Insight

July 29, 2022

Is Congress Helping or Hurting Inflation?

Executive Summary

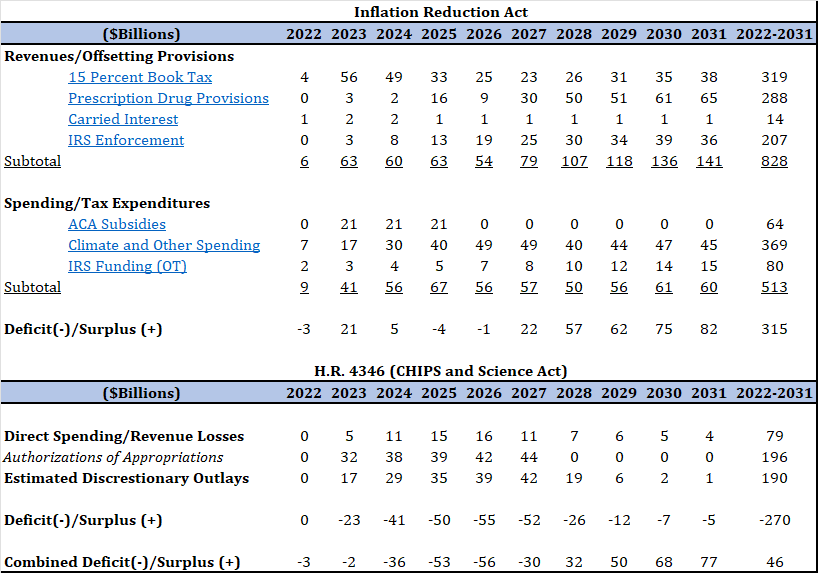

- The Inflation Reduction Act will be estimated by the Congressional Budget Office as reducing the deficit over the budget window; meanwhile, Congress is completing action on the CHIPS and Science Act, which would add on the order of $270 billion to the deficit over the next decade.

- Combined, the two bills would modestly reduce the deficit over the next decade – essentially, the CHIPS and Science Act would absorb the majority of the deficit reduction from the Inflation Reduction Act.

- For four years, 2024–2027, the combined bills would increase the deficit by more than $10 billion per year.

- It is worth noting that, combined, the bills would not begin to materially reduce the deficit until 2028, long after one would hope that the Federal Reserve would have brought inflation back to target.

Introduction

On Wednesday, Senator Joe Manchin surprised much of Washington, D.C. in announcing that he had agreed to the final iteration of the Build Back Better Act (BBBA). In a sign of the times, the BBBA has been renamed the Inflation Reduction Act (IRA). The IRA is also more modest in its ambitions than past efforts and does not rely on nearly $2 trillion in additional borrowing that past iterations did. Rather, the Congressional Budget Office (CBO) will estimate the IRA as reducing the deficit over the budget window. The IRA’s advocates are presenting this change, and the legislation generally, as anti-inflationary. But in virtually the same breath, many senators may champion their support for the CHIPS and Science Act (H.R. 4346), which would add about $270 billion to the deficit over the next decade. Combined, the IRA and CHIPS bill would, in some years, be roughly budget-neutral or reduce the deficit. But for four years, these bills would combine to add to the deficit. To the extent Congress can meaningfully affect the rate of inflation, doing no harm would seem like a first principle. The combined deficit effects are relatively modest, and one would not want to overstate the inflationary risks these new deficits present, but simple math lays plain that Congress is certainly not helping the cause.

Estimated Budget Effects

As of this writing, CBO has not released a cost estimate for the IRA. Approximating budgetary effects of the bill is nevertheless possible given the availability of the legislative text, summaries, and CBO and Joint Committee on Taxation (JCT) estimates of past versions of the BBBA. Similarly, CBO did prepare a cost estimate for the CHIPS and Science Act but did not detail or estimate the outlay effects of the $200 billion in authorizations for appropriations included in the bill. Assuming those funds are appropriated as authorized, the additional spending will meaningfully affect the deficit outlook. Indeed, the authorizations in CHIPS commit nearly triple the amount of taxpayer funds than do the direct tax and semiconductor subsidies in the legislation. CBO has a helpful tool for estimating the outlay (spending) effects of authorizations, which was employed here to approximate the full potential deficit effect of the CHIPS bill.

Table 1: Approximate Budgetary Effects of the Inflation Reduction Act and the CHIPS and Science Act

Combined, the two bills would modestly reduce the deficit over the next decade – essentially, CHIPS will have absorbed the majority of the deficit reduction from the IRA. For four years, 2024–2027, the combined bills would increase the deficit by more than $10 billion per year. These bills were somewhat related politically, with Republican support for the CHIPS and Science Act notionally tied to the abandonment of the BBBA. CHIPS is certainly not the only deficit-financed bill enacted by this Congress, but CHIPS and the IRA are now essentially riding through Congress in tandem such that the pretense of deficit hawkishness notionally embodied in the IRA is somewhat undone by the contemporary deficit spending in CHIPS. It is worth noting that, combined, the bills would not begin to materially reduce the deficit until 2028, long after one would hope that the Federal Reserve would have brought inflation back to target.

Methodological Note

These estimates are humble in their assumed precision and are presented here to approximate the general direction and order of magnitude of the deficit effects of these bills, with a mind toward their potential impact on inflation. The estimates for the policies were sourced from the CBO/JCT estimate of the BBBA as passed by the House of Representatives, while the Affordable Care Act subsidy estimate is somewhat of a clumsy budgetary placeholder. Nevertheless, the scale of imprecision in that estimate compared to CBO’s forthcoming cost estimate is likely to be minimal. It is also important to note that this is not an attempt to replicate a CBO cost estimate. Indeed, under CBO scoring, neither the $207 billion in revenue assumed to be generated by increasing Internal Revenue Service (IRS) funding by $80 billion, nor the $190 billion in outlays associated with the CHIPS and Science Act, would “score” or count. CBO’s scoring rules would only count the $80 billion expenditure for the IRS and leave out the discretionary outlays in CHIPS. Yet to the extent that the goal of this exercise is to assess the ultimate deficit impact and the potential for inflationary risk, including both non-scorable elements is appropriate.

Conclusion

Advocates for the IRA are understandably highlighting the fact that the bill’s combination of taxes, spending, and more IRS agents will net to estimated deficit reduction. In isolation, that’s a mathematical reality. The IRA is not isolated, however, but is more than usually tied to the CHIPS and Science Act—both politically and in terms of timing. While the bills do not combine to multi-trillion-dollar deficits that have been in vogue of late, they nevertheless make clear that Congress may not pushing in equal and opposite directions against the Federal Reserve at the moment, but it’s certainly not helping.

The author gratefully acknowledges the assistance of Jackson Hammond, Tom Lee, and Tori Smith.