Insight

May 4, 2018

Housing Crisis Déjà Vu

Only ten years have passed since the housing bubble burst and helped spark the financial crisis, and conditions in the mortgage lending space are already creeping back to being equally bad or, in some cases, even worse than they were. One focus of the Dodd-Frank financial reform legislation and its ensuing rulemakings was debt-to-income (DTI) ratios for mortgages. DTI ratios were statutorily limited to a certain level that they could not go beyond. Initially this limit was set at 43—meaning that your monthly debt repayments could not exceed 43 percent of your total monthly income. If your DTI was higher, you would fail to qualify for a taxpayer-backed mortgage.

Over the last decade, however, those DTI ratio limits have slowly crept up through exceptions made by Fannie Mae and Freddie Mac (the government-sponsored enterprises, or GSEs). One exception allowed a bank to approve a mortgage applicant with a DTI ratio greater than 43 if the applicant also had a high credit score or any number of other mitigating factors. Today, the DTI ratio limit has climbed all the way up to 50 percent, a move which was not made through legislation. Rather, the GSEs themselves implemented this change unilaterally.

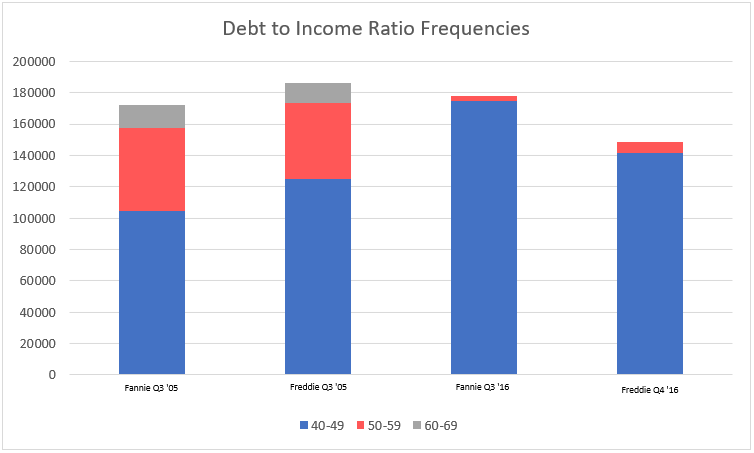

Below is a chart showing the frequency of the highest DTI ratios during two periods, or the number of instances when a loan with the highest DTI ratio was approved by Fannie or Freddie. The first two columns represent the peak of high DTI ratio frequencies at the GSEs before the crisis, and the second two columns represent the peak of high DTI ratio frequencies at the GSEs since the crisis.

Source: Fannie Mae and Freddie Mac

As the chart demonstrates, the frequency of mortgages with the highest DTIs, which are the riskiest mortgages, is nearing its pre-crisis rate, thus showing lending standards eroding to pre-crisis levels. This erosion should alarm anyone following lending trends. Since Fannie and Freddie put taxpayer money on the line for each of these risky mortgages, they should not be allowed to play the roles of guarantor, secondary-market packager, and lawmaker all at the same time. Congress should subject the GSEs and their lending standards to aggressive oversight to ensure we don’t find ourselves in the same place we were ten years ago.