Insight

December 9, 2025

Netflix/WBD Deal Likely to Face Antitrust Investigation

Executive Summary

- Netflix emerged as the winner in a months-long bidding war for Warner Bros. Discovery (WBD), beating out rivals Paramount and Comcast; Paramount nevertheless continues to pursue WBD.

- The $82.7-billion deal would combine Netflix’s industry-leading subscriber base with WBD’s studio, deep content catalogue, and its third-ranked streaming service, HBO Max.

- The deal has met with resistance across the political spectrum – including from President Donald Trump; the inevitable regulatory review conducted by either the Department of Justice or Federal Trade Commission should focus on the consumer effects: prices, output, and innovation.

Introduction

On December 5, 2025, Netflix emerged as the winner in the bidding bonanza for Warner Bros. Discovery (WBD), beating out rivals Paramount and Comcast (Paramount continues to pursue WBD, however, launching a hostile bid for the firm). The $82.7-billion deal would combine Netflix’s industry-leading subscriber base with WBD’s studio operations, robust content catalogue, and third-ranked streaming service, HBO Max. WBD’s linear cable assets would be spun off into a separate entity.

The deal has drawn bipartisan criticism, including from President Donald Trump, and will undoubtedly attract attention from federal antitrust regulators at the Department of Justice or Federal Trade Commission. Whichever agency ultimately conducts the investigation should focus on the competitive effects of the transaction, specifically what it would mean for consumers with respect to prices, output, and innovation.

The Deal

On December 5, Netflix and WBD announced a definitive agreement under which Netflix will acquire WBD, including its film and television studios, HBO Max, and HBO for an enterprise value of $82.7 billion. The deal would exclude WBD Global Networks – a traditional cable, news, and sports network – which the company had previously planned to spin off.

Netflix’s primary business is subscription video on demand (SVOD), a streaming service where viewers pay a subscription fee to access a library of movies, TV shows, and other content on demand. Netflix provides customers with its own creative content and licensed content from studios and other third-party distributors.

WBD is a global entertainment business that “creates and distributes a differentiated and comprehensive portfolio of content and products across television, film, streaming, interactive gaming, publishing, themed experiences, and consumer products.” The business sells its content to distributors that carry the company’s network through cable, direct-to-home satellite, telecommunication and digital service providers, and through direct-to-consumer subscription services. The firm also licenses its content to be shown in theaters, on television, and SVOD, including its own HBO Max service.

Multiple Markets

Horizontal Integration: Subscription Video on Demand

The federal reviewing agency is likely to argue that Netflix and WBD compete directly in the SVOD market. It will argue that combining Netflix’s market-leading subscriber base with WBD’s HBO Max service, which comes with a deep bench of content, would eliminate head-to-head competition between two of the industry’s largest players and likely substantially lessen competition in violation of Section 7 of the Clayton Act.

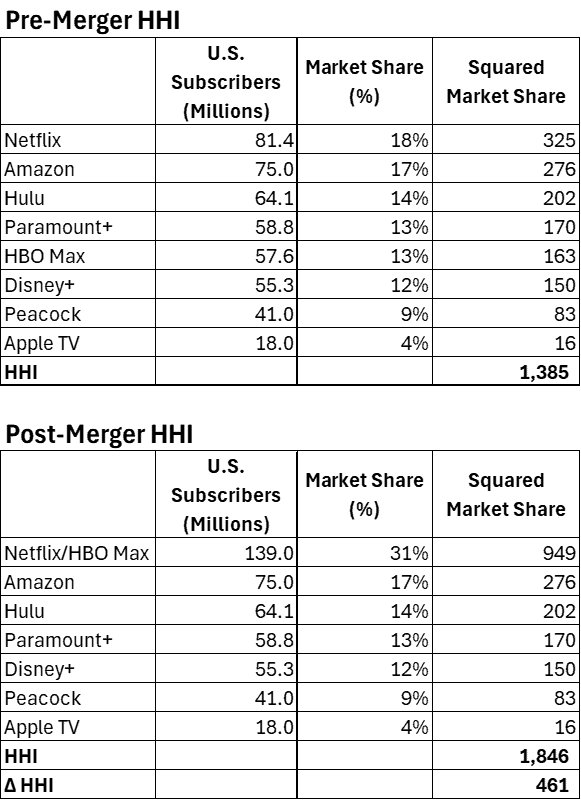

A key component of the government’s case will be to show that the market share of the post-merged firm, which will serve as a proxy for market power, will exceed the bright-line structural presumptions outlined in the revised 2023 Merger Guidelines jointly published by the Department of Justice (DOJ) and Federal Trade Commission. The structural presumptions rely on a measure of market concentration called the Herfindahl-Hirschman Index (HHI). This is calculated by taking the sum of the squared market shares of each firm. The Merger Guidelines note that “Markets with an HHI greater than 1,800 are highly concentrated, and a change of more than 100 points is a significant increase.” They conclude that such consolidation is “presumed to substantially lessen competition or tend to create a monopoly.” Moreover, the agencies explain, “a merger that creates a firm with a share over thirty percent is also presumed to substantially lessen competition or tend to create a monopoly if it also involves an increase in HHI of more than 100 points.”

Figure 1: HHI Structural Presumption Thresholds

*Source: 2023 Merger Guidelines

To estimate the market share, the government has several options. Using revenue data is a typical starting point, but it can be misleading. Media Play News reported that Netflix generated an industry-topping $31.6 billion in revenue in 2023. Hulu ($10.7 billion), HBO Max ($6 billion), Disney+ ($5.5 billion), Amazon Prime Video ($5 billion), Apple TV+ ($2.2 billion), Paramount+ ($1.2 billion), and Peacock ($830 million) rounded out the rest of the industry. The vertical integration of many of these firms, however, could mean they can charge lower prices because the SVOD service is being subsidized by other parts of the firm. Apple TV+, for example, is subsidized by Apple’s other businesses, including devices. Amazon Prime Video is likely supported by its retail and web services business, and Disney+ is propped up by its theme parks and live sports.

Another approach uses global subscriber counts. Netflix dwarfs its competitors in this category with approximately 302 million subscribers. The rest of the top four include Amazon Prime Video (200 million), Disney+ (132 million), and HBO Max (128 million). Limiting this metric to United States-based subscribers reveals that Netflix (81.4 million) still has the largest share while HBO Max drops from fourth to fifth with 57.6 million. Together, the two would hold roughly 30 percent of the U.S. SVOD subscriptions, meeting the Merger Guideline’s structural presumption threshold.

Figure 2: Pre- and Post-Merger Market Share Based on U.S. Subscribers

*Source: FlixPatrol: Top Streaming Services by Subscribers in the United States; author’s calculations

The calculations are approximations and should not be mistaken for definitive data the government would receive from both companies. Simply combining the count of subscribers probably includes double-counting as some are likely subscribed to both services. Yet based on the calculation in Figure 2, the agencies would consider the post-merger industry to be highly concentrated and deemed presumptively illegal.

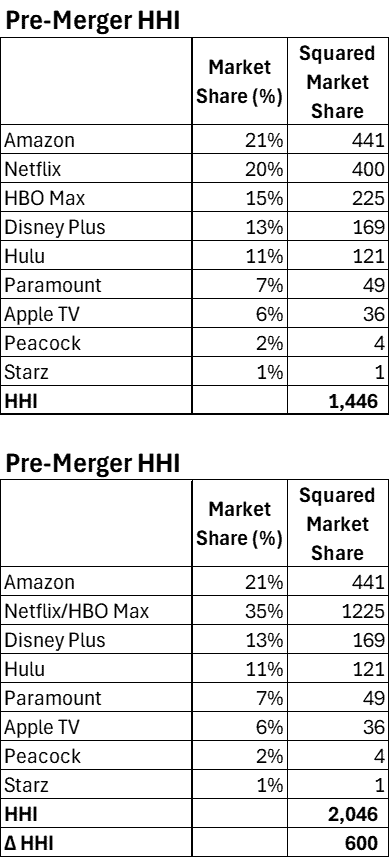

Calculating market share using viewing hours rather than subscribers yields a similar conclusion

Figure 3: Pre- and Post-Merger Market Share Based on Viewing Hours

*Source: Media Play News

As with revenue, subscriber counts may not be a completely reliable measure. Services such as Amazon Prime Video are included in an Amazon Prime subscription, for example. Other SVOD services have similar models.

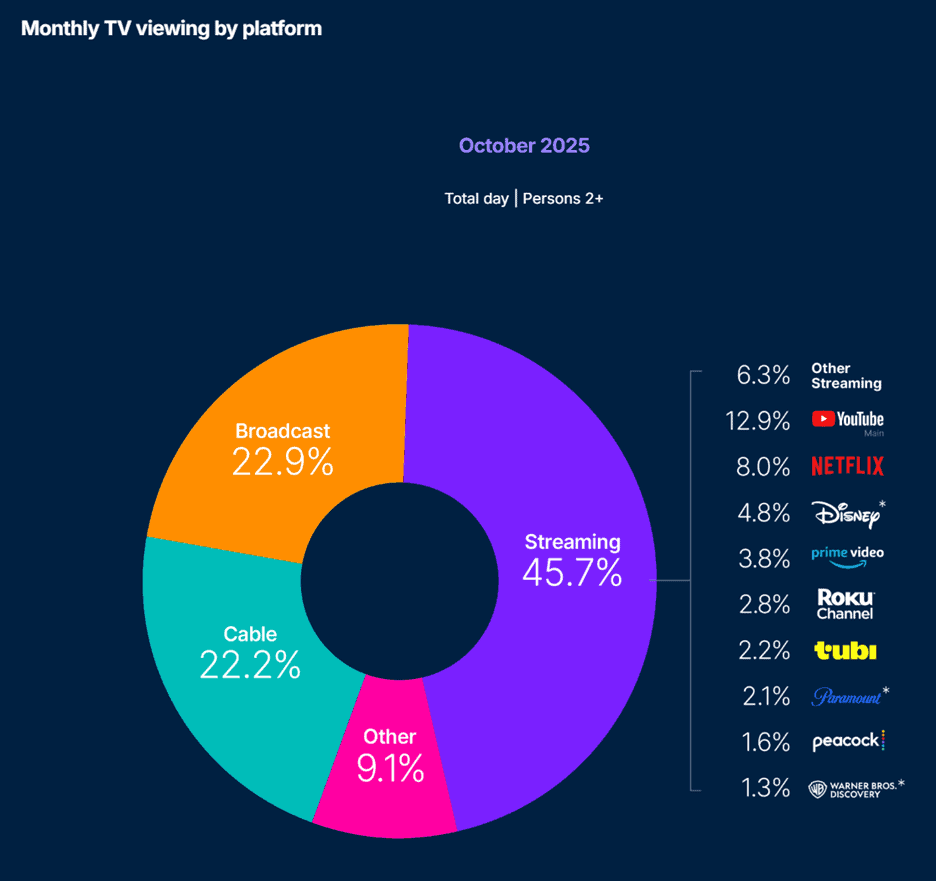

Netflix and WBD may contend that defining the market as SVOD is artificially narrow. The firms are likely to argue that they are competing for eyes on their content and the medium through which content is delivered does not matter. In other words, SVOD competes with broadcast television and cable.

Data from Nielsen’s monthly The Gauge report for October 2025 showed that streaming still represents less than half of all monthly TV viewing, meaning that their market share is much less than the investigating agency is likely to allege.

Figure 4: Monthly TV Viewing by Platform

*Source: Nielsen Media Research The Gauge

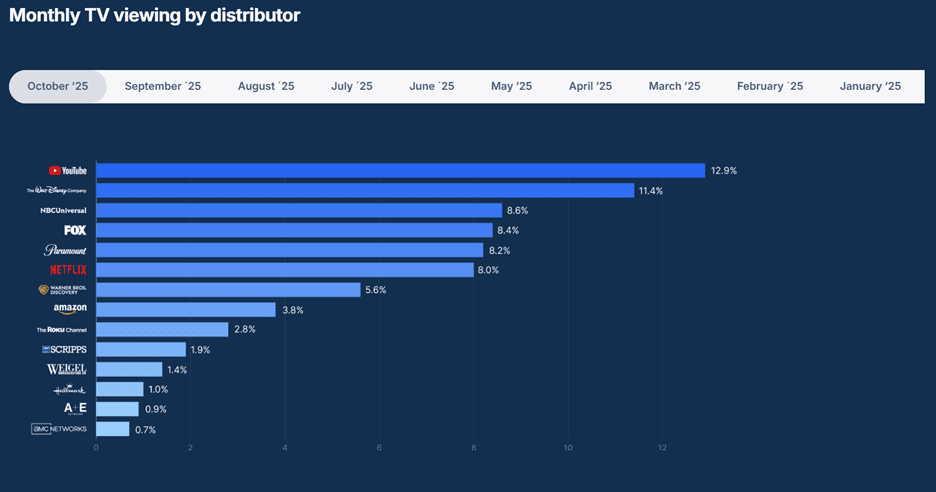

Figure 5: Monthly TV Viewing by Distributor

*Source: Nielsen Media Research The Gauge

The Nielsen data reveal that the combined total viewing time of Netflix (8.0 percent) and WBD (5.6 percent) was 13.6 percent in October 2025. That was well below the 30-percent structural presumption outlined in the Merger Guidelines.

But this is only TV viewing. Netflix and WBD are likely to argue that the market may be broader still. Not included in the narrowly defined SVOD market are live streaming services such as YouTube TV and social media platforms such as TikTok and Meta’s Facebook. All these platforms compete for consumer screen time. In fact, the competition section included in Netflix’s 2024 Annual Report stated that the firm competes “with a broad set of activities for consumers’ leisure time”–including social media, video gaming providers, and others. Convincing the court that this broader view is a more accurate depiction of competition would shrink their combined market share even further.

Vertical Integration: Risk of Foreclosure

The extensive catalogue of WBD is rich with highly sought after titles that consistently attract new subscribers to SVOD platforms and draw audiences to theaters. It includes Harry Potter, Lord of the Rings, the DC Universe (Batman, Superman, etc.), and Game of Thrones. Netflix, by contrast, produces its own original content and licenses existing content from other studios to put directly on its streaming platform. The agencies will have to assess whether Netflix’s ownership of WBD’s existing catalogue and future studio content would create a profitable incentive to foreclose on rival distributors. Netflix could do this by simply withholding WBD content from competitors, delaying its distribution, or making it prohibitively expensive to license.

The possibility of foreclosure could reduce the amount of content available to consumers and diminish the choices through which they can view content. Moreover, raising the prices for rivals could spill over to increased costs for consumers.

Monopsony: Effect on Content Creators and Talent

WBD and Netflix compete directly for creative talent and content. Roy Price, former head of Amazon Studios, warned that the merger would “create a monopsony problem: too few buyers with too much bargaining power.” In a New York Times op-ed, Price explained that “Writers, directors, actors, showrunners, puppeteers, visual effects artists – all are suppliers,” and that the merger would result in “fewer buyers competing to hire them,” potentially leading to lower compensation and fewer opportunities.

Price also noted that the DOJ blocked the proposed merger between Penguin Random House and Simon & Schuster in 2022 using a similar theory. The successful merger challenge did not hinge on consumer prices, but the “diminished bargaining power of authors.”

The investigating agency will likely consider the downstream labor market effects in the Netflix-WBD merger as Penguin Random House and Simon & Schuster.

Merger Efficiencies

The merger, however, would also generate efficiencies through vertical integration between Netflix’s distribution resources and WBD’s vast library of content. Netflix would no longer need to pay for distribution rights; this would lower costs, generating savings that could be passed along to consumers. Consumers also would likely see more content available on a single platform, which may allow them to reduce their number of subscriptions.

In a Wall Street Journal opinion, Harlan Capital Partners founder and managing partner Josh Harlan discussed the procompetitive benefits of the merger. He stated that “Warner’s vast library also becomes more valuable when integrated into Netflix’s data and analytics systems.” He added that “Decades of films and series that have been unevenly monetized around the world can suddenly be offered to the precise audiences most likely to engage with them.”

Furthermore, the firms will likely argue that the merger leverages economies of scale through Netflix’s platform with WBD’s studio lots. Harlan stated that Netflix is acquiring a “fully developed studio infrastructure – a physical production base that complements its global reach.” In summary, Harlan explained that “The combination of Warner’s intellectual property, Netflix’s data engine, and production efficiency offers a path to long-term value that no legacy studio could achieve alone.”

Hostile Bid and Potential Politics

Hostile Bid

On December 8, just days after failing to secure a deal, Paramount launched a $108.4-billion hostile bid to buy the entirety of WBD, including the Global Networks segment. Paramount claimed that its acquisition of WBD would have an easier path toward regulatory clearance than the competing bid from Netflix.

Politics

Paramount’s all-cash offer “is backstopped with equity financing from the Ellison Family – owner of Skydance Media, the parent company of Paramount – and RedBird Capital in addition to debt fully committed by Bank of America, Citi, and Apollo, according to the press release. It was also reported that a part of the equity financing comes from Saudi Arabia’s Public Investment Fund, Abu Dhabi’s L’imad Holding Company PJSC, the Qatar Investment Authority, and Affinity Partners, which was founded by President Trump’s son-in-law, Jared Kushner.

Politics could play a role in the ultimate outcome. Not only is President Trump’s son-in-law square in the middle of the deal, Larry Ellison – father of Paramount Skydance chief David Ellison – is reportedly “close” to President Trump. Speaking on the announced Netflix/WBD deal, President Trump stated that he will be “involved in that decision,” a clear indication that he plans to influence the pending antitrust investigation.

Conclusion

The $82.7-billion merger agreement would combine Netflix’s industry-leading subscriber base with WBD’s studio, deep content catalogue, and its third-ranked streaming service, HBO Max.

While the deal has been met with resistance across the political spectrum, any regulatory review should focus on the competitive and consumer effects: prices, output, and innovation.