Insight

June 15, 2023

The Biden Administration’s Spring 2023 Unified Agenda of Regulatory Actions

EXECUTIVE SUMMARY

- The Biden Administration recently released its Spring 2023 Unified Agenda of Regulatory and Deregulatory Actions (UA) detailing the approximately 3,200 rulemakings it plans to put forward within the next year or so.

- While it appears at first glance that the overall regulatory flow associated with the report aligns with similar regulatory output trends over the past few years, a deeper look reveals that the 280 “major rules” and 1,326 “significant rules” included within represent high-water marks for both categories across the past decade.

- The mix of agencies with the busiest near-term regulatory plans does not largely differ from other recent UA reports, but the number of rulemakings from these top agencies still in the “proposed stage” of the process suggests that they may soon begin to feel a time-crunch to get these rules across the finish line by the end of the administration’s current term.

INTRODUCTION

On June 13, the Office of Information and Regulatory Affairs (OIRA) released the Biden Administration’s Spring 2023 edition of the “Unified Agenda of Regulatory and Deregulatory Actions” (UA). The biannual report lays out “the actions administrative agencies plan to issue in the near and long term.” As this administration heads into the second half of its term, the UA provides a useful update on its regulatory priorities as well as rough estimates on when the public at large can expect certain future rulemakings. A cursory examination of this UA reveals that while the hierarchy of particularly active agencies remains largely unchanged, the Biden Administration is anticipating more and more big-ticket regulatory items as it heads into 2024.

OVERALL REGULATORY VOLUME

One of the more helpful aspects of a given UA is how it can demonstrate the scope of an administration’s regulatory plans. The following table includes statistics on the volume of prospective actions included over the past decade of Spring UAs. “Active” items include those that agencies reasonably expect to act on within 12 months of the UA’s publication. “Long-Terms” are those that agencies expect to act on outside of that one-year window. The “Total Prospective” category is the sum of those two. “Major” items include rulemakings that agencies expect to meet the definition of a “major rule” under the Congressional Review Act. “Significant” items include those that meet either: 1) the threshold of “economically significant” as established under Executive Order (E.O.) 12866[i], or 2) the definition of “other significant” that OIRA sets as “A rulemaking that is not economically significant but is considered significant by the agency. This category includes rules that the agency anticipates will be reviewed under E.O. 12866 or rules that are a priority of the agency head.”

|

Trends in Rulemaking Volume Across Spring Unified Agendas |

||||||||||

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Active Items | 2389 | 2323 | 2239 | 1731 | 2224 | 2597 | 2697 | 2551 | 2673 | 2617 |

| Long-Term Items | 441 | 460 | 502 | 696 | 647 | 610 | 575 | 623 | 574 | 582 |

| Total Prospective Items | 2830 | 2783 | 2741 | 2427 | 2871 | 3207 | 3272 | 3174 | 3247 | 3199 |

| “Major” Active Items | 122 | 141 | 125 | 49 | 88 | 123 | 155 | 170 | 217 | 236 |

| “Major” Long-Term Items | 27 | 33 | 43 | 51 | 34 | 30 | 40 | 47 | 38 | 44 |

| Total “Major” Items | 149 | 174 | 168 | 100 | 122 | 153 | 195 | 217 | 255 | 280 |

| “Significant” Active Items | 934 | 905 | 800 | 429 | 707 | 919 | 974 | 945 | 1055 | 1042 |

| “Significant” Long-Term Items | 170 | 200 | 208 | 299 | 222 | 218 | 218 | 262 | 263 | 284 |

| Total “Significant” Items | 1104 | 1105 | 1008 | 728 | 929 | 1137 | 1192 | 1207 | 1318 | 1326 |

As the data show, over the past five years – across different administrations, no less – the overall volume of planned rulemakings has held relatively steady at an average of roughly 3,220 per UA. This most recent UA’s total comes in at slightly below that level at 3,199 rulemakings. Where it diverges, however, is in the “major” and “significant” subcategories with 280 and 1,326 in each, respectively. These totals represent the highest levels across this 10-year period. For perspective, this major rule total is approximately 65 percent higher than the average level over the previous nine years (170) while the significant rule total represents a 23 percent increase over that nine-year average (1,081).

MAJOR TRENDS ACROSS AGENCIES

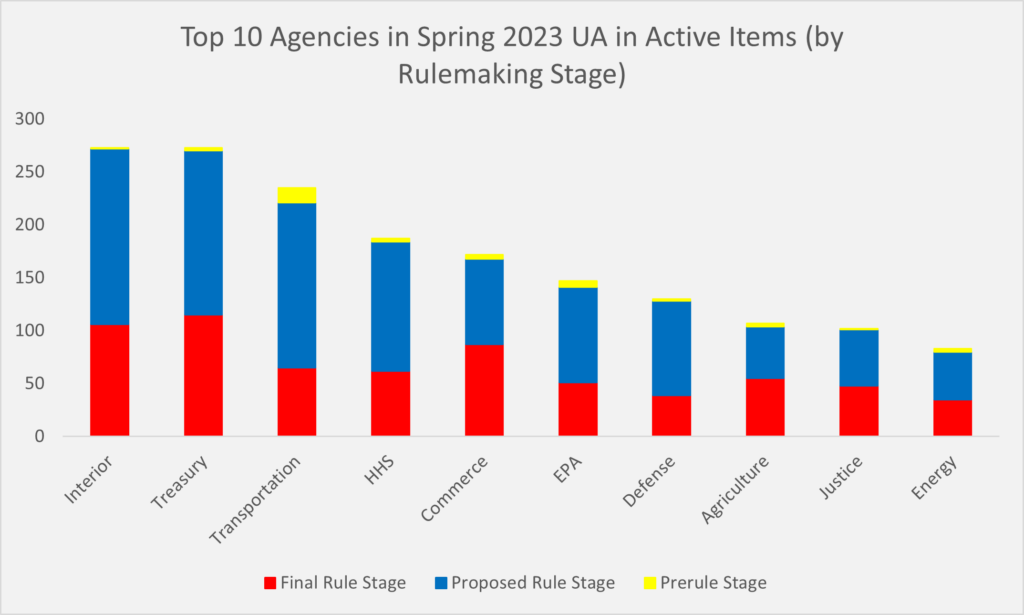

As in other recent examinations of UA activity, it is important to look at which agencies have the busiest agendas planned. The following table details the top 10 agencies in terms of active items.

The Department of Treasury has closed the gap – relative to the most recent UA – with the Department of Interior and is now tied at the top of the rankings with 273 rulemakings apiece. Combined, these two agencies have roughly one-fifth of the overall active item total. The Department of Transportation maintains the bronze medal with 235 active items. That agency also continues to have the highest share of “prerule” actions[ii] at 14, with many focused on still-formative regulatory considerations for automated vehicles. Across the rest of the top 10, the only shake-up compared to the preceding UA is the Department of Justice edging ahead of the Department of Energy by a count of 102 to 83.

The Department of Treasury has closed the gap – relative to the most recent UA – with the Department of Interior and is now tied at the top of the rankings with 273 rulemakings apiece. Combined, these two agencies have roughly one-fifth of the overall active item total. The Department of Transportation maintains the bronze medal with 235 active items. That agency also continues to have the highest share of “prerule” actions[ii] at 14, with many focused on still-formative regulatory considerations for automated vehicles. Across the rest of the top 10, the only shake-up compared to the preceding UA is the Department of Justice edging ahead of the Department of Energy by a count of 102 to 83.

In terms of the relative balance between actions in the proposed rule stage versus those in the final rule stage, most of the top 10 agencies still primarily have items in the proposed rule stage. In fact, the only two agencies that have relatively more in the final stage are the Departments of Commerce and Agriculture. This is an important consideration because as a matter of the timing involved in the regulatory process these rulemakings likely need to at least be on the books as proposed rules within the next year to be set up for finalization by the end of the Biden Administration’s current term.

OTHER NOTABLE STATISTICS

With more than 2,600 active items included in the pages of this UA, it is not practical to include full lists of the various potential cross-sections of rulemakings. It is, however, possible and potentially helpful to highlight the volume of items that fall into certain subcategories. Some of these totals include:

- 343 “Novel Rulemakings,” or those included in the UA for the first time;

- 197 rulemakings that agencies find “likely to have a significant economic impact on a substantial number of small entities” under the Regulatory Flexibility Act (RFA);

- 178 rulemakings that agencies expect “to have international trade and investment effects, or otherwise may be of interest to our international trading partners;

- 23 rulemakings set for retrospective review under Section 610 of the RFA; and

- 21 rulemakings that agencies find “likely to result in a mandate that may result in expenditures by State, local, and tribal governments, in the aggregate, or by the private sector of more than $100 million in one year” under the Unfunded Mandates Reform Act.

CONCLUSION

Like so many other government reports on regulatory activity, this Unified Agenda will largely come and go with little press fanfare. That should not discount its importance, however. Each edition contains each agencies’ regulatory plans for the next year or so, and considering that each edition contains thousands of items, it paints a pretty clear picture of the scope of the administrative state. This latest portrait shows that the Biden Administration is putting forward its most consequential actions at an increasingly higher rate and that the implications of the timing involved in taking a regulation from the proposed to final stage likely plays some role in that dynamic.