Insight

January 5, 2026

President Trump Wants Investments in Venezuelan Oil: What Are the Challenges?

Executive Summary

- President Trump has urged U.S. oil companies to invest in the Venezuelan oil industry—to “go in, spend billions of dollars, fix the badly broken infrastructure, the oil infrastructure, and start making money for the country”—after the administration’s military incursion into Venezuela and capture of its former leader, Nicolás Maduro.

- Despite having one of the world’s largest oil reserves, Venezuela’s crude oil production has dropped substantially from about 3.5 million barrels per day in 1997 to 0.9 million in 2024, which is about 1 percent of the world’s total crude oil production; the Venezuelan heavy crude is suitable for U.S. refining capabilities.

- This insight provides an overview of Venezuela’s crude oil reserve and production and analyzes the potential challenges to investment, including uncertainty in political stability, muted appetite of global oil markets, the country’s deteriorating infrastructure, and the world’s transition to clean energy—concluding that it is unlikely that Venezuelan oil production and exports will recover significantly over the short term.

Introduction

After the Trump Administration’s military incursion into Venezuela and capture of the former Venezuelan leader, Nicolás Maduro, President Trump urged U.S. oil companies to invest in the oil industry in Venezuela. “We’re going to have our very large United States oil companies, the biggest anywhere in the world, go in, spend billions of dollars, fix the badly broken infrastructure, the oil infrastructure, and start making money for the country,” said President Trump at a press conference.

As of 2023, Venezuela had one of the world’s largest proven crude oil reserves at approximately 303 billion barrels, which accounted for about 17 percent of total global reserves. The Venezuelan heavy crude is suitable for U.S. refining infrastructure as 70 percent of U.S. refining capacity is designed to process heavier crude.

Despite Venezuela’s vast oil reserves, its oil production has dropped substantially from about 3.5 million barrels per day in 1997 to 0.9 million barrels per day in 2024, which is about 1 percent of the world’s total crude oil production (79 million barrels per day).

This insight provides an overview of Venezuela’s crude oil reserve and production and analyzes the potential challenges to investment, including uncertainty in political stability, muted appetite of global oil markets, the country’s deteriorating infrastructure, and the world’s transition to clean energy, and concludes that it is unlikely that Venezuelan oil production and exports will recover significantly over the short term.

Venezuela Oil Reserve and Production

As of 2023, Venezuela had one of the world’s largest proven crude oil reserves at approximately 303 billion barrels, which accounted for about 17 percent of total global reserves. Most of the country’s oil reserves are concentrated in the Orinoco Belt, and require dilution for export or refining.

The Venezuelan heavy crude is suitable for U.S. refining infrastructure as 70 percent of U.S. refining capacity is designed to process heavier crude, which is mostly imported from Canada. Most of the oil produced in the United States is lighter and cannot be easily refined domestically.

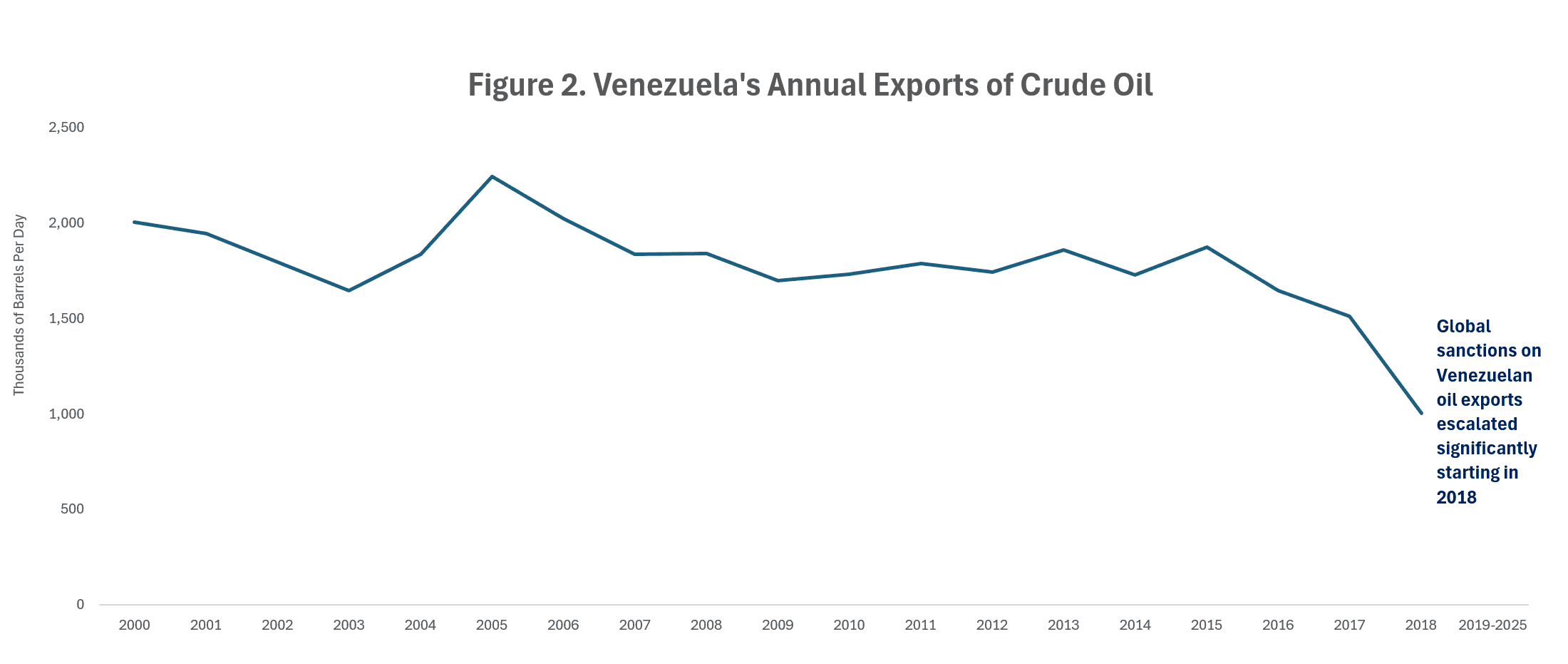

Despite Venezuela’s vast oil reserves, as shown in Figure 1, its oil production has dropped substantially from about 3.5 million barrels per day in 1997 to 0.9 million barrels per day in 2024, which is about 1 percent of the 79 million total barrels of crude produced worldwide per day. This sharp decline in oil production started several years after Maduro first came to power in 2013 due to a range of factors, including mismanagement of the oil industry, deteriorating infrastructure, and strict U.S. sanctions. These sanctions on Venezuelan oil exports were imposed in response to the Maduro regime’s involvement in “criminal, antidemocratic, or corrupt actions.” As a result, as shown in Figure 2, Venezuelan oil exports also declined significantly starting in 2015 to almost none as of now, except black market exports through the shadow fleet aimed at circumventing the sanctions.

Source: U.S. Energy Information Administration

Source: U.S. Energy Information Administration

Potential Challenges

Although President Trump has strongly urged U.S. oil companies to invest in the crude oil industry in Venezuela, there are tremendous challenges:

- Uncertainty in political stability: Venezuela’s domestic political stability is arguably one of the most important factors that determine whether U.S. or other Western oil companies feel comfortable tapping into the country’s large oil reserves. Many oil companies will likely wait and observe how the political situation unfolds in Venezuela before jumping in with large investments.

- Muted appetite of global oil markets: Relatively low oil prices ($63/barrel for Brent crude oil in December 2025) and oversupply in the global oil market mean that there is not an urgent appetite for oil companies to invest in the Venezuelan oil industry. In fact, the ouster of Maduro has had minimal impact on global oil prices, with Brent crude futures trading around $61 a barrel. This shows investors’ expectations that there are enormous barriers to increasing Venezuelan oil production and exports. What makes it more challenging is that Venezuela is a founding member of the Organization of the Petroleum Exporting Countries (OPEC), which tends to limit oil production to keep oil prices from falling too low.

- Deteriorating infrastructure: After undergoing many years of lack of investment and maintenance, dilapidated infrastructure in Venezuela poses significant challenges to companies that wish to extract oil. These companies need to decide whether the rate of return on Venezuelan oil investment is worth the steep costs of revitalizing the infrastructure. The only U.S. oil company currently operating in Venezuela is Chevron, generating between a quarter to a third of the country’s total crude oil output.

- World’s transition to clean energy: Fossil fuels will continue to be an important global energy source for the next several decades, especially with soaring power demand from artificial intelligence. As the world is transitioning to clean energy sources, however, unilateral policies such as the European Union’s official carbon border adjustment mechanism have started to levy tariffs based on the carbon emissions associated with traded goods. Venezuela’s highly carbon-intensive oil production, especially its methane emissions (direct venting of methane equal to Colombia’s entire annual natural gas consumption) would make it less competitive in a future where carbon emissions are discouraged.

In view of these major challenges, it is unlikely that Venezuelan oil production and exports will recover significantly over the short term, which means that it will have a minimal impact on the world’s oil market. It remains to be seen how geopolitical developments will unfold over the next several months and how they will affect the oil industry in the country.