Insight

January 16, 2024

Six Months of FedNow

Executive Summary

– The development of real-time payment networks, allowing for effectively instantaneous money transfers, was led by private industry before the surprise announcement by the Federal Reserve in 2018 of a competing, government-operated real-time payment system, FedNow.

– The development of FedNow would prove to be costly, time consuming, and duplicative, and would discourage competition and slow the progress of existing real-time services; moreover, it is likely not consistent with the Fed’s own mandate.

– Six months after launch, few of these concerns have been addressed. While private real-time payment networks saw negative impacts on the market during the development of FedNow, post-launch business may actually have improved; yet despite the size and scale of the Fed’s intervention in the economy, it has declined to provide the data required to assess the adequacy or success of its initiative.

Introduction

The advent of electronic banking allowed for the development of real-time payment (RTP) networks globally, providing consumers access to instantaneous or effectively instantaneous transfers of money between bank accounts. Unlike some other countries, in the United States the development of RTP platforms has been championed by a few private actors, most notably The Clearing House (TCH), Mastercard, PayPal, Venmo, and Zelle, together servicing the needs of hundreds of banks and billions of dollars in electronic transactions.

It took many by surprise, then, when in October 2018 the Federal Reserve (the Fed) announced the creation of a competing, government RTP network. Four years later, in July 2023, the Fed launched its FedNow RTP network. The system has been live now for six months, giving us the opportunity to review the progress of one of the most expensive, duplicative, and anticompetitive initiatives ever launched by the Fed.

A Brief Overview of FedNow

Consider the payment system as the “plumbing” or infrastructure that supports the broader financial system. If the support system is better and faster, the economy as a whole runs more efficiently. For decades, the plumbing for electronic payments in the United States created lag time. A consumer would authorize another party to “pull” money from their account, involving multiple parties in the process, which takes time. Even companies offering rapid payments, at the time most notably Venmo, did not offer truly instantaneous account-to-account payments: Venmo effectively fronted the cash and then paid itself back from the payer’s account. Any delay creates problems, as money shortfall is in and of itself an expensive proposition.

RTP systems, in contrast, use “push” technology, allowing individuals to authorize payments leaving their accounts themselves, speeding up the process. Payments in real time benefit consumers and firms by providing access to funds immediately, removing or greatly reducing lag time. RTP platforms also provide for the transmission of more data about individual transactions, allowing businesses a better picture of cash flows and more seamless integration with other systems such as invoicing and bill payment. Firms have better access, management, and forecasting over their individual capital requirements with real-time payments, reducing back-office costs. Even consumers less likely to have a gap in personal finances prefer a system that prioritizes speed and convenience. As for safety, advanced technology solutions better mask sensitive account numbers via a “tokenization” process, which creates unique party identifiers, meaning account numbers are shielded within the system.

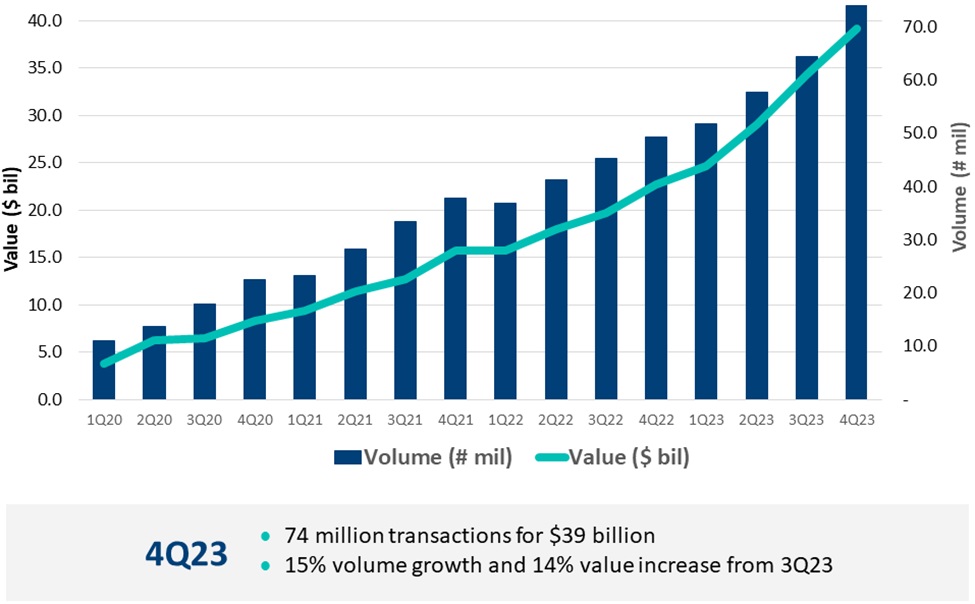

Until recent years the U.S. approach had been to allow for private industry to create solutions meeting consumers’ needs. With the support of the Fed, in TCH rolled out its RTP service in 2017. TCH now supports over half of all U.S. accounts and has shown remarkable growth. Although the most important actor in this space, it is not the only private provider of real-time (or nearly real-time) payment services, which include offerings (and competition) from PayPal, Venmo, Zelle, and Mastercard.

Source: The Clearing House

This emphasis on private solutions makes the Fed’s decision to enter this market particularly surprising. In October 2018, the Fed announced that it was developing its own real-time payment system, FedNow.

At the time, I noted that the Fed’s decision to pursue FedNow would be costly, time consuming, duplicative, discourage competition, slow down the development progress of real-time services, and likely be unsupported by the Fed’s own mandate. Furthermore, unless the Fed could demonstrate evidence of a market failure, a decision to proceed would be entirely without basis. Regardless, on July 20, 2023, some four years after the first announcement, the Fed launched FedNow.

FedNow, Six Months Later

Six months later, the Fed has done nothing to strengthen the constitutional basis for FedNow – if anything can be done. The Fed’s decision to launch FedNow was in theory governed by the 1980 Monetary Control Act, which notes that the Fed should intervene only if “the service is one that other providers alone cannot be expected to provide with reasonable effectiveness, scope, and equity.” Although adoption of a real-time payments system for consumers in the United States has been slow by comparison to the European Union and other nations, there is simply no evidence of a market failure that would justify the Fed’s intervention. Likewise, to be both participant and regulator in the economy remains a glaring conflict of interest. Serious questions remain as to the private sector’s ability to compete on an even playing field, with FedNow enjoying systemic advantages including participation fee waivers. Similarly, concerns as to the ability of the federal government to appropriately safeguard data privacy, prevent breaches, as maintain consumer protections have not been addressed by the Fed.

Procedurally speaking, estimates that the development of FedNow would be both lengthy and expensive proved correct; while four years is perhaps not an unreasonable timeline for government enterprise, The Wall Street Journal reported in late 2023 that the creation of a new RTP set of rails had cost the taxpayer over half a billion dollars. Again, while this is perhaps an appropriate sum of money for such an enormous undertaking, the question remains why the Fed spent that money on a duplicative system at all. Critics also pointed to the likelihood that the Fed’s RTP platform would not be interoperable, with customers needing to run multiple systems that are not necessarily capable of communicating with each other, which would be cumbersome for instantaneous clearing.

Where things become more curious is on the anti-competitive thrust of FedNow. I previously noted that government bodies entering public markets reduces competition, stopping or slowing down innovation. Between the announcement and launch of FedNow, TCH and other networks saw a “chilling” effect as banks and credit unions paused the adoption of private RTP networks for fear of incompatibility with FedNow. Six months after launch, however, the position seems to be remarkably different. TCH CEO David Watson noted that the launch of FedNow may actually have encouraged banks and credit unions to join the TCH RTP network, with 130 new members joining TCH, about double the numbers seen in the previous year. Currently, TCH has about 456 members, with FedNow reporting 360 members of its own – with at least 100 of these institutions holding membership with both systems. Little has been revealed to date as to the interoperability of these systems.

That lack of data remains the chief criticism of FedNow. Unlike TCH, the Fed does not reveal statistics as to the value or volume of transactions processed by FedNow. It is astounding that the Fed would go so far out of its way to create a duplicative system and then provide little to no reporting as to its practical utility. This omission is particularly noteworthy in light of the Monetary Control Act’s inclusion of language relating to equity. Some would argue that the costs of FedNow are outweighed by the results – that disparate impact has been eliminated and the creation of FedNow has led to better outcomes for the categories of consumer the Fed is most keen to support. If this is the case, the Fed should make this argument with data.

Other Payment Developments

FedNow is not the only federal foray into the payments industry, and the impact of FedNow should not be considered in a vacuum. Insufficient clarity as to the success, functioning, or even basic market necessity of FedNow has not prevented the Fed and Congress from pursuing other payment initiatives. The Durbin-Marshall Credit Card Competition Act was first introduced in 2022, when it showed no signs of advancing even out of committee and nonetheless has since been reintroduced. The bill would, ostensibly, introduce competition into the credit card market by forcing banks to provide an alternate payment processing network (other than Visa or Mastercard) on purchases, while also setting caps on interchange fees. Similarly, the Fed is working on a proposal requiring banks to lower debit card swipe fees.

In theory, other networks would offer cheaper processing fees, passing savings onto consumers. The problem is that, as has been seen in previous iterations of this legislation, retailers unequivocally decline to lower prices (more than 20 percent actually raised prices). Similar programs led to a series of other unintended consequences, from raising the prices on checking accounts to slashing loyalty and rewards programs – with some banks noting that these fees are vital to keeping consumers safe from fraud.

Conclusions

FedNow remains a fascinating experiment by the Federal Reserve in the creation of a full-scale, government-operated, real-time payment system from scratch. While it is fortunate that private industry does not appear to have suffered from the introduction of a federal competitor (at least post-launch of FedNow), questions remain as to the necessity or mandate of the Fed in providing this government alternative at all. Taxpayers deserve greater insight into the operation of FedNow, including value and volume processing data, to better assess the impact of such a sizeable assault on the existing private networks.