Insight

June 26, 2018

Highlights from CBO’s 2018 Long-Term Budget Outlook

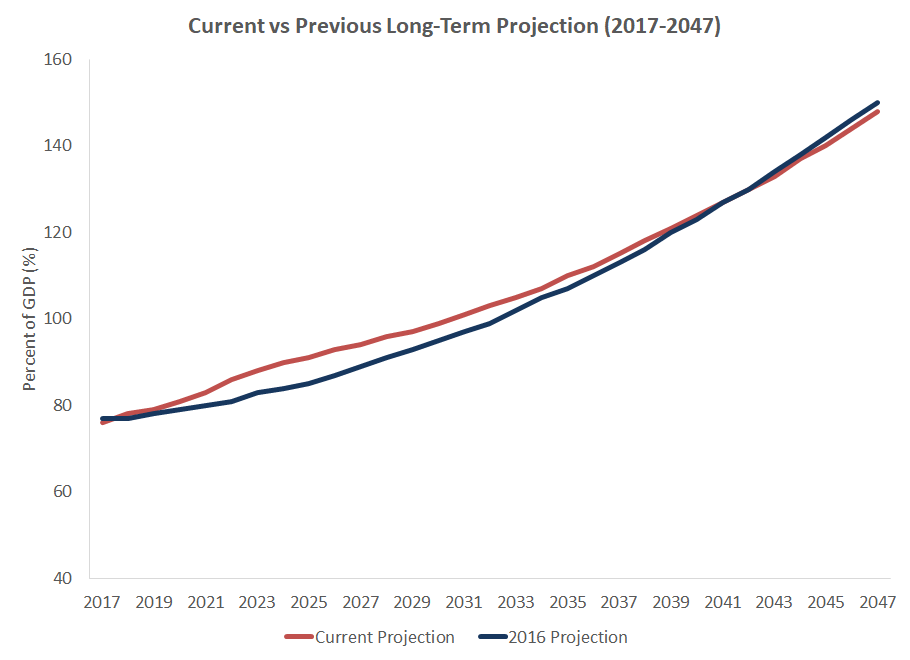

Today, the Congressional Budget Office (CBO) released its latest Long-Term Budget Outlook and projected that the nation’s debts will essentially double as a share of the economy by 2048, reaching 152 percent of gross domestic product (GDP). Even though CBO has projected higher deficits over the last year, this year’s Long-Term Outlook is remarkably similar to last year’s. This projection reaffirms longstanding demographic and economic trends as well as highlights the continued willingness of policymakers to avoid addressing or, in some cases, to worsen the nation’s finances.

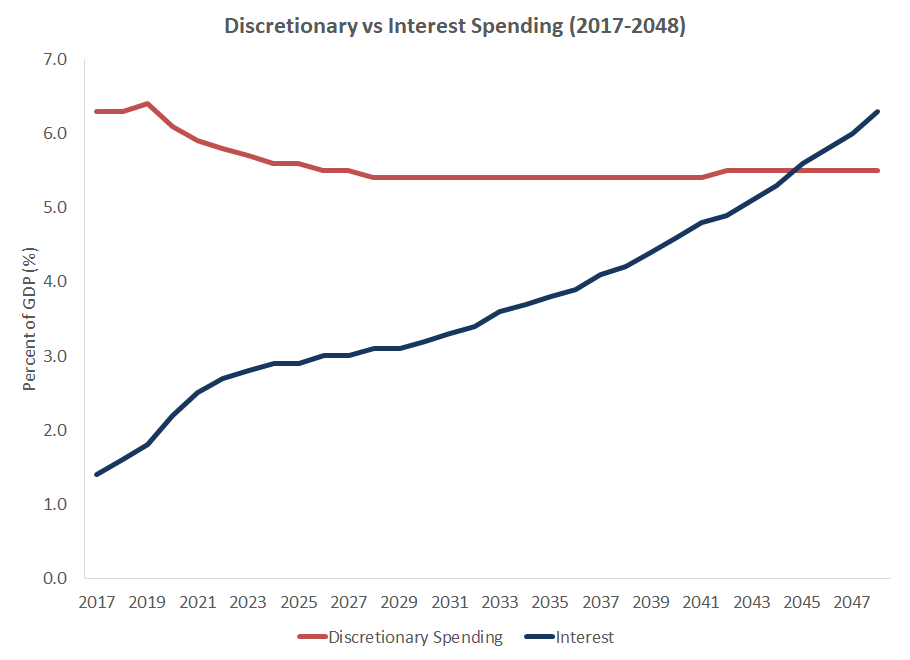

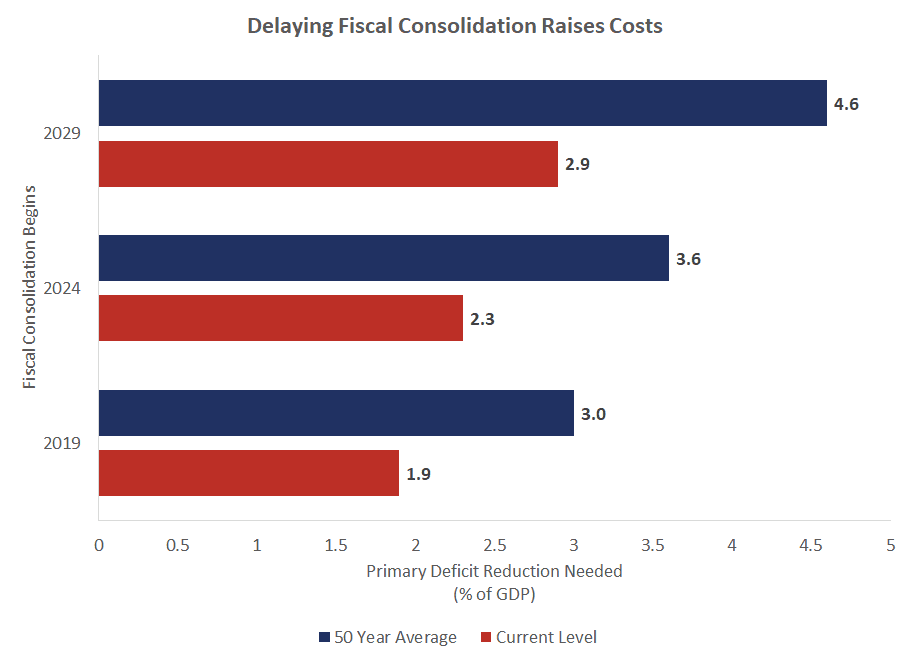

Associated with higher borrowing needs are higher borrowing costs, which will crowd out other federal priorities (figure 2). If the only major difference between this year’s projection and last year’s projection is the passage of time, notwithstanding policymakers’ appetite for contributing to the problem, it is important to recognize that waiting to address America’s debt challenge is costly. As Figure 3 demonstrates, the longer policymakers wait to slow and reverse the nation’s debt accumulation, the tax increases or spending reductions (or combination of both) necessary to accomplish this consolidation become larger and more painful. Already, the amount of fiscal consolidation needed simply to stabilize the nation’s historically high debt level of 78 percent of GDP is staggering. Simply keeping the debt at 78 percent of GDP by 2048 would require lawmakers to enact 1.9 percent of GDP in annual deficit reduction, which would be $400 billion in 2019. Recall that Congress recently failed to pass an attempt to reduce spending by a mere $1.1 billion.[1]

Figure 1

Compared to CBO’s last Long-Term Outlook, projected debt in the hands of the public is largely unchanged over the long run. Over the medium term, projected deficits are higher due to recently enacted fiscal policies, but looking further out, the debt outlook remains driven by three primary factors: demography, which hasn’t changed since the last Long-Term Budget Outlook; the nation’s major entitlement programs, which have also been unchanged; and growing interest on the nation’s growing debt portfolio.

Figure 2

Today’s Long-Term Outlook reaffirms a trend in the nation’s finances: Debt service costs are crowding out other federal expenditures and will exceed every other discretionary program – from defense and education to infrastructure – combined.

Figure 3

CBO also calculates what is essentially the cost of delaying needed fiscal consolidation. To hold debt held by the public as a share of GDP to current levels (78 percent of GDP) in 2048 would require an annual reduction (relative to CBO projections) in the primary deficit of 1.9 percent of annual GDP if begun next year, which amounts to $400 billion in 2019. This cut could be accomplished through a revenue increase, spending decrease, or both, excluding net interest. Achieving the same level of debt in 2048 would require a much larger fiscal consolidation if such consolidation is delayed until 2024 or 2029. The same story holds true if the United States were to return its 2047 debt level to the 50-year historic norm of 41 percent of GDP. It would require annual savings of 30 percent if begun in 2019, but 4.6 percent if begun in 2029. In both instances, making the necessary deficit reduction to achieve fairly modest debt targets in 2048 would be difficult if begun now, but would be about 50 percent more painful if delayed for 10 years.

The current federal budget trajectory promises higher debt with reduced productive public and private investment. This trajectory reflects growing federal transfer programs and consequently greater borrowing needs, all financed by a lower standard of living for future generations. Absent reform, these trends are becoming increasingly intractable and will require significant fiscal consolidations to address them.

[1] https://www.americanactionforum.org/insight/the-house-dabbled-in-governing-the-senate-took-a-pass/