Insight

October 24, 2025

SSA Announces 2.8-percent Social Security COLA for 2026

Executive Summary

- The Social Security Administration (SSA) has announced that the cost-of-living adjustment (COLA) for Social Security benefits in 2026 will be 2.8 percent.

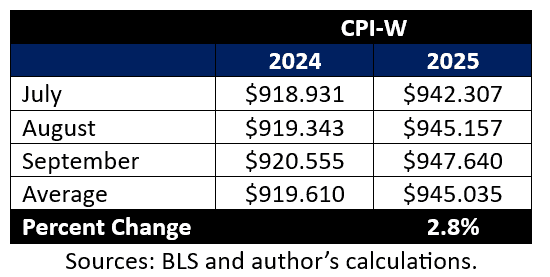

- The 2026 COLA was calculated using a formula that measures the percent change from the third quarter of 2024 to the third quarter of 2025 in the Consumer Price Index for Urban Wage Earners and Clerical Workers, or the CPI-W, a narrow price index.

- The method for calculating the COLA is outdated and would likely change in any meaningful Social Security reform.

Introduction

The Social Security Administration (SSA) has announced the cost-of-living adjustment (COLA) for Social Security benefits in 2026 will be 2.8 percent. As a result, average benefits for the 71 million Americans on Social Security will increase by $56 per month ($672 per year), which could give a slight boost to economic activity.

The 2026 COLA is 0.2-percentage points above the 2025 COLA of 2.5 percent and 0.3-percentage points below the 3.1-percent average COLA over the past decade. In addition, SSA announced the Social Security taxable maximum will increase by $8,400 (5 percent), from $176,100 in 2025 to $184,500 in 2026.

Historical Context

In July of 1972, President Nixon signed into law H.R. 15390, which increased the statutory debt limit and reformed Social Security’s Old-Age and Survivors Insurance and Disability Insurance programs. Among the changes was a new mechanism for automatically adjusting benefits to account for price increases. These annual COLAs took effect in 1975 and have remained largely unchanged in their calculation since.

Since 1975, the COLA has averaged 3.7 percent. It peaked at 14.3 percent in 1980 and 11.2 percent in 1981 when the U.S. economy was in a recession. Social Security beneficiaries received a 0-percent COLA in 2010, 2011, and 2016, when inflation did not rise enough to trigger a benefit adjustment.

Over the past decade, the COLA has averaged 3.1 percent. Beneficiaries received a 0.3-percent COLA in 2017, which was the lowest non-zero increase since automatic COLAs began. Beneficiaries received a staggering 8.7 percent COLA in 2023 following a period of high inflation. The 2.8-percent 2026 COLA is 0.2-percentage points above the 2025 COLA of 2.5 percent and 0.3-percentage points below the average COLA over the past decade.

How COLAs Are Calculated

The policy rationale for COLAs is the preservation of the real value of Social Security recipients’ benefits. To measure price changes, SSA relies on the Consumer Price Index for Urban Wage Earners and Clerical Workers, or the CPI-W. For a time, the CPI-W was the only price index the Bureau of Labor Statistics produced. Over time, however, federal statistical agencies have improved their data collection and developed more comprehensive price indices. The Bureau of Labor Statistics’ Consumer Price Index for all Urban Consumers (CPI-U) covers over 90 percent of the U.S. population and is generally the most widely cited measure of inflation. The CPI-W only covers about 30 percent of the population, making it a narrower price index. The CPI-W also tends to rise more rapidly than the more representative CPI-U.

Social Security’s 2.8-percent 2026 COLA will become effective for December benefits, payable in January of 2026. The applicable COLA for these benefits is equal to the percentage increase in the CPI-W from the average for the third quarter of the current year (2025) to the average for the third quarter of the last year (2024) in which a COLA became effective.

As the formula specifies, these COLAs move in only one direction. In the event of deflation, benefits are not reduced. In October, BLS releases CPI data, including that for the CPI-W, for September, the final month of the third quarter and thus the last input for calculating COLAs. The COLA that will apply to benefits payable in January of 2026 has thus been calculated:

An Opportunity for Reform

There is consensus that the CPI-W generally overstates inflation because it only looks at price changes for a small sample of goods and does not account for how consumers substitute based on relative prices – a phenomenon known as substitution bias. That is, the CPI-W fails to account for the effects of how, for example, an increase in the price of apples may cause consumers to purchase oranges instead.

A possible reform is to switch to the Chained Consumer Price Index (Chained CPI) for Social Security’s COLA. The Chained CPI is considered a better and more accurate measure of inflation than the CPI-W or the CPI-W, not just for the Social Security COLA but for all federal programs and tax provisions that are indexed to inflation. The Chained CPI grows an average of 0.25-percentage points more slowly per year.

SSA estimates that if the COLA was calculated using the Chained CPI instead of the CPI-W starting with the 2027 COLA, Social Security’s 75-year actuarial imbalance would fall from 3.82 percent of taxable payroll to 3.20 percent of payroll. That is, such a reform would close 16 percent of Social Security’s 75-year shortfall and push the insolvency date of the Social Security trust funds back one year, from 2034 to 2035.

Conclusion

Every year, SSA calculates an automatic adjustment in Social Security benefits to reflect changes in the cost of living, allowing beneficiaries to maintain the purchasing power of their benefits. The 2.8-percent 2026 COLA was calculated using the CPI-W, a narrow price index that tends to overstate inflation. While this approach roughly preserves recipients’ real benefits, it is nevertheless a somewhat outdated index. Reforms to the calculation of the COLA, such as a switch to the Chained CPI, will likely be included in any meaningful Social Security reform effort.