Insight

September 21, 2020

Highlights from CBO’s Long-Term Budget Outlook 2020

Executive Summary

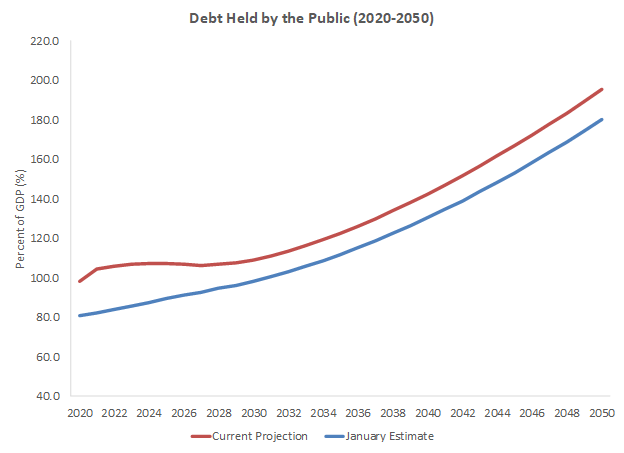

- According to the Congressional Budget Office (CBO), debt held by the public will reach 195 percent of gross domestic product in 2050, which is 15 percentage points higher than what the agency projected in its January estimate.

- The pace of projected debt accumulation tracks previous estimates, but the significant federal borrowing due to the COVID-19 pandemic has substantially increased existing federal indebtedness.

- Before long, stabilizing the debt will require an unprecedented fiscal consolidation.

The Long-Term Budget Outlook

The Congressional Budget Office (CBO) released its updated Long-Term Budget Outlook and projected that the U.S. debt will essentially double as a share of the economy by 2050, rising from the current level of 98 percent to 195 percent of gross domestic product (GDP). While the trajectory of projected debt accumulation is similar in many respects to preceding Long-Term Outlooks – the level of debt as a share of GDP is substantially higher than previously estimated because of the material deterioration in the nation’s fiscal outlook due to the COVID-19 pandemic.

Whereas in January CBO estimated that the debt would reach 180 percent of GDP by 2050, CBO now projects that debt held by the public will reach 195 percent of GDP by then – essentially twice the projected size of the U.S. economy midway through the 21st century. The pace of debt accumulated over the long-term horizon – beyond the 10-year budget window – essentially tracks with prior estimates.

Figure 1

Over the medium term, increased projected deficits necessarily reflect the economic and federal response to the pandemic, which CBO estimates will increase the deficit by $2.6 trillion over the 2020-2030 period. But over the longer term, the debt outlook remains driven by demography (which hasn’t changed since the last Long-Term Budget Outlook), the nation’s major entitlement programs (which are also unchanged), and growing interest on the nation’s ever-larger debt portfolio.

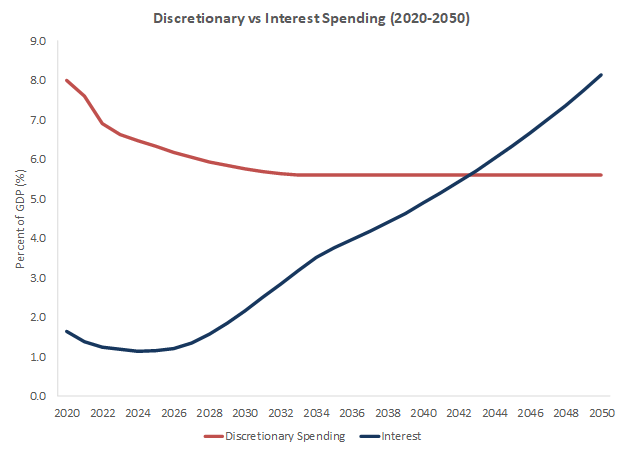

The long-term outlook reaffirms a trend in the nation’s finances, as Figure 2 illustrates. Despite continued markdowns in interest rates, debt service costs will crowd out other federal expenditures, and in 2043 these costs will exceed all other discretionary programs – defense, education, infrastructure – combined.

Figure 2

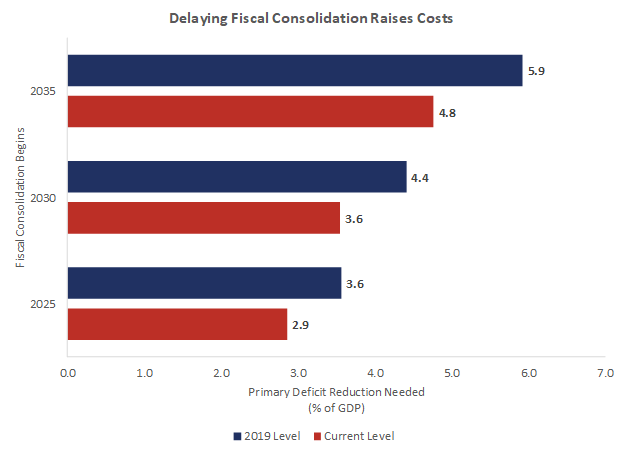

CBO has also been calculating what is essentially the cost of delaying needed fiscal consolidation, shown in Figure 3. To hold debt held by the public as a share of GDP to about current levels, 100 percent, in 2050 would require an annual reduction (relative to CBO projections) in the primary deficit (a revenue increase, spending decrease, or both, excluding net interest) of 2.9 percent if begun in 2025. This sum amounts to $598 billion in 2020. Achieving the same level of debt in 2050 would require a much larger fiscal consolidation if delayed until 2030, or 2035.

Figure 3

The same story holds true if the United States were to return to its 2019 debt level of 74 percent of GDP. It would require annual savings of 3.6 percent if begun in 2025, but 4.4 percent if begun in 2030. In both instances, achieving the necessary deficit reduction to achieve fairly modest debt targets in 2050 would be difficult if begun now, but would be more than 50 percent more painful if delayed for 10 years. For context, the magnitude of fiscal consolidation contemplated in any of these scenarios significantly dwarfs all but one historical tax increase. Essentially, this challenge would require deliberate fiscal consolidation on an unprecedented scale.