Insight

November 3, 2017

The Tax Cut and Jobs Act of 2017 and the Budget

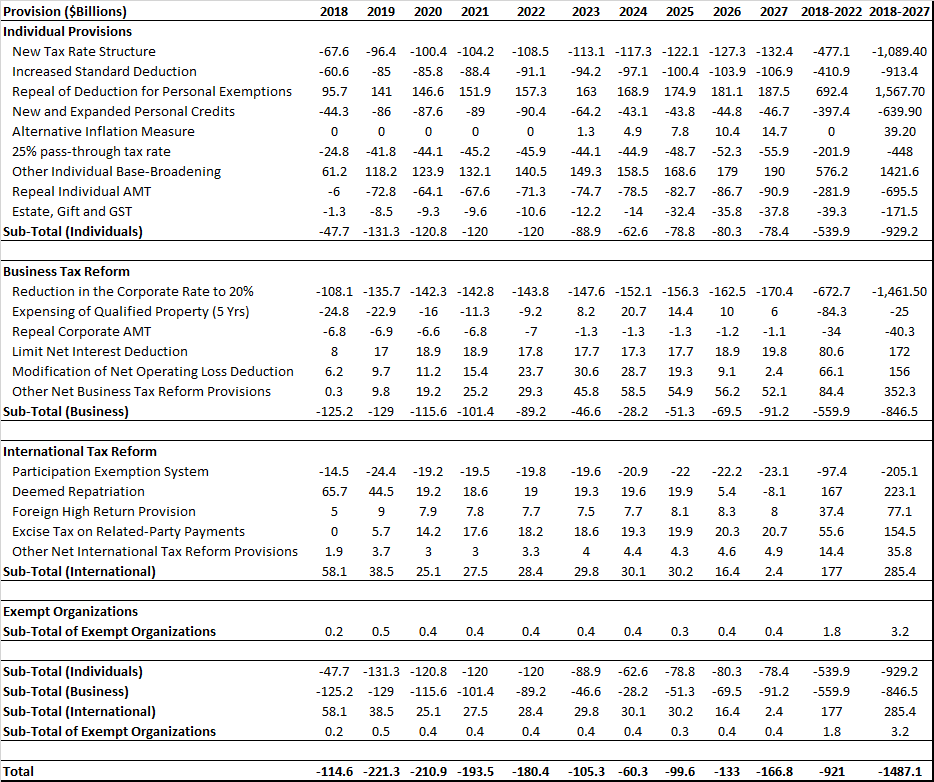

On November 1st, the Ways and Means Committee released its long-awaited House tax reform plan, now codified in the Tax Cut and Jobs Act of 2017 (TCJA). Accompanying the release of the tax bill was the revenue estimate performed by the Joint Committee on Taxation (JCT), which details its budgetary implications. On net, JCT estimates that the TCJA would lose $1,478.1 billion in revenues over the next 10 years, with roughly $5.5 trillion in gross revenue losses against $4 trillion in revenue-raising provisions. This insight examines this revenue loss against a plausible macro-economic feedback scenario informed by previous analysis performed by the Congressional Budget Office (CBO). It is possible that the TCJA could produce adequate growth to offset the majority of the revenue loss as estimated by the JCT.

Table 1: Revenue Effects of the Tax Cut and Jobs Act of 2017

If there has been one persistently bad adage at the intersection of tax and budget policy, it is that tax cuts can “pay for themselves.” Cuts in taxes reduce revenues. However, insofar as taxes raise the cost of labor and capital, they do suppress economic growth. Reducing taxes therefore tends to have a salutary economic effect, which has an associated revenue effect. Higher economic growth increases tax revenue, all else being equal. Indeed, CBO has a “rule of thumb” for estimating the revenue effect from economic growth. According to CBO, a 0.1 percentage point annual increase in productivity growth (a fair proxy for GDP growth from tax reform) would improve the 10-year deficit by $273 billion.[1]

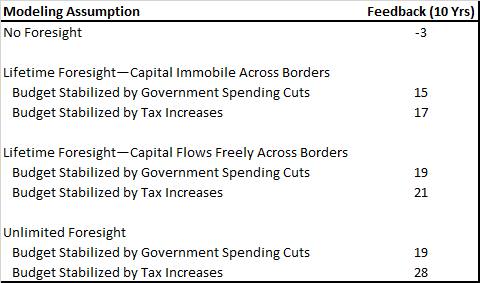

Separately, CBO has also done analysis examining the range of the feedback effects from tax changes based on its own economic models.

Table 2: Macroeconomic Feedbacks as a Percentage of the Conventional Estimate[2]

Based on these analyses, it is entirely plausible that the TCJA would generate adequate macroeconomic feedback to substantially reduce its budgetary cost. Assuming a crude average of CBO’s estimates suggests that the gross revenue reduction of $5.5 trillion could generate over $900 billion in macroeconomic feedback. Based on CBO’s rule of thumb, this level of revenue growth would be consistent with a real GDP increase of about 3.2 percent over the next 10 years. This would represent a substantial improvement in the nation’s growth outlook, but is well within the range of potential growth effects from tax reform.[3]

[1] https://www.cbo.gov/sites/default/files/115th-congress-2017-2018/reports/52370-outlook_1.pdf

[2] https://www.cbo.gov/sites/default/files/109th-congress-2005-2006/reports/12-01-10percenttaxcut.pdf