Insight

February 7, 2019

Latest Oil Production Data Show Lower Prices, Reduced Imports, and More Economic Value

Summary

- The federal government’s latest projections of future energy production, which include data on oil prices, imports, and production, shows a marked expansion in domestic oil production.

- This means more of Americans’ energy spending will remain in the United States, prices will be lower, and domestic production value will be 19 percent—$687 billion—more over the next ten years than previously estimated.

- Increased oil production marks a policy success for federal innovation programs that have allowed for shale oil extraction, as well as the strength of privatized energy markets that can respond to falling oil outputs from foreign suppliers.

Introduction

The Energy Information Administration, the de facto authority on projections of energy production in the United States, has released its 2019 Annual Energy Outlook (AEO). The annual data include projections of energy production from virtually all sources through 2050, and this year’s release in particular sheds light on the topsy-turvy world of oil production—a perennial economic and foreign policy concern.

The data can be summed up as follows: more production, lower prices, and reduced imports. All three portend good things for the United States.

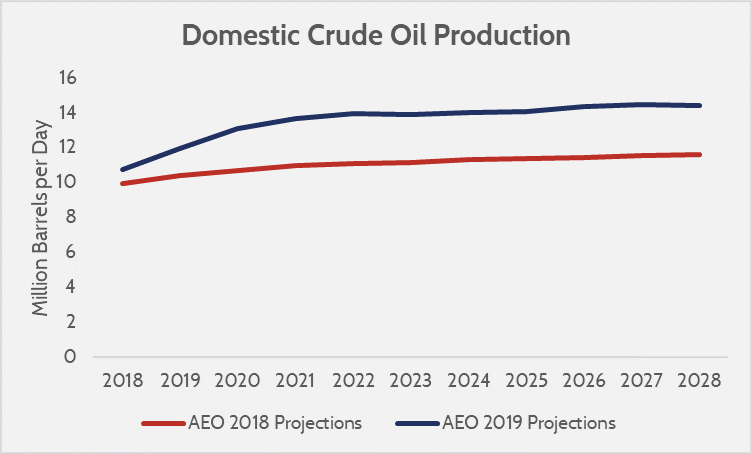

Production

Relative to last year’s projections, oil production over the next 10 years is substantially higher. The expectation is that by 2028, domestic crude oil production will have increased from 10.7 million barrels per day in 2018 to 14.4 million barrels per day, a 34 percent increase. By contrast, last year’s report estimated an increase from 9.9 million barrels per day to 11.5 million barrels per day over the same time period, which would only have been a 17 percent increase in production.

Source: Energy Information Administration’s AEO, 2018 and 2019 editions.

Source: Energy Information Administration’s AEO, 2018 and 2019 editions.

The increased production is being driven by continued impressive growth in tight oil (i.e. “fracking” production). It is worth noting that new oil and gas leases in New Mexico contribute to expectations of production growth, as well as pipeline capacity growth. Furthermore, foreign oil producers have been struggling to fulfill demand, creating opportunities for U.S. suppliers to fill the gap. Venezuela’s socialist policies have been disastrous for its oil production, causing a fall of nearly a million barrels per day, and Canada’s rejection and subsequent nationalization of major pipeline projects has caused it to fall from projections by roughly 0.52 million barrels per day.

Reduced Net Imports

Increased domestic production is causing the United States’ expected net imports of crude oil to drop. The United States currently imports 5.9 million barrels a day. Last year’s AEO projected that the United States would import on net 5.4 million barrels per day in 2028, but this year’s AEO projects net imports by 2028 will be 2.8 million barrels per day—48 percent less oil than previously thought. Total oil trade volume will remain high regardless, on account of oil trade occurring among a range of grades.

Source: Energy Information Administration’s AEO, 2018 and 2019 editions.

Source: Energy Information Administration’s AEO, 2018 and 2019 editions.

One upshot is that foreign powers, although still key players in price formation, have a reduced ability to influence U.S. politics. Foreign producers might curtail supply to raise energy prices, but if oil prices increase, most of that increased revenue will go to U.S. companies, rather than state-owned foreign producers.

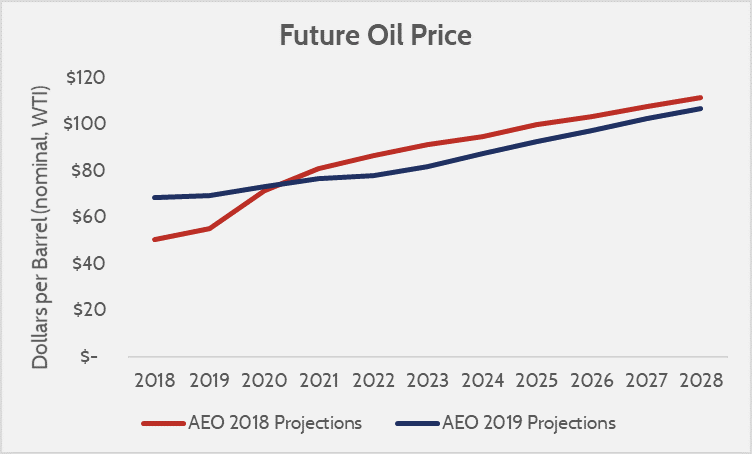

Lower Prices

Increased supply means lower prices, and the oil industry is no different. The latest projections show a nominal oil price of $107 per barrel by 2028, relative to last year’s projection of $112 per barrel. Given that oil prices were higher than expected in 2018, however, this relatively small difference translates to only a 54 percent increase in oil prices from today, instead of the expected 102 percent increase in last year’s AEO.

Source: Energy Information Administration’s AEO, 2018 and 2019 editions.

Source: Energy Information Administration’s AEO, 2018 and 2019 editions.

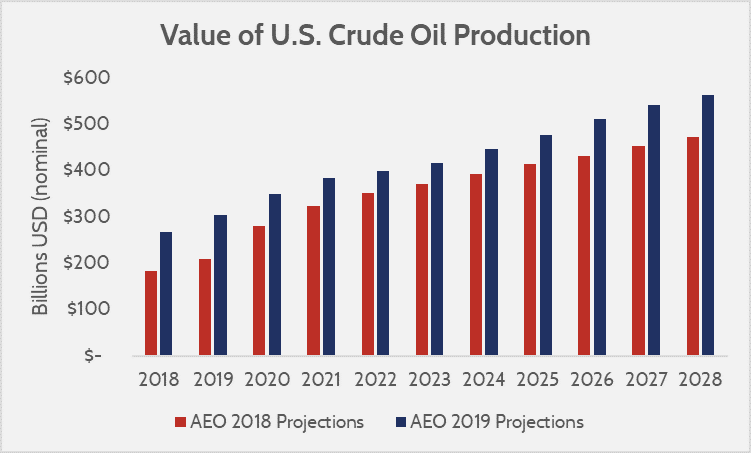

Increased Economic Value

While this year’s AEO projects a slightly lower oil price than last year’s, this drop is more than offset by projected increases in production. Increased supply means lower prices and more economic value for consumers, and increased production means more sales and economic value for producers. Compared to last year’s projections, American oil producers can expect approximately $687 billion more in cumulative production value over the next 10 years—a 19 percent increase.

Source: AAF projections based on the Energy Information Administration’s AEO, 2018 and 2019 editions.

Source: AAF projections based on the Energy Information Administration’s AEO, 2018 and 2019 editions.

Why It Matters

Oil has been the subject of many policies aimed at energy security and environmental protection. The latest data confirm that free market policies provide the best environment for the promotion of both. While production is dropping in Canada and Venezuela, the competitive and private markets of energy production in the United States have created ample signals for investor opportunities that have paid off with increased domestic production. From an environmental perspective the same technology which has bolstered oil production has spurred natural gas production, and the replacement of coal with far cleaner natural gas is expected to continue.

Economically, these figures portend only good news for the U.S. economy. An American Action Forum report last year estimated that Americans are spending $431 billion less on energy annually, with most of that benefit coming from lower oil prices. As noted above, lower prices and increased production mean increased wealth for the country.

These figures also highlight the continuing value of federal energy innovation spending. Federal research was the source of the directional drilling technology that has made directional drilling into shale formations possible, and that investment has more than paid off.