Insight

December 22, 2021

Spurring Energy Sector Innovation

Executive Summary

- The Build Back Better Act (BBBA) includes provisions that extend existing tax credits and create new ones for the energy industry.

- Countering the growth of greenhouse gas emissions requires novel technologies that have not yet been deployed at scale and would benefit from production and investment credits.

- The BBBA should employ a technology-agnostic approach in combination with a planned phase-down of credits as market penetration increases to prevent continued subsidization of technologies that have achieved widespread market adoption.

Introduction

The Build Back Better Act (BBBA) includes House Ways and Means Committee reconciliation recommendations to extend existing and introduce new tax credits for the energy sector.[1] Generally, the proposals continue to incentivize energy infrastructure developers to build commercialized clean energy technologies, such as wind and solar. While some credits simply extend existing incentives, others also phase down the value of the credit in future years under the presumption they would be less beneficial.[2]

The Energy Sector Innovation Credit (ESIC) Act of 2021[3], introduced in July, would provide both investment and production tax credits for emerging energy technologies that are not currently eligible for such tax credits. By doing so, the bill aims to bring novel energy solutions to market. The bill would reduce the value of these credits as market penetration increases. Such provisions, however, have not been included in the BBBA.

Effectively addressing climate change will require the implementation of nascent technologies that have not yet been commercialized or gained market share. These technologies can be more rapidly commercialized with the assistance of tax credits that are discontinued when the technology gains market share. Rather than continue to subsidize existing technologies that have been steadily adopted with the help of tax credits, future credits aimed at supporting technologies that would reduce greenhouse gas emissions may be better targeted at filling gaps in generation technology. In short, the aim of government influence in the renewable energy sector should be simply to foster the development and adoption of critical new technology. Policies should not aim to pick winners and losers, specify labor requirements, or simply sustain already-successful preferred technology–none of these strategies is conducive to the most rapid development of the best technologies, nor the best use of taxpayer dollars.

Trends in Technological Adoption

The BBBA extends eight existing production and investment tax credits. It also introduces new tax credits including transmission and advanced energy property credits, nuclear power and hydrogen production, advanced manufacturing investment and production credits, and sustainable aviation fuel credits for blenders. These new credits largely seek to incentivize the use of existing technologies and are structured to provide additional value to projects that meet labor requirements, such as prevailing wages and apprenticeship requirements, or domestic content requirements for materials.

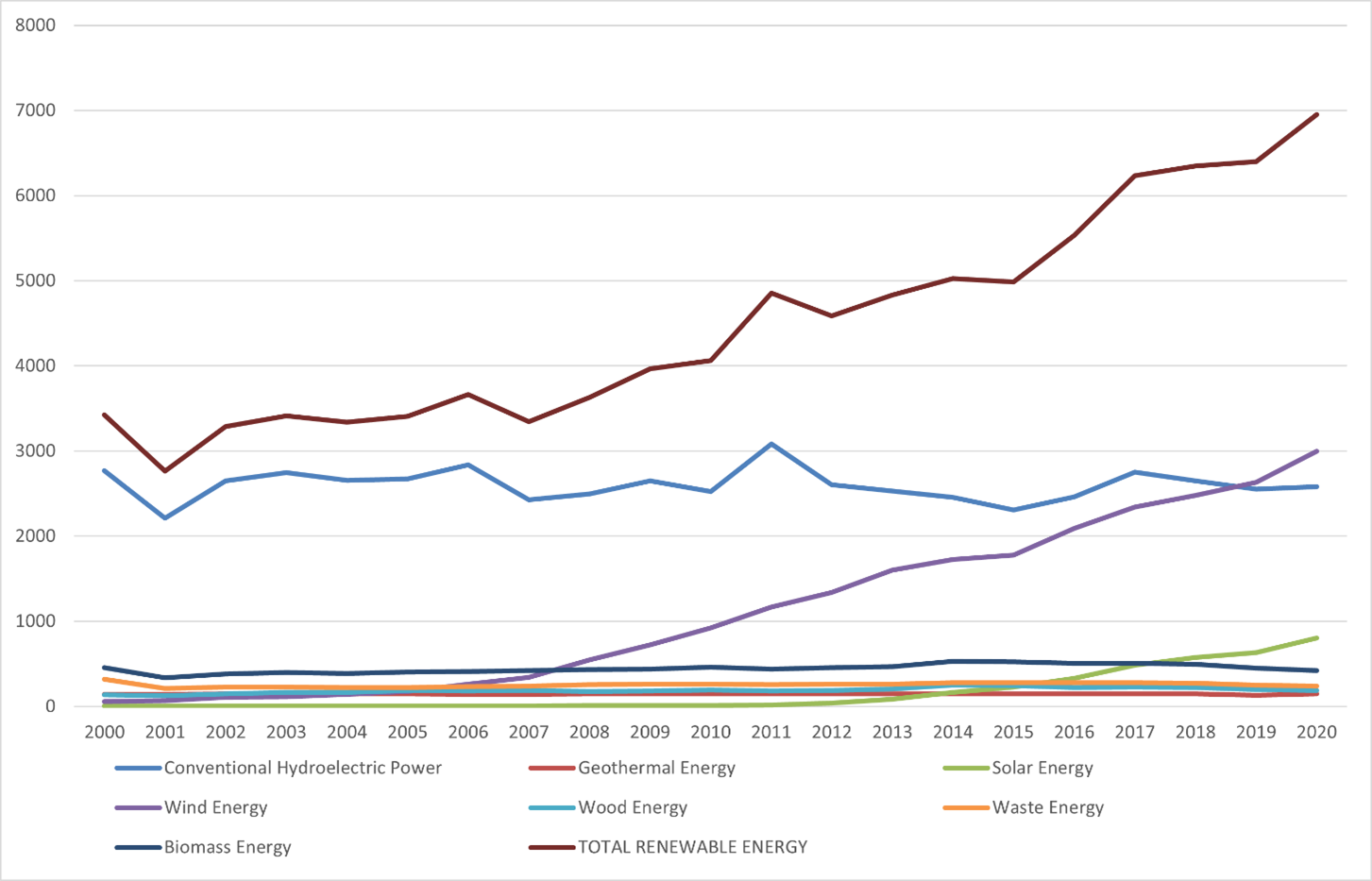

Throughout the past 15 years, wind and solar facilities have contributed to the growing quantity of renewable utility-scale production, as demonstrated in the chart below. According to the Solar Energy Industry Association, “In the last decade alone, solar has experienced an average annual growth rate of 42%.”[4] In 2020, renewable resources provided about 20 percent of the electricity consumed in the United States.[5] Under the BBBA, their owners and operators would continue to receive tax credits while novel technologies would not, despite the need to fill technological gaps in order to abate emissions.

Power Consumed by the Electric Power Sector (Trillion Btu)

Source: EIA

Source: EIA

To prevent the escalating effects of climate change, atmospheric temperature growth must be halted by mitigating the effects of existing greenhouse gas emissions and preventing further emissions. Emissions are generated by various sectors, and as a result, various technologies must be adopted to reduce the impact of greenhouse gases on the atmosphere. Simply continuing to subsidize commercialized technologies will lead to a more uncertain climate future by failing to comprehensively address greenhouse gas emissions throughout the generation sector.

Novel Technology

The ESIC Act of 2021 provides qualified emerging energy facilities with an emerging energy technology credit. Qualifying facilities generate electricity using a technology that emits less than 110 grams of carbon dioxide equivalent per kilowatt-hour and are placed in service after the passage of the bill. A facility is placed in a tier based on the market penetration of the technology it relies upon to determine the percentage of capital investment for which the facility will receive credit. When a technology reaches 3 percent of market share, it would no longer qualify for the credit.

The ESIC also includes an emerging technology production credit. The production credit is also applied as a percentage, determined by calculating and comparing the annual gross receipts from the sale of electricity generated at the facility to the product of 150 percent of the national average wholesale price of a kWh of electricity in the calendar year two years prior, multiplied by the number of kWh produced at the facility. The lesser value determines the percentage of production subject to the tax credit, as demonstrated in the table below. Like the technology credit, the production credit is only available for those technologies that have less than 3 percent market share.

ESIC in Practice

|

Market Penetration |

Investment Tax Credit | Production Tax Credit | ||

| Qualified Generators | Carbon Capture | Energy Storage | Qualified Generators | |

| Tier 1 ( <0.75% ) | 40% | 40% | 40% | 60% |

| Tier 2 ( 0.75-1.49% ) | 30% | 30% | 30% | 45% |

| Tier 3 ( 1.50 – 2.24%) | 20% | 20% | 20% | 30% |

| Tier 4 ( 2.25 – 3% ) | 10% | 10% | 10% | 15% |

The ESIC would exclude those technologies already receiving credits rather than replacing existing production and investment tax credits. In addition, it excludes facilities that benefit from Section 45 of the tax code which provides various tax credits, such as those employing carbon capture and storage.

Benefits & Risks

The ESIC would not only benefit the owners of facilities but also send a broader market signal. Commitment to the energy transition has ebbed and waned with each administration choosing to prioritize the development of particular technologies or focus on specific sectors. An amendment to the tax code, on the other hand, would demonstrate continuity that would incentivize investment.

Attaching a phase-out process to the credits ensures they are only available to get technology off the ground—not to sustain industry that can stand on its own. Rather than relying on a date to retire a tax credit, which inevitably is delayed by follow-on legislation, market penetration is a better indicator of success. Risks are also associated with this approach. The method for determining market penetration, including properly defining the scope of the market, can lead to misapplication of the credit.

As it currently stands, the BBBA attempts to tackle broader economic issues, including labor and trade, in conjunction with its climate change mitigation efforts by providing tax credits subject to various conditions. Rather than continuing to subsidize technologies that have gained a foothold in the market, future legislation should focus on incentivizing investment in the technologies we have yet to commercialize. A tax credit with a mechanism that reduces its value as adoption grows can effectively address this need.

[1] https://waysandmeans.house.gov/sites/democrats.waysandmeans.house.gov/files/documents/SUBFGHJ_xml.pdf

[2] https://taxnews.ey.com/news/2021-9027-house-approves-build-back-better-act-reconciliation-bill

[3] https://www.govtrack.us/congress/bills/117/hr4720/text

[4] https://www.seia.org/solar-industry-research-data

[5] https://www.eia.gov/energyexplained/electricity/electricity-in-the-us.php