Research

July 12, 2018

America’s Energy Revolution 101: Lessons Learned

Summary

- The “Energy Revolution” marked rapidly falling energy prices in oil, natural gas, wind, and solar power, which has resulted in Americans spending $431 billion less on energy annually.

- Numerous policies contributed to the Energy Revolution, but they were not equally effective. Policies aimed at early-stage innovation were enormously beneficial for both the economy and the environment, but policies aimed at expanding government-preferred energy deployments sacrificed economic benefits for environmental ones.

- The lesson to be gleaned is that market conditions are enormously important to the effectiveness of energy policies, early-stage investments are better than later-stage ones, and attempts to force outcomes through policy can be an expensive endeavor.

Introduction

In late 2014, something extraordinary happened in the energy world. Gasoline prices—one of the most visible indicators of energy costs—took a nose dive. Internet memes of Robin Williams in Jumanji demanding to know “what year is it?!” were juxtaposed with pictures of pump prices. And the falling gas prices were not alone: Solar, wind, and natural gas prices were also falling rapidly. Relative to 2010, by 2016 solar and wind capital costs had fallen 55 and 23 percent, respectively, and by 2017 natural gas prices for electricity had fallen 52 percent. The “Energy Revolution” was in full swing and was making a more prosperous America.

But what caused the energy revolution, and what can we learn from it? Today, the situation is very different than just a few years ago, as energy prices—particularly for oil—are on the rise again, while coal and nuclear power plants are struggling to remain profitable. As a result, some are calling for policies hoping to limit the rise of energy prices or support struggling power plants. Reportedly the United States even asked Saudi Arabia to raise its oil output. But the Energy Revolution counsels against any such policies: That period demonstrates that command-and-control policies deliver little benefit, but investment in innovation can have huge payoffs.

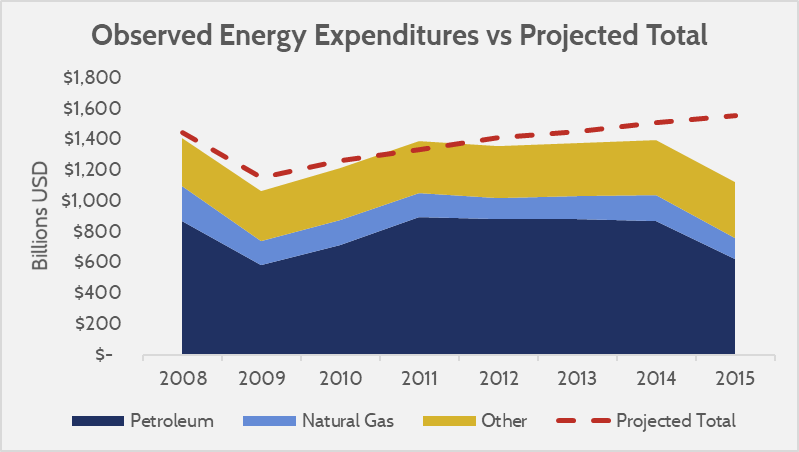

Oil and Gas: Directional Drilling

To gauge the impact of the Energy Revolution, this paper compares recent data with official governmental projections. In 2009, the Energy Information Administration (EIA) published a projection of energy expenditures as part of its Annual Energy Outlook. The latest observed data (2015) shows that relative to EIA’s 2009 expectation, Americans are spending $431 billion less on energy annually.[1] That difference is mostly thanks to reduced petroleum expenditures ($389 billion) and reduced natural gas expenditures ($57 billion). How did these reductions come about?

Domestic oil production rose 74 percent relative to 2009, and natural gas by 30 percent. That increased production came almost entirely from shale deposits (rock formations that can hold oil and gas within themselves). What changed during the Energy Revolution was that a relatively novel technology for extracting oil and gas from shale became profitable because of high oil prices. Before the Great Recession, oil prices peaked at $140 per barrel, and after the recession prices quickly returned to over $100 per barrel, but after shale drilling became mainstream prices fell by more than 70 percent, to a low of under $30 per barrel.

The market conditions were a huge factor for why oil and gas extraction from shale became commonly used (and why its processes rapidly improved). But the enabling technology, directional drilling, has its roots in government research dating back to the 1970s as a response to oil crises from oil embargoes. Previous AAF research found that the public-private partnership dynamics of drilling technology research was a key element for improved productivity. The enormous economic benefits that have come from shale resources may not have been possible without consistent U.S. investment in an early stage technology.

Affordable Renewables

Renewable energy, particularly wind and solar power, has had rapid adoption in the United States in recent years. Since 2009, wind generation has increased by 344 percent, and solar generation has increased by (get ready for it) 5,942 percent.[2] Wind power is poised to overtake hydroelectricity as the biggest source of renewable electricity in the United States, as it is currently providing 6.3 percent of the total, though photovoltaic solar still only provides about 1.2 percent of the United States’ electricity. What has spurred such rapid adoption?

Unlike oil and gas, where market conditions were more favorable to risk taking, there are more factors at play for renewables. First, there are a lot of direct market subsidies: tax credits mostly directed toward wind and solar are expected to total $5.6 billion this year, which in terms of subsidies per unit of energy is far greater than those for competing energy sources. Second, a lot of public policies incentivize (or even require) capacity increases of renewable technology. Third, renewables benefited from early-stage government research and development (just like oil and gas): wind power got advanced airfoil designs from the National Renewable Energy Laboratory, and the Department of Energy continues to maintain the SunShot initiative to identify cost cutting opportunities for photovoltaic solar power. Those latter points should not be underestimated, as the unsubsidized capacity cost of wind has fallen 23 percent since 2010, and the unsubsidized capacity cost for solar has fallen by 55 percent.[3]

It is not simple to tease out exactly how much of wind or solar power’s growth is due to government mandates and subsidies versus how much is due to efficiency and cost improvements that market competition forced. Some mixture of both is obvious, but in gauging policy effectiveness the context of outcomes can offer insight into what is relatively better.

Economic and Environmental Benefits of the Energy Revolution

As stated above, relative to the baseline Americans were spending $431 billion less than expected (2.4 percent of GDP) on energy by 2015. The most obvious cause of those reduced expenditures is increased production of petroleum products ($389 billion) and natural gas ($57 billion)—but note that the reduction in expenditures for both of those energy types exceeds the total fall in energy expenditures ($389 billion plus $57 billion is $446 billion, but the difference between projection and observation is only $431 billion). That suggests that other energy expenditures must have increased despite falling expenditures for petroleum and natural gas.

Most likely, the area with the least progress was electricity. Relative to 2009 EIA projections, average electricity costs are up 15 percent, despite total retail sales being down by 9 percent.[4] If demand is reduced, but prices still rise, then the productivity of electricity generation must have been diminished somehow. This outcome is somewhat puzzling in our current environment, because natural gas is primarily used for electricity, and increased production of it should have depressed electricity prices. Further, subsidies for wind and solar that were aimed at reducing their costs should have also depressed electricity prices.

If electricity prices did not fall, despite declining upstream costs for electricity production, it indicates that policies like subsidies may not have made their way to the retail customer, or other aspects of electricity production may have worsened and offset the potential benefits from reduced production costs. This conclusion is damning to the wind and solar subsidies, which have proven popular enough to resist planned sunsets. Even though electricity costs were the target of the lion’s share of subsidies and mandates, those policies seemed to have been ineffective at delivering economic benefits to Americans and may have instead driven more expensive electricity production.

There are many reasons why electricity prices may rise, but a likely explanation for higher retail prices despite falling capital costs is that government preferred fuel types (wind and solar) are not perfect substitutes for “dispatchable” fuel types (ones that can be turned on and off at will). Increased use of non-dispatchable fuel types means using less of dispatchable ones, but as their presence is still required in the fuel mix their capital costs must still be recovered and are thus passed on to consumers at the retail level. Consequently, this means subsidies or mandates asserting a government preference are unlikely to depress energy prices, and more likely to cause prices to rise.

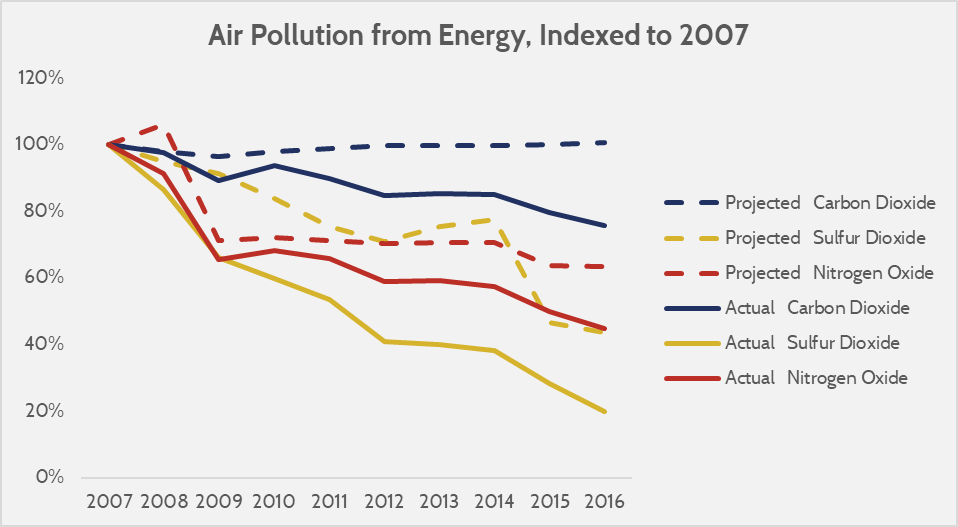

Aside from economic benefits, though, the Energy Revolution has delivered significant environmental benefits. Increased natural gas production has spurred the replacement of coal power plants, and a past AAF research indicates that natural gas accounts for two thirds of coal’s lost capacity (the remaining third coming mostly from wind). Pollution rates for natural gas are 82 percent lower for nitrogen oxides, 99.8 percent lower for sulfur dioxide, and about 50 percent lower for carbon dioxide.[5] Switching from coal to natural gas and wind power has meant less pollution. And total emissions from energy production have fallen significantly over recent years, as the chart below shows.

AAF estimate comparing EIA 2009 AEO Projections and Observed EIA data. Carbon dioxide for all U.S. energy, others restricted to electricity-related pollution.

Some of those environmental benefits came from markets, some from regulations, and some from subsidies. The market surely motivated much of the switch from coal to natural gas, but regulations on sulfur dioxide are a likely explanation as well. Further, subsidies for wind power created a government incentive for companies to switch to this cleaner fuel type (as opposed to a market-based decision), which produces environmental benefits in exchange for subsidies.

What the above data shows is that economic benefits to the public come almost entirely from market choices, and practically none from mandates or subsidies. This conclusion is not surprising, since a subsidy merely uses taxpayer funds to create incentives (profit) for a behavior in lieu of the genuine market conditions. Considering that Americans spent a combined $446 billion less on petroleum and natural gas in 2015 than they were projected to spend, it seems unlikely that taxpayers’ willingness to subsidize an industry could ever match the power of the market (total annual energy subsidies are around $15 billion).

The second lesson is that environmental benefits, which are often a justification for policy, come from a variety of sources. Regulations and subsidies seem to have produced environmental benefits at an economic cost, but market-based choices also delivered considerable environmental benefits while producing economic benefit. Mandates can be effective environmental policy, but they may not be cost effective compared to market-based policies.

What Policies Delivered the Most Benefit in the Energy Revolution?

The Energy Revolution was a confluence of events and policies, such as energy efficiency mandates, energy subsidies, and technology research and development (R&D) support. But which policies most benefited the public? As explained above, most of the economic benefits came from petroleum and natural gas, along with considerable environmental benefits, whereas government-preferred fuel types for electricity (such as wind and solar) seem to have had a harder time combining economic gains with environmental benefits, despite receiving most of the government expenditures. What insight can be gleaned here?

Oil and gas production increased while receiving relatively modest governmental support, but that fact does not mean that the government did not support oil and gas. Rather, that support came much earlier, during an important time in the R&D process: when private sector profit opportunities were too distant to incentivize investment. Conversely, subsidies for wind and solar have been targeted at immediate commercial deployment. As such, they are competing against the existing economic incentives, and the stronger the economic pull is against the subsidies, the costlier and less effective they will be.

The salient lesson is that early stage R&D has the potential for enormous payoffs, whereas direct subsidies or mandates for commercialization mean high costs with relatively modest or narrow payoffs (though they are delivered expediently). The data suggests that a better approach to long-term energy policy would be to pare back direct subsidies and instead focus on applying those resources to earlier-stage innovation.

Political Restraint is Important to Innovation

A second lesson of the Energy Revolution is that high energy costs spur the deployment of relatively new energy technologies. The high prices, and the possibly high revenues that result, reduced the risk of experimenting with deploying expensive technologies, which is a key first step in achieving economies of scale and improving productivity. Yet the political dynamics are opposed to this outcome: Whenever energy prices rise, politicians are eager to talk about their plans to bring those costs down, regardless of the impact on the market.

The classic example comes from the oil crises of the 1970s, when President Nixon implemented price controls to disastrous effect. Despite the obvious policy failures, price controls were lifted on everything except energy, justified by energy’s high costs. Price controls on energy during the 1970s inhibited incentives for productivity, and immediately after President Reagan ended price controls in 1981 domestic energy production took off, helping to normalize prices—an especially salient lesson as gasoline prices are on the rise again.

When policymakers interfere with market incentives to control costs or limit consumer’s exposure to price volatility, they are also eliminating opportunities for innovation to bring those costs down. Rather, they are preserving incumbents and shifting costs to consumers by other means (i.e. subsidies on energy, which are paid for by taxes).

What the Energy Revolution Teaches Us About the Philosophy of Energy Policy

Energy policy is inextricably tied to political conditions. Energy security is as important as food or water security, and politicians typically want to ensure these are stable and affordable for everyone. The political incentives for governments to meddle in energy markets are great, and most, if not all, governments have some sort of “energy policy.”

The Energy Revolution provides key lessons in what shape this energy policy should take. Policymakers’ attempts to mandate a change or to artificially incentivize a change in energy sources via subsidies struggle as they compete with the economic incentives to do otherwise. Such policies are likely to be extremely costly as they fight the pull of profit opportunities from a more efficient allocation of capital. The Energy Revolution shows that a market environment conducive to change is important to achieving that change that policymakers seek. A good philosophy for energy policy, therefore, is one that invests in a lot of potential energy technologies early on and then allows the market to determine what is commercially viable to deploy. Such an approach leverages the advantages of competition towards policy objectives. If policymakers truly want clean, cheap, and abundant energy, they should be agnostic to fuel types and focus instead on having a market that values those attributes in energy.

[1] This estimate is derived by applying the EIA’s 2009 projected energy expenditures as a proportion of GDP to the observed nominal GDP of the year, and comparing such to the actual observed expenditures reported by the EIA (latest release 2017, data reporting for 2015).

[2] Energy Information Administration, “Electric Power Monthly,” Table 1.1.A (Washington, D.C.: March, 2018). https://www.eia.gov/electricity/monthly/epm_table_grapher.php?t=epmt_1_01_a

[3] Energy Information Administration, “Capital Cost Estimates for Utility Scale Electricity Generating Plants,” (Washington, D.C.:2010, 2013, and November 2016 editions).

[4] EIA’s 2009 AEO projected average retail electricity price for 2017 was 9.15 cents per kilowatt hour, with a total electricity consumption of 4,046 billion kilowatt hours. Observed data was 10.54 cents per kilowatt hour, with retail sales of only 3,682 billion kilowatt hours.

[5] Oak Ridge National Laboratory, “Environmental Quality and the U.S. Power Sector: Air Quality, Water Quality, Land Use and Environmental Justice,” (2017). https://www.energy.gov/sites/prod/files/2017/01/f34/Environment%20Baseline%20Vol.%202–Environmental%20Quality%20and%20the%20U.S.%20Power%20Sector–Air%20Quality%2C%20Water%20Quality%2C%20Land%20Use%2C%20and%20Environmental%20Justice.pdf