Insight

September 24, 2025

HSR Report Showed Increased M&A Activity in 2024

Executive Summary

- On September 17, the Federal Trade Commission (FTC) and Department of Justice (DOJ) released their 47th Annual Hart-Scott-Rodino Report (Fiscal Year 2024), providing insight into merger and enforcement activity.

- The report showed 1,973 adjusted transactions were reported in 2024, a 12.5-percent increase from the previous year, approximately a quarter of which were valued at more than $1 billion.

- While the data for FY 2024 – which include data between October 1, 2023, and September 30, 2024 – cover the final year of the Biden Administration, the increasing share of transactions among large firms will likely remain a focal point during the Trump Administration.

Executive Summary

On September 17, the Federal Trade Commission (FTC) and Department of Justice (DOJ) released their 47th Annual Hart-Scott-Rodino Report (Fiscal Year 2024). The report provides insight into merger and enforcement activity.

The report showed 1,973 adjusted transactions were reported in 2024, a 13.7-percent increase from the previous year, approximately a quarter of which were valued at more than $1 billion. The aggregate dollar value of reported transactions was $2.1 trillion.

While the data for FY 2024 – which includes data between October 1, 2023, and September 30, 2024 – cover the final year of the Biden Administration, the increasing share of transactions among large firms will likely remain a focal point during the Trump Administration.

Hart-Scott-Rodino Annual Report

As discussed in previous American Action Forum insights, the Hart-Scott-Rodino Annual Report provides insight into merger enforcement actions and summary statistics of merger transactions.

In FY 2024 – covering October 1, 2023, through September 30, 2024 – 2,031 transactions were reported to the FTC and DOJ. The agencies also reported 1,973 adjusted transactions, which omit from the total number of transactions reported all transactions for which the agencies were not authorized to request additional information, showing an increase of 13.7 percent from the prior year, as seen in Figure 1.

Figure 1

*Source: HSR FY 2024 Annual Report

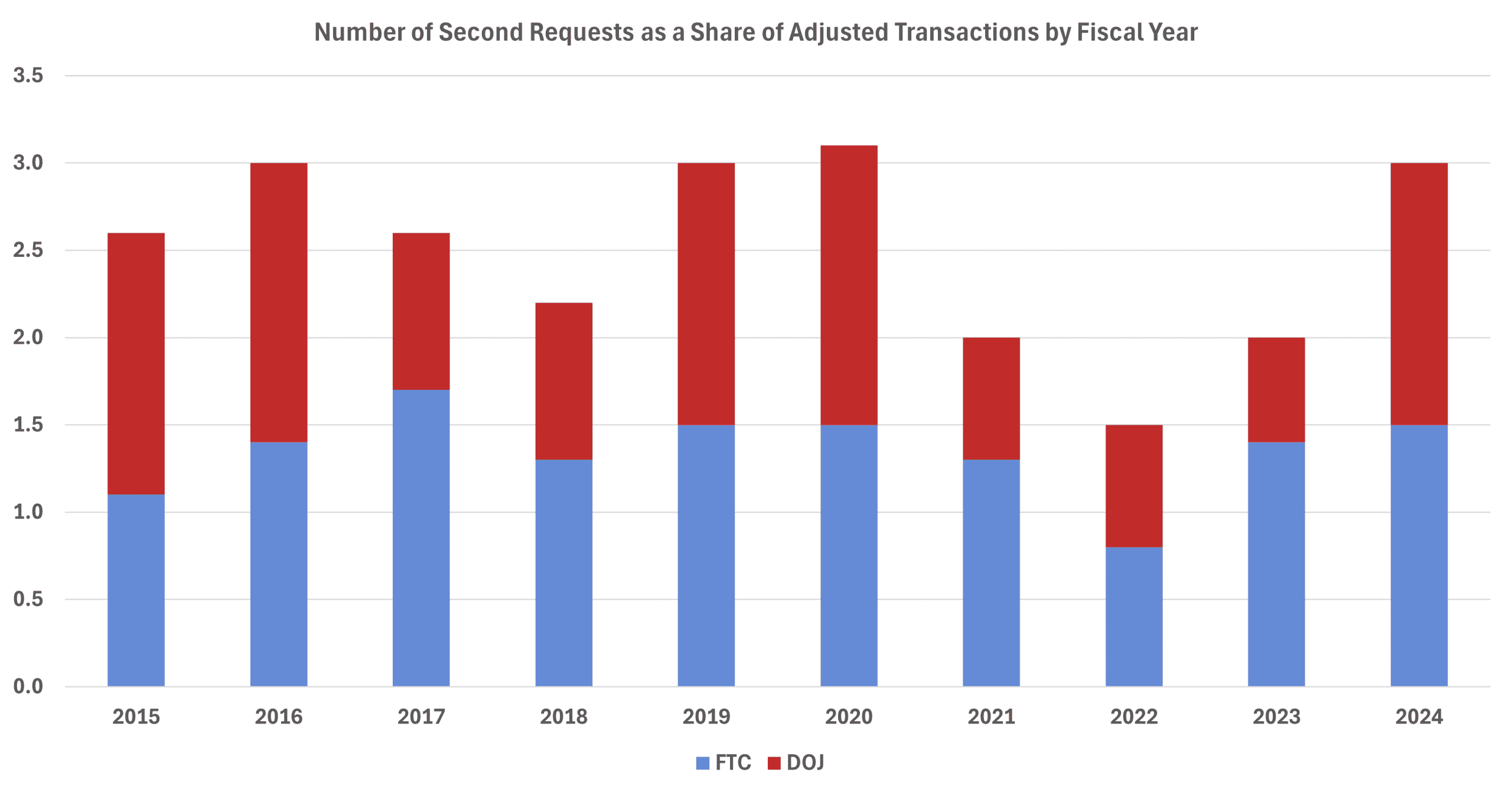

The HSR report also showed that the rate of second requests – a process that requires merging firms to submit additional information to the agencies – increased from the prior year but remained in line with historical norms at 3.0 percent of adjusted transactions, as shown in Figure 2.

Figure 2

*Source: HSR FY 2024 Annual Report

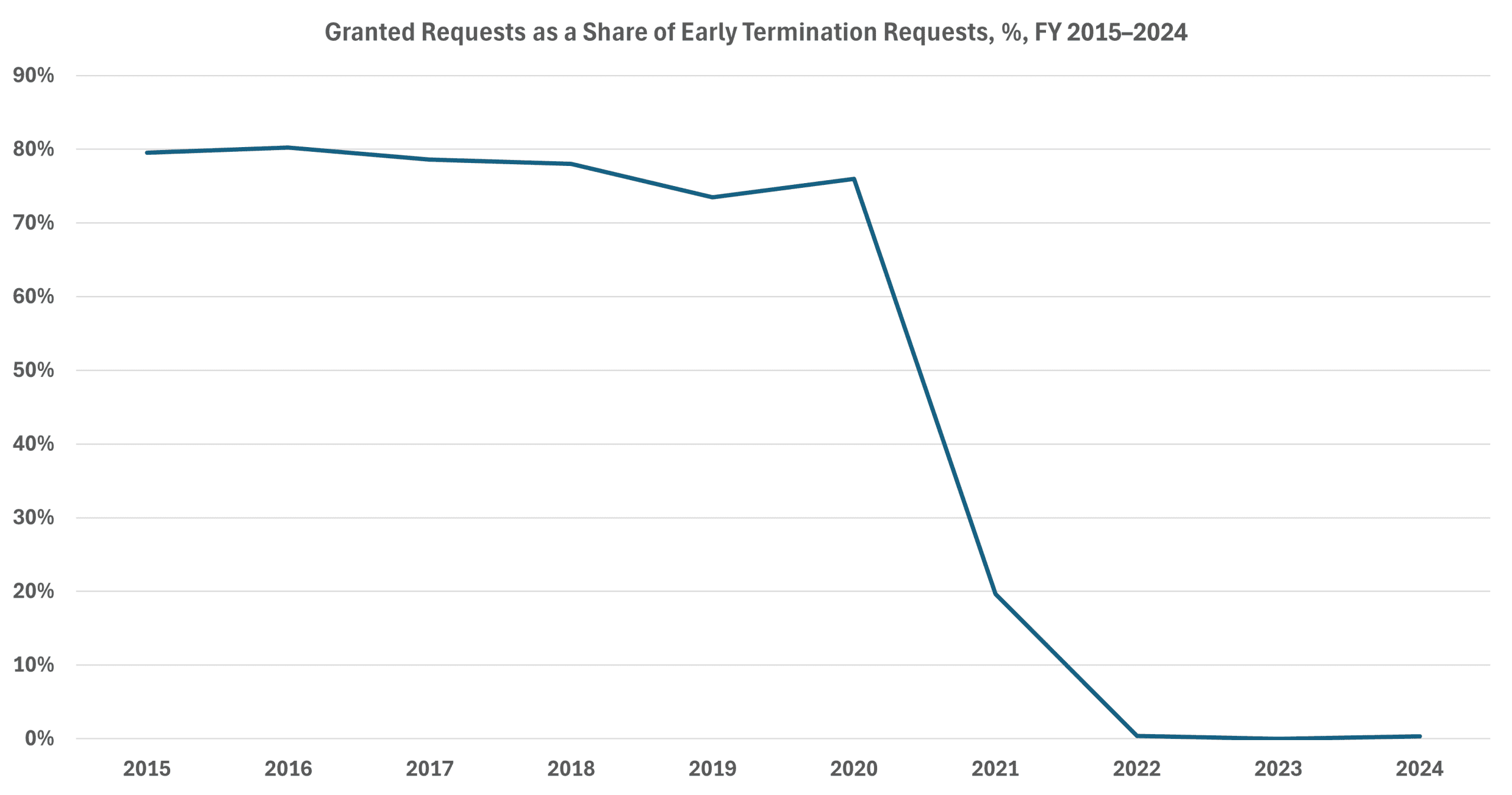

Fiscal year 2024 covers most of the final year in which the suspension of early termination was in effect. Early termination is a practice that allowed mergers and acquisitions that posed no competitive concerns to close quickly. Since 2021, when the early termination process was suspended four months into the fiscal year, grants of early termination largely evaporated. Just three of 858 requests were granted in FY 2024. Historically, between 70–80 percent of requests have been granted (Figure 3). Early termination has since been reinstated, but it is still unclear whether the FTC and DOJ will grant early terminations at the same historical rate.

Figure 3

*Source: HSR FY 2024 Annual Report

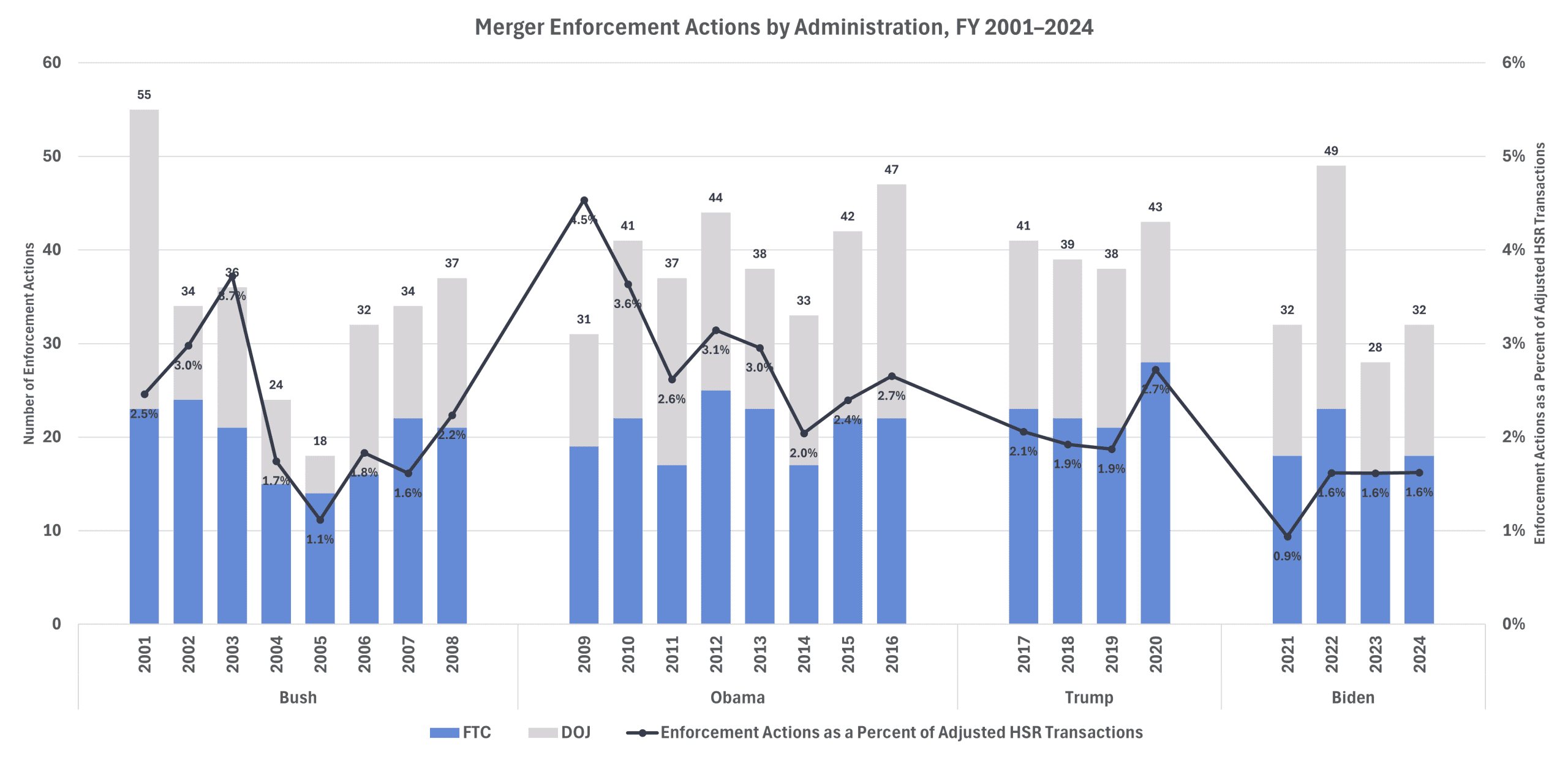

The FTC took enforcement action against 18 transactions. Twelve of these actions resulted in the parties abandoning or restructuring the merger as a result of antitrust concerns raised during the investigation. Six transactions resulted in the FTC initiating administrative or federal court litigation. The DOJ took enforcement action against 14 transactions, 12 of which were abandoned and two of which were restructured. The 32 enforcement actions represented just 1.6 percent of adjusted transactions, the same rate experienced in 2022 and 2023 (Figure 4).

Figure 4

*Source: HSR FY 2024 Annual Report; HSR Competition Reports FY 2001–2023

The Rise of Larger Transactions

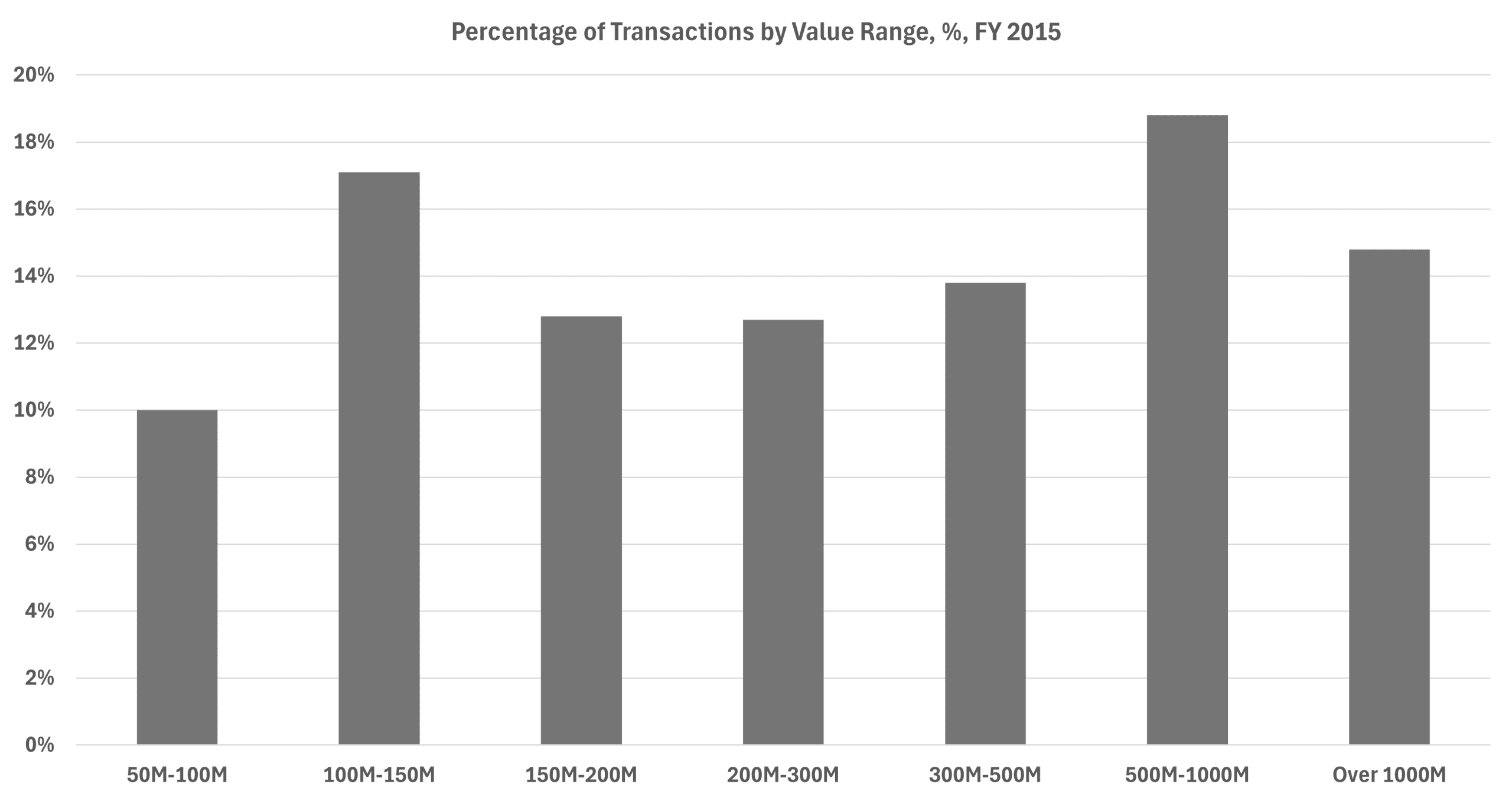

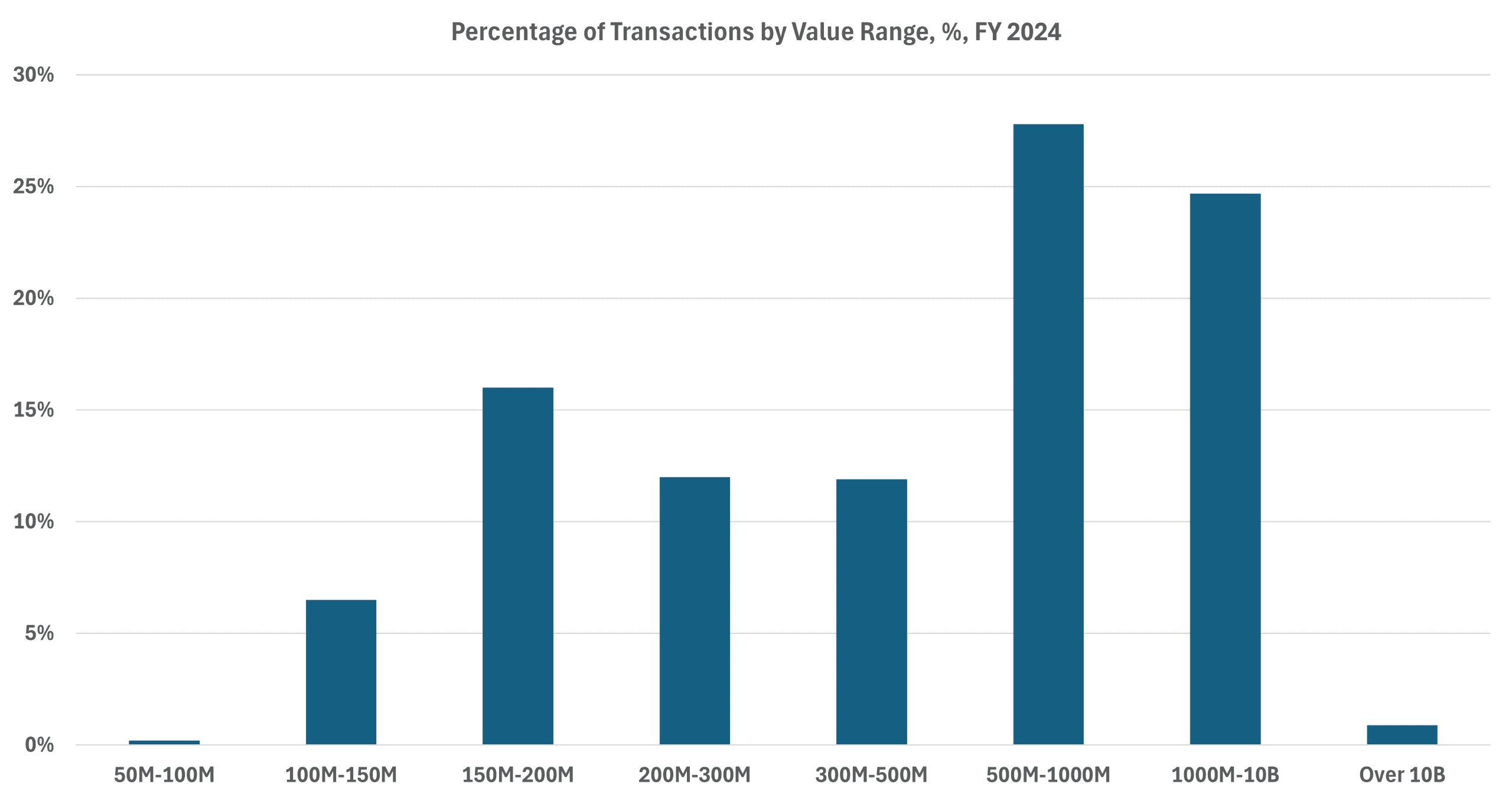

The HSR FY 2015 report showed a much more even distribution across various transaction values, with no value range accounting for more than 19 percent of transactions (Figure 5). By 2024, the distribution was more concentrated at the top end of the transaction ranges (Figure 6).

Figure 5

*Source: HSR FY 2015 Annual Report

Figure 6

*Source: HSR FY 2024 Annual Report

In the FY 2024 report, the FTC and DOJ changed the traditional “Over 100M” category by capping it at $10 billion and adding a new category for transaction values exceeding $10 billion.

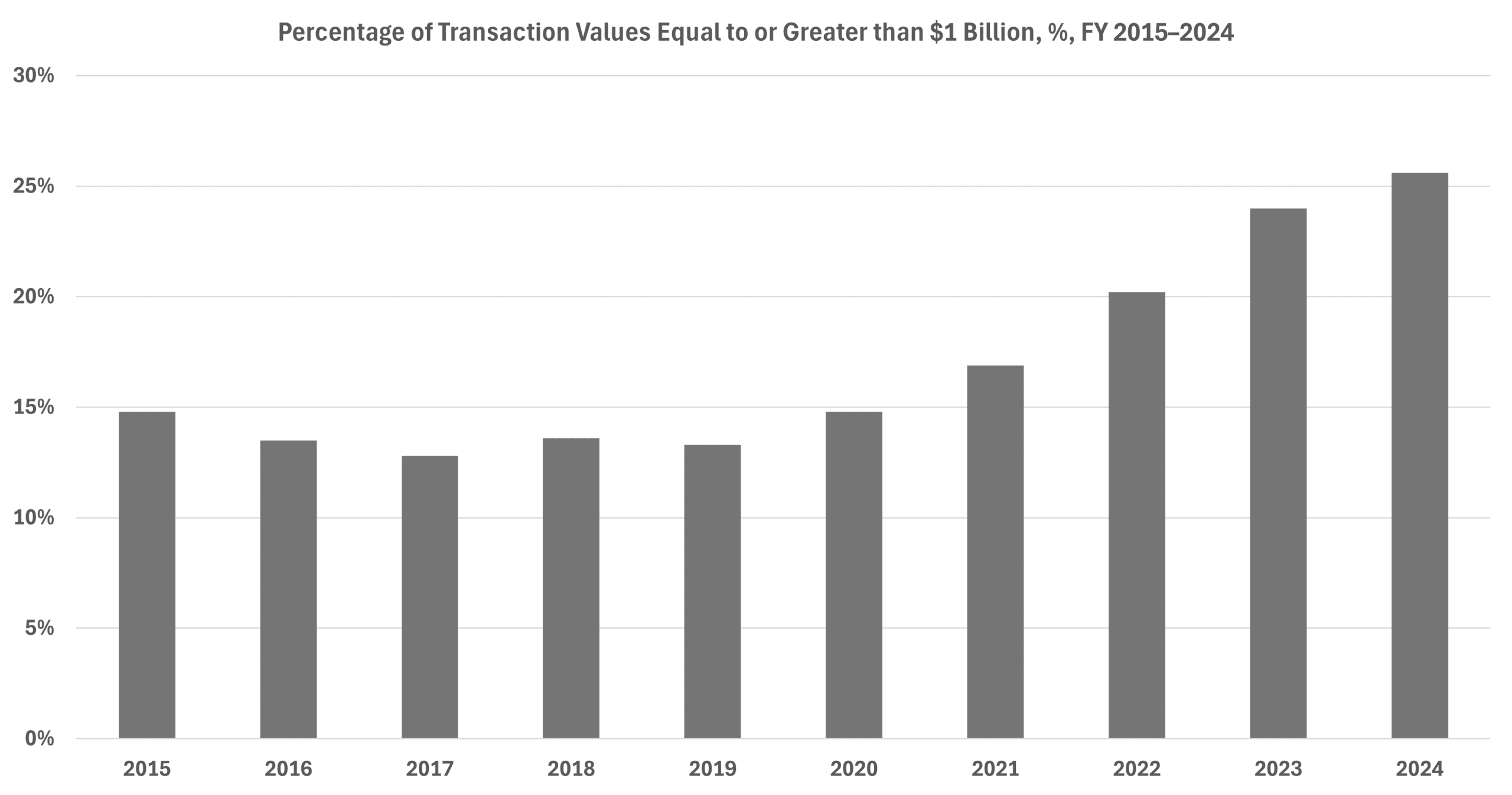

The FTC’s press release announcing the HSR FY 2024 report noted that the share of transactions valued at more than $1 billion reached approximately one-fourth in FY 2024. To put that share in perspective, just under 15 percent of transactions were valued at $1 billion or more in 2015. Furthermore, that share was relatively steady between 2015–2020, before steadily rising to 25.6 percent in 2024 (Figure 7).

Figure 7

*Source: HSR FY 2024 Annual Report

The decision to create more granular categories at the top end of the transaction value ranges suggests that the FTC and DOJ are keenly aware of – and possibly concerned about – the share of larger transactions. This could translate into added scrutiny from the enforcement agencies.

Conclusion

The antitrust agencies’ annual HSR report offered insight into the final year of merger enforcement under the Biden Administration. The share of transactions valued in excess of $1 billion continued to rise, surpassing 25 percent in FY 2024. It is likely that FTC and DOJ will remain vigilant when evaluating the transactions of larger firms.