Insight

July 16, 2018

Multiemployer Pension Financing and Federal Policy

Executive Summary

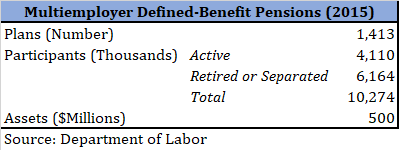

- Over 10 million Americans participate in 1,413 multiemployer defined-benefit pension plans.

- Multiemployer plans as a whole face significant long-term funding challenges — holding assets equal to less than half of their liabilities — while a small subset face near-term insolvency.

- In February of 2018, Congress established the Joint Select Committee on Solvency of Multiemployer Pension Plans to address these challenges; this effort remains underway.

Introduction

Multiemployer defined-benefit plans are collectively bargained, i.e. union, pension plans maintained by more than one employer. Over 10 million workers are covered under about 1,413 such plans. The system as a whole has deteriorated in recent years, and some plans are severely underfunded. The likely collapse of these plans could precipitate federal intervention. Indeed, recent legislation has already attempted to mitigate this challenge, but is unlikely to alter materially the pending insolvency of some large plans. Moreover, the federal backstop for these plans, the Pension Benefit Guarantee Corporation (PBGC), is itself facing insolvency. The intersection of the likely insolvency of multiple pension plans and the projected insolvency of the federal backstop raises the likelihood of federal intervention. Accordingly, Congress established the Joint Select Committee on Solvency of Multiemployer Pension Plans to grapple with these challenges and weigh appropriate federal involvement.

The Multiemployer Pension System

The modern multiemployer pension system was established by the Labor Management Relations Act of 1947, commonly known as the Taft-Hartley Act, which governs the structure and operation of multiemployer plans.[1] Multiemployer plans must, at a minimum, cover two separate employers and two employees, and governance of multiemployer plans must reflect equal labor-management representation. Characteristics of plans vary, but many plans represent smaller employers in the building trades, as well as retail trade and service industries, manufacturing, mining, trucking and transportation industries, and the entertainment industry (film, television and theater).[2]

As of 2015, the most recent year for which data is available, there were 1,413 multiemployer defined-benefit pension plans with 10,274,000 participants.[3] Of these 10- million plus participants, 4,110,000 were active participants, and 6,164,000 were retired or separated participants either receiving or eligible to receive benefits. Collectively, these plans held $500.76 billion in assets.

Table 1: Basic Statistics

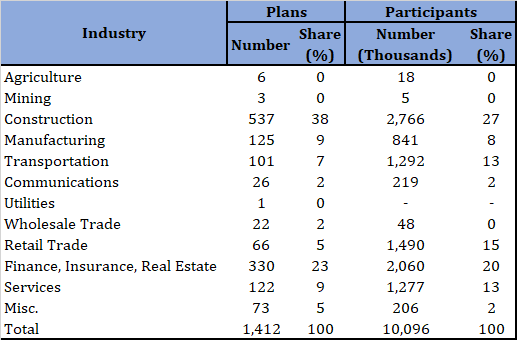

Plans and participation are concentrated in certain industries, with nearly half of all multiemployer pension participants working (or having worked) in the construction and finance, insurance, and real estate industries.

Table 2: Multiemployer Pension Participation by Industry

Source: Department of Labor

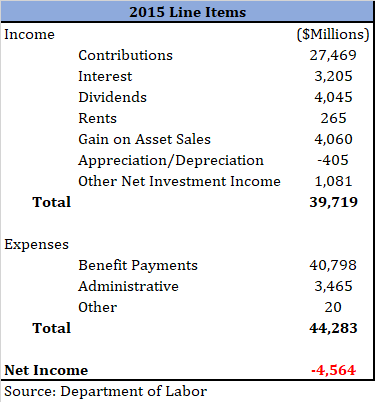

On the whole, multiemployer plans with over 100 participants (99.98 percent of all multiemployer defined-benefit plans) collected over $39 billion in net income in 2015.

Table 3: Income Statement of Multiemployer Defined-Benefit Plans with 100 or More Participants

Table 3 shows that the net income of the multiemployer plans is already in the negative with a total of $44.3 billion in expenses and only $39.7 billion in income. This is a significant deterioration from last year, when the net income of the plans was positive ($24 billion). Though just over 60 percent of multiemployer pensions are adequately financed (“green status”), the system as a whole faces net liabilities of $495 billion.[4]

Figure 1: Multiemployer Pension Finances (2000-2014)

Source: PBGC

Since 2000, funding for multiemployer plans has deteriorated significantly. Funding challenges represent liabilities that extend to the long term, however, and for many plans facing difficulty, there remains time to address funding challenges and recoup losses from past investment performance. Meanwhile, a significant number of plans face severe challenges. The PBGC recently estimated that 130 multiemployer plans, with over three million participants, are likely to face insolvency.[5] A small subset was deemed in “critical and declining status” because they meet certain criteria for distressed financing and face projected insolvency within 15 years (or 20 years in certain circumstances).[6]

“Orphan” Participants of Pension Plans

Many factors have contributed to the challenges faced by multiemployer pensions, including the withdrawal of firms from plan contributions. Its former employees, or “orphan participants,” remain beneficiaries of the multiemployer plan to which their former employer no longer contributes. Firms may choose to withdraw from plans, and pay a withdrawal liability, or the withdrawal may stem from firm bankruptcy or other corporate change. Even if firms pay their withdrawal liability, payments are limited by law. Thus, plans with large “orphan” liabilities can be uniquely challenged by the combination of a relative decline in assets and/or contributions to support a population of largely inactive participants. Accurately estimating the scope and scale of “orphan” liabilities is difficult because reported data likely understate the scale. According to the PBGC, reporting “orphan” participants is a relatively new reporting requirement, and pension processing systems are not designed to identify these populations. Moreover, the concept of an “orphan” varies, with a different population, captured by criteria specified in the Multiemployer Pension Reform Act of 2014, than is reported by firms’ Form 5500 filings. According to these data, there were 1.4 million plan participants whose employer did not make a contribution to the plan in the previous year, up from over 1.3 million in 2010.[7] This figure, however, likely understates the “orphan” population by a significant degree.[8]

Federal Policy Issues

While troubling, financial distress of private firms or contractual arrangements need not precipitate federal involvement. The pensions in question reflect employer-employee agreements in private industry. Those agreements necessarily reflect the risks inherent to those firms and industries and should be borne by the parties to those agreements — not the taxpayer. The federal government, however, is already to a degree entangled in the performance of these pensions.

The PBGC is a federal agency that insures both single and multiemployer pensions. The terms of PBGC’s insurance of single-employer pension plans differ considerably from those of multiemployer plans, but in general, both types of plans pay premiums in exchange for a guaranteed benefit in the event of bankruptcy or plan insolvency. The PBGC’s cash operations are reflected in the federal budget, but the PBGC has no claims on resources outside of the premiums, assets, and investment income it collects. On a cash basis, the Congressional Budget Office (CBO) expects financial assistance claims from multiemployer pensions to the PBGC to total $9 billion over 2017-2026. This represents the total projected cost of guaranteed benefits to participants in multiemployer plans estimated to be in insolvent over that period.[9] Over the subsequent decade, when still more plans are facing insolvency, that amount increases to $35 billion. Notably, the PBGC multiemployer program is itself projected to be insolvent in 2025.

Over the 2017-2036 period, premium collections and other income would only cover $11 billion of the total $45 billion in estimated claims over that period. However, because the PBGC has no claims to federal resources, under current law, this shortfall has no budgetary effects. Rather, PBGC can only pay benefits to the degree it has resources to do so, resulting in significant reductions below guaranteed benefit, which is itself only a fraction of average multiemployer pension benefits. As such, the most recent CBO baseline projects assistance payments to total $5.6 billion over the period 2018-2028, well below likely assistance needs.[10]

While the PBGC has no authority to pay benefits beyond what it has assets to finance, many policymakers and observers view its obligations as having an implicit federal guarantee.[11] Thus while under current law dozens multiemployer pensions are expected to face insolvency and a loss of guaranteed benefits from PBGC for hundreds of thousands of participants, the resulting hardship and disruption would likely precipitate congressional action. Indeed, Congress recently enacted the Multiemployer Pension Reform Act of 2014, which increased premiums and allowed certain eligible plans to reduce payable benefits. Only 27 plans, however, have applied to the Treasury Department to approve benefit reductions, of which only five have been approved.[12]

The Joint Select Committee

To respond to the multiemployer pension insolvency crisis, Congress established the “Joint Select Committee on Solvency of Multiemployer Pension Plans” on February 9, 2018, under Section 30422 of H.R. 1892.[13] The goal of the joint committee is to improve the solvency of multiemployer pension plans and the PBGC.[14]

In general, the joint committee is charged with providing recommendations and legislative language that will significantly improve the solvency of multiemployer pension plans and the PBGC. The joint committee shall vote on a report that contains a detailed statement of its findings, conclusions, and recommendations no later than November 30, 2018. [15]

The joint committee is chaired by Sen. Orrin Hatch (R-UT) and Sen. Sherrod Brown (D-OH). In the Senate, the majority members of the committee are Sen. Lamar Alexander of Tennessee, Sen. Mike Crapo of Idaho, and Sen. Rob Portman of Ohio. The minority members are Sen. Joe Manchin of West Virginia, Sen. Heidi Heitkamp of North Dakota, and Sen. Tina Smith of Minnesota.[16] In the House, the majority members are Rep. Virginia Foxx of North Carolina, Rep. Phil Roe of Tennessee, Rep. Vern Buchanan of Florida, and Rep. David Schweikert of Arizona. The minority members are Rep. Richard Neal of Massachusetts, Rep. Bobby Scott of Virginia, Rep. Donald Norcross of New Jersey, and Rep. Debbie Dingell of Michigan. [17]

The joint committee has held five hearings, including a field hearing in Ohio, as of July 13, 2018. The hearings have covered key topics such as the history and structure of the multiemployer pension system, the structure and financial outlook of the PBGC, and Employer Perspectives on Multiemployer Pension Plans. Various problems of the current systems and solutions have been put forth by the witnesses who participated in these hearings.

Conclusion

Multiemployer defined-benefit plans are facing a serious crisis. In the aggregate, these plans are paying out more than they are bringing in. About 60 percent of multiemployer pensions appear to be adequately financed at present, but the system as a whole faces net liabilities of $495 billion, with 130 plans with over three million participants likely to face insolvency over the next 15-20 years. The federal guarantee for these plans is not adequately funded, with PBGC’s multiemployer plan itself being projected to become insolvent by 2025. Congress has created the Joint Select Committee on Solvency of Multiemployer Pension Plans to provide recommendations and legislation to address this challenge.

[1] While there are also multiemployer defined-contribution plans, this report is specific to defined-benefit plans.

[2] http://www.pbgc.gov/prac/multiemployer/introduction-to-multiemployer-plans.html#1

[3] https://www.dol.gov/sites/default/files/ebsa/researchers/statistics/retirement-bulletins/private-pension-plan-bulletins-abstract-2015.pdf

[4] https://www.pbgc.gov/sites/default/files/2015-pension-data-tables.pdf

[5] https://www.pensions.senate.gov/content/structure-and-financial-outlook-pension-benefit-guaranty-corporation

[6] https://www.dol.gov/sites/default/files/ebsa/about-ebsa/our-activities/public-disclosure/status-notices/critical/2015/retirement-benefit-plan-of-gciu-detroit-newspaper-union-13n-with-detroit-area-newspaper-publishers.pdf

[7] http://www.pbgc.gov/documents/pbgc-report-multiemployer-pension-plans.pdf

[8] Based on author’s discussion with PBGC

[9] https://www.cbo.gov/publication/51536

[10] https://www.cbo.gov/system/files?file=2018-06/51305-2018-04-pbgc.pdf

[11] https://www.cbo.gov/sites/default/files/cbofiles/ftpdocs/66xx/doc6646/09-15-pbgc.pdf

[12] https://www.treasury.gov/services/Pages/Plan-Applications.aspx

[13] https://www.congress.gov/115/bills/hr1892/BILLS-115hr1892enr.xml

[14] Ibid.

[15] Ibid.

[16] https://www.pensions.senate.gov/content/members

[17] Ibid.