Insight

August 23, 2016

The Nation’s Adjustable Rate Mortgage

On Tuesday, the Congressional Budget Office (CBO) released its usual summer update to its budget and economic update. Though an otherwise staid report, the August update reveals a disturbing feature about the nation’s finances. The nation’s finances are increasingly beholden to credit conditions.

CBO budget and economic updates allow for the periodic incorporation of recent changes in laws or more up to date economic data. Tuesday’s update largely reflects the latter, with CBO marking down its growth projections. Slower expected growth and greater demand for U.S. Treasuries also pushed CBO’s interest rate projections down. Changes in the economy can have significant effects on the federal budget – indeed good growth policy is typically good budget policy. A growing economy raises incomes and tax revenue and diminishes spending on social safety net spending. A stronger economy also pushes up interest rates and increases the government’s cost of future borrowing – either the financing of additional deficits or the rolling over the existing national debt. But usually the revenue implications of higher growth swamp the higher borrowing, improving the nation’s bottom line on net. We’d expect to see the inverse hold true with slower growth – revenue losses would swamp interest savings. If there’s one important budget trend to be gleaned from an otherwise prosaic CBO update, it’s that this isn’t really holding true. The nation’s debt portfolio is so large (and growing) that changes in financing costs can wipe out other economic influences on the budget.

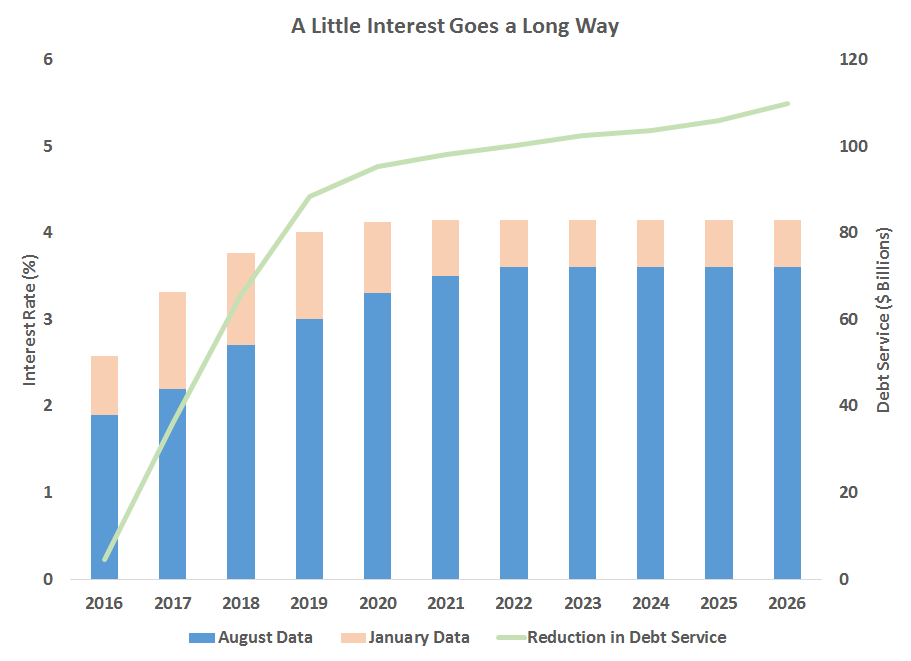

In Tuesday’s update, CBO lowered its growth forecast, which in turn reduced projected revenue collections by $580 billion.[1] By contrast CBO’s downward revisions in borrowing costs due to its change interest rate projections amounted to $905 billion – the largest moving piece in CBO’s budget update. Swings in interest rate take on greater significance the higher the debt. Taken to the extreme, they can matter more than the capacity of the economy to finance those debts. Perhaps the best analogy is the archetypal borrower during the housing crisis – someone of modest income carrying three mortgages. What matters more to their budget, a ten percent raise or their ballooning ARM payments?

In the case of this update that downward revision in interest rates produced large expected savings in borrowing costs. That’s nominally a good thing. But it’s more important in revealing how exposed the nation’s budget is to interest rate fluctuations. Another update could go in the other direction. When updates that reflect just a few months of pondering at CBO can produce near trillion-dollar budget swings, it should give observers pause and policymakers anxiety.

[1] Changes in CBO’s revenue projections due to economic factors was down $428 billion if higher Federal Reserve remittances are included, which were revised upward due to lower expected interest rates.