holds. The massive growth in domestic oil production—which is still growing—means that more than half of the United States’ oil consumption is from domestic suppliers, not foreign ones. In short, that means the RFS’ requirements are more likely to replace domestic oil production than foreign production. As a result, the RFS stifles demand for domestic oil more than foreign, indirectly helping foreign competitors by hampering the potential strength of their domestic competitors.

The Expansion of RFS Harms the Environment

In 2007, Congress expanded the RFS primarily for environmental policy (reducing pollution from gasoline) and climate policy (reducing greenhouse gas emissions) reasons. Research into the environmental benefits of the RFS have had troubling results, though. While ethanol is estimated to have roughly only 80 percent of the greenhouse gas emissions of an equivalent amount of gasoline energy, research that considers the full lifecycle and all pollutants from ethanol production show that corn-based ethanol produces more pollution than gasoline. Further, cleaner advanced biofuels, such as cellulosic fuel (made from inedible plant matter) never became economically viable—despite mandated demand via the RFS.

Aside from the negligible climate benefits of the RFS, the EPA put restrictions on E15 specifically to combat air pollution. Although ethanol can reduce air pollution, when it is a larger portion of a gasoline blend it produces smog.

Additionally, the idea of replacing fossil fuels with agriculturally produced fuels as an environmental policy is a dubious one at best. Producing combustible fuels via farming requires far more land use than fossil fuel production, making it fundamentally at odds with an objective of environmental conservation. Ideally, we want to be able to produce food, fuel, and other products by using less land—not more.

Political Impetus for the RFS

Clearly, the RFS has failed on multiple grounds, and there is no policy rationale for maintaining it. Nevertheless, it endures. The policy is a classic example of dispersed costs (gasoline consumers) and concentrated benefits (farmers). Ending the policy would obviously be appropriate, but such a reform is rarely a priority for Americans generally, while sustaining it is a high priority for key constituencies.

The RFS has come under more scrutiny since the beginning of the Trump Administration, as the RIN provisions have proven to be costly for refiners. Ironically, instead of creating an opportunity to evaluate and judge the RFS, this scrutiny has instead led to even worse policy.

The expansion of E15 sales is intended to be a boon to farmers that produce corn and soy used for RFS compliance (and who are also harmed by retaliatory tariffs on U.S. agricultural exports). In exchange, regulators will clamp down on speculative investing by restricting RIN purchases from non-industry participants, hopefully depressing RIN prices. While preventing speculative investment in RIN markets will likely be good for consumers, it is not a substitute for ending the policy altogether.

Separate from the E15 expansion, the EPA has been exempting many refiners from the compliance requirements of the RFS. Ironically, reducing the burdens of the RFS in this fashion is worse than keeping the RFS as it was, because only small refiners are eligible for waivers, and thus these actions have created an artificial government preference for refineries based on their size. If such a policy continues, it could incentivize refiners to manage their refineries based on what may be exempt from the RFS rather than what is most productive.

Conclusion

The latest changes to the RFS represent a mixture of good—reducing speculative activity in RIN markets—and bad—allowing the RFS to worsen air quality to aid political constituents. Ultimately, however, the proposed changes highlight how the RFS continues to fail in its environmental and national security policy objectives, while imposing high costs on consumers. The appropriate policy response is to end the RFS altogether. Instead, the policy continues to be put on life support, with the bill being paid for by Americans at the pump.