Insight

June 7, 2022

The Biden Administration’s Blanket Student Loan Forgiveness Would Be Regressive and Shortsighted

Executive Summary

- President Biden campaigned on providing $10,000 in blanket forgiveness for all federal student loan holders, but despite recent speculation that an announcement on the policy was imminent, the administration has yet to act.

- Blanket loan forgiveness—in any amount, and even with income caps—is a regressive policy; higher-income families would receive the majority of the forgiveness since they hold the majority of outstanding student loan debt.

- Blanket loan forgiveness would do nothing to increase educational attainment or lower costs, but instead would create incentives for borrowers to pay back their loans as slowly as possible, if at all, since they would expect future forgiveness for their loans.

- Enacting a blanket loan forgiveness policy would only delay, but not reverse, historical trends in outstanding federal student loan debt: By 2026, the total amount of federal student loan debt would bounce back to present levels.

Introduction

President Biden campaigned on providing $10,000 in blanket forgiveness for all federal student loan holders, a policy that, in any amount, and even with income caps, would be highly regressive: More than half of the loan forgiveness would go to higher-income students and families.

Blanket student loan forgiveness suffers from a host of other deficiencies, including that it would fail to increase educational attainment, likely increase the price of a college degree, discourage future borrowers from paying back their loans in a timely fashion, and would represent remarkably shortsighted policy: It would only delay, not reverse, the historical growth of student loan debt.

At the end of May, there was speculation President Biden would finally announce during his commencement speech at the University of Delaware a $10,000 cancellation in outstanding federal student loan debt with the potential caveat that only individuals making no more than $150,000 per year or couples making no more than $300,000 per year would be eligible. Yet President Biden did not announce the anticipated $10,000 loan forgiveness; instead, he continued his administration’s trend of providing more targeted forgiveness, this time for former students of Corinthian Colleges.[1]

Nevertheless, the current pause in repayment on federal student loans that is slated to end in August, combined with political pressures from the midterm elections in November, make it likely that the push for blanket loan forgiveness with income caps will only strengthen in the coming weeks and months.

This analysis finds that, despite the inclusion of income caps, blanket loan forgiveness in any amount would be regressive, meaning that most of the forgiveness would go to higher-income families, as they hold the majority of student debt. As this paper notes, income caps would do little to make such loan forgiveness less regressive.

As for those who either do not have student loans, did not attend college (the majority of Americans), already paid off their loans, or attended a community college to contain costs, they would receive nothing. They would instead be among the taxpayers liable for the loan holders’ debt.

Further, any form of blanket loan forgiveness would introduce a new set of disincentives for future borrowers to pay back what they owe, presenting a clear moral hazard. Loan forgiveness would also do nothing to lower the costs of college and would perhaps instead cause costs to rise. Finally, the historic pattern of outstanding student loan debt, even after $10,000 blanket loan forgiveness, demonstrates that the total outstanding federal student loan debt would bounce right back to current levels by 2026.

Regressive Policy

The American Action Forum has previously demonstrated the regressive nature of blanket federal student loan forgiveness. More than half of outstanding student debt is held by families in the top 40 percent of the income distribution, while the bottom 40 percent of the income distribution holds just about a quarter of the total federal student loan debt. At any amount of blanket loan forgiveness—from the $10,000 per-student promised by then-candidate Biden to the $50,000 per-student called for by progressive Democratic lawmakers—the breakdown noted above would remain the same: Higher-income families would receive nearly double the amount of loan forgiveness of lower-income families.

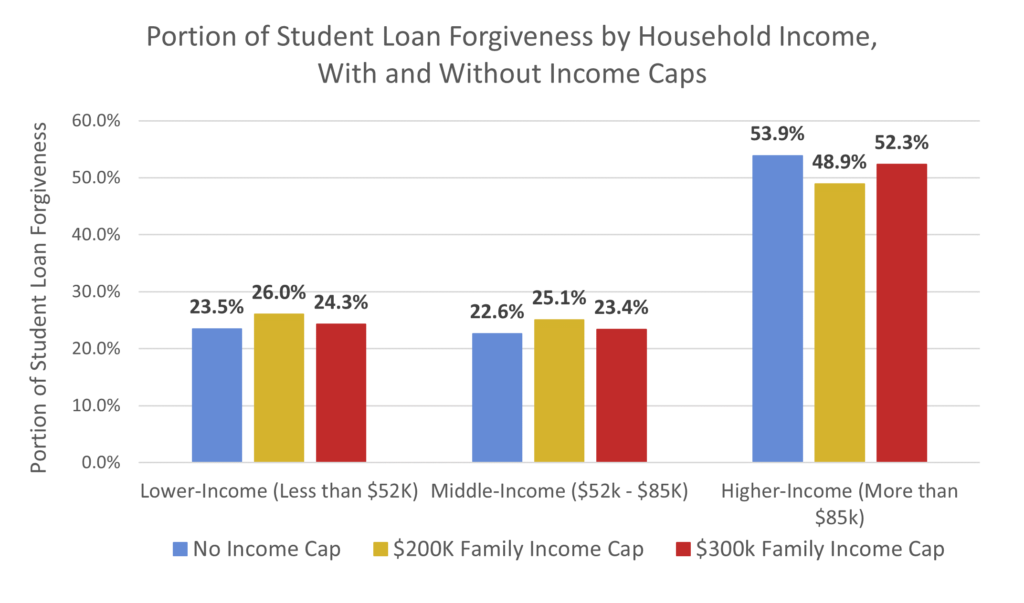

Adding income caps to blanket student loan forgiveness would do little to change the policy’s regressive nature. This is because most of the outstanding student debt is held by higher-income families. The chart below shows the portion of student loan forgiveness by household income. The blue bars demonstrate the distribution of loan forgiveness when there is no income cap: Higher-income families would receive 53.9 percent of loan forgiveness, a little more than double the 23.5 percent that would go to lower-income families. Adding a $300,000 family income cap would do little to change the regressive distribution.[2] Similarly, even with a lower $200,000 family income cap, the vast majority of loan forgiveness would still go to higher-income individuals and families.

Chart 1: Portion of Student Loan Forgiveness by Household Income, With and Without Income Caps[3], [4]

Blanket loan forgiveness would be unfair to most Americans. According to the 2020 Census report on education attainment in the United States, about 44.9 percent of the United States’ civilian noninstitutionalized population 18 years and older has an associate degree or higher.[5] That means the 55 percent of Americans who did not go to college would be among the taxpayers liable for the debt of those receiving forgiveness. Non-college-attending Americans are not alone in shouldering this liability, however. The individuals who went to college without taking out loans, those who already paid off their loans, and even those who went to community college for the sake of containing costs would not benefit from blanket loan forgiveness whatsoever.

A Moral Hazard for Future Students and Borrowers

In the meantime, blanket loan forgiveness would do nothing to lower the cost of college and would perhaps produce higher costs for students. Universities would have less incentive to find ways to lower tuition if they predict their students would simply be bailed out by the federal government again in the future. Students entering college in the fall 2023 semester and beyond would still pay the same tuition rates as before, if not more, but they would enter with the assumption that they will receive loan forgiveness. In turn, they would likely be incentivized to take out more loans than necessary, and to not pay in a timely fashion, or at all, presenting a clear moral hazard. If enough students were to engage in this behavior, the entire federal loan system would be inundated with poorly written and possibly fraudulent loans.

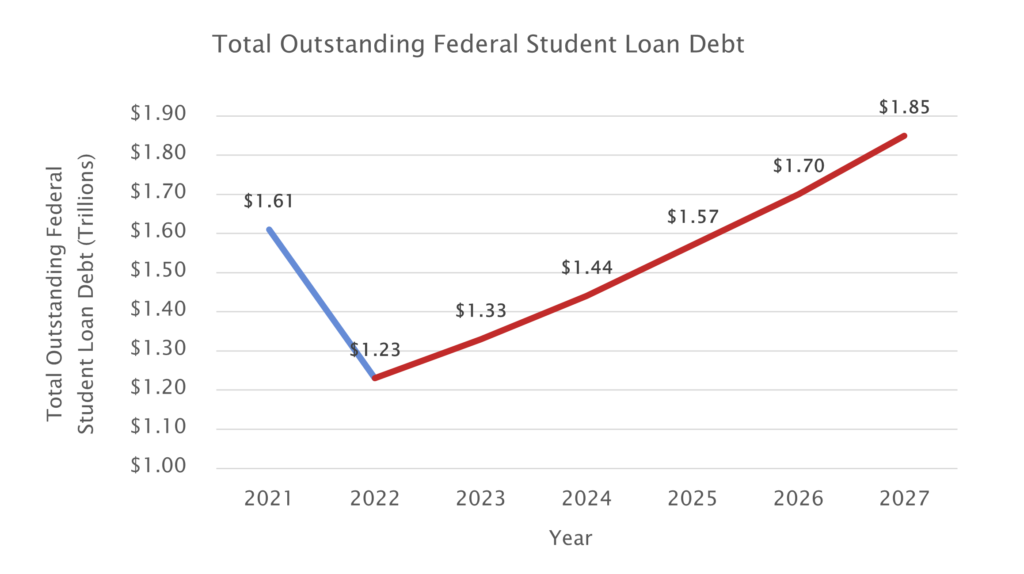

Chart 2 projects what would happen to total outstanding federal student loan debt if a one-time $10,000 blanket loan forgiveness was enacted in 2022. It uses historical annual growth rates of federal student loan debt to calculate an average annual growth rate. In 2021, the outstanding federal student loan balance stood at about $1.61 trillion. A $10,000 blanket loan forgiveness in 2022 would reduce the outstanding balance by about $380 billion, bringing the total to $1.23 trillion. Nevertheless, because blanket loan forgiveness would do nothing to lower the cost of college, and those students entering post-secondary education 2023 and beyond would still take out loans like before—if not in greater volume—the outstanding federal student loan debt would bounce right back to current levels by 2026.

Chart 2: Projected Total Outstanding Federal Student Loan Debt[6]

*The real figure is shown in blue. The projected figures are shown in red. The $1.61 trillion figure was the actual outstanding federal student loan debt in 2021. The $1.23 trillion for 2022 is the projected figure of the year’s outstanding federal student loan balance after a blanket $10,000 forgiveness.

*The real figure is shown in blue. The projected figures are shown in red. The $1.61 trillion figure was the actual outstanding federal student loan debt in 2021. The $1.23 trillion for 2022 is the projected figure of the year’s outstanding federal student loan balance after a blanket $10,000 forgiveness.

Conclusion

To date, the Biden Administration cancelled $25 billion in outstanding student loan debt for 1.3 million borrowers since entering office.[7] Considering that the current pause on federal student loan repayment is slated to end on August 31, and the midterm elections follow just two months later, the push from the administration and many congressional Democrats for $10,000-$50,000 in blanket loan forgiveness will likely increase throughout the summer.

While it remains to be seen what, exactly, the Biden Administration will do on this front, what is clear is that blanket loan forgiveness—at any level, and even with income caps—would be a regressive policy. Moreover, it would not represent reform; it would not raise educational attainment or bring down the cost of college. Instead, blanket loan forgiveness would introduce a new moral hazard that creates a disincentive for borrowers to repay their loans. It would also add hundreds of billions of dollars to the federal deficit and put those who never attended college or responsibly paid their loans on the hook for the debt.

Finally, enacting a blanket loan forgiveness policy would only delay, but not reverse, historical trends in outstanding federal student loan debt, and by 2026, the total amount of federal student loan debt would return to present levels.

[1] https://www.ed.gov/news/press-releases/education-department-approves-58-billion-group-discharge-cancel-all-remaining-loans-560000-borrowers-who-attended-corinthian-colleges

[2] This analysis assumes the income distribution of households for the income distribution of married couples.

[3] To achieve these calculations, the author used data from the Federal Reserve’s 2019 Survey of Consumer Finances. “Table 13 19 %s & medians” contains the percentage of families that have student loan debt, by income quintiles. “Table 13 19 means” contains the average outstanding student loan debt of families by income quintiles. The author then used STATA to analyze IPUMS CPS data to create a corresponding household income distribution.

[4] Calculations made possible by 2021 CPS data courtesy of IPUMS. IPUMS-CPS, University of Minnesota, www.ipums.org.

[5] https://www.census.gov/data/tables/2020/demo/educational-attainment/cps-detailed-tables.html

[6] https://studentaid.gov/data-center/student/portfolio

[7] https://www.ed.gov/news/press-releases/education-department-approves-58-billion-group-discharge-cancel-all-remaining-loans-560000-borrowers-who-attended-corinthian-colleges