Insight

December 10, 2025

Meeting AI Data Center Power Demand in Virginia: Challenges Posed by Carbon-free Electricity Regulations

Executive Summary

- The Virginia Clean Economy Act (VCEA) mandates that Dominion Energy achieve carbon-free electricity by 2045, though it includes a provision allowing exemptions if the utility demonstrates that compliance would threaten service reliability.

- With Dominion’s projected summer peak load growing by 70 percent between 2022–2045, primarily driven by soaring demand from artificial intelligence (AI) data centers, the company indicated in its recent filings that it does not appear viable to fully retire fossil fuel generation to meet VCEA compliance by 2045—a conclusion supported by a separate study commissioned by the commonwealth.

- This insight examines the tension between VCEA mandates and the rapid growth of AI data center demand, showing why current carbon-free targets are likely unachievable; it recommends that lawmakers shift toward a market-based framework to better address both capacity needs and decarbonization goals.

Introduction

The Virginia Clean Economy Act (VCEA) mandates that Dominion Energy —the dominant electric company in Virginia—provide 100-percent carbon-free electricity by 2045, though it includes a provision allowing exemptions if the utility demonstrates that compliance would threaten service reliability.

Dominion projects that summer peak load will increase by 70 percent between 2022–2045, primarily driven by soaring demand from artificial intelligence (AI) data centers. It has thus indicated in its recent filings that it does not appear viable to fully retire fossil fuel generation to meet VCEA requirements by 2045. This conclusion is supported by a separate 2023 study commissioned by the commonwealth, which found that fossil fuel resources are an inescapable component of the projected capacity mix to meet energy demand in Virginia.

This insight examines the tension between VCEA mandates and the rapid growth of AI data center demand, showing why current carbon-free targets are likely unachievable. It recommends that lawmakers consider shifting toward a market-based framework that better addresses both growing capacity needs and decarbonization goals.

Virginia—A Global Top Data Center Market

Virginia, which some analysts have dubbed “Data Center Alley,” is leading the global market for data centers by a large margin. The commonwealth is home to over 600 data centers, most of which are concentrated in the northern part of the commonwealth. This is primarily due to the region’s flat terrain, proximity to the nation’s capital and other large East Coast cities, and access to water for cooling high-speed fiber optic infrastructure. As a result, around 70 percent of the world’s internet traffic flows through northern Virginia. This trend is not projected to lose momentum anytime soon—in 2024, Virginia had 5,926 megawatts (MW) of operational capacity, with 1,834 MW of capacity under construction, and 15,432 MW of capacity planned.

Virginia’s data centers also consume more electricity than those in any other state. In 2023, data centers in Virginia consumed around 34 million megawatt hours of electricity – 35 percent more than centers in Texas, which ranked second in the country. Moving forward, electricity demand from data centers is expected to undergo unprecedented growth as they increasingly support generative AI. AI data centers consume more electricity than traditional data centers because generative AI consumes 10–30 times more energy than task-specific AI and simultaneously produces more heat, requiring more advanced cooling solutions.

The Virginia Clean Economy Act

Instead of adopting a market-based policy to drive decarbonization in the electricity sector, Virginia has adopted a command-and-control approach to mandate the power sector be carbon-free by certain dates established in the Virginia Clean Economy Act. The legislation was passed in 2020 by a 22–18 margin in the Virginia Senate and 53-45 margin in the House of Delegates before being signed into law by Governor Ralph Northam (D). The law establishes a renewable portfolio standard program that annually sets increasingly stringent targets for utilities to adopt renewable energy sources. The VCEA also includes regulations concerning energy efficiency, carbon emissions, and energy storage.

Additionally, the VCEA mandates that Dominion Energy, the dominant electric company in Virginia serving the vast majority of the commonwealth’s data centers, generate 100 percent of its electricity from carbon-free sources by 2045.

The VCEA has a reliability exception provision, however, that grants exemptions to utilities if they can show that complying with the 2045 carbon-free electricity targets would “threaten the reliability or security of electric service to customers.”

Fossil fuels are currently Dominion’s main energy source. As of June, 2025, natural gas was the primary source, generating about 58 percent of total electricity, followed by nuclear energy (25 percent), renewable energy (14 percent), and coal-fired sources (3 percent).

For context, the average operating coal-fired plant in the United States is 45 years old, while the designed life of a combined-cycle gas plant is typically 25–30 years. As for renewable energy, the operational lifespan of a solar panel is 25–35 years whereas it is about 30 years for wind turbines. Nuclear plants have longer lifespans, with some in the United States that can operate for 60 years or more. The permitting and construction of power plants require significant lead time, spanning approximately two years for a combined cycle gas plant, three to four years for a coal plant, and a decade for nuclear facilities.

AI Data Centers Are Driving Up Electricity Demand

Load forecasting refers to utilities’ prediction of future electricity demand in the market in which they operate. Typically, utilities use summer or winter peak load to forecast the maximum amount of electricity demand to account for air conditioning or heating.

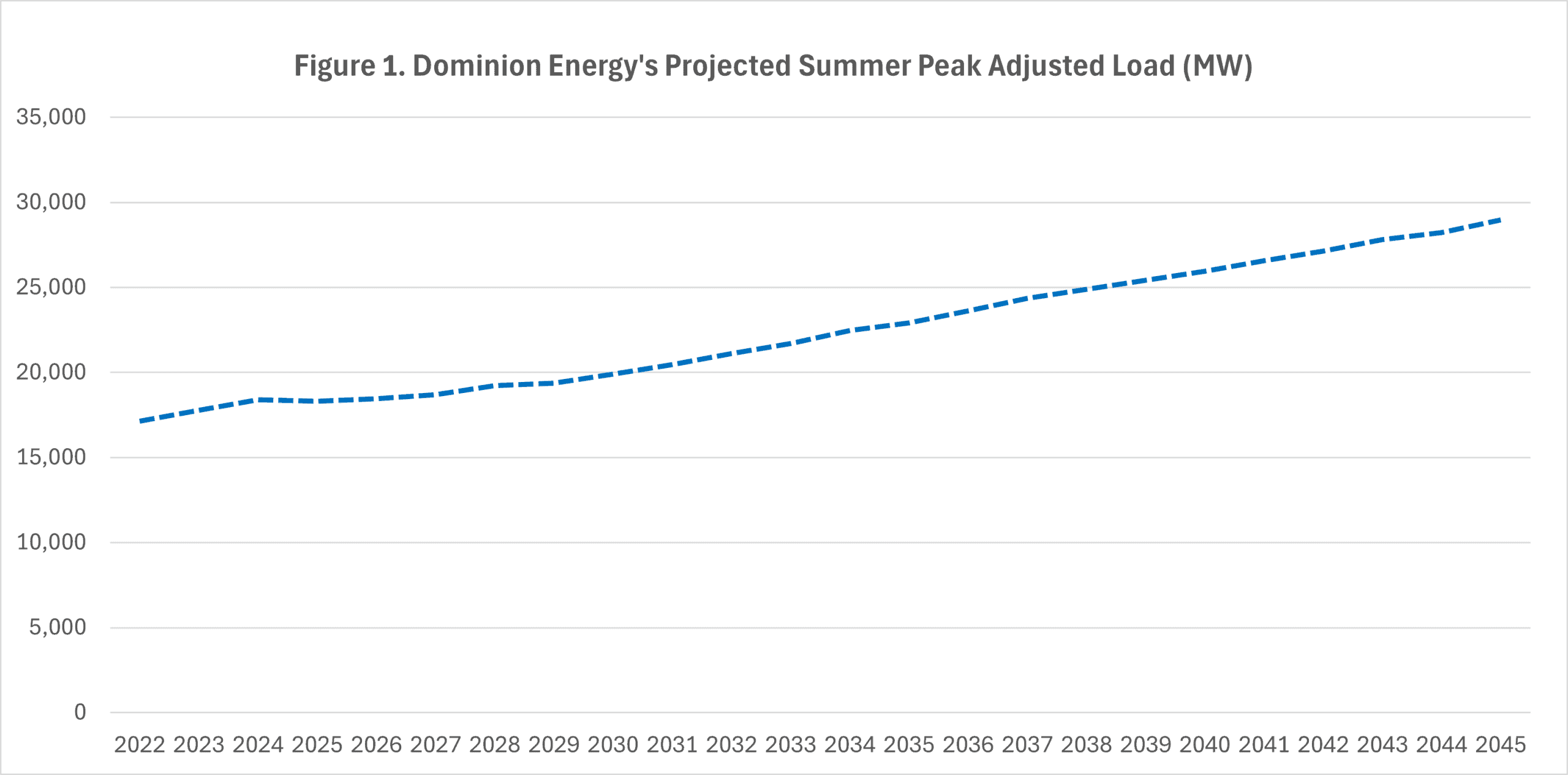

As shown in Figure 1, Dominion projects that its summer peak load will grow from 17,131 MW in 2022 to 28,963 MW in 2045, a striking increase of almost 70 percent. This increase in electricity demand is largely driven by data centers.

Source: Dominion Energy 2025 Integrated Resource Plan Update

Source: Dominion Energy 2025 Integrated Resource Plan Update

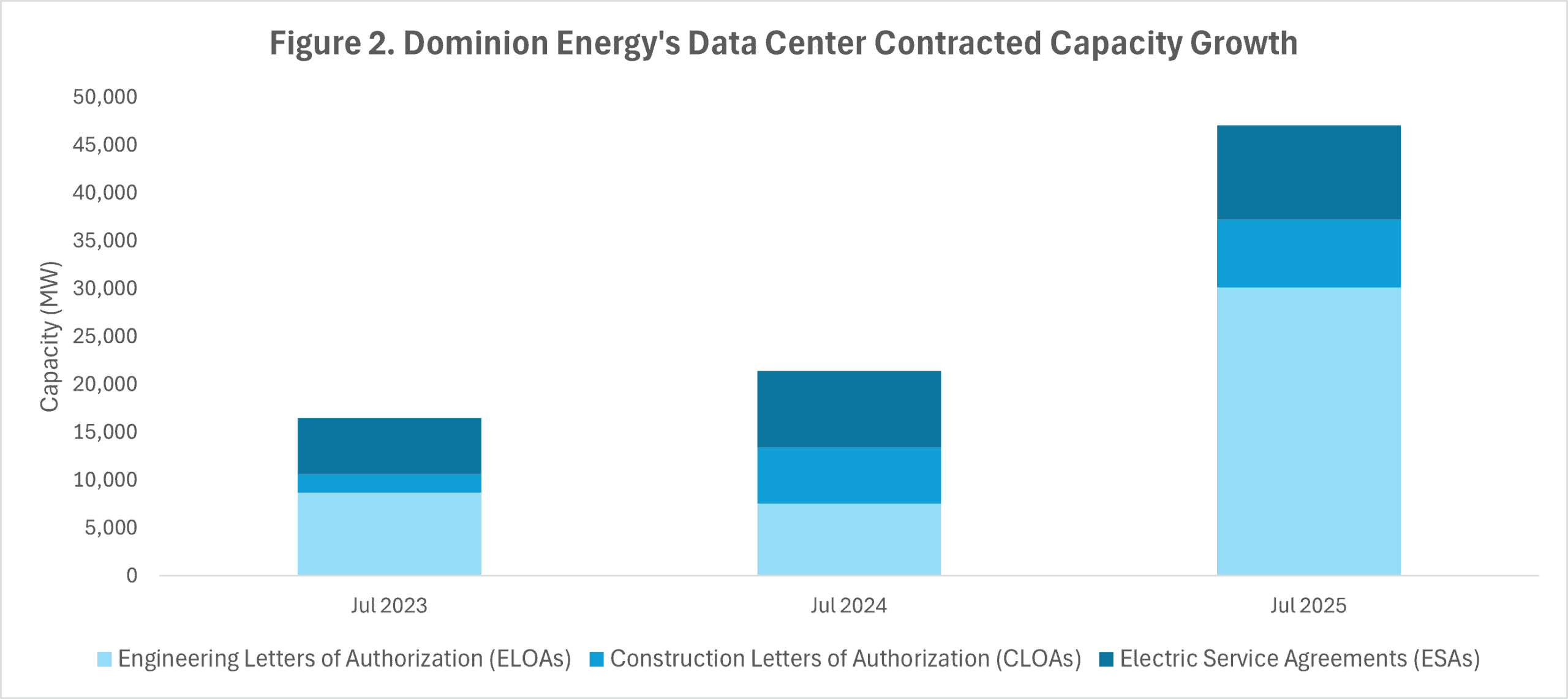

Figure 2 shows the fast-growing numbers of Dominion’s contracts with data centers in terms of capacity—the maximum amount of power the data centers will require. There are three types of contracts that a data center customer must complete over the course of a project.

- Engineering Letter of Authorization (ELOA): Allows the customer to begin pre-construction design and engineering work.

- Construction Letter of Authorization (CLOA): Permits the customer to build the data center.

- Electric Service Agreement (ESA): Officially contracts Dominion to provide electricity to the data center.

As shown in Figure 2, between July 2023 and July 2025, the total contracted capacity (ELOAs, CLOAs, and ESAs) between Dominion and its data center customers increased by 185 percent.

Given the projected growth in the data center industry, energy demand in Virginia is estimated to increase by 183 percent between 2023–2040, compared to a 15-percent increase if there was no new data center demand.

Source: Dominion Energy 2025 Integrated Resource Plan Update

Source: Dominion Energy 2025 Integrated Resource Plan Update

VCEA’s 2045 Carbon-free Electricity Target May Not Be Achievable Given Data Centers’ Enormous Power Demand

Dominion’s newly released 2025 update of its 2024 Integrated Resource Plan provides a forecast of the company’s total installed capacity by energy source for its serviced territory in Virginia by 2045 across three different scenarios:

- “Company Preferred Plan”: In this scenario, Dominion Energy would not comply with the VCEA 2045 carbon-free electricity target but instead petition the regulator for a reliability exception that would allow the company to preserve certain fossil fuel generation sources to ensure reliable electricity service to its customers. Dominion would comply with the 2024 Environmental Protection Agency (EPA) regulations released under the Biden Administration, including regulations on greenhouse gas emissions, wastewater discharge, and hazardous air pollutants from power plants. The estimated construction costs for this plan are $91.8 billion.

- “Least Cost VCEA Compliant Without EPA”: This scenario is similar to the “Company Preferred Plan” scenario, except that it would not comply with the EPA regulations. This scenario assumes that the 2024 EPA regulations on power plants would eventually be repealed, as proposed by the Trump Administration earlier this year. The estimated construction costs for this plan are the lowest of all three scenarios at $80.1 billion.

- “Forced Retirements by 2045”: This is the only scenario that would achieve full compliance with the VCEA 2045 carbon-free target without petitioning the reliability exception. Under this plan, Dominion would retire all carbon-emitting resources in Virginia, except for biomass units. Dominion states, however, that it “does not consider this to be a feasible Portfolio based on the assumptions beyond reasonable build limits, customer affordability concerns, capital requirements and reliability concerns associated with retiring dispatchable generation during a time of significant load growth.” The estimated construction costs of $270.4 billionfor this plan are about three times the costs of the other two plans.

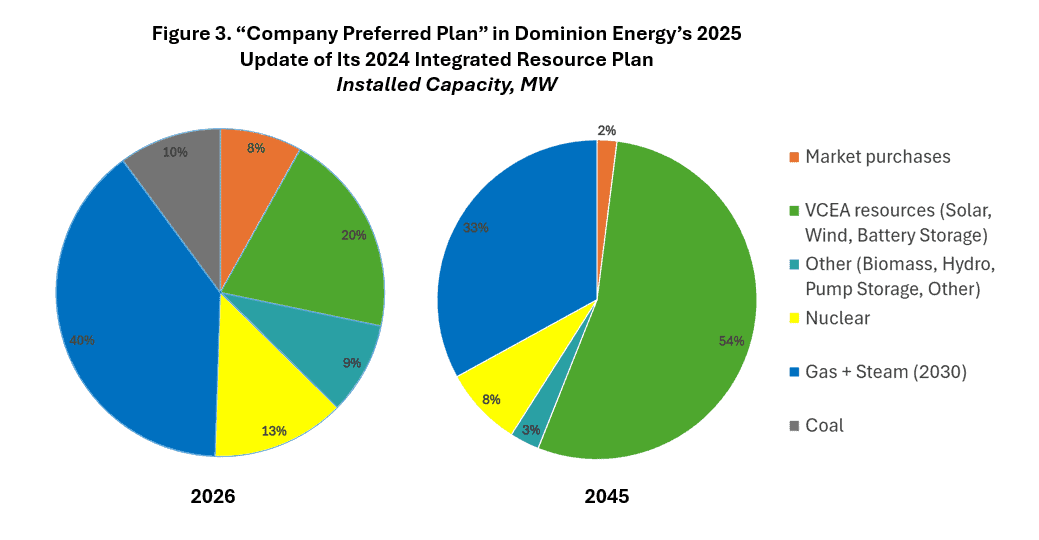

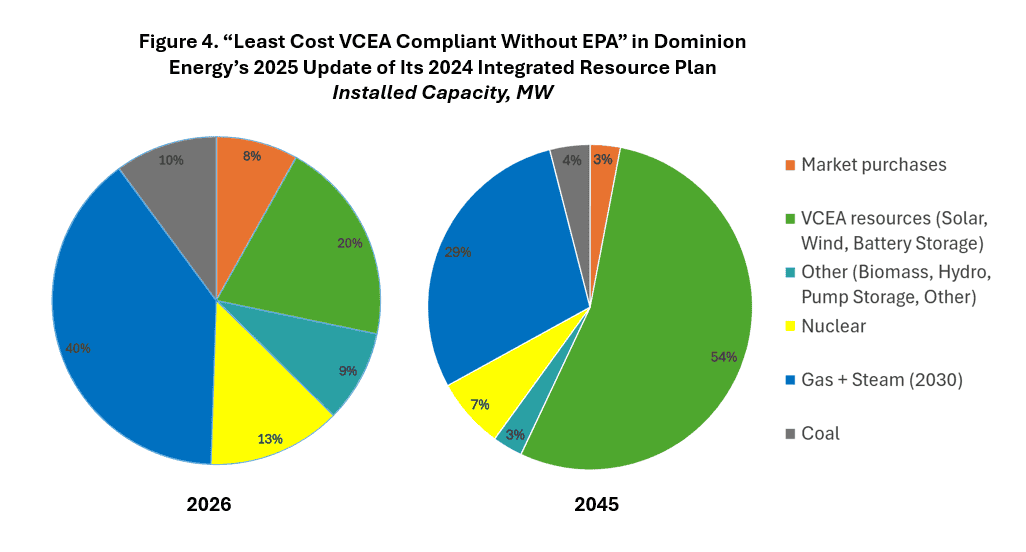

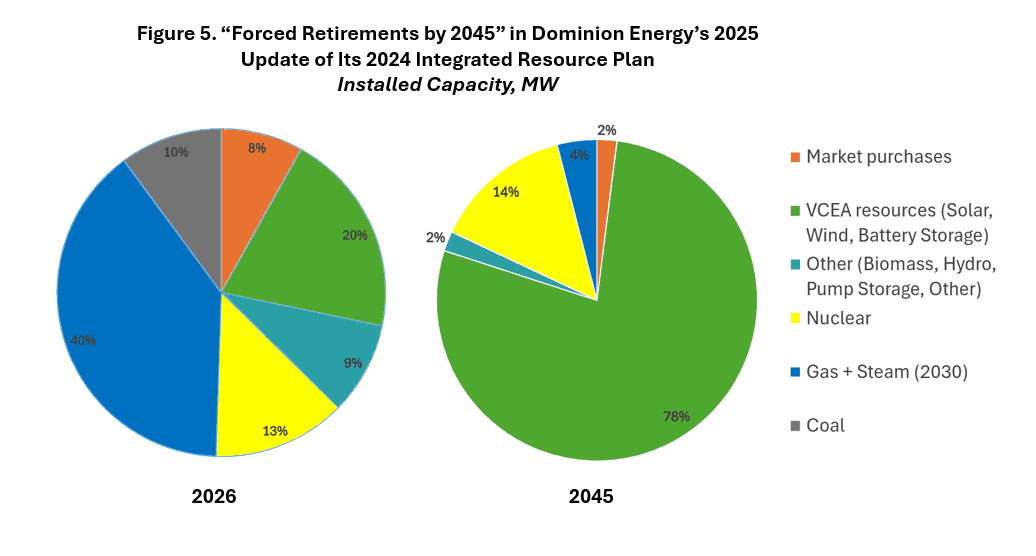

As shown in Figures 3, 4, and 5, Dominion projects that in 2026, its installed capacity (the maximum amount of electricity produced from certain generation plants) will consist of natural gas (40 percent), solar, wind, and battery storage (20 percent), nuclear (13 percent), coal (10 percent), biomass, hydro and others (9 percent), and market purchases of electricity (8 percent).

Under the “Company Preferred Plan” scenario, as shown in Figure 3, renewable energy (solar, wind, and battery storage) will become the major energy source that accounts for 54 percent of the total installed capacity, while natural gas will decrease to about one-third of the total installed capacity. Coal will be completely phased out by 2045 in this scenario. Market purchases of electricity from other non-Dominion owned sources will only account for 2 percent of the total capacity mix, which is about the same as that of the other two scenarios. Dominion explains the reason for the decreased target of market purchases from other utilities in 2045: “[T]he ability to purchase power is finite, and over-reliance on market purchases will create risks to both reliability and affordability.”

Source: Dominion Energy 2025 Integrated Resource Plan Update

Source: Dominion Energy 2025 Integrated Resource Plan Update

Under the “Least Cost VCEA Compliant Without EPA” scenario, as shown in Figure 4, the 2045 installed capacity mix is similar to that in the “Company Preferred Plan.” The main difference is that in the second scenario, some coal generation sources are preserved – accounting for 4 percent of the total capacity. With natural gas accounting for another 29 percent, fossil fuel sources make up 33 percent of the total generation mix, the same as the first scenario.

Source: Dominion Energy 2025 Integrated Resource Plan Update

Source: Dominion Energy 2025 Integrated Resource Plan Update

Under the “Forced Retirements by 2045” scenario, as shown in Figure 5, renewable energy (solar, wind, battery storage) will make up close to 80 percent of total capacity, with nuclear accounting for 14 percent, which is similar to the percentage number in 2026. While coal will be completely phased out, natural gas will still account for 4 percent of total capacity. Notably, Dominion explains that the “Company does not currently see a viable path towards full retirement of all carbon-emitting resources by 2045,” so it would continue several gas-fired power plants in West Virginia and other locations outside of the Commonwealth of Virginia.

Source: Dominion Energy 2025 Integrated Resource Plan Update

Source: Dominion Energy 2025 Integrated Resource Plan Update

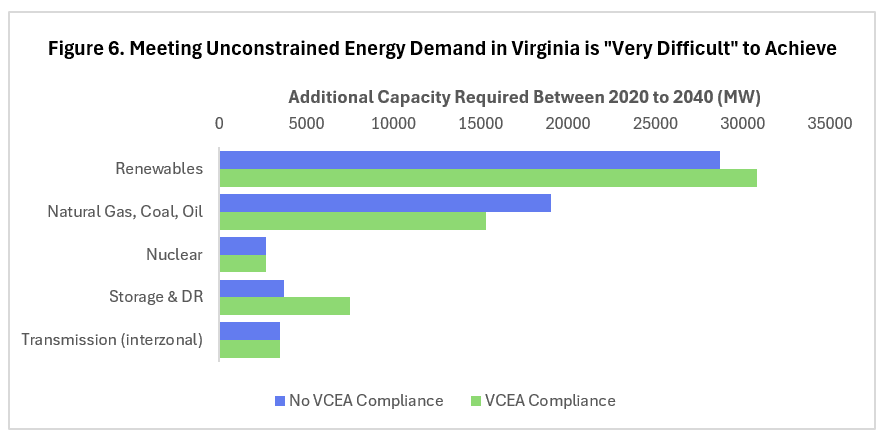

Virginia-initiated Third-party Study Corroborates Dominion Energy’s 20-year Outlook

In 2023, the Joint Legislative Audit and Review Commission conducted a study of the impact of data centers in Virginia. The report provided a 20-year projection of Virginia’s future generating capacity from 2020–2040 and whether it will be able to meet the large demand growth. The report concludes: “Building enough infrastructure to meet unconstrained energy demand will be very difficult to achieve, with or without meeting the Virginia Clean Economy Act requirements,” as renewable, fossil fuel, nuclear, and storage facilities would have to be constructed at rates that far exceed historical build rates.

Figure 6 shows the estimated additional capacity from each energy source required for Virginia to meet projected energy demand between 2020–2040. Under a VCEA-compliant scenario, an additional 59,800 MW of capacity would be required. Even in a scenario where VCEA requirements are not met, 57,600 MW of additional capacity would still be needed. For context, Dominion had 20,131 MW of generation capacity in 2023. Both scenarios continue to rely on fossil fuel resources to be added to the capacity mix.

Source: Joint Legislative Audit & Review Commission

Source: Joint Legislative Audit & Review Commission

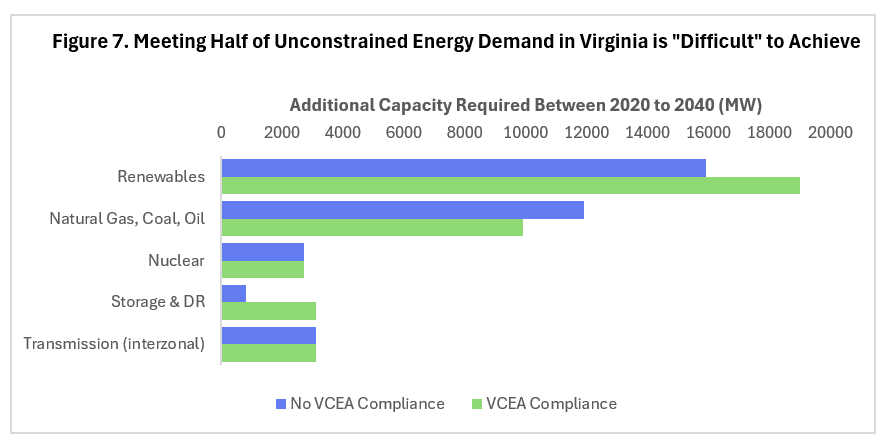

As shown in Figure 7, the report finds that meeting even half of the projected energy demand would “likely still be difficult,” requiring 37,800 MW and 34,400 MW of additional capacity in the VCEA-compliant and non-compliant scenarios by 2040, respectively.

Source: Joint Legislative Audit & Review Commission

Source: Joint Legislative Audit & Review Commission

Conclusion

Based on the projection of AI data centers’ energy growth over the next 20 years, current energy mix in Virginia, and estimated expansion of future electricity supply, it may not be viable for Dominion Energy to meet VCEA’s mandated target of 100-percent retirement of all fossil fuel generation sources by 2045—unless there is an unforeseen technological breakthrough in electricity generation. Lawmakers in Virginia should consider adopting a more hands-off approach that allows the market to figure out how to best meet AI data centers’ exploding power demands while also reducing power-sector emissions.