Insight

March 29, 2022

Potential Consequences of Continued Student Loan Forbearance, and Blanket Loan Forgiveness

Executive Summary

- Just over 1 percent of all borrowers are regularly making student loan payments, in large part due to COVID-19 forbearance provided by the Trump and Biden Administrations.

- Over half of federal student loan holders have entered and remained in forbearance since the third quarter of 2020, yet there remain calls for blanket student loan forgiveness.

- A $10,000 or $50,000 blanket forgiveness would reduce outstanding federal student loan debt by $380 billion or $1.1 trillion, respectively; provide greater relief to the affluent as half of the benefit would go to the top 40 percent of the income distribution; and would create a moral hazard with future student loans.

Introduction

In the third quarter of 2020, more than half of federal student loan holders entered forbearance using the provision within the Coronavirus Aid, Relief, and Economic Security (CARES) Act that allowed these borrowers to pause principal and interest payments in response to the COVID-19 pandemic. Since entering office, President Biden has extended the pause in repayment numerous times, with the current pause slated to end on April 30, 2022. The extensions have allowed borrowers to put off making payments—despite the economy’s rebound in 2021, with economic output exceeding pre-pandemic levels. As of the fourth quarter of 2021, more than half of federal student loan holders are still not making payments, with just over 1 percent making regular payments. Meanwhile, the Biden Administration has also canceled about $16 billion in outstanding federal student loan debt for about 680,000 borrowers through targeted mechanisms.

With the economy and labor markets booming back in 2021, the repeated extensions of student loan forbearance became unnecessary. Instead, the continued pause in repayment requirements, combined with the targeted forgiveness provided so far, have raised the expectation of future blanket loan forgiveness, a promise on which then-candidate Biden campaigned.

Both President Biden and congressional Democrats have proposed blanket student loan forgiveness. While the president initially proposed $10,000 per borrower in federal student loan forgiveness, he has since walked that figure back. Some in Congress, however, are urging the president to forgive up to $50,000 in loans per borrower. Such policies would be highly regressive. More than half of this relief would be realized by the top 40 percent of families by income, while the bottom 40 percent would realize just a quarter of the relief. Further, any form of blanket loan forgiveness would also inundate the already-troubled student loan system with a new set of disincentives for borrowers to pay back what they owe.

Current Distribution of Federally Managed Student Loans by Repayment Status

Repayment requirements for federal student loans were initially paused as part of the CARES Act, a $2.2 trillion economic stimulus bill in response to the COVID-19-induced economic recession, passed on March 27, 2020. CARES specifically allowed borrowers to suspend principal and interest payments on outstanding federal student loans without penalty and set zero percent interest rates. CARES also stopped automatic collections on defaulted federal student loans. Using authorities granted in the CARES Act, the Trump Administration extended these suspensions for federal student loans twice more until January 31, 2021. Upon taking office, the Biden Administration quickly extended the suspensions and has extended them several times since. As of now, the return to regular federal student loan principal and interest payment requirements is set to resume on May 1, 2022; there is speculation that the administration will extend the pause into 2023, however.[1]

Not surprisingly, many borrowers chose to suspend their repayment of federal student loans in 2020 and have not resumed payments to date. The percentage of federal direct student loan holders in forbearance increased from 10.8 percent in the second quarter of 2020 to 55.2 percent in the third quarter of 2020. The portion of holders in repayment decreased from 42.6 percent to just 0.8 percent in the third quarter of 2020. As of the fourth quarter 2021, the portion of holders in forbearance changed little at 56.4 percent. The portion of borrowers making regular payments also remained relatively static at 1.1 percent.

Chart 1: Distribution of Federal Direct Loans by Status[2]

It is also not surprising that the continued pause in repayment requirements is widely popular among borrowers. A recent poll from Data for Progress found that 87 percent, or nearly 40 million of the 45.6 million federal student loan holders, support extending the pause in repayment through the end of the year.[3]

The Distribution of Blanket Forgiveness by Debt Size and Income

The Biden Administration initially signaled its support for $10,000 in blanket forgiveness for all federal student loan holders, but has since walked back this commitment due to uncertainty over whether it has the legal authority to do so. Some congressional Democrats have even suggested up to $50,000 in forgiveness. In the meantime, the administration has used more targeted mechanisms, such as borrower defense and total permanent disability discharge (TPD), to forgive $16 billion in outstanding federal student loan debt for about 680,000 borrowers.[4]

Impact of Blanket Loan Forgiveness by Borrower Debt Size

There are no exact details on what blanket loan forgiveness under the Biden Administration would look like, only that the amount would total $10,000 per holder. It is unclear whether blanket forgiveness would cover only direct federal loans, all federally managed loans, or whether it would extend to private loans. This analysis assumes the blanket forgiveness would cover all federally managed loans.[5] It does not consider private student loans, which make up a relatively small portion of total outstanding student loan debt.

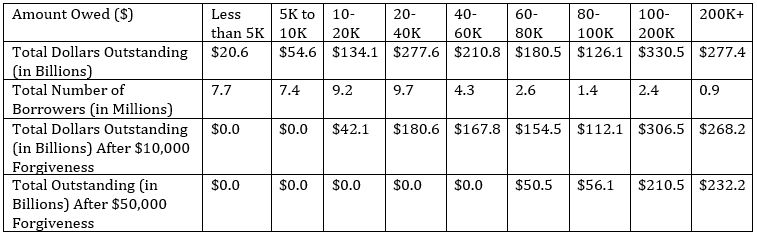

Below is a table of the current federally managed student loan portfolio by the outstanding balances of borrowers. A $10,000 blanket forgiveness policy would fully eliminate the balances of 15.1 million holders in the first two categories while reducing for each holder in the subsequent categories up to the amount. Overall, a $10,000 blanket forgiveness would reduce total federal outstanding student debt by $380.2 billion, 24 percent of the $1.6 trillion in total outstanding federal student loan debt. A $50,000 blanket forgiveness would fully eliminate the balances of 38.3 billion holders in the first five categories and would reduce total federal outstanding student debt by $1.06 trillion, 66 percent of the $1.6 trillion in total outstanding federal student loan debt.

Table 1: Federal Student Loan Portfolio by Borrower Debt Size as of the Fourth Quarter of 2021[6]

Impact of Blanket Loan Forgiveness by Income

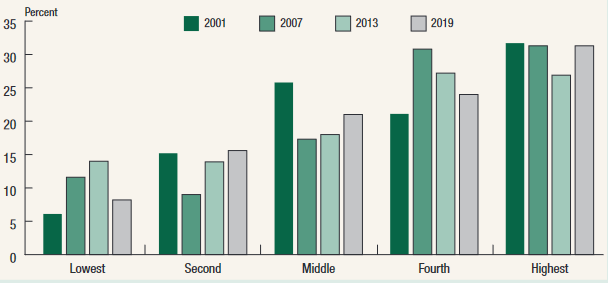

Upper-income families hold a disproportionate amount of outstanding student debt. According to the Federal Reserve chart below, more than half of outstanding student debt is held by families in the top 40 percent of the income distribution, while the bottom 40 percent of the income distribution holds just about a quarter of the total federal student loan debt. Of the approximately $380 billion in canceled debt under the $10,000 blanket forgiveness proposal, more than half would be realized by families in the upper 40 percent of income. The bottom 40 percent would realize just a quarter of the $380 billion forgiven. This dynamic holds for any amount of blanket loan forgiveness.

Chart 2: Distribution of Student Debt by Income Quintiles[7]

Moral Hazard

Blanket loan forgiveness would also create a moral hazard in the student loan system. Students would enter college with the expectation that past forgiveness programs will be repeated. This assumption would reduce borrowers’ incentives to repay loans in a timely fashion—or at all. If enough students were to hold this perspective, the entire federal loan system would be inundated with poorly written and possibly fraudulent loans. And because taxpayers back federal student loans, forgiveness amounts to providing taxpayer-financed checks to each loan holder.

Conclusion

The current pause on repayment of federal student loans is slated to end on May 1, 2022. The Department of Education is contemplating extending the pause again into 2023. If it does, federal student loan holders would most likely continue in forbearance while holding out for future forgiveness. In the meantime, the pause in repayment has done nothing to increase educational attainment or lower costs; instead, it has encouraged holders to attempt to shift their debt to taxpayers by holding out for blanket forgiveness. Blanket student loan forgiveness would be a highly regressive policy. It would reward the wealthiest of students and families all the while encouraging future borrowers to pay back their loans as slowly as possible, if at all.

[1] https://www.washingtonpost.com/education/2022/03/16/murray-request-loan-moratorium-extension/

[2] https://studentaid.gov/data-center/student/portfolio

[3] https://protectborrowers.org/new-poll-as-joe-biden-addresses-the-nation-voters-of-color-overwhelmingly-support-action-to-cancel-student-debt-extend-pause-on-student-loan-payments/

[4] https://www.ed.gov/news/press-releases/education-department-approves-415-million-borrower-defense-claims-including-former-devry-university-students

[5] Includes Direct Loan, Federal Family Education Loan, and Perkins Loan borrowers in an Open loan status.

[6] https://studentaid.gov/data-center/student/portfolio

[7] https://www.federalreserve.gov/publications/files/scf20.pdf