Insight

February 15, 2023

Highlights of CBO’s Update to the Budget and Economic Outlook for 2023–2033

Executive Summary

- According to new projections from the Congressional Budget Office (CBO), the debt will eclipse the highest levels in U.S. history by the end of fiscal year 2028.

- Since CBO’s last baseline update in May 2022, the combination of more deficit-financed spending, interest costs, and other economic factors have contributed an estimated $3.1 trillion in higher deficits on net, with debt service payments increasing by more than $1.6 trillion over a comparable period.

- CBO has significantly marked down the near-term economic outlook, forecasting real GDP growth to “stagnate” over the course of the year and unemployment to rise.

- The CBO outlook presents a federal budget that reflects the risks of running structural deficits with high levels of indebtedness.

Introduction

The Congressional Budget Office (CBO) has released its updated budget and economic outlook, which provides Congress with a 10-year budget and economic baseline to assess the cost of legislation. Since the last update in May 2022, Congress has enacted the Inflation Reduction Act and an omnibus appropriations act, among other legislation. Meanwhile the Federal Reserve has announced six increases in the federal funds rate totaling 375 basis points. While no longer a prevailing national emergency, the legacy of the COVID-19 pandemic materially animates the current budget outlook. The budgetary and economic outlook reflects the costs of those recent challenges, both in the incremental accumulation of debt and the growing cost of servicing that additional debt. Whereas the last CBO baseline reflected a near-term decline in deficits (from historically elevated levels), under the current outlook, budget deficits are projected to increase over the next two years, and by the end of the decade, reach nearly twice the historical average.

What’s Changed?

The February 2023 CBO budget outlook is substantially worse than last year’s. The expiration of multi-trillion-dollar emergency COVID-related spending has necessarily reduced deficits relative to the pandemic era. But Congress’s appetite for deficit-spending and rising interest rates, which in turn increases debt service costs, has worsened the budget outlook. CBO has also marked down its near-term growth forecast, expecting growth to “stagnate” and unemployment to rise owing to the Federal Reserve’s efforts to reduce inflationary pressures, which is also reflected in CBO’s estimates for interest rates. These features of CBO’s outlook combine to increase the agency’s 10-year deficit projection by $3.1 trillion. Over a comparable period, CBO estimates that Congress has increased deficits by about $1.5 trillion, entirely through additional spending. CBO has forecast improved economic growth over the medium term, which should improve the budget outlook though increased revenue. The combination of higher debt service and higher projected costs to entitlement programs swamps any potential revenue growth, however. Combined, CBO’s revised economic forecast increases deficits by $1.2 trillion compared to last year’s baseline. Additional technical revisions serve to increase CBO’s deficit projections relative to last year’s by over $400 billion.

The Budget Outlook: By the Numbers

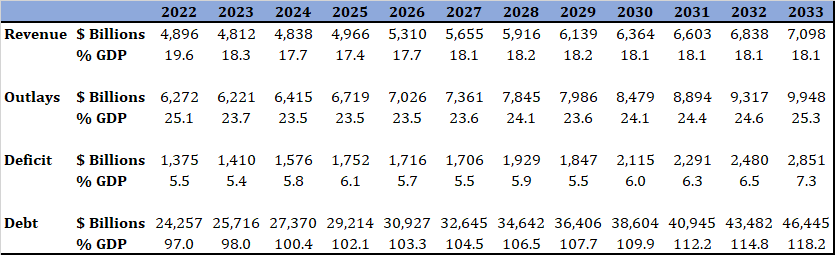

Taxes: By the end of the 10-year budget window, tax revenues will amount to 18.1 percent of gross domestic product (GDP). Tax revenues will average 18.0 percent of GDP over the next 10 years, well above the 17.4 percent historical average. CBO previously estimated that tax revenues would average 18.1 percent of GDP over the budget window.

Spending: CBO estimates that, by the end of the budget window, overall spending will total 24.6 percent of GDP, more than 3.5 percentage points higher than the historical average of 21.0 percent of GDP. Entitlement, or mandatory, spending will continue to remain roughly two-thirds of federal outlays over the next decade. It comprised 66 percent of federal outlays in 2021, up from 56 percent in 2011 and 35 percent in 1971.

Deficits: The federal budget deficit is estimated to be $1.4 trillion in 2023, or 5.4 percent of GDP. This follows a $1.4 trillion deficit record in 2022 and a $2.8 trillion deficit recorded in 2021. The highest nominal deficit ever previously recorded was $1.4 trillion in 2009. The deficit will average 6.0 percent of GDP over the 2023–2033 period, never falling below $1 trillion, and ultimately eclipsing $2 trillion in 2030.

Interest Payments: Interest payments on the debt will reach $1.4 trillion in 2032. Compared to CBO’s last forecast, interest payments are projected to increase by more than $1.6 trillion over the next decade due to higher interest rates and increased debt. By comparison, the Tax Cuts and Jobs Act was estimated to cost $1.45 trillion. Interest payments are projected to nearly double as a share of federal outlays, rising from 8 percent of total federal spending in 2022 to over 14 percent of federal spending in 2033. Interest payments are already larger than any other federal agency’s operating budget other than that of the Department of Defense.

Debt Held by the Public: Borrowing from the public is projected to increase as a share of the economy under current law, reaching 118.2 percent of GDP in 2033. The debt surpassed 100 percent of the economy in 2020, the first time since 1946. By the end of the budget window, the debt is expected to reach the highest level as a share of GDP in U.S. history – and in 2028 will surpass the 106.1 percent record from 1946 following the end of World War II – three years earlier than was projected last year.

The Economic Outlook: By the Numbers

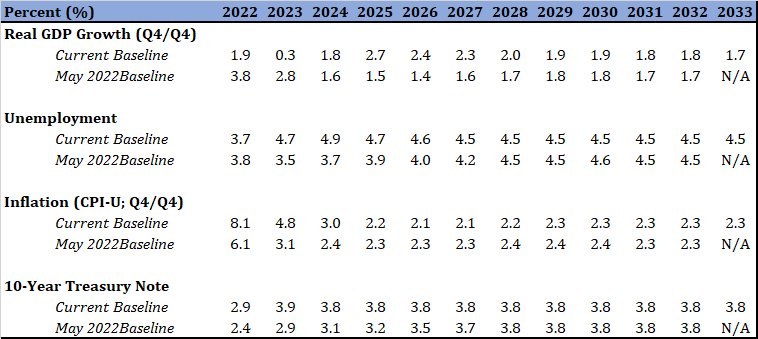

CBO projects real GDP growth to average 1.9 percent over the budget window. CBO was uniquely dour on the near-term economic outlook, forecasting growth to “stagnate” over the course of 2023 and unemployment to increase from the current 3.4 percent to 4.9 percent by 2024.

The largest departures from CBO’s prior forecast reflect essentially a shift in CBO’s expectation of tempered price growth from changes in monetary policy, and the related growth deceleration. CBO’s forecast includes upwardly revised near-term inflation. Indeed, CBO estimates that CPI-U inflation will be more persistent and higher than its prior forecast, before assuming monetary policy reduces the rate of price growth. CBO has relatedly increased its relative estimates of interest rates. The agency estimates the rate on the 10-year Treasury will be a full percentage point higher in 2023 than was estimated last year, and to average 30 basis points higher than previously forecast over the budget window.