Insight

July 27, 2022

Lowlights of CBO’s Long-Term Budget Outlook 2022

Executive Summary

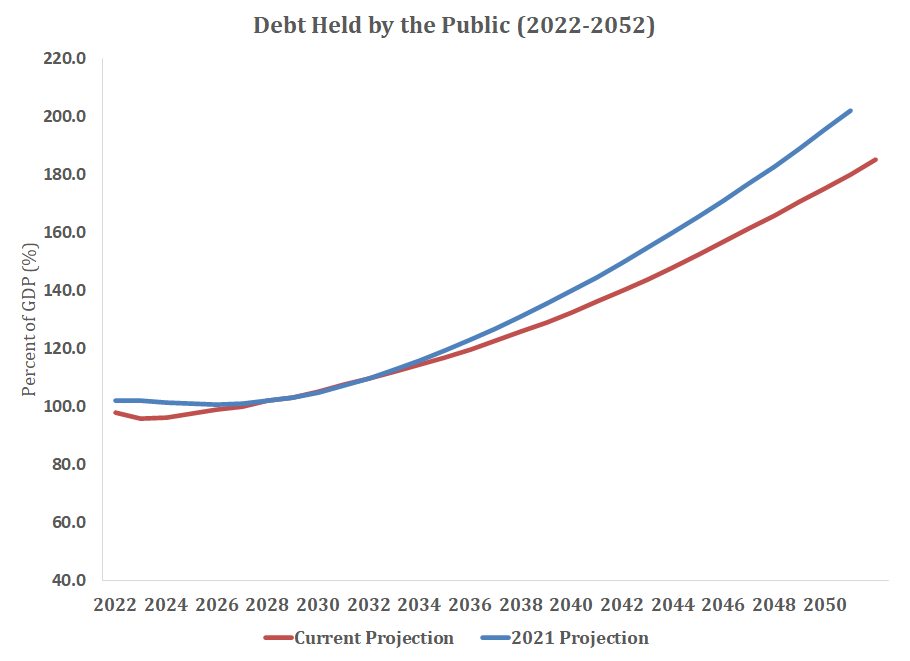

- According to the Congressional Budget Office (CBO), debt held by the public will reach 185 percent of gross domestic product in 2052.

- These updated projections deviate from last year’s report largely as a result of higher inflation over the first 10 years of CBO’s outlook but are largely unchanged in their trajectory.

- Before long, stabilizing the debt will require an unprecedented fiscal consolidation.

The Long-Term Budget Outlook

The Congressional Budget Office (CBO) released its updated Long-Term Budget Outlook and projected that U.S. debt held by the public will nearly double as a share of the economy by 2052, rising from the current level of 98 percent to 185 percent of gross domestic product (GDP).

Figure 1

The debt as a share of the economy is presently 4 percentage points below what CBO previously estimated, and the debt is expected to be lower over the next 6 years than was previously estimated. The debt outlook largely converges with previous estimates until 2033, at which point the debt is expected to grow incrementally slower than was previously estimated.

The key element of these relatively small departures from last year’s estimates is the effect of inflation on the federal budget. High price growth increases nominal GDP, the denominator in the key budgetary metrics in CBO’s outlook. Relatedly, inflation increases nominal revenue collection and nominal spending as well, and both are elevated in the updated CBO’s baseline. The Federal Reserve’s response to the inflationary environment has been to rapidly increase interest rates, which CBO has necessarily incorporated in its projections. The interaction of all these elements is necessarily complex and grows and recedes in significance over the budget window.

Fundamentally, the budgetary pressures that drive long-term debt growth are unchanged. The United States is projected to spend, on average, 7.3 percent of GDP more than it collects in taxes revenue over the next 30 years.

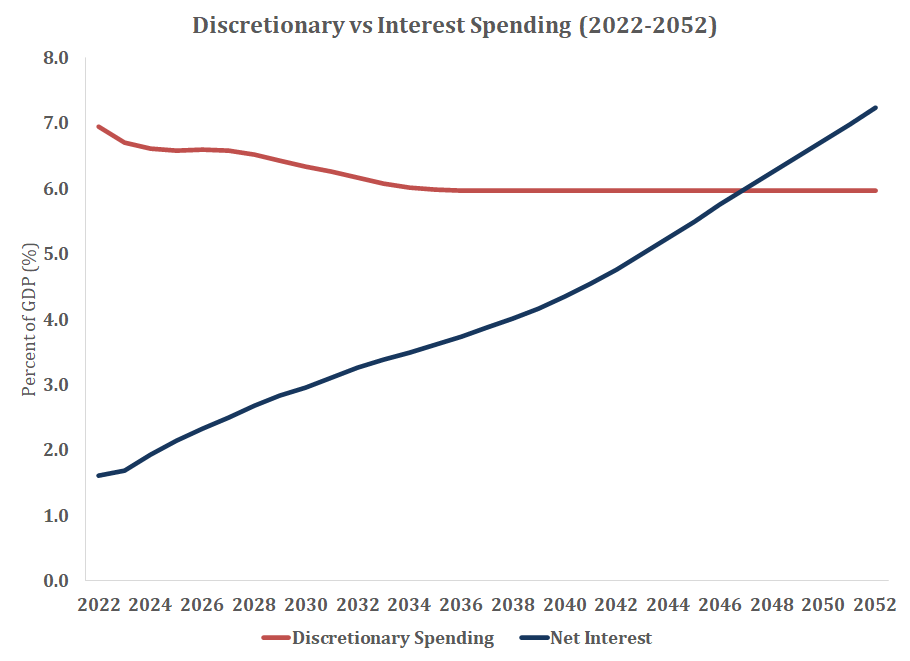

The long-term outlook reaffirms a trend in the nation’s finances, as Figure 2 illustrates. Despite higher nominal GDP, debt service costs will crowd out other federal expenditures, and in 2047 these costs will exceed all other discretionary programs – such as defense, education, infrastructure – combined.

Figure 2

CBO has also calculated the scale of tackling the budget challenge. To hold debt held by the public as a share of GDP to 100 percent in 2052 would require an annual reduction (relative to CBO projections) in the deficit of 2.8 percent of GDP, about $800 billion in 2027, if begun in 2027.

CBO also highlighted the effect that delay has on the scale of fiscal consolidation needed to meet certain debt targets. For example, CBO estimated the fiscal consolidation (non-interest spending cut or tax increase) necessary to stabilize the debt at 80 percent of GDP by 2052. This more ambitious and prudent target would require an additional 0.7 percentage points as a share of GDP in annual fiscal consolidation than would stabilize the debt at present levels. Delaying this fiscal consolidation until 2032 would add 0.8 percentage points to the required fiscal consolidation, while waiting until 2032 would make the challenge steeped by 1.4 percentage points of GDP. For context, the magnitude of fiscal consolidation contemplated in any of these scenarios significantly dwarfs all but one historical tax increase. Essentially, this challenge would require deliberate fiscal consolidation on an unprecedented scale.

Figure 3