Insight

April 3, 2024

FTC’s COVID-19 Grocery Supply Chain Study Taught Us…Nothing

Executive Summary

- On March 21, 2024, the Federal Trade Commission (FTC) released its findings on grocery store supply chains and how “pandemic-related supply chain disruptions affected competition among retailers, wholesalers, and producers, as well as the impacts on consumers and businesses.”

- The FTC concluded that large corporations leveraged their size to entrench their market power at the expense of smaller rivals and suggested that firms used the inflationary environment to extract ill-gotten profits.

- The study’s narrow scope and limited economic analysis should give the FTC pause before using the conclusions as a catalyst to resurrect Robinson-Patman Act antitrust enforcement.

Introduction

On March 21, 2024, the Federal Trade Commission (FTC) released its findings on grocery supply chain performance during the COVID-19 pandemic. The agency concluded that large firms were able to leverage their size to extract ill-gotten profits and entrench their market power at the expense of smaller rivals.

The conclusions largely mirrored President Biden’s assertion that firms used supply chain disruptions and their size to pad profit margins during the pandemic, in a phenomenon he dubbed “greedflation.”

The FTC’s inquiry, conducted over 28 months, analyzed three large corporations at each stage of the grocery supply chain – retailers, wholesalers, and producers. Yet the study largely failed to measure business practices or their effects on competition. The firms subject to the investigation included retailers Kroger, Walmart, and Amazon; wholesalers C&S Wholesale Grocers, McLane Company, and Associated Wholesale Grocers; and products Procter & Gamble, Kraft Heinz, and Tyson Foods.

The study’s narrow scope and limited economic analysis yielded unsubstantiated conclusions that say little about the current state of competition in grocery supply chains. The FTC should be hesitant to use the conclusions as a reason to revitalize Robinson-Patman Act (RPA) enforcement, a law whose provisions have been mostly dormant since the focus of antitrust enforcement shifted away from protecting competitors and toward consumer welfare over the past 40 years. Reinvigorating RPA enforcement is likely to usher in higher prices for consumers.

Supply Chain Pressure

The response to the COVID-19 pandemic put global supply chains under tremendous strain. Ports were closed, workers were shuttered in their homes, and ground transportation was stifled. The unprecedented disruptions resulted in delayed deliveries and shortages of both inputs and final goods.

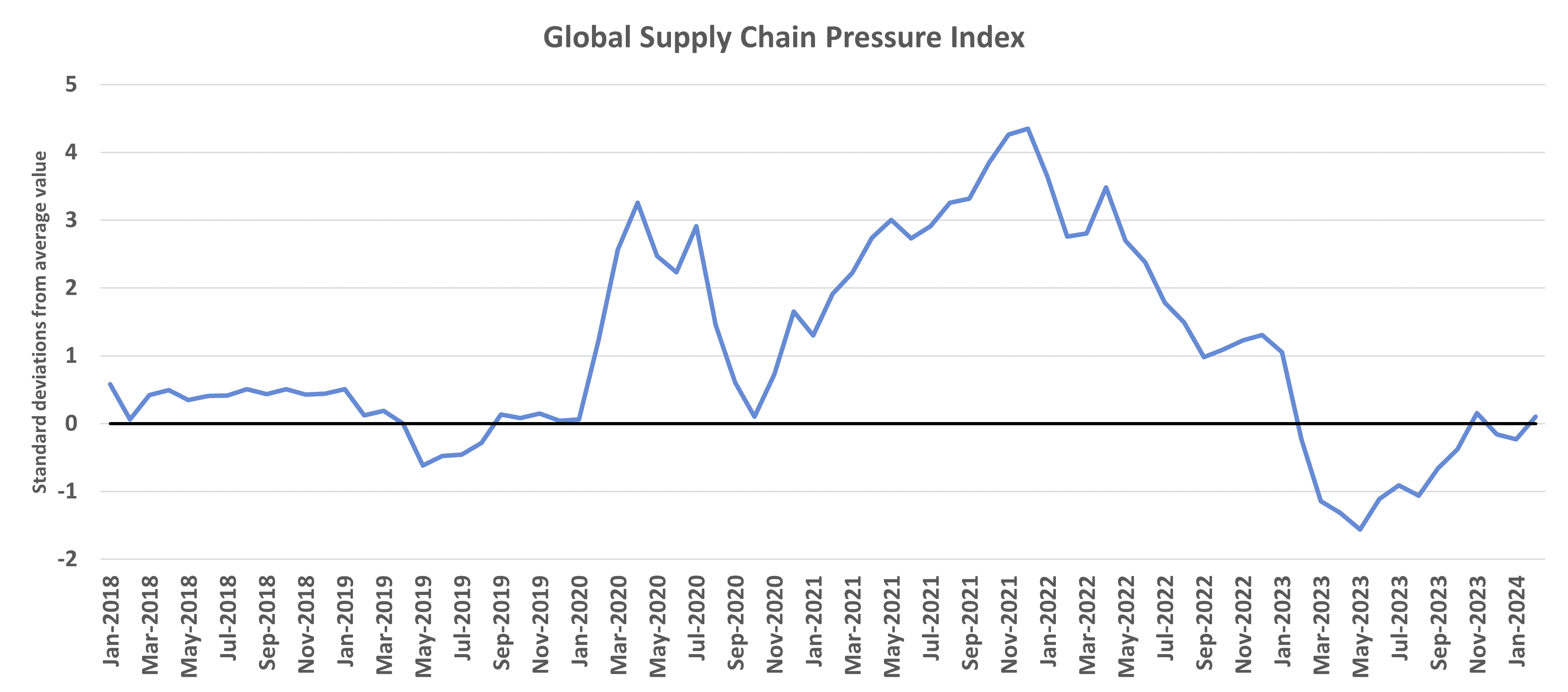

The Federal Reserve Bank of New York’s Global Supply Chain Pressure Index measured the extraordinary level of supply chain disruption during the pandemic. The index peaked in December 2021 at 4.35 standard deviations from its average value. In a statistical context, 95 percent of observations are within two standard deviations of the average value. An observation with a standard deviation above four means that it falls outside 99.9 percent of values. Prior to the pandemic, the largest reading was 1.54 standard deviations from the average value in April 2011.

Figure 1

*Source: Federal Reserve Bank of New York

Change in Consumer Demand and Food Inflation

Because food is a consumer necessity, disruption to the grocery supply chains during the COVID-19 pandemic was noticeable. To understand the industry’s response, the FTC commenced a study to determine “whether supply chain disruptions [were] leading to specific bottlenecks, shortages, anticompetitive practices, or contributing to rising consumer prices.” The agency ordered nine firms – three retailers, three wholesalers, and three producers – to provide information on “the disruptions they experienced, how they adapted to those disruptions, and how those approaches may have ultimately affected competition and consumers.” The FTC found that disruptions in labor supply, transportation and trucking, and inputs and raw materials, coupled with changing consumer demand, led to widespread shortages and increased costs throughout the supply chain.

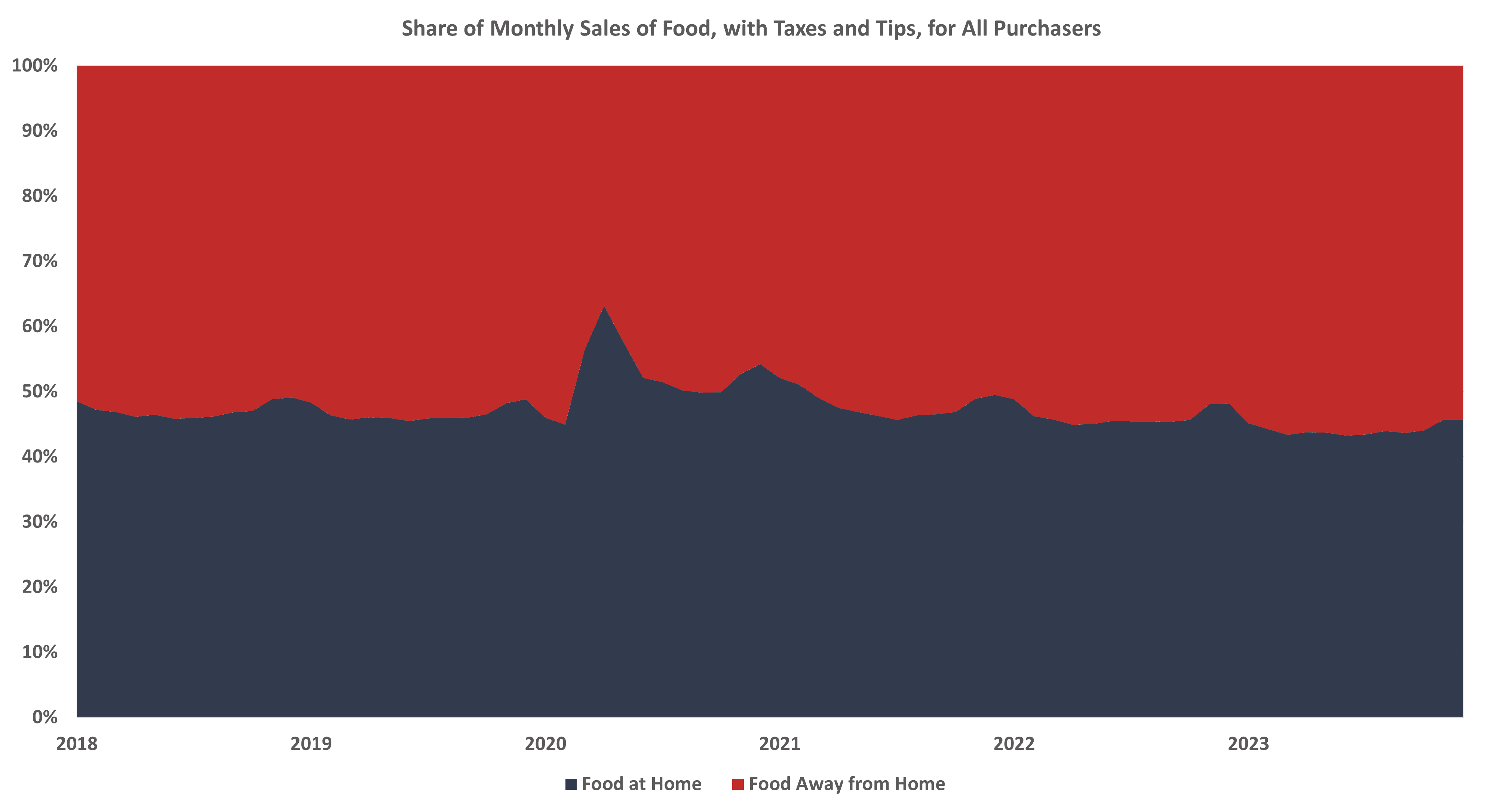

Data from the U.S. Department of Agriculture dating back to 1997 showed the magnitude of the change in consumer preference between purchasing food at home and food away from home. Demand for food at home – food purchased from grocery stores, wholesale clubs, supercenters, and other grocers – accounted for 49 percent of spending on food in December 2019. By April 2020, it was 63 percent. The previous high was 59 percent in December 1999.

Figure 2

*Source: USDA Food Expenditure Series

The abrupt shift in demand for food at home required firms to rapidly adapt to consumer demand. As the FTC explained, producers struggled to “shift production lines from quantities and packaging designed for restaurants to manufacturing smaller packages designed for retail sales.” The agency found that wholesalers had to “alter the product mix being shipped to each store,” and that retailers struggled to keep shelves stocked. The imbalance of supply and demand pushed prices higher, and those costs, as the FTC noted, were “generally passed along through the supply chain.” Food inflation soared.

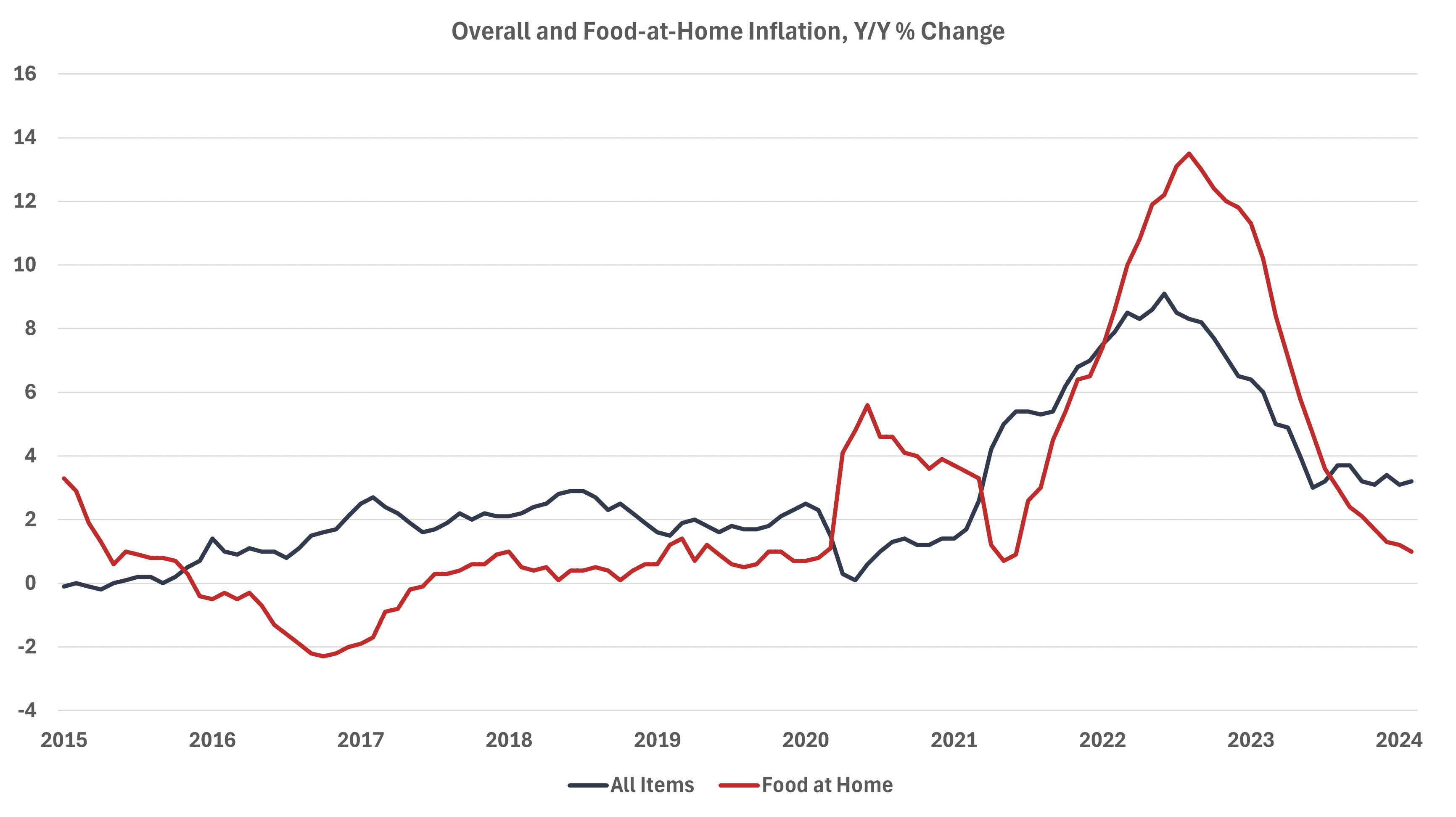

Consumers flocking to the grocery store resulted in food-at-home inflation outstripping overall inflation early in the COVID-19 pandemic. The overall annual inflation rate from April to September 2020 averaged 0.8 percent. Conversely, the annual inflation rate for food at home averaged 4.6 percent. As overall inflation began to accelerate in 2021, food-at-home inflation reignited, hitting a year-over-year peak of 13.5 percent in August 2022. More recently, food-at-home inflation slowed to a rate below overall inflation, measuring 1 percent in February 2024.

Figure 3

*Source: U.S. Bureau of Labor Statistics

FTC on Profits

The FTC drew several conclusions using the information provided by the nine firms and publicly available data. The agency did, however, caveat its findings saying that “the conclusions…are based on specific information, but they do not measure the wider prevalence of observed practices or the magnitude of their impact on competition.” The statement casts doubt on the broader implications of the findings and their reflection of the current state of competition at any stage of the grocery supply chain.

While inflation was running rampant, the FTC found that annual profits for food and beverage retailers rose during the pandemic and have yet to recede, and that industry concentration was, in part, responsible. The findings, the FTC stated, “warrant further consideration by the Commission and policymakers.”

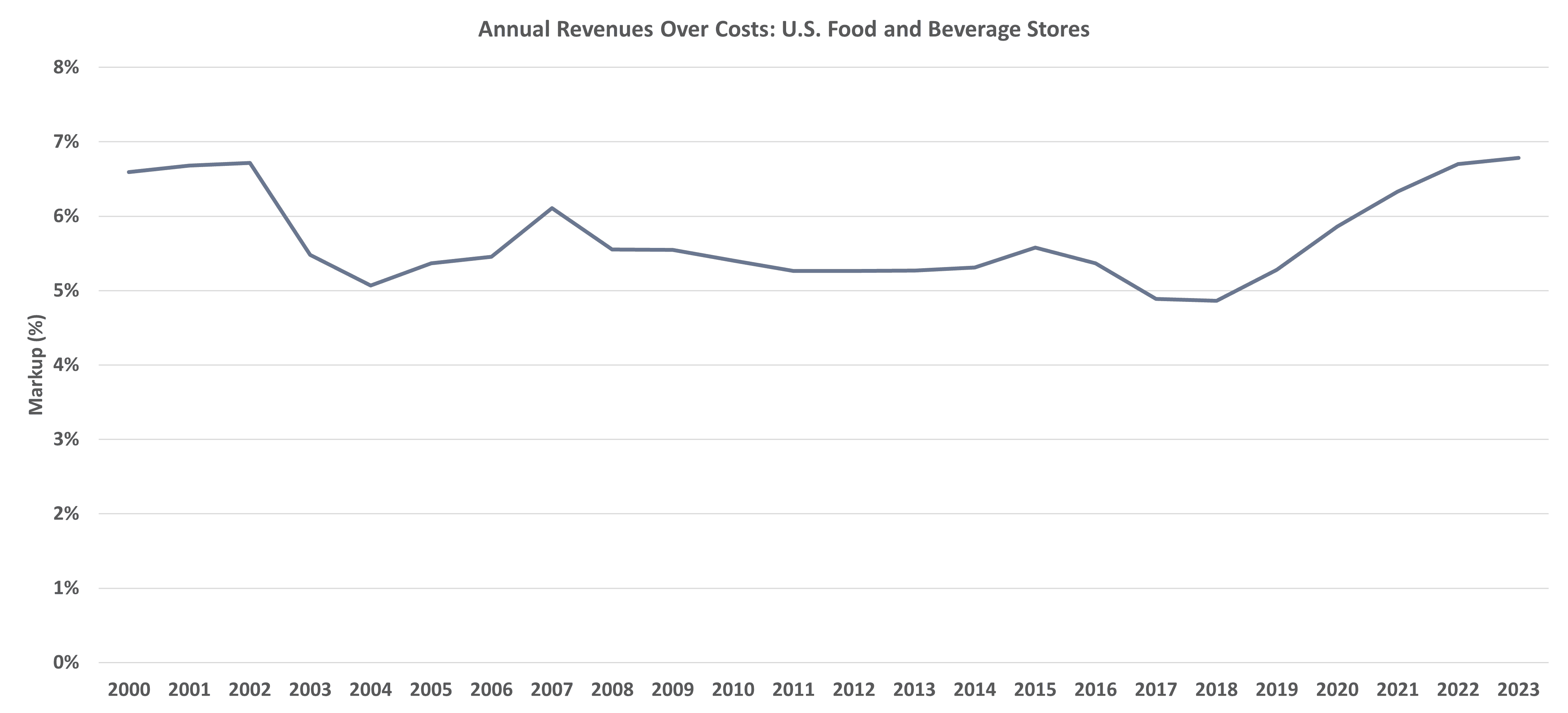

Figure 4, recreated from the FTC report, shows annual revenues over costs for food and beverage stores. Figure 4 includes data for Q4 2023 that were not available to the FTC at the time of the study.

Figure 4

Markups increased from their recent peak of 5.6 percent in 2015 to 7 percent over the first three-quarters of 2023. This measure of markups was 6.8 percent for the full-year 2023. The FTC pointed to these elevated markups as a signal that “casts doubt on the assertion that rising prices at grocery stores are simply moving in lockstep with retailer’s own rising costs.” The FTC added that “some firms seem to have used rising costs as an opportunity to further hike prices to increase their profits, and profits remain elevated even as supply chain pressures have eased.” In other words, the FTC suggested that these increased profits were ill-gotten. Though the FTC was armed with information directly from nine companies in the supply chain, it did not “test whether the specific companies…increased their prices by more or less than their input cost increases.” Passing over this information calls into question the validity of the conclusions.

Moreover, policymakers should be cautious not to overstate the study’s findings, particularly as some were predisposed to draw such conclusions more than a year before the study findings were released. In a January 2022 exchange with Federal Reserve Chair Jerome Powell, Senator Elizabeth Warren (D-MA) made similar claims, asserting that rising grocery prices and increased profit margins were the result, in part, of industry concentration. In response, Chair Powell warned against such a simplistic view, pointing out that “the connection between concentration and market power is not as clean as we might think it might be. In some of the industries that have concentrated, there actually has been lower cost increases that has resulted in lower cost to consumers…. So, it’s not as direct.”

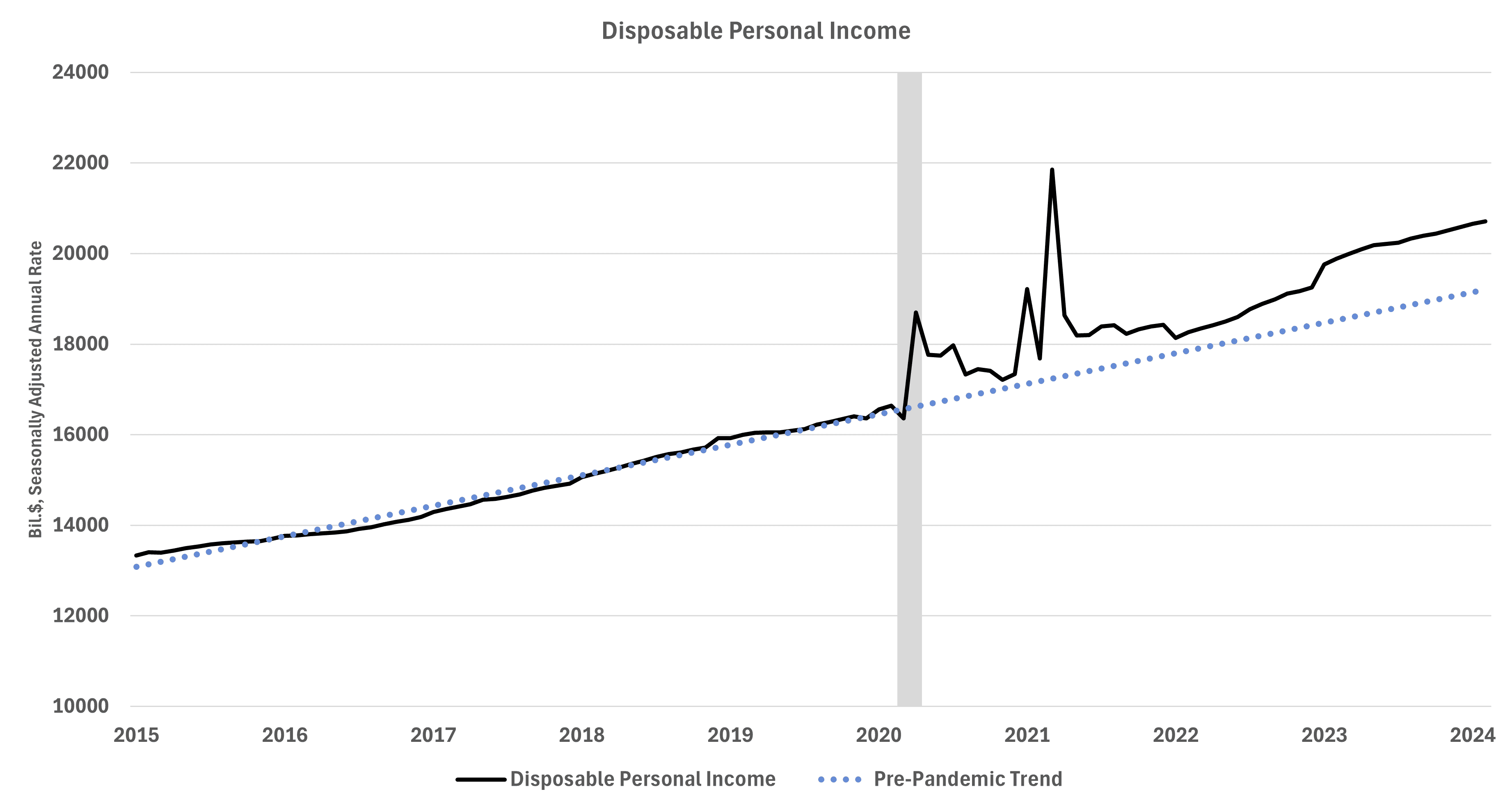

The FTC’s allegation that these increased profit margins were somehow nefarious overlooks the economic realities of the pandemic. Unlike most recessions when disposable personal income (DPI) ticks lower, fiscal stimulus pushed DPI higher and above its pre-pandemic trend (Figure 5). Data showed that the gap in DPI and trend DPI rose to over $2 trillion in April 2020 and correlated with the first jump in food-at-home prices. A year later, as the DPI gap reached $4.6 trillion, overall inflation began to accelerate from 2.6 percent in March 2021 to 4.2 percent in April, and peaked at 9.1 percent in June 2022.

Figure 5

*Source: St. Louis Fed FRED Database; Author calculations: Pre-pandemic trend calculated from January 2015–March 2020.

Consumers, many of whom were flushed with cash and unable to dine out, raced to the grocery store to buy food to prepare at home. This supply/demand shock pushed prices higher and left shelves bare.

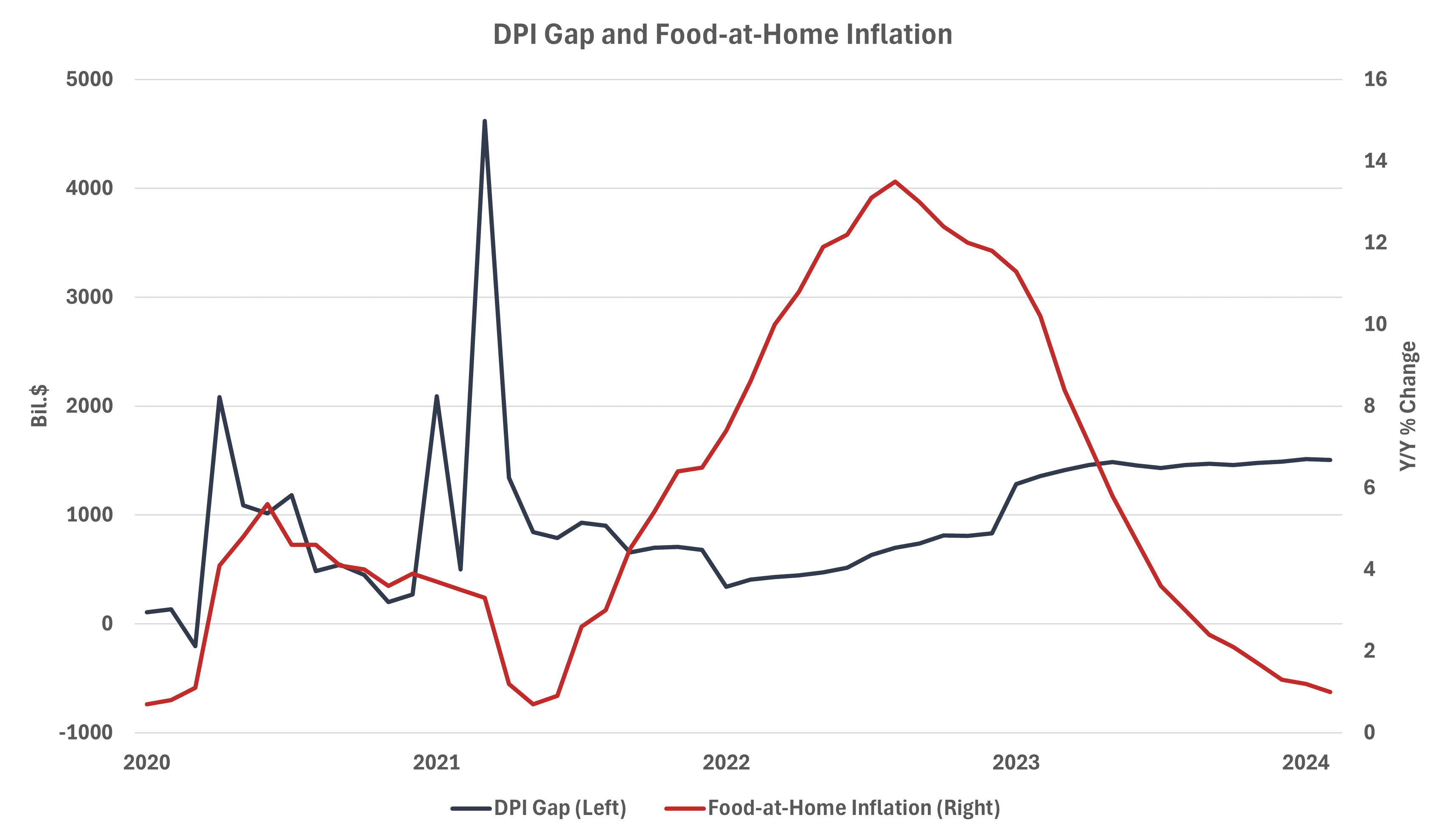

Figure 6 depicts the DPI gap and food-at-home inflation. The first jump in the DPI gap was associated with an immediate rise in food-at-home inflation as restaurants and other eating establishments were shuttered. The second climb in food-at-home inflation came months after successive jumps in the DPI gap in January and March 2021. The delay was likely the result of restaurants reopening in the spring of 2021 and consumers using their excess cash to satisfy pent-up demand for food away from home.

Figure 6

*Source: Bureau of Labor Statistics; St. Louis Fed FRED Database; author calculations

Robinson-Patman Act

In addition to increased profit margins, the FTC also investigated whether large firms were given preferential access to goods in short supply and if large firms were charged a different price compared to their smaller rivals. The FTC concluded that “large purchasers pressured their suppliers for favorable allocations of products in short supply” and that “when trade promotions designed to increase demand for products dried up, some firms were harmed more than others.”

To garner preferential treatment, according to the FTC, companies implemented or strengthened “on time and in full” (OTIF) delivery policies – a policy whereby purchasers penalize (usually a fine as a percent of the cost of goods ordered) suppliers if a certain quantity of an order goes unfilled or delivery is delayed – in order to “pressure suppliers to favor them over rivals.” An OTIF policy “incentivize[s] producers or wholesalers to divert products toward customers that impose OTIF penalties and away from customers that do not,” according to the FTC. The agency found that Walmart’s OTIF policy required “suppliers to achieve 98 percent OTIF compliance to avoid fines of 3 percent of the cost of goods.” The FTC stated that, as a result, “wholesalers and retailers receiving less product as a result of enhanced OTIF requirements were at a competitive disadvantage.” Of note, the FTC study “did not attempt to empirically evaluate the magnitude of product diversions due to OTIF policies across the vast number of suppliers and retailers in the grocery supply chain.”

While the FTC sees the use of OTIFs as a display of market power to entrench firms’ dominant position, it is more likely that they used their buying power to restock shelves to best serve their customers. While smaller firms may have been at a competitive disadvantage, the study said little with respect to the effects OTIF policies had on competition.

The FTC also found that “everyday low pricing models” used by firms such as Walmart outperformed short-term promotion pricing methods used by traditional grocery retailers. Short-term promotion pricing calls for retailers to pay a higher upfront wholesale price and receive promotional funds later. Wholesalers have similar arrangements with producers. An everyday low pricing model, by contrast, “foregoes all promotional co-operative expenditures on its behalf in exchange for the lowest possible wholesale price.” Product shortages, however, “prompted producers to reduce their funding or trade promotions,” thereby raising costs on smaller competitors. These pricing strategies are a manifestation of competition, not an indication of its absence.

Both conclusions focused on the disparity between prices paid and access larger retailers had compared to their smaller rivals. Such conclusions hint that the FTC may consider resurrecting the use of the Robinson-Patman Act to address any “unfairness” among competitors.

Congress passed the RPA in 1936 in response to the growth of large grocery chains buying goods directly from suppliers and cutting out wholesalers. As a result, smaller firms could not acquire goods at the same price and were unable to match the final sale price to consumers. The intent of the RPA was to protect these smaller stores from being priced out of the market by prohibiting price discrimination among purchasers.

As antitrust enforcement shifted away from protecting small competitors and toward a focus on consumer welfare, the RPA has been used only twice since 1998.

President Biden’s executive order on Promoting Competition in the American Economy called for RPA enforcement. FTC Commissioner Alvaro Bedoya stated that the statute’s enforcement should be part of the agency’s plan to “return to fairness.” Moreover, a week after the FTC study was published, Senator Warren, along with 15 members of Congress, sent a letter to FTC Chair Lina Khan calling for the revival of RPA enforcement and pointed to concentrated food supply chains as a potential target.

A revitalization of RPA is likely to usher in higher prices for consumers while protecting inefficient competitors.

Conclusion

The FTC’s study on the grocery supply chain during the COVID-19 pandemic concluded that corporations leveraged their size to entrench their market power at the expense of smaller rivals and that these firms used the inflationary environment to extract ill-gotten profits.

The study signals that the FTC may use these conclusions to revitalize RPA enforcement, which would likely usher in higher prices for consumers while protecting inefficient competitors. Its methodology relied heavily on caveats and carveouts, and the resulting conclusions failed to measure the effects on competition broadly. The FTC should not rely on the findings as a guide to implement policy.