Insight

July 12, 2016

Highlights from the Long-Term Budget Outlook

Highlights from the Long-Term Budget Outlook

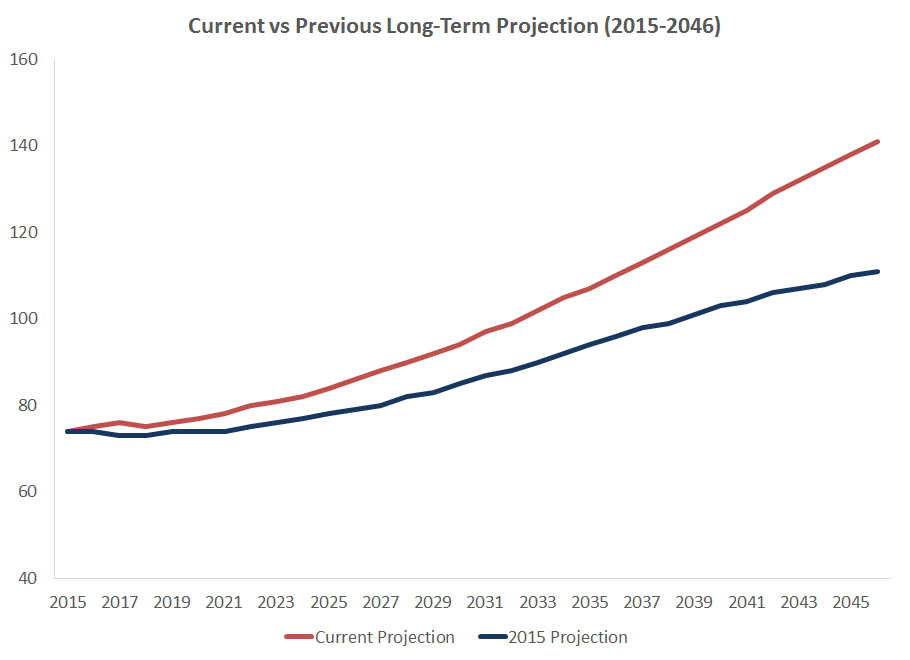

Today, CBO released its latest Long-Term Budget Outlook and projected that the nation’s debts will nearly double as a share of the economy by 2046, reaching 141 percent of Gross Domestic Product (GDP). This projection reflects well entrenched demographic and economic trends and intransigence on the part of policymakers to alter America’s fiscal outlook. Compared to last year’s Long-Term Outlook, CBO projects higher deficits and debt. Associated with higher borrowing needs are higher borrowing costs with projected interest payments increasingly swamping other areas of the federal budget. Lastly, these borrowing costs crowd out private investment that will, absent reform, depress incomes for American workers.

Figure 1

Compared to CBO’s last Long-Term Outlook, projected debt in the hands of the public has increased by 30 percentage points in 2046. This is driven by several factors, the largest of which is the permanent codification of longstanding year-by-year tax policy that, as a result, reduces revenues over the long term. This permanent reduction in revenues leads to higher projected debt and associated interest. Lower projected growth also has the effect of raising the share of debt as a share of the economy.

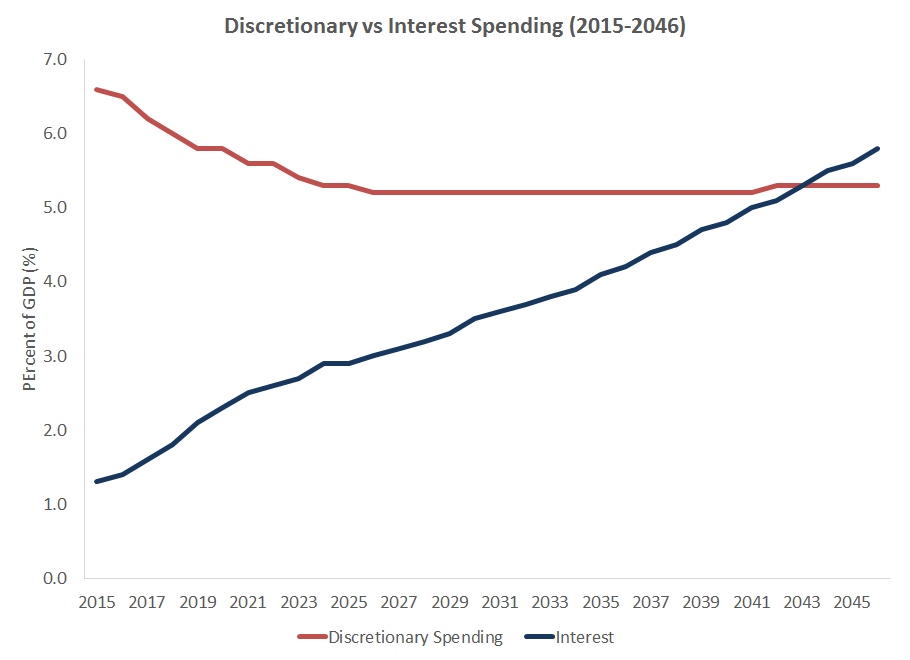

Figure 2

Today’s Long-Term Outlook reaffirms a trend in the nation’s finances – debt service costs are crowding out other federal expenditures, and will exceed every other discretionary program – defense, education, infrastructure – combined.

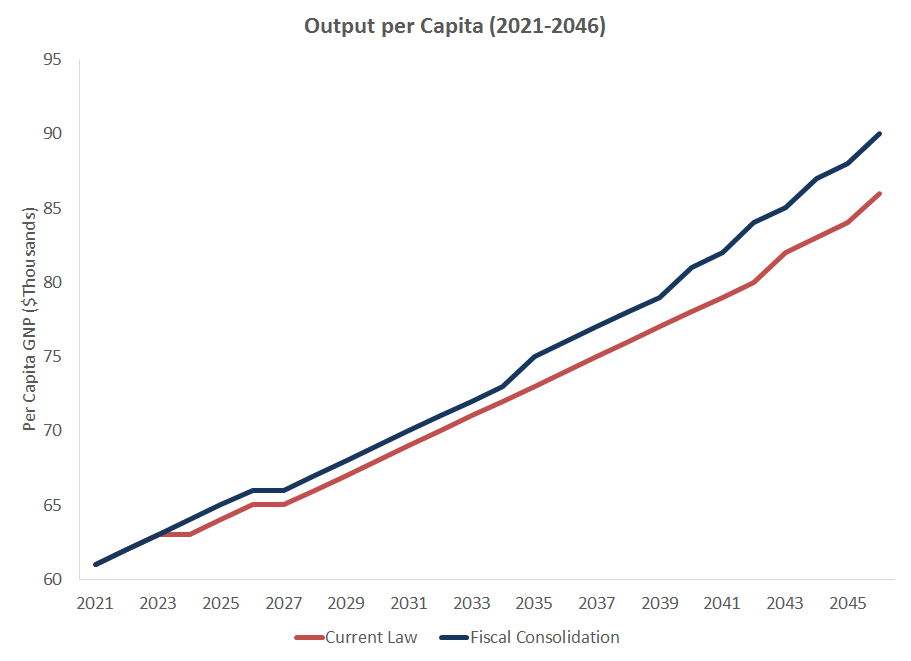

Figure 3

As federal borrowing increases over the near, medium, and long term, private investment declines. The decline in private investment – known as “crowd out” – reduces investment in equipment and machines and the nation’s capital stock in general. This decline reduces worker productivity and ultimately, economic growth. Reversing this crowd-out effect would require a fiscal consolidation that reduces federal borrowing needs over time. An illustrative fiscal consolidation of $4 trillion would sufficiently reduce the crowd-out effect to increase per capita income significantly over the next 30 years. Compared to current law, a $4 trillion fiscal consolidation would increase per capita income by $4,000 in 2046 – reflecting a cumulative increase of $46,000 per person over that time.

The current federal budget trajectory promises higher debt with reduced productive public and private investment. This reflects growing federal transfer programs and borrowing needs financed by a lower standard of living for future generations. Absent reform, these trends are becoming increasingly intractable and will require more significant fiscal consolidations to address.