Insight

May 2, 2025

Highlights of President Trump’s FY 2026 “Skinny Budget”

Executive Summary

- The Trump Administration has released its fiscal year (FY) 2026 “skinny budget,” which details its proposals for defense and nondefense discretionary spending for FY 2026; the budget does not include any proposed changes to mandatory spending or revenue, nor does it include proposals and cost estimates in any fiscal years beyond 2026.

- The budget proposes $1.45 trillion of base discretionary budget authority (BA) for FY 2026, including $892.6 billion of base defense BA and $557.4 billion of base nondefense BA.

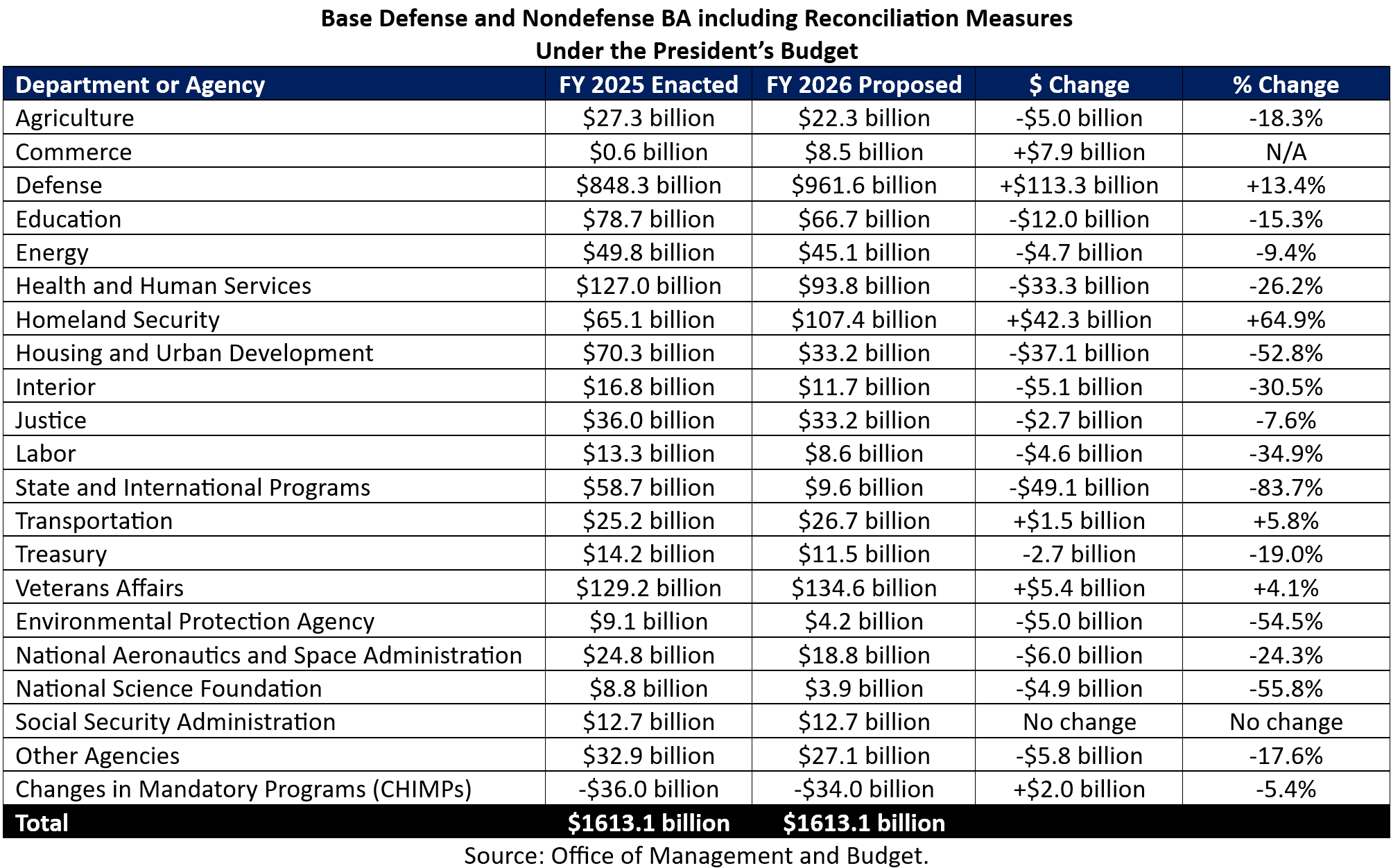

- After including the effects of the reconciliation legislation being negotiated in Congress, the budget proposes $1.61 trillion of base discretionary BA, including $1.01 trillion of base defense BA and $601.2 billion of base nondefense BA.

- The proposed spending increases are concentrated in the Departments of Defense, Homeland Security, Transportation, and Veterans Affairs; most other departments and agencies would see their funding decreased relative to their FY 2025 enacted levels.

Introduction

The Trump Administration has released its fiscal year (FY) 2026 “skinny budget” proposal, which details its proposals for defense and nondefense discretionary spending for FY 2026. The budget does not include any proposed changes to mandatory spending or revenue, nor does it include proposals and cost estimates in any fiscal year beyond 2026.

Details of the President’s FY 2026 “Skinny Budget”

The president’s budget proposes $1.45 trillion of base discretionary budget authority (BA), which is a $163.1 billion (10.1 percent) decrease from the FY 2025 enacted amount of $1.61 trillion. The budget maintains the FY 2025 level of base defense BA – $892.6 billion – but would cut nondefense base BA by $163.1 billion (22.6 percent), from $720.5 billion to $557.4 billion.

The president’s budget also outlines how the pending budget reconciliation legislation would affect the administration’s discretionary spending request. The FY 2025 budget resolution that was adopted by Congress includes reconciliation instructions to increase spending for defense, homeland security, and law enforcement activities. The administration assumes at least $325 billion of additional base discretionary BA ($150 billion for defense and $175 billion for nondefense) will be enacted in the reconciliation legislation. Of that amount, $163.1 billion would be spent in FY 2026, including $119.3 billion for defense and $43.8 billion for nondefense. As a result, the total amount of base BA in FY 2026 under the president’s budget with reconciliation measures would total $1.61 trillion, the same as the FY 2025 enacted level. Base defense BA would be $119.3 billion (13.4 percent) higher, however – $1.01 trillion instead $892.6 billion – while base nondefense BA would be $119.3 billion (16.6 percent) lower, $601.2 billion instead of $720.5 billion.

The proposed spending increases are concentrated in the Departments of Defense, Homeland Security, Transportation, and Veterans Affairs, which get 13.4 percent ($113.3 billion), 64.9 percent ($42.3 billion), 5.8 percent ($1.5 billion), and 4.1 percent ($5.4 billion) increases, respectively. The increased Department of Defense funding would go toward developing the Golden Dome, expanding U.S. shipbuilding capacity, funding the F-47 fighter jet, and boosting servicemember pay by 3.8 percent, among other things. The additional Department of Homeland Security funding would go toward deporting illegal immigrants, construction of the border wall, providing advanced border security technology, and enhancing U.S. Coast Guard and Secret Service operations. The increased Department of Transportation funding would go toward enhancing Federal Aviation Administration facilities and operations, Rail Safety and Infrastructure Grants, Infrastructure for Rebuilding America Program Grants, and enhanced shipbuilding and port infrastructure. Finally, the additional Department of Veterans Affairs funding would go toward health care services for veterans and electronic health record modernization at Veterans Affairs.

Almost all other departments and agencies would see their funding decreased relative to their FY 2025 enacted level due to consolidations and the elimination of programs within the agency or department. For example, the nearly 84-percent reduction in Department of State and international programs funding would come from eliminating funding for the Economic Support Fund, development assistance, the Democracy Fund, and Assistance for Europe, Eurasia, and Central Asia; cutting funding for international disaster assistance, migration and refugee assistance, and international humanitarian assistance; and cutting USAID funding, among other changes.

The nearly 53-percent reduction in Department of Housing and Urban Development funding would come from transitioning federal rental assistance programs to state-based formula grants, eliminating the Community Development Block Grant program, the HOME Investment Partnerships Program, the Fair Housing Initiatives Program, and the Pathways to Removing Obstacles Housing Program, among other changes.

The over 26-percent reduction in Department of Health and Human Services funding would come from eliminating the Low-Income Home Energy Assistance Program, the Refugee and Unaccompanied Alien Children Programs, the Community Services Block Grant program, and the Preschool Development Grant program; restructuring the National Institutes of Health, the Centers for Disease Control and Prevention, and the Substance Abuse and Mental Health Services Administration, among other changes.

The over 9-percent decrease in Department of Energy funding would mostly come from rescinding $15.2 billion of Infrastructure Investment and Jobs Act funding, including a repeal of the electric vehicle tax credit.

Conclusion

The President’s FY 2026 skinny budget details the Trump Administration’s proposal for defense and nondefense discretionary spending in the next fiscal year but does not provide any information about the administration’s mandatory spending and revenue priorities. After accounting for the pending reconciliation legislation in Congress, the budget would maintain the overall base discretionary spending level of $1.61 trillion in FY 2026, though defense funding would increase, and nondefense funding would fall under the president’s budget. Hopefully the administration will soon release additional details about its FY 2026 budget proposal to give a fuller picture of its tax and spending priorities over the next decade.