Insight

October 23, 2016

Pointless, Ridiculous, or Dangerous?

The Congressional Budget Office (CBO) released a short study last week carrying as usual a dull-to-coma-inducing title of “The Effects of Increasing Fannie Mae’s and Freddie Mac’s Capital”. The CBO analyzed a stylized version of H.R. 4913, the Housing Finance Restructuring Act of 2016 that the Wall Street Journal characterized as offering “a bonanza for hedge funds seeking to cash in on their investments in Fannie Mae and Freddie Mac—but the cost to taxpayers would be steep.”

The study shows a proposal the impacts of which range from pointless to ridiculous to dangerous. Let’s take a closer look.

The proposal is that each Government Sponsored Enterprise (GSE; Fannie Mae or Freddie Mac) would be allowed to retain an average of $5 billion of its profits annually and would thus increase its capital by up to $50 billion over 10 years. The government’s commitment to purchase more senior preferred stock from the GSEs if necessary to ensure that they maintain a positive net worth would remain in place – that is the GSEs could draw a “bailout” from the Treasury as needed. And the GSEs would invest the profits that they retained under the option in Treasury securities.

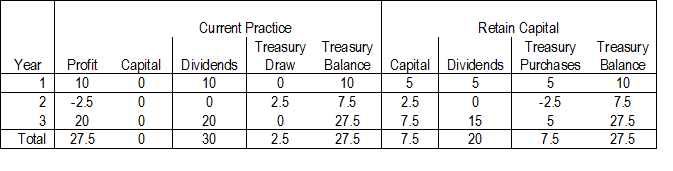

To make the proposal concrete, consider a simple example in which a GSE earns $10 billion, follows this with a loss of $2.5 billion the next year, and finally earns $20 billion in year three. This is shown in the first two columns of the table below.

Under current law, the Treasury has a senior position (lingo for the fact that the taxpayers effectively own the GSEs lock, stock, and barrel – which is fitting since the GSEs leveraged the taxpayer for private gain for decades), so all profits are “swept” up and sent as a dividend to Treasury. The GSEs are on track to hold zero capital (column 3). The only glitch in the process is that in year 2, the GSE must draw $2.5 billion from the Treasury (column 5) to cover its losses.

The bottom line is simple: over three years the GSE earns $27.5 billion and transfers this amount to the Treasury (column 6).

Now, suppose we let the GSE accumulate up to $5 billion in retained capital each year. In year 1, capital would rise to $5 billion, and only $5 billion would be paid to Treasury (columns 7 and 8). Notice, however, that the GSE would have to invest its retained capital in Treasuries (column 9) transferring another $5 billion in cash to the Treasury. The upshot: $10 billion earned and $10 billion transferred to the Treasury.

In the second year, the GSE loses $2.5 billion with its accumulated capital. Mechanically, it sells back $2.5 billion of its Treasuries to get the needed cash. The upshot, $2.5 billion lost and $2.5 billion transferred from the Treasury.

In the final year, the $20 billion in profits results in $5 billion in additional capital (with a corresponding $5 billion transferred to Treasury for the securities) and a $15 billion dividend. The upshot: $20 billion earned and $20 billion transferred to the Treasury.

The attentive, caffeine-rich reader will notice that the upshot for year 1, year 2, and year 3 is identical under current law and the proposed change. Accordingly, so is the bottom line: $27.5 billion in profits yield $27.5 billion in cash at the Treasury.

From this perspective, the proposal is pointless. All it does is introduce some artificial accounting and asset swaps. Since the taxpayer owns the Treasury and the GSE, how the money gets divided between them changes not one single economic fundamental.

Or perhaps, it is worse than pointless. It is ridiculous because it makes the overall accounting more complex and less transparent to the taxpayer, perpetuates the legal fiction that the GSE is a private enterprise with shareholders that have rights independent of the taxpayer, and that somehow intra-government transfers constitute a bailout. (Note: there are substantive legal issues surrounding the GSEs that are above my legal pay grade. But I have exactly zero sympathy for these serial bloodsucking economic zombies or the private interests trying to make a quick buck via investments in them.)

But, in fact, the proposal is actually dangerous because the paper accounting that shows them accumulating capital reserves will feed the narrative that it is safe to simply turn them loose from government conservatorship. The “recapitalize and release” crowd has been working hard on this narrative for the past several years; essentially arguing for collective amnesia regarding the crony capitalism, misaligned incentives, and overreaching that generated an enormous housing bubble and widespread economic devastation.

The best course forward is real GSE reform. But in the absence of that, the worst thing is to pursue faux reforms that enable turning back the clock.