Insight

April 24, 2018

Raising the Gas Tax is Not a Long-Term Fix for the Highway Trust Fund

Executive Summary

- As of 2021, the Highway Trust Fund – a primary source of federal funding for highway and transit projects – will be insolvent.

- There are several proposals being considered by Congress to address the funding shortfalls of the Highway Trust Fund, including, but not limited to, raising the current gas tax, indexing the gas tax, and replacing the gas tax with a mileage-based tax.

- This study evaluates current proposals and concludes that a combination of the proposals is needed to capture the cost of highway use and stabilize the Highway Trust Fund.

Introduction

Earlier this year the Trump Administration released its principles for an infrastructure plan.[1] Notably absent was mention of the Highway Trust Fund (HTF) and its funding shortfalls. Money from the HTF, which is financed through federal fuel and truck-related taxes, is distributed to federal highway and transit projects. Roughly 25 percent of annual spending on highways and mass transit comes from the federal government. While it is the government’s main source of highway funding, the HTF has seen underwhelming revenues and is expected to go bankrupt in 2021.[2] The trust fund’s impending insolvency raises the question: What is Congress going to do to fix the HTF?

Legislative leaders have pointed to the current federal gas tax as the cause of low revenues. The federal gas tax has not been raised in over 20 years, failing to keep up with the rising costs of highway spending due to inflation. Some members of Congress, and at one point President Trump himself, suggested raising and indexing the gas tax to fix the HTF. Other members of Congress, however, have argued the gas tax should be replaced by a mileage-based user fee.

As Congress begins to draft several infrastructure bills over the upcoming months, it will have to address the funding shortfalls of the HTF. Unfortunately, a one-size-fits-all solution will not work for the HTF. To prevent further transfers from the General Fund, the HTF needs to secure long-term funding. The best way to secure this funding is through a combination of new user fees implemented alongside the existing gas tax.

History of the Highway Trust Fund

Congress established the Highway Trust Fund (HTF) to pay for the newly created Interstate Highway System.[3] While the HTF was only intended to finance highways, Congress determined that some of the tax receipts directed to the HTF should be used to fund mass transit needs. As a result, the HTF was separated into two accounts: the Mass Transit Account and the Highway Account.[4] The Mass Transit Account supports federal light-rail and mass transit projects, while the Highway Account supports the interstate system. All HTF receipts not specifically designated to the Mass Transit Account go to the Highway Account.

During the 1980s the HTF had a positive balance. An increase in the tax rate on highway and motorboat fuels in 1990 helped the HTF to grow steadily during the 1990s. In response to the fund’s rapid growth, Congress passed legislation that increased HTF spending to spend down the fund’s accumulated balance. Beginning in 2000, and nearly every following year, HTF outlays have exceed its revenues.

Under current law, the HTF cannot incur negative balances, nor can it borrow funds to cover unmet obligations. Consequently, Congress has passed short-term measures authorizing transfers from the General Fund of the Treasury to the HTF. The most recent measure is set to expire after FY2022, threatening the solvency of the HTF. For investment in our nation’s infrastructure to continue, the HTF needs to be fixed.

Fixing the HTF

Congress has several options to preserve the long-term solvency of the HTF. First, Congress could simply limit highway spending. Since FY2008, highway spending has exceeded HTF revenues, requiring transfers from the General Fund. If Congress limited highway spending to only expected HTF revenues, the fund would rarely require transfers.

Another option is to limit the use of HTF revenues to the repair and expansion of highways, instead of both highways and transit projects. The Mass Transit Account receives an estimated 16 percent of HTF revenues, and all of these funds come solely from federal fuel and truck-related taxes, not transit-related taxes.[5] While investment in transit is necessary, the gas tax only captures highway use. Thus, there is an argument that revenues should only be used for the repair and expansion of highways.

While these options would help to keep the HTF solvent, both options would reduce federal funding for U.S. infrastructure. Meanwhile, the American Society of Civil Engineers estimates that by 2025 the United States will only be able to pay 50 percent of the infrastructure investment needed to maintain a state of good repair.[6] The best way to keep the HTF stable and increase investments in our infrastructure is to secure more long-term funding for the HTF. Proposals being considered in Congress include, but are not limited to, raising the gas tax and indexing it to inflation, replacing the gas tax with a mileage-based tax, and congestion pricing.

- Raise/Index the Gas Tax

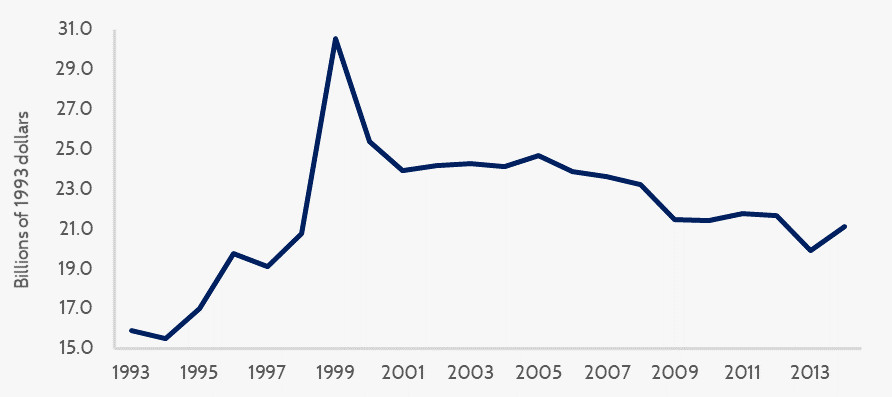

Low HTF revenues are often attributed to the insufficient fuel tax rates. The federal gas tax and diesel tax have remained at 18.4 cents and 22.4 cents, respectively, since 1993. Neither tax is indexed to inflation, meaning each year since 1999 the purchasing power of revenues from the taxes have generally been decreasing, as shown in Figure 1.

Figure 1: Net Revenues to the Federal Highway Trust from Taxes on Gasoline, Gasohol, and Diesel (in billions of 1993 dollars), 1993-2014 Source: Federal Highway Administration

Source: Federal Highway Administration

Raising the gas tax would increase HTF revenues and move the tax to a more effective rate. Additionally, indexing the gas tax to inflation would help to prevent the purchasing power of revenues from decreasing. Had the gas tax been indexed for inflation, the tax rate for 2017 would have been 31 cents per gallon, while the tax on diesel indexed for inflation would have been roughly 42 cents.[7] As the purchasing power of the federal gas tax has fallen, 39 states have opted to raise their own state gas tax since 1993.[8]

Supporters of an increase in the gas tax include the U.S. Chamber of Commerce, the American Trucking Association, and several members of Congress. The Chamber has said it will push for a 5-cent per year increase for five years, totaling a 25-cent increase, and the adjustment of the fee to inflation thereafter.[9] The American Trucking Association echoed the Chamber, expressing its support for a 20-cent per gallon increase, phased in over four years.[10] And earlier this year the Problem Solvers Caucus – a 48-member bipartisan group in the U.S. House of Representatives – recommended Congress raise the gas tax.[11]

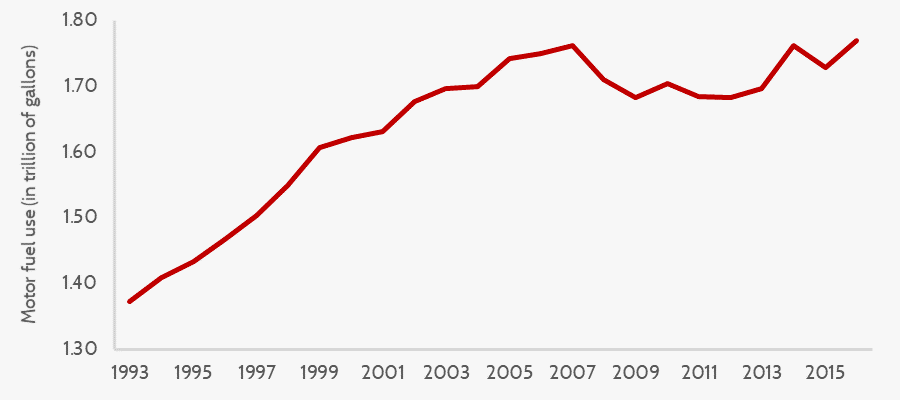

While groups have warmed to the idea of increasing the gas and fuel tax, there is concern over the sustainability of the gas tax to support highway spending. Figure 2 below shows a decrease in gas after motor consumption peaked in 2007. From 2007 to 2016, fuel consumption has grown by a total of 0.39 percent.

Figure 2: Motor Fuel Use (in trillions of gallons), 1993-2016 Source: Federal Highway Administration

Source: Federal Highway Administration

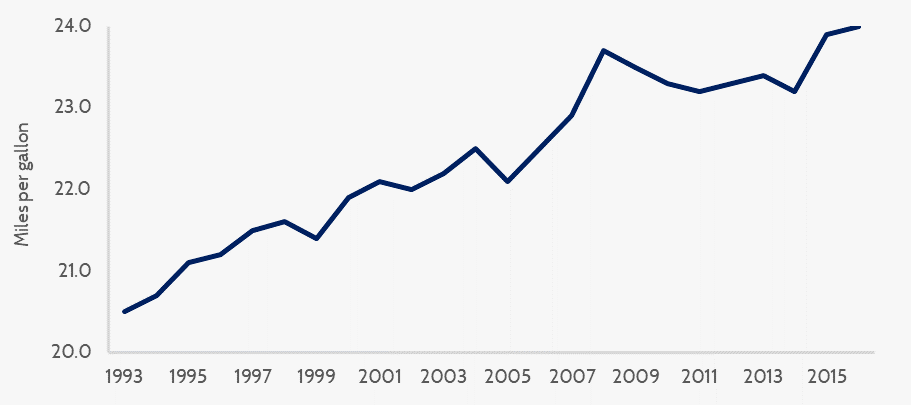

Skeptics of raising the tax point to increased fuel efficiency of vehicles and the development of alternative fuel vehicles as threats to future gas consumption – and thus to the sustainability of the tax itself. Cars today require less fuel than ever before. According to the U.S. Energy Information Administration, the average fuel economy of passenger vehicles has increased by 17.1 percent from 1993 to 2016. Figure 3 shows how fuel efficiency has increased since the gas tax was last raised.

Figure 3: Fuel Economy of Passenger Vehicles[12] (in miles per gallon), 1993-2016 Source: U.S. Energy Information Administration

Source: U.S. Energy Information Administration

Greater fuel efficiency means less fuel consumption, and less consumption means less revenue from a gas tax. Given this concern, Congress has begun to explore the implementation of a mileage-based tax.

- Replace Gas Tax with a Mileage-Based User Fee

Some have proposed a mileage-based user fee as a financing mechanism to replace the traditional gas tax in the United States. Rather than taxing motorists for every gallon of gas purchased, the mileage-based tax would charge motorists a fee for every vehicle-mile they travel.

Oregon was the first state in the United States to pass a law implementing a mileage-based user-fee program to pay for its transportation system. Prior to implementing the mileage-based program, Oregon piloted the user-fee program twice before, once in 2006 and again in 2012. Under Oregon’s current program, a driver contributes 1.5 cents for each mile driven, regardless of rural or urban location or the vehicle’s fuel efficiency. Pilot programs have also begun in California, Colorado, Hawaii, and Washington. Nine other western states have begun researching implementation of a mileage-based tax. (These states are members of RUC West, a voluntary coalition of state departments of transportation committed to collaborative research and information sharing on the development of alternative funding methods for transportation infrastructure; RUC stands for Road Usage Charge.)

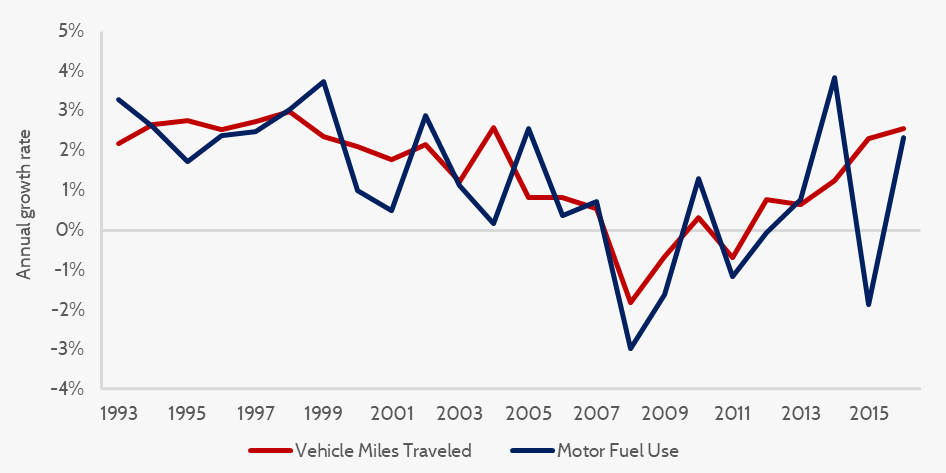

Implementing a mileage-based tax in place of the current gas tax would help to restore stability to the HTF. Vehicle-miles traveled have been growing at a greater rate than motor fuel use since the gas tax was last raised. Figure 4 shows the average annual growth rates of both vehicle-miles traveled and motor fuel use from 1993 to 2016. While it appears that the growth of vehicle-miles traveled and motor fuel use have followed a similar trend, between 1993 to 2016 vehicle-miles traveled grew by 41.3 percent compared to a 33.1 percent growth in motor fuel use. Over that period the average annual growth rate of vehicle-miles traveled was 1.6 percent, roughly 0.4 percentage points higher than the annual average growth rate of motor fuel use. From 2009 to 2016, the average annual growth rate of vehicle-miles traveled was 0.92 percent, roughly 0.3 percentage points higher than motor fuel use.

Figure 4: Annual Growth Rates of Vehicle Miles Traveled in the United States and Motor Fuel Use, 1993-2016  Source: Federal Highway Administration

Source: Federal Highway Administration

The growth in vehicle-miles travelled has been attributed, in part, to ridesharing services. Uber and Lyft have attracted some commuters away from public transit, biking, and walking. Development of autonomous vehicles may also increase the number of annual vehicle-miles traveled.

Still, both the gas tax and the mileage-based tax do not capture the negative externalities caused by congestion.

According to the American Society of Civil Engineers, in 2014, congestion caused 6.9 billion hours in delays – 42 hours per rush-hour commuter – and wasted more than 3 billion gallons of fuel. The lost time and wasted fuel totaled $160 billion in costs or $960 per commuter.[13] To address this issue, several states have implemented toll roads that use congestion pricing.

- Implement Congestion Pricing

Congestion pricing aims to reduce rush-hour traffic by incentivizing commuters to use other transportation modes – e.g. carpools, biking, transit – or to travel during off-peak hours. This incentive is typically created by varying toll prices based on demand. Depending on the time of day or the amount of traffic on the road, tolls will increase or decrease accordingly. Rates can be set in advance or set dynamically by Traffic Management Centers.

Other industries apply the same principle behind congestion pricing. Airlines charge higher prices during the holidays when more individuals will be flying. Similarly, hotels charge higher rates for rooms when there is an event or convention in town because the demand is higher.

London successfully implemented congestion pricing in 2003. To enter central London, motorists are charged anywhere between $15 and $20 dollars. The scheme generated over $170 million net between 2005 and 2006. By 2006, congestion in central London had fallen by 26 percent from 2002 levels

In the United States, Virginia implemented congestion pricing in 2017 along Interstate 66 express lanes. Those who drive alone along the express lanes during rush hour are required to pay a toll, while carpoolers can use the road for free. Toll prices adjust every six minutes depending on traffic. Following the implementation of congestion pricing, drivers on Interstate 66 saw a 45 percent drop in average travel time, compared to the previous year, along the tollway during the morning commute hour.[14]

Congestion pricing encourages drivers to use non-interstate routes or adjust travel times to accommodate for rush hour. It can also encourage commuters to use alternative modes of transportation such as biking, rail, and buses. These changes in behavior can significantly lower interstate congestion levels and save commuters time and money. Furthermore, the implementation of congestion pricing would better capture the total cost of drivers’ highway use – wear and tear to roads, hours wasted in traffic, and the additional emission of air pollutants due to traffic.

Is There a Best Way to Secure Long-Term Funding?

A mileage-based tax is a more stable alternative to the gas tax. Immediate implementation of a federal mileage-based tax, however, is unrealistic. At a House Highways and Transit Subcommittee hearing on long-term infrastructure funding, Michael Lewis, Executive Director of the Colorado DOT and speaking on behalf of RUC West, claimed a national mileage-based user charge is 10 years away from full implementation. While Congress may be eager to implement the user fee, states cannot make a change to a tax scheme that is not yet fully developed. Given that the HTF is estimated to become insolvent in 2022, a mileage-based tax will not address imminent funding issues. And neither the mileage tax nor the gas tax addresses the costs associated with congestion.

In order to address the HTF solvency problems (both short and long-term) and capture costs associated with congestion, Congress should consider a combination of user fees. To keep the HTF solvent in the short-term, Congress should consider a gas tax increase (along with indexing). Although a mileage-based tax is more effective at securing reliable highway funding, the HTF will become insolvent before any such tax can be implemented nationally. To secure the necessary funding for infrastructure investment until the mileage-based tax can be fully implemented, Congress should look at ways to improve the existing gas tax.

While more states have begun developing and testing their own mileage-based pilot programs, more research on a mileage-based tax is needed to address questions around implementation and systems design. These issues – including whether drivers on uncongested rural roads should be charged the same as drivers on congested urban roads, and how to charge fairly vehicles that drive across state lines – remain unresolved under current pilot programs. Congress should incentivize additional pilot projects focused on the transition to a mileage-based user fee in order to assess the functionality of and public reaction to existing pilot projects. Congress should also consider creating a pilot project to implement a mileage-based user fee on fully automated vehicles. Expanding pilot programs enables Congress to phase in the mileage-based tax alongside the gasoline tax and accelerate the full implementation of the new tax.

Additionally, states should begin exploring the implementation of congestion pricing along highly congested highways and roads. Over two out of every five miles of America’s urban interstates are congested.[15] This costs the country billions of dollars in wasted time and fuel. While congestion pricing would place a financial burden on commuters in urban areas, these areas are disproportionate beneficiaries of federally funded highway apportionments and allocations. Urban areas typically receive more appropriations and allocations, while not necessarily paying more in user fees.[16] This imbalance is possible because some states are effectively “donor” states, as they pay more in taxes than they receive in federally funded highway apportionments and allocations. Congestion pricing would act as an “equity adjustment,” requiring urban areas to pay appropriate fee levels.

Conclusion

The country’s highways and bridges are in dire need of repair. One out of every five miles of highway is in poor condition. Nearly 40 percent of bridges are 50 years or older and over 9 percent of bridges were structurally deficient in 2016. And after years of decline, traffic fatalities increased by 7 percent from 2014 to 2015, resulting in 35,092 deaths on America’s roads.[17] While there is a clear need for infrastructure investment, current and projected HTF revenues are inadequate to meet these needs, let alone future demands.

Congress should consider a combination of user fees to prevent insolvency of the HTF and secure long-term funding for America’s roads and bridges. Reforms to the current gas tax will help temporarily. But to secure future revenues, a mileage-based tax and congestion pricing are more appropriate tax schemes for stable, long-term highway funding. As Congress begins to draft infrastructure legislation, it should consider financing schemes that address the current and future needs of the country’s roads and bridges.

[1] “Legislative Outline for Rebuilding Infrastructure in America,” The White House, (2018), https://www.whitehouse.gov/wp-content/uploads/2018/02/INFRASTRUCTURE-211.pdf.

[2] “Status of the Highway Trust Fund,” Congressional Budget Office, (September 2016), https://www.cbo.gov/publication/52307.

[3] Federal Highway Act of 1956 (Public Law 84-627), https://www.gpo.gov/fdsys/pkg/STATUTE-70/pdf/STATUTE-70-Pg374.pdf.

[4] Surface Transportation Assistance Act of 1982 (Public Law 97-424), https://www.gpo.gov/fdsys/pkg/STATUTE-96/pdf/STATUTE-96-Pg2097.pdf.

[5] Robert S. Kirk et al., “Surface Transportation Funding and Programs Under MAP-21: Moving Ahead for Progress in the 21st Century Act (P.L. 112–141),” Congressional Research Service, (September 2012), https://www.fas.org/sgp/crs/misc/R42762.pdf

[6] “Failure to Act: Closing the Infrastructure Investment Gap for America’s Economic Future,” American Society of Civil Engineers, (2016), https://www.infrastructurereportcard.org/wp-content/uploads/2016/10/ASCE-Failure-to-Act-2016-FINAL.pdf.

[7] Estimates calculated using the Bureau of Labor Statistics CPI inflation calculator.

[8] “Roadmap to Modernizing America’s Infrastructure,” U.S. Chamber of Commerce, (2018), https://www.uschamber.com/sites/default/files/2018_infrastructure_summit_handout_fin.pdf.

[9] Ibid.

[10] “America’s Truckers Challenge Policymakers to Support Bold Infrastructure Plan,” American Trucking Associations, (January 2018), http://www.trucking.org/article/America%E2%80%99s-Truckers-Challenge-Policymakers-to-Support-Bold-Infrastructure-Plan.

[11] “Rebuilding America’s Infrastructure,” Problem Solvers Caucus, (2018), https://reed.house.gov/uploadedfiles/psc_infrastructure_report.pdf.

[12] Figure 2 reports data on passenger vehicles with a wheelbase greater than 121 inches.

[13] “2017 Infrastructure Report Card: A Comprehensive Assessment of America’s Infrastructure,” American Society of Civil Engineers, (2017), https://www.infrastructurereportcard.org/wp-content/uploads/2017/10/Full-2017-Report-Card-FINAL.pdf.

[14] “66 Express Lanes Inside the Beltway Toll Day One Analysis,” Virginia Department of Transportation, (December 2017), http://www.virginiadot.org/newsroom/northern_virginia/2017/66_express_lanes_inside121598.asp.

[15] “2017 Infrastructure Report Card: Roads,” American Society of Civil Engineers, (2017), https://www.infrastructurereportcard.org/wp-content/uploads/2017/01/Roads-Final.pdf.

[16] “The Highway Trust Fund: Collection of taxes,” Federal Highway Administration, (March 2017), https://www.fhwa.dot.gov/policy/olsp/fundingfederalaid/07.cfm.

[17] “2017 Infrastructure Report Card: Roads,” American Society of Civil Engineers, (2017), https://www.infrastructurereportcard.org/wp-content/uploads/2017/01/Roads-Final.pdf.