Insight

March 20, 2024

Highlights of CBO’s Long-Term Budget Outlook 2024

Executive Summary

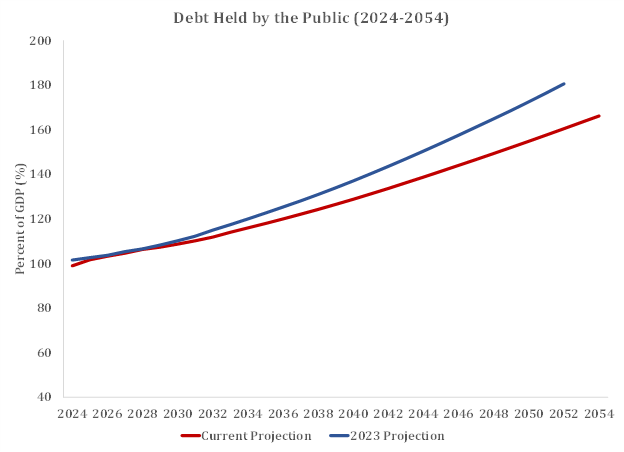

- According to the Congressional Budget Office (CBO), debt held by the public will reach 166 percent of gross domestic product in 2054.

- CBO projects that the debt will be 17 percentage points lower over a comparable period than the agency projected in last year’s estimates.

- The improved outlook stems from reduced projected discretionary spending resulting from the enactment of caps on discretionary spending for fiscal years 2024 and 2025, as well as other underlying re-estimates of Social Security and the economic outlook.

- Consistent with more near-term projections, despite the improved debt outlook relative to last year’s projections, debt will reach the highest levels in U.S. history by 2029.

- In short, the fundamentally unsustainable budget outlook remains: historically high spending, deficits, debt service, and ultimately debt.

The Long-Term Budget Outlook

The Congressional Budget Office (CBO) released its updated Long-Term Budget Outlook and projected that U.S. debt held by the public will increase by essentially two thirds of its current levels, from 98 percent to 166 percent of gross domestic product (GDP) by 2054.

Figure 1

The debt as a share of the economy is about 1 percentage point below what CBO estimated for fiscal year 2024 in its prior long-term outlook, and the debt is expected to remain below previous estimates over the extended 30-year budget window. As CBO notes, this improved outlook is in part driven by reduced projected discretionary spending. Yet these projected savings are essentially the savings of just two years of spending caps projected over three subsequent decades. While this is consistent with how CBO is supposed to build its budget projections, given the congressional appetite for spending, there is little reason to assume those savings will be realized.

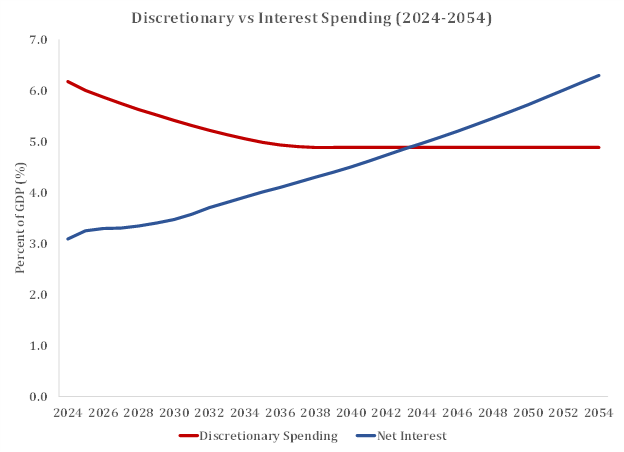

Fundamentally, the budgetary pressures that drive long-term debt growth are unchanged. The United States is projected to spend, on average, 6.7 percent of GDP more than it collects in tax revenues over the next 30 years.

The long-term outlook reaffirms a trend in the nation’s finances, as Figure 2 illustrates. Debt service costs will crowd out other federal expenditures, and in 2044 these costs will exceed all other discretionary programs – such as defense, education, and infrastructure – combined. Under the current outlook, interest costs will more than double, consuming 6.3 percent of GDP by 2054.

Figure 2

The basic long-term outlook is fundamentally unchanged from last year’s estimates, though CBO does estimate that the Old Age and Survivors Insurance Trust Fund – the Social Security trust fund for retirees – will be exhausted in 2034, one year later than was previously estimated.