Insight

February 12, 2021

Highlights of CBO’s Budget Outlook for 2021-2031

Executive Summary

- According to new projections from the Congressional Budget Office (CBO), the debt will reach the highest levels in U.S. history in 2031.

- Since CBO’s last baseline update in September, the economic, legislative, and technical effects of the COVID-19 pandemic have combined to reduce baseline deficits since CBO’s last projection by $345 billion over the period 2021-2030.

- While the debt is projected to reach an all-time high at the end of 2031, this is actually an improvement over CBO’s prior estimates.

Introduction

The Congressional Budget Office (CBO) released an update to its periodic budget outlook, which provides Congress with a 10-year budget projection. This update incorporates CBO’s most recent economic forecast and the budgetary effects of the Consolidated Appropriations Act. While CBO’s economic forecast and its budgetary projections reflect an economy and national fisc impaired by COVID-19, the most recent forecast do reflect improvements on both fronts. Indeed, while policymakers have legislated their way toward an additional $1.4 trillion in deficits, and are likely to continue, CBO’s economic forecast has improved since its last estimates in July.

What’s Changed?

The February 2021 CBO budget outlook is somewhat improved from CBO’s projections released in September, primarily due to an improved economic outlook. Stronger economic growth, all else equal, leads to higher tax collections, and lower expenditures on many transfer programs. According to CBO, relative to its prior estimates, an improved economic outlook reduced the baseline budget deficit by a combined $1.469 trillion over 2020-2030. This effect is net of over $2.0 trillion in reduced deficits from higher tax collections, $300 billion in reduced deficits due to technical factors, and $560 billion in higher spending, including $224 billion from higher debt service. CBO estimated that legislation enacted since September increased the deficit by $1.424 trillion over the budget window. Net of the contributions from the relatively improved economic outlook and additional fiscal interventions, CBO estimates that the baseline deficit improved by $345 billion over 2021-2030.

By the Numbers

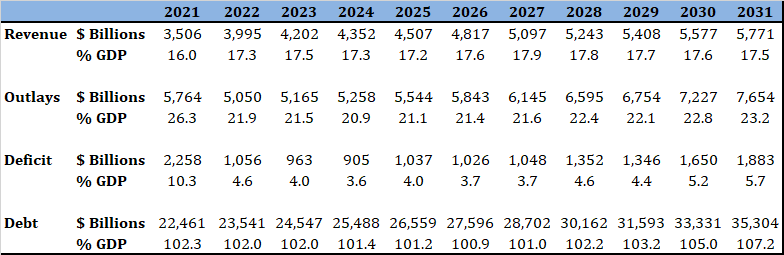

Taxes: By the end of the 10-year budget window, tax revenues will amount to 17.5 percent of gross domestic product (GDP), after recovering from a projected low of 16 percent in 2021. Tax revenues will average 17.4 percent of GDP over the next 11 years, which is slightly above the 17.3 percent historical average. It is important to note that significant elements of the Tax Cuts and Jobs Act sunset in 2025, helping to drive up revenue as a share of the economy in the budget window’s last four years.

Spending: CBO estimates that, by the end of the budget window, overall spending will total 23.2 percent of GDP. Entitlement, or mandatory, spending will continue to remain roughly two-thirds of federal outlays over the next decade. It presently comprises 66 percent of federal outlays up from 56 percent in 2011 and 35 percent in 1971.

Deficits: The federal budget deficit is estimated to be $2.3 trillion in 2021, or 10.3 percent of GDP. Prior to the 3.1 trillion deficit record in 2020, the highest nominal deficit ever previously recorded was $1.4 trillion in 2009. As a share of GDP, the 2021 deficit of 10.3 percent of GDP would be the highest observed other than last year and those of World War II. The deficit will average 4.9 percent of GDP over the 2021-2031 period.

Interest Payments: Interest payments on the debt will reach $799 billion in 2031. Interest payments are projected to double as a share of federal outlays, rising from 5 percent of total federal spending in 2021 to over 10 percent of federal spending in 2031.

Debt Held by the Public: Borrowing from the public is projected to increase as a share of the economy under current law, reaching 107.2 percent of GDP in 2031. The debt surpassed 100 percent of the economy in 2020, the first time since 1946. By the end of the budget window, the debt is expected to reach the highest level as a share of GDP in U.S. history – surpassing the 106.1 percent record from 1946 following the end of World War II.