Insight

September 8, 2025

President Trump Gears Up to Levy Tariffs on Wind Turbine Imports

Executive Summary

- As part of its long-running opposition to wind energy generation, the Trump Administration has recently initiated a Section 232 investigation into imports of wind turbines and components, laying the groundwork to levy tariffs on these goods ostensibly in the interest of national security as soon as the end of 2025 or early 2026.

- The United States imported about $1.8 billion worth of wind turbines and component parts in 2024, with top countries of origin including Mexico, France, India, Denmark, and Germany; assuming the potential wind turbine tariffs match the 50-percent Section 232 tariff rate on steel and aluminum imports, they would result in approximately $385 million in added costs for U.S. consumers and businesses.

- This research provides an overview of the Section 232 investigation into wind turbine imports, the value of these imports, and their top exporters; it also provides a summary of wind energy’s role in the United States.

Introduction

On August 13, the Department of Commerce initiated an investigation into the national security implications of importing wind turbines and component parts under Section 232 of the Trade Expansion Act of 1962. The investigation follows in the wake of President Trump’s repeated criticism of wind turbines.

Further details as to what imports may be impacted and what specifically prompted the investigation remain to be seen. The Department of Commerce is accepting public comments from impacted parties until September 9. Notably, wind turbines are already subject to other types of U.S. tariffs ranging from 2.5–3 percent.

The United States imported about $1.8 billion worth of wind turbines and component parts in 2024, with top countries of origin including Mexico, France, India, Denmark, and Germany. If the wind turbine tariffs align with the 50-percent Section 232 tariff rate on steel and aluminum imports, they would result in approximately $385 million in added costs for U.S. consumers and businesses.

This insight provides an overview of the Section 232 investigation into wind turbine imports, the value of these imports, and their top exporters. It also provides a summary of wind energy’s role in the United States.

U.S. Imports of Wind Turbines

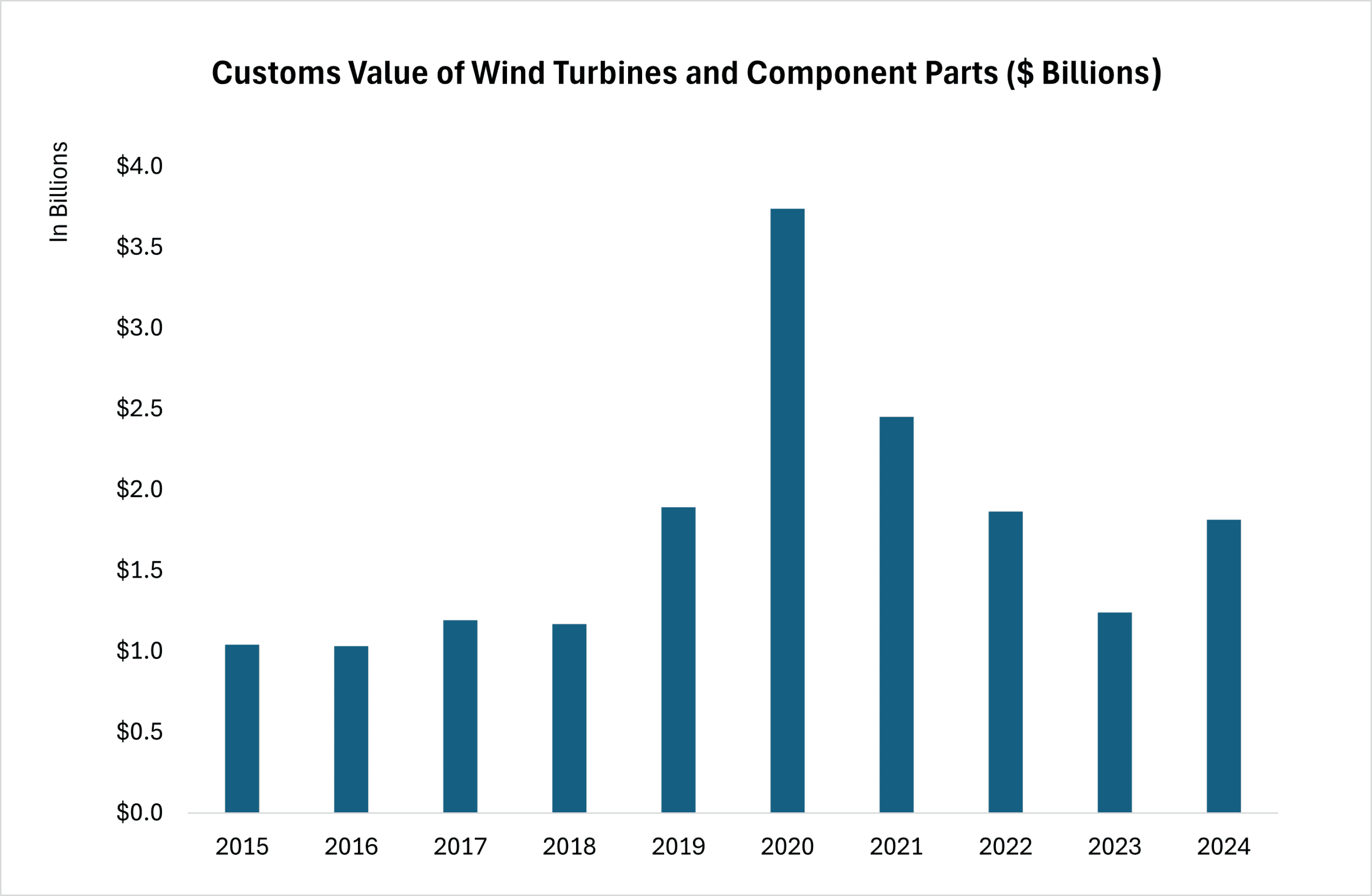

In 2024, the United States imported roughly $1.8 billion worth of wind turbines and component parts. This includes blades, hubs, and electric generating sets, although other related parts may be included within the wind turbine Section 232 investigation. As of June 2025, imports have reached nearly $1.4 billion, a 97-percent increase from the same period last year. This large increase in imports may be due to frontloading, as companies try to import products prior to the imposition of the Trump Administration’s likely forthcoming large-scale tariffs.

Source: International Trade Commission

Under the existing tariffs, the weighted average tariff rate between 2015 and 2024 for the selected wind turbine imports was 2.2 percent. These tariffs predate President Trump and are outlined in the Harmonized Tariff Schedule. The effective tariff rate in June 2025 surged to 9.3 percent, with tariffs amounting to $87 million between January and June. The 2025 increase in tariff rates is due primarily to the Trump Administration’s 10-percent universal tariff on all imported goods, as well as other tariffs imposed via the International Emergency Economic Powers Act (IEEPA).

As shown in the map below, there is a wide range of country origins for wind turbine imports. The top five trade partners include Mexico, France, India, Denmark, and Germany, which altogether constituted 83 percent of U.S. wind turbine imports in 2024. Mexico alone accounts for nearly one-third of all imports and has maintained its position as the top trade partner for most of the past five years. While reliance on China is often flagged for national security concerns, just 5.6 percent of imports came from the country in 2024.

U.S. Imports of Wind Turbines and Component Parts in 2024

Source: International Trade Commission (all numbers in the map are in U.S. dollars)

Assuming the potential tariff rate on selected wind turbine imports reflects the rate of previous Section 232 tariffs, the resulting tariff from investigation will be between 25–50 percent. More likely, the wind turbine tariff will align with the 50-percent rate on steel and aluminum imports. This research estimates that a 50-percent tariff would result in approximately $385 million in added costs for U.S. consumers and businesses, factoring in behavioral responses and income and payroll tax offsets.

Overview of the 232 Investigation

The Section 232 trade authority allows the executive branch to raise tariffs or restrict imports of goods if they are found to jeopardize U.S. national security (more information here). Unlike the president’s use of the IIEPA to impose “Liberation Day” tariffs on the grounds of national security, Section 232 holds more robust historical precedent. It has recently been used to impose a 50-percent tariff on steel and aluminum, a 50-percent tariff on certain copper products, and a 25-percent tariff on automobiles. The steel and aluminum content of wind turbines and component parts are already subject to a 50-percent tariff as of August 18 due to the recent inclusion of 407 steel and aluminum derivative products. Ongoing investigations into other sectors include timber and lumber, semiconductors, pharmaceuticals, and critical minerals. It remains to be seen what criteria the administration would use to determine whether wind turbine imports pose any national security threats, but the administration will likely use the same argument for increasing the Section 232 tariffs on steel and aluminum—that the imported goods weaken the U.S. economy and threaten national security.

While the anticipated timeline from start to finish for a Section 232 investigation varies, the recent use of the authority shows that a tariff can be expeditiously implemented. The typical process can take up 375 days to go through the fact-finding process, public comment period, and finalization of recommended actions. During President Trump’s first term, for instance, it took 338 days to impose the initial tariffs on steel and aluminum. In contrast, the investigation into copper was launched on March 10 and the executive order imposing a tariff took effect on August 1 – just 144 days. Using this case as an example, a separate wind turbine tariff could be implemented by the end of the year or early 2026. just 144 days. Using this case as an example, a separate wind turbine tariff could be implemented by the end of the year or early 2026.

Wind Energy in the United States

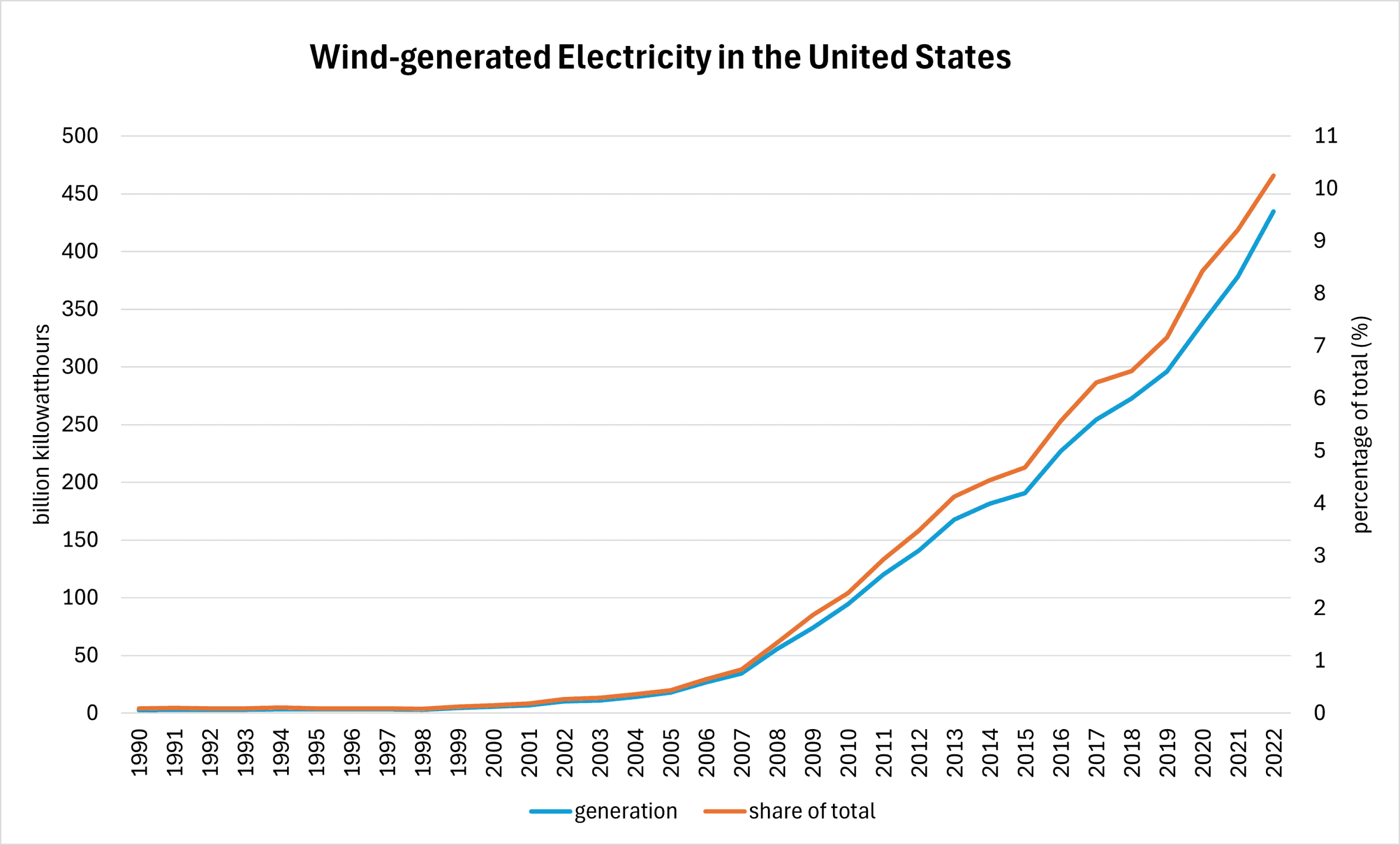

Wind is the most important renewable energy source for the United States in terms of its electricity generation capacity. In 2023, wind-generated electricity accounted for 10.2 percent of total U.S. utility-scale electricity generation, followed by hydropower (5.7 percent), solar (3.9 percent), and biomass (1.1 percent). For perspective, wind-based power is dwarfed by fossil fuels-based power in the United States, with fossil fuels such as natural gas, coal, and petroleum, generating about 60 percent of the country’s total electricity.

As shown in the chart below, wind electricity generation in the United States has increased substantially over the past three decades, especially since around 2007. Wind electricity generation grew dramatically from 34.5 billion kilowatt-hours (less than 1 percent of total U.S. electricity generation) in 2007 to 434.8 billion kilowatt-hours (more than 10 percent of total U.S. electricity generation) in 2022.

Source: Energy Information Administration

Notably, U.S. wind generation hit record levels in April 2024 at 47.7 terawatt-hours, exceeding coal-fired electricity generation at 37.2 terawatt-hours in the same month.

For context, the second Trump Administration has adopted various executive actions impacting the wind energy industry, including temporally withdrawing offshore wind leasing through an executive order, halting ongoing offshore wind projects citing national security concerns, and launching a full review of offshore wind energy regulations including leases, permits, rights-of-way and loans. President Trump posted on Truth Social stating “We will not approve wind or farmer destroying Solar.” Additionally, the One Big Beautiful Bill Act, passed by Republican lawmakers and signed by President Trump, repealed several wind-energy related energy credits.

Looking Forward

The initiated Section 232 investigation will likely lead to tariffs on wind turbine imports, which would likely saddle consumers and businesses with added costs. Tariffs on wind turbine imports would impede the deployment of wind energy, thus creating additional obstacles to the use of an important renewable energy source for electricity generation.